The only 5 ETFs you need to outperform over the long term

You may have heard of Chris Brycki, the founder and CEO of Sydney-based online investment company Stockspot. The last time he appeared on this platform he quite literally caused a stir, after he shared his views on several listed investment companies on Buy Hold Sell.

According to Brycki, the problem with LICs, or any active fund, for that matter, is that hefty management and performance fees detract from returns over the long term. He also doesn't believe that anyone has any clue about what could happen in the future - making it hard to pick the winners (or losers) in any market.

Instead, he wholeheartedly believes in the power of simple exchange-traded funds, passive products which track an index's returns, with significantly lower fees so as to not detract from performance.

In fact, he only uses five ETFs - as do his clients - meaning he doesn't make any tactical bets on stocks, and he isn't picking trends with thematic ETFs. In reality, he is doing "nothing" and letting the market do the work for him.

"To me, the hardest thing to get people's heads around since starting Stockspot is everyone looks at our portfolio and goes, 'It's so simple. There's no way that could beat shares or this fund manager or that fund manager.' And I always say, just wait and see," Brycki said.

"On any rolling five-year period it's beaten something like 97% of diversified funds, just because it's low-cost."

It's a far cry from where Brycki began - at just 10 years old investing in stocks. No, his Mum and Dad didn't work in investment management or finance at all, for that matter. But they helped Brycki and his brother out with $1000 to get their start.

In high school, Brycki won the ASX's Share Game not once, but thrice - which landed him a work experience role with the securities exchange's surveillance and education division in Year 10. For some comparison, in Year 10 I was working at my local pizzeria.

At university, he entered the JP Morgan Trading Competition, which he also won several times. This helped him land his first real job - with the infamously low-profile Blue Lake Partners, with the equally infamous Daniel Droga. This was in second-year uni, mind you.

.jpg)

He then landed a graduate role with UBS - where he worked in the investment manager's propriety trading division (managing the bank's capital). Here, Brycki learnt about dual-listed and capital-structure arbitrage, long/short strategies, and various other complex areas of trading.

But it was here that he also started to learn about market efficiency.

"For me, I think people wrongly assume market efficiency means prices are perfect. I don't think like that," he said.

"I think market efficiency means markets are hard to beat and markets can be irrational. Prices can go crazy, but they can also stay crazy for a long time. And that's often what makes them hard to beat because you can be the value manager that says technology's overvalued, but you can be wrong for 15 years before you're eventually right."

Thus, getting your view AND the timing right isn't exactly a piece of cake.

"That's what I learnt as a trader - you need catalysts to actually change views," Brycki said.

"It doesn't matter if you're right and everyone else is wrong if everyone doesn't have the information that you have. And working in that world, I realised a lot of the funds management industry in Australia works in a way that's very similar to the benchmark, but charges high fees for it.

"They might be slightly overweight CBA, slightly underweight BHP, but ultimately, they're benchmark-huggers. The problem is that over time, even by being right, the value added is not big enough to counteract the 1% fee that a lot of these fund managers charge."

And herein lies the old investment proverb from author Fred Schwed - fees maketh the manager, but at the investor's expense. After all, as Schwed asks, "Where are the customers' yachts?"

"Fund managers are extracting all of the alpha for themselves," Brycki said.

"That made me realise that the industry would probably diverge over the next 20 years when investors would clue up to this and demand either high-quality alpha or low-cost beta."

And the rest, really, is history. Brycki launched Stockspot in 2013, after he realised that the average investor shouldn't be picking stocks or trading or giving their money to fund managers, but instead, they should be investing in the wonderful world of ETFs.

"My view is that over the next 20 years, there's going to be a secular change in the industry - not cyclically driven by markets, but a secular downtrend in active management and uptrend in indexing," he said.

"Really, the only survivors in the active management world will be those very few that actually can consistently beat the market."

.jpg)

The stats you need to know

- The ETF industry grew by 32% last year to over $135 billion in funds under management.

- More than $100 million was lost by investors by investing in trendy thematic ETFs.

- Over the past five years, FUM in Australian ETFs has grown by 38% per year, more than four times faster than the broader Australian wealth management market (7% p.a.)

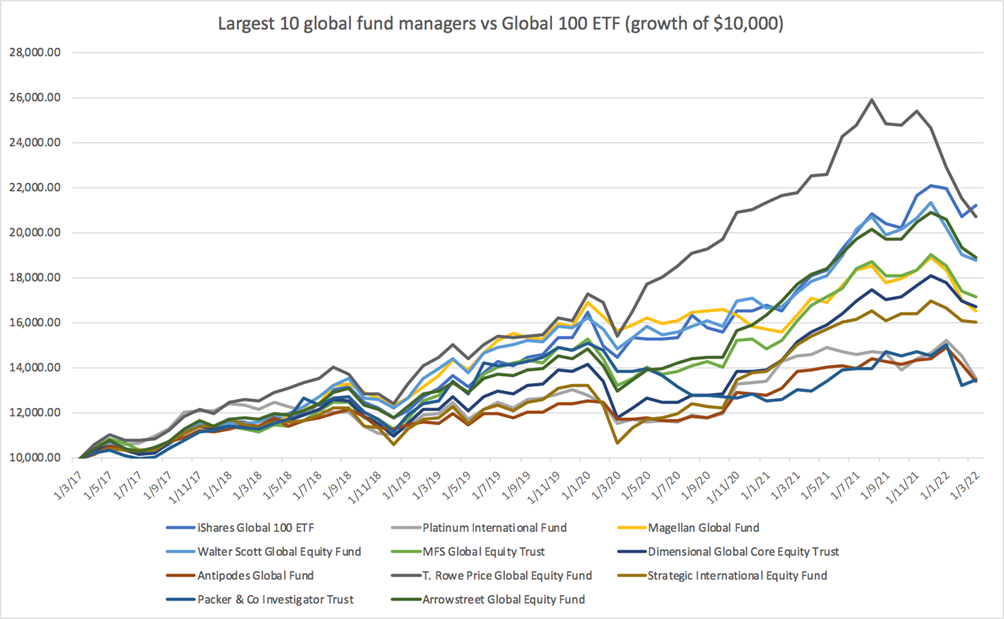

- If you had invested $10,000 equally into the 10 most popular global share funds available to Australians over the last five years you would have $16,530 today. If you had instead invested all of that money into ASX: IOO you would have $21,213 today. See below:

So which 5 ETFs does Brycki actually like?

Vanguard Australian Shares Index ETF (ASX: VAS)

Since 2014, Stockspot has invested on behalf of its clients in VAS, which tracks the S&P/ASX 300 Index, offering greater diversification benefits than SPDR S&P/ASX 200 (ASX: STW), which only tracks the S&P/ASX 200. VAS is the largest index ETF in the Australian market and boasts a lower expense ratio, greater liquidity and better long-term returns. Its management fees are 0.10% per annum.

iShares Global 100 ETF (ASX: IOO)

Similarly, since 2014, Stockspot has used IOO as it provides great diversification to the world's largest and most successful companies across the US, UK, Switzerland, France, Germany, Japan and Korea. IOO has higher fees (0.40%) than its competitors, such as the Vanguard MSCI Index International Shares ETF (ASX: VGS) (which has management fees of 0.18%), but Stockspot believes that IOO has better liquidity and likes its longer-listed track record. In addition, IOO's focus on large companies has helped it to outperform similar broad global ETFs like VGS and SPDR S&P World ex Australia Carbon Control (ASX: WXOZ).

iShares MSCI Emerging Markets ETF (ASX: IEM)

This ETF provides investors with exposure to over 800 emerging market shares and includes companies from countries like China and South Korea. While IEM has a higher expense ratio (fees of 0.69%) than alternatives like the Vanguard FTSE Emerging Market Shares ETF (ASX: VGE), which has fees of 0.48%, Stockspot said that IEM has better liquidity and also a longer-listed track record.

iShares Core Composite Bond ETF (ASX: IAF)

Similarly, Stockspot selected IAF for its portfolios thanks to its size, liquidity, track record, high credit quality and relatively short duration. With management fees of 0.15%, it beats peers like the Vanguard Australian Fixed Interest ETF (ASX: VAF), which has fees of 0.20%.

ETFS Physical Gold ETF (ASX: GOLD)

Since 2014, Stockspot has been using GOLD in its clients' portfolios. This ETF is backed by physical gold bullion, stored in a vault in London. It's also unhedged, so investors can benefit from a falling Aussie dollar. It's also the oldest ETF of its kind in the market, is the largest in size (meaning liquidity is not an issue), and it has the tightest spreads. An alternative would be the BetaShares Gold Bullion ETF (ASX: QUA), which has fees of 0.59%. However, this ETF is hedged to the Aussie dollar.

Example portfolios

For those interested in how Brycki and the team create portfolios with only these five ETFs for different investors, he has graciously outlined two below.

The first is Stockspot's Sapphire portfolio (used for those looking for a moderately conservative option):

IAF: 35.2%

IEM: 14.4%

IOO: 7.9%

GOLD: 14.8%

The second is Stockspot's Topaz portfolio (used for those who want high growth):

There are already north of 250 ETFs. Do we need more?

There are more than 250 ETFs available to Australian investors, but Brycki doesn't believe we need more. In fact, it's quite the opposite, with Brycki predicting several major ETF closures over the next few years.

"The problem is all the good ones - the ones that people really need - are already out there," he said.

"What a consumer needs is very different to what a product producer needs to keep on innovating and making money. In the US, there are hundreds of ETF closures every year now, because there are so many of these ETFs that get launched at the peak of hype, and then they don't attract funds and they shrink. So, that's what we'll start to see in Australia."

But will we continue to see more ETF launches? "Absolutely," Brycki said. "There's always motivation to put out new products in any industry."

One piece of advice

As always, I like to end my wires with one piece of advice that investors can take away from reading this interview. For Brycki, it's that "markets don't go the way that you expect" - as we saw in 2020, and are seeing now.

"The future is unknowable. So when you get a prediction wrong, you shouldