Higher core inflation should challenge ECB signalling of a June rate cut

The ECB has long signalled a strong preference to start cutting rates in June, but the recent pick-up in underlying inflation should give policy-makers pause for thought, as well as reinforcing the view there is little to be gained in offering the market clear forward guidance on policy over the rest of this year.

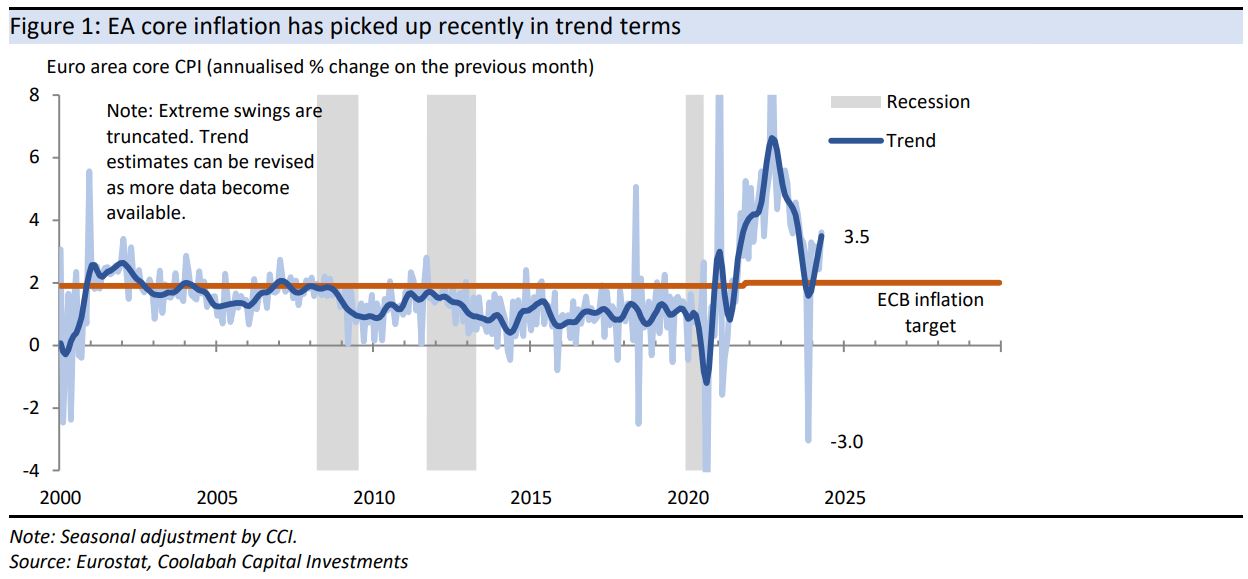

On CCI's seasonal adjustment, the core CPI for the euro area rose by 0.3% in April after a 0.2% rise in March, having previously increased by 0.3% three months in a row after an inexplicable 0.3% fall in November. The estimated trend in the core CPI is now growing at an annualised monthly rate of 3½%, up from a low of about 1½% in November

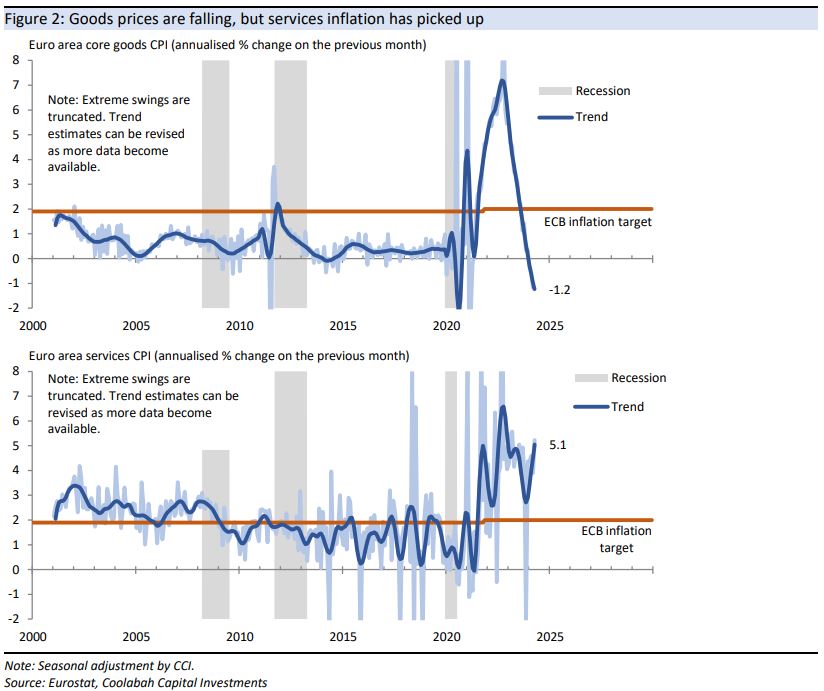

- Core goods prices continued to follow the lead of the USA, falling by another 0.1% in April after flatlining over prior months. In trend terms, annualised monthly core goods disinflation continued to intensify, reaching an estimated -1¼% in April.

- Disappointingly, services prices resumed growing strongly, up 0.4% in April after a 0.3% increase in March (initially estimated as a 0.2% increase). Estimated trend annualised monthly services inflation has accelerated to about 5%, reflecting the strong April result and revised recent history. This compares with a low of about 1¾% late last year.

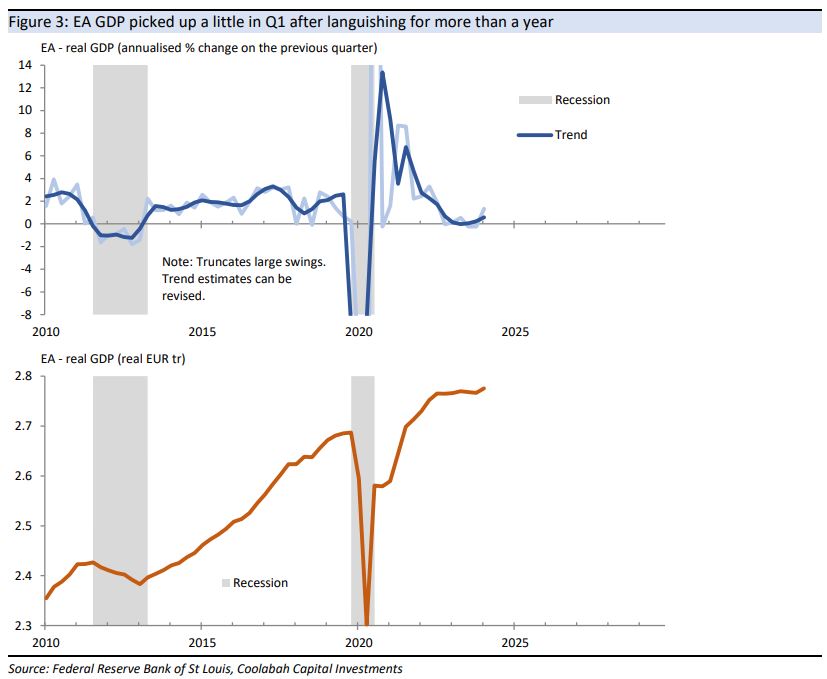

As for activity in the euro area, the broad stagnation in real GDP since late 2022 probably weighs on the minds of some ECB policy-makers, although even on that front recent data have been stronger than expected, with output increasing by 0.3% in Q1 after falling by 0.1% for two quarters in a row.

However, the importance of the long stretch of weak GDP can be overstated, in that it never curbed firms' hiring plans, with the euro area unemployment rate still holding at a multi-decade low of around 6½%.

4 topics