Australian outdoor advertising revenue growth

In past posts, we have discussed the outlook for the outdoor advertising industry in Australia. The are a number of reasons why the outdoor advertising industry should grow its share of the overall advertising pie over the next five to ten years.

These include:

- Fragmentation of the audience in traditional forms of media such as:

Television – due to the growth of streaming and alternative viewing platforms that leverage the internet in breaking down televisions historical control over access to the consumer of video content.

Print – due to social media and blogs etc

Radio –as the car fleet is renewed to include more seamless access to the internet music, streaming will fragment the primary radio audience. In the longer term, autonomous cars will see video streaming all but replace radio’s audio entertainment.

- The roll out of digital screens which provide the dual benefits of:

Growth in available site capacity

Greater speed to market, allowing the industry to tap into more reaction and short life advertising and marketing pools (eg product promotions)

Opportunities for enhanced content and greater interactivity

- Improved audience measurement and data. This provides better reliability and information around the advertisers return on investment as well as the ability to produce more targeted outcomes.

These longer term drivers present an attractive investment case for the outdoor advertising industry. However, more recently we have seen some concerning signs for the industry.

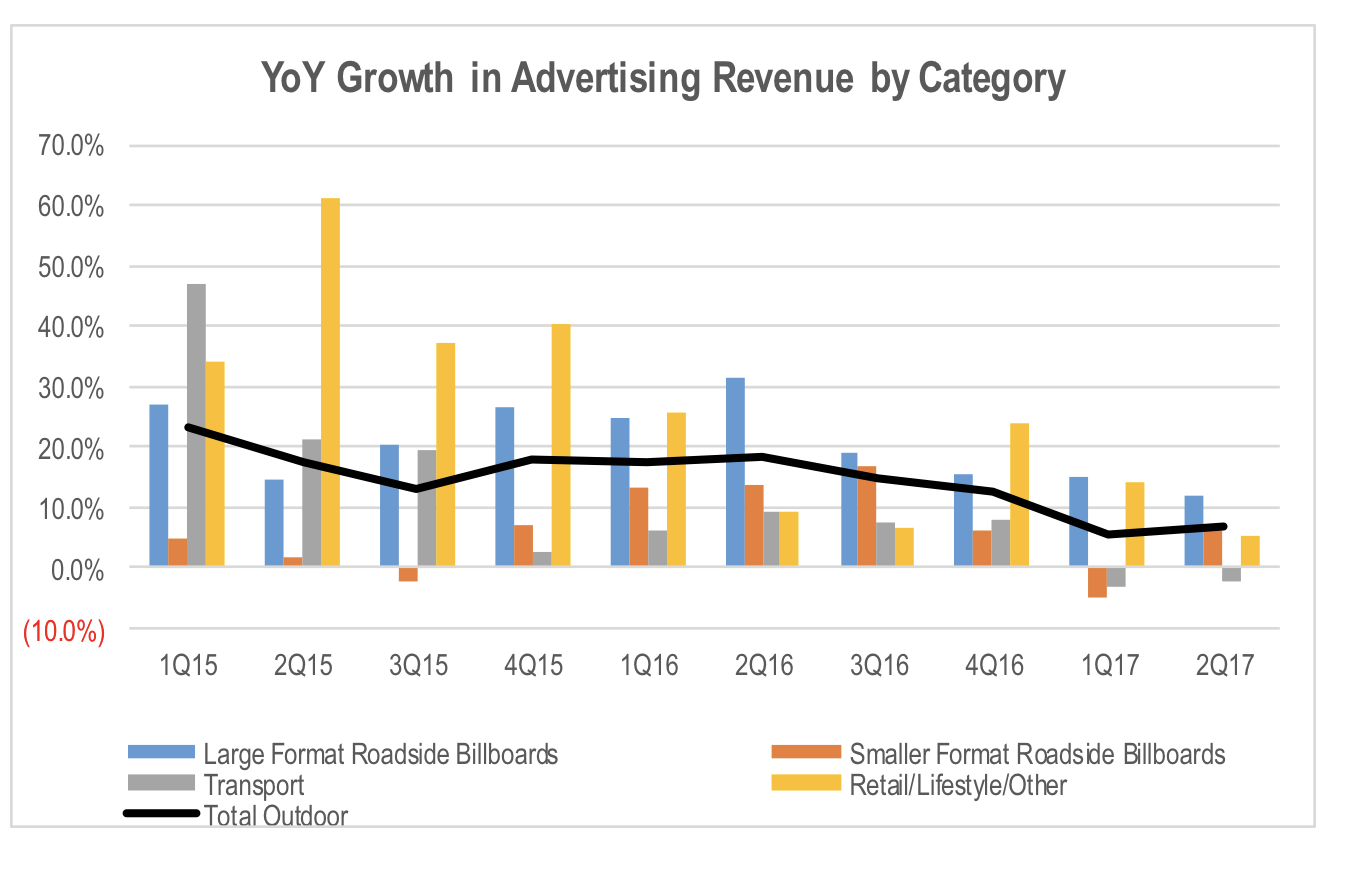

The industry’s body, the OMA, released the advertising revenue data for the month of June earlier this week. It showed that for the month of June, overall Australian outdoor advertising industry revenue excluding commissions paid as well as production and installation revenue increased 5.3% in June relative to the prior year, and by 6.4% for the six months to June 2017. This is reasonable growth given the overall advertising market in Australian has been roughly flat on the same basis.

