The Match Out: Huge intra-day bounce as buyers emerge with force

What Mattered Today

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify

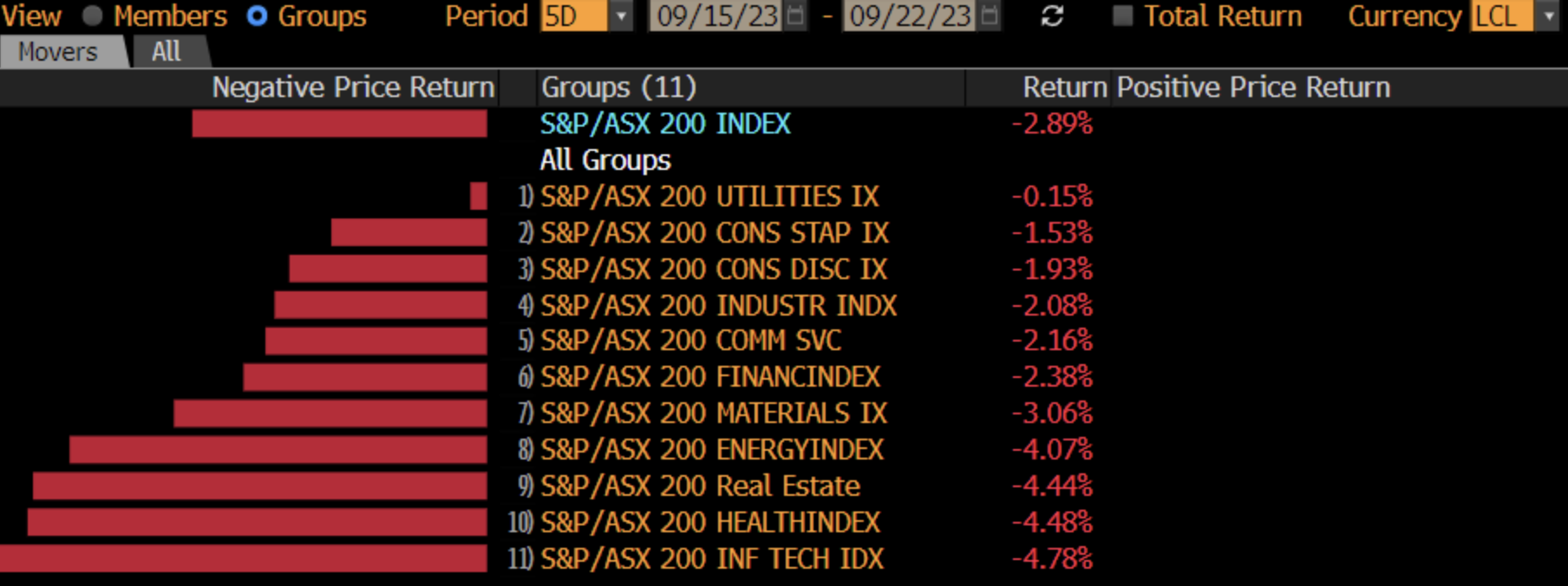

The ASX200 traded below the 7000 level this morning for the first time since March as the risk-off trade continued after the Hawkish update from the Fed yesterday, but a huge intra-day turnaround took hold and the ASX200 ultimately finished marginally higher, rallying +111pts from the morning lows which was simply a phenomenal effort! The intra-day buying helped snap a 4-day losing streak, though the index fell by -210pts/-2.89% over the course of a tough week.

- The ASX 200 eventually closed up +3pts / +0.05% to 7068

- The Utilities sector +0.79% was best on ground today, supported by Energy (+0.72%) and Materials (0.56%)

- Interest rate leveraged sectors of Real Estate (-1.41%), Healthcare (-1.02%) and Tech (-0.67%) found it the toughest.

- There was clearly aggressive buying sub-7000 which is a very positive sign and implies a strong level of support at the bottom end of the trading range.

- We’ve written a lot about respecting the range on the ASX200 in recent months, which sits between 7000-7500 and while it’s been equally restrictive on the upside, the downside support was very obvious today.

- Most stocks opened smack on their lows and rallied hard throughout the session – a day that paid dividends to those who bought the open.

- The Bank of Japan continues to hold out on rate hikes, sticking with the -0.1% interest rate, still targeting 0% for Government 10-year bonds and maintaining a dovish stance.

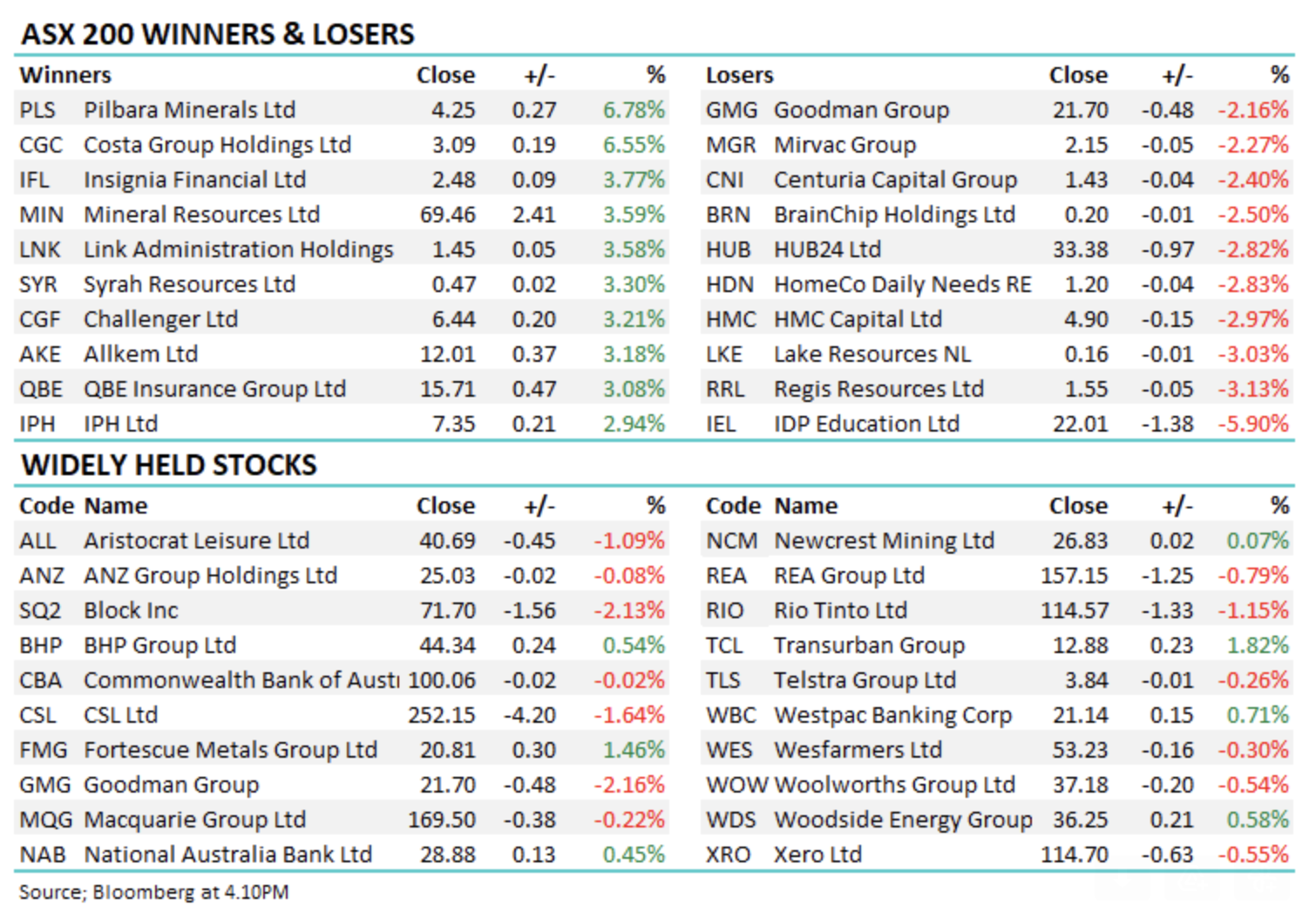

- Costa Group (ASX: CGC) +6.55% rallied as the board of the fruit and veg producer unanimously accepted the bid from Paine Schwartz at $3.20/sh, down from $3.50/sh.

- News Corp (ASX: NWS) +2.24% was higher after Rupert Murdoch announced he was handing over the reins to his son Lachlan. At 92 years young, it’s been a good innings from Rupert!

- Lithium stocks held up well in the face of a softer market, prices for Spodumene were up overnight which flowed through to the Chemical producers today, notably Pilbara (ASX: PLS) which added +6.78% after opening lower – a huge turnaround!

- Healius (ASX: HLS) and Aust. Clinical Labs (ASX: ACL) were both largely unchanged following the ACCC’s request for more information on the planned tie-up of two of Australia’s largest pathology companies.

- Gold was up 0.25% in Asia to $US1925/oz. For the most part, gold stocks were marginally higher today.

- Iron Ore was up ~0.6% in Asia, supporting a ~4.5% rally for FMG off its early lows.

- Stocks across the region also rallied from lows with the Hang Seng the star, up +1.15%.

- US Futures are up around 0.25%.

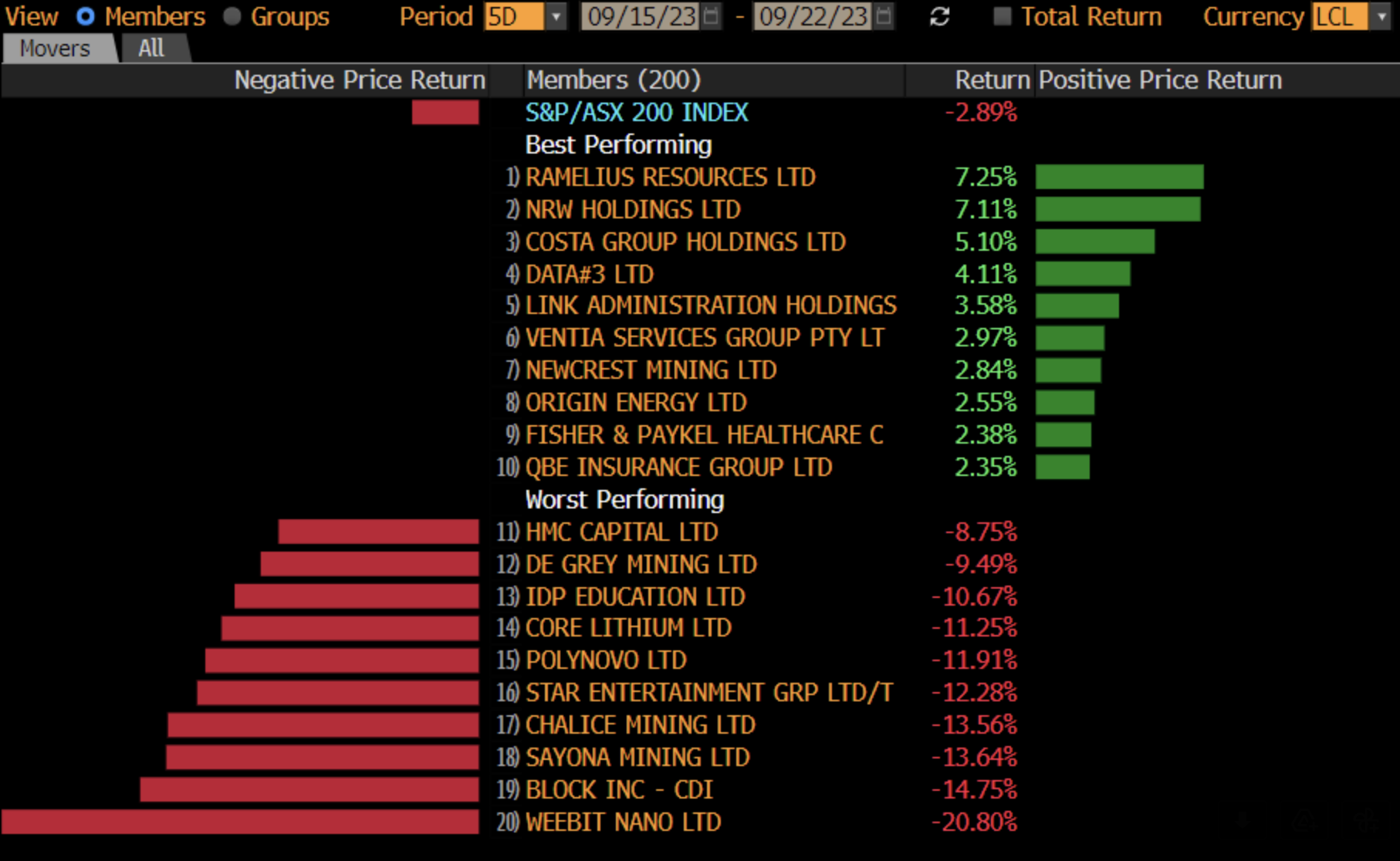

Stocks this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Bank of Queensland Cut to Underperform at Macquarie; PT A$5.25

- Bendigo & Adelaide Cut to Underperform at Macquarie; PT A$8.75

- Santos Cut to Neutral at Jarden Securities; PT A$8.05

- Mesoblast Raised to Speculative Buy at Bell Potter

- Transurban Raised to Buy at Jefferies; PT A$14.08

Major Movers Today

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

5 stocks mentioned