Within this, large format roadside showed the strongest growth, with revenue up 12.1% in June and by 13.6% in the 6 months to June. Large format roadside revenue growth has exceeded that of the overall outdoor industry for the last 2 years. Given the exposure of APO, OML and QMS to this category, this would to be reasonably encouraging.

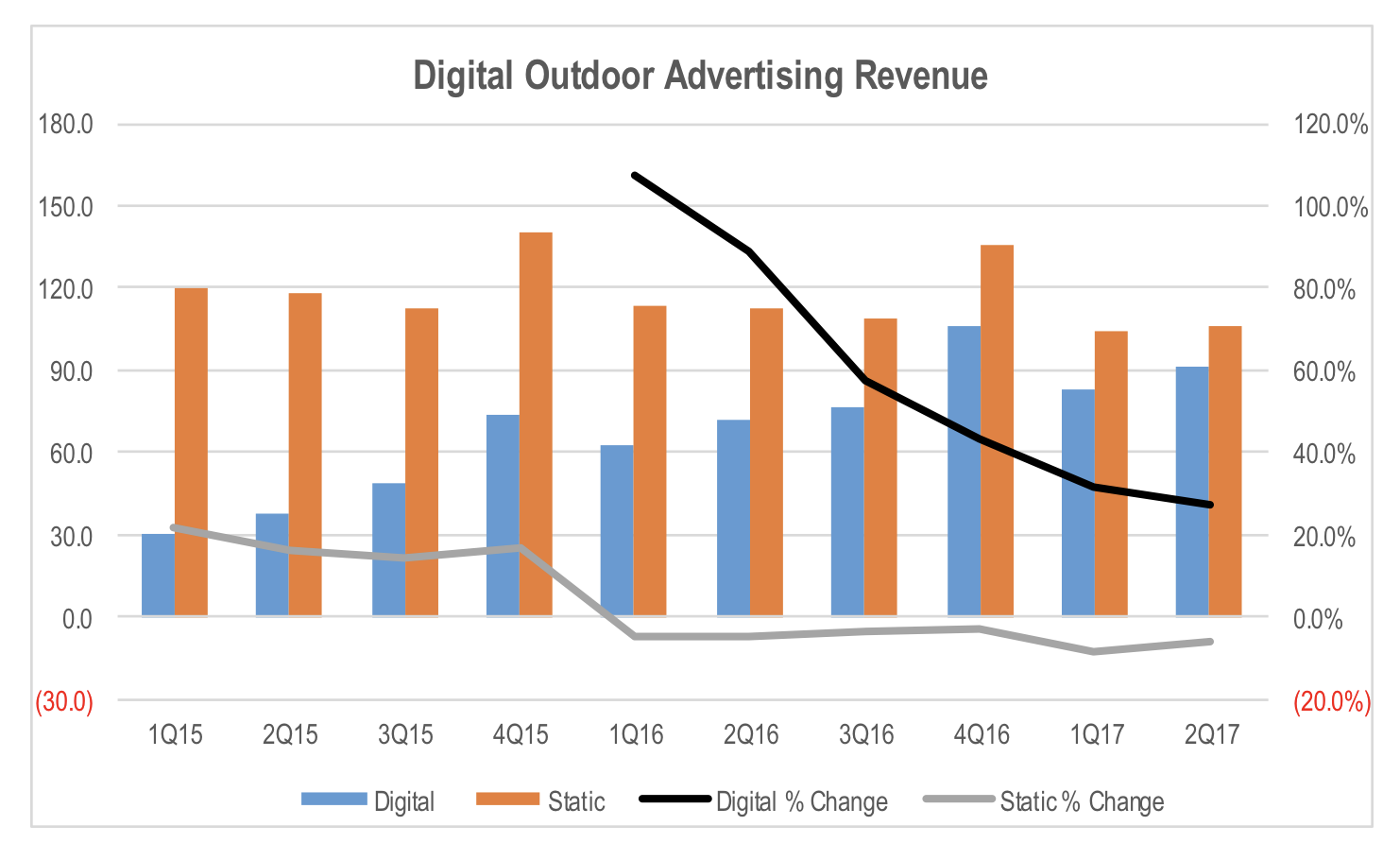

Digital sign revenue is the driver of revenue growth for the industry with digital revenue increasing 30% in the June half year relative to the prior year. This compares to a 7.4% decline in revenue for static outdoor assets over the same period.

However, beneath the headline rate of growth, there are some concerns in the near term.

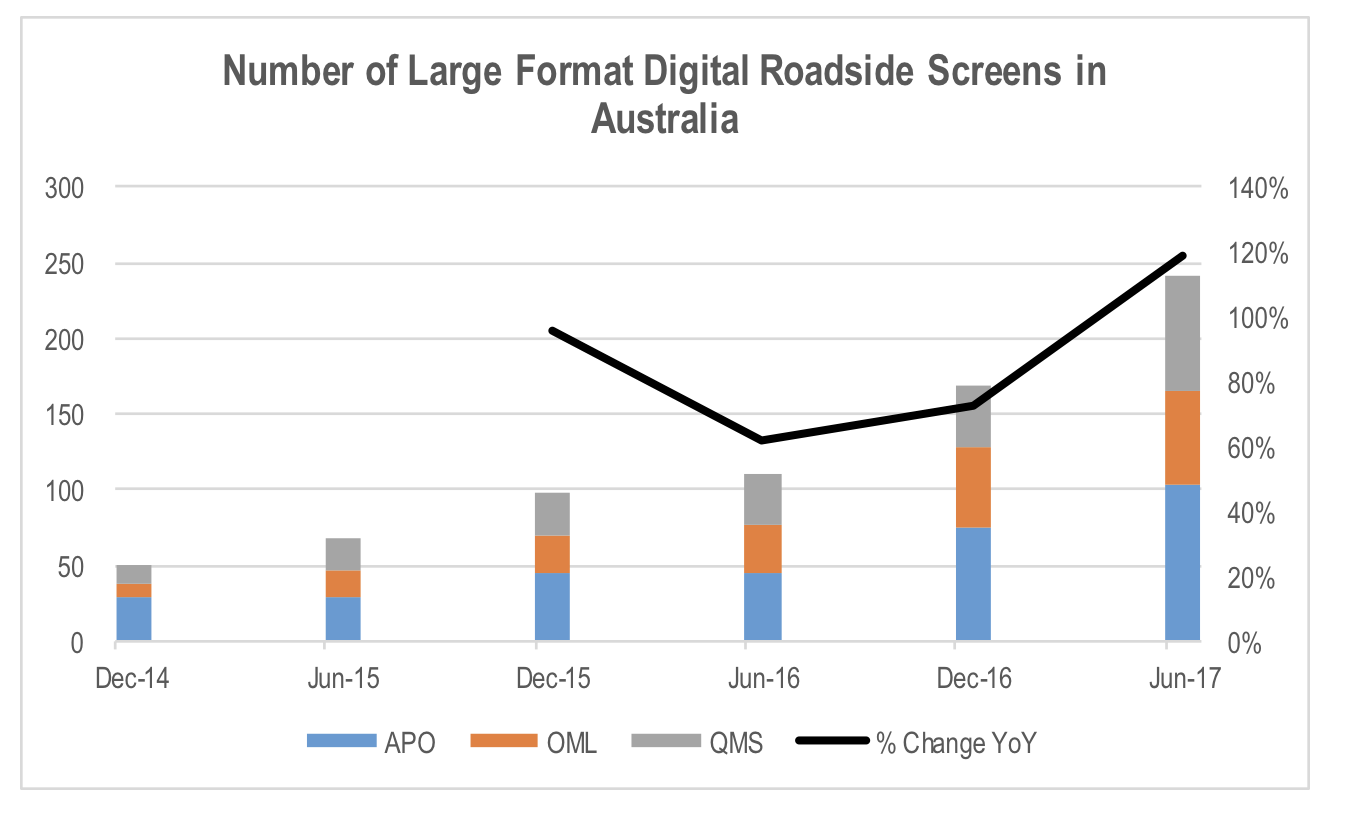

The attractive returns generated by digital assets has seen a significant increase in the rate of digital content over the last 12 months. The table below shows the dramatic acceleration in the number of large format digital billboards operated by the three major roadside operators in Australia.

The number of large format digital screens operated by the three largest players will have increased around 120% in June 2017 relative to the same time last year. These screens have significantly higher capital cost and increasing the number of them in the market increases the aggregate operating costs of the industry due to higher lease costs and electricity charges.

There has been somewhat of a land grab occurring in the industry with digital capacity growth outstripping the rate of demand growth. Given digital revenue growth has fallen well short of the 120% growth in screen numbers, like for like revenue on digital assets is clearly declining. While there is a reasonably large variable component to operating costs through revenue sharing agreements with site owners and agency commissions, there is still a fair bit of fixed cost leverage in the business.

Unfortunately, we have not seen any of the operators pull back on their roll out plans in order to allow demand time to catch up with supply. Competition in the sector means that the companies are afraid they will be seen to have fallen behind if they slow down and the other two players do not.

Adding to the risk on margins, the outdoor operators have been investing in overheads to improve their data, technology and creative capabilities. This investment is designed to improve the long term revenue opportunity for their newly rolled out digital asset base.

While we continue to like the longer term opportunity for outdoor advertising, it appears that growth supply in the short term is significantly outstripping demand growth, presenting the risk that earnings expectations as a result of weakening margins.

The Montgomery Funds own shares in QMS Media

To read more articles written by me, click here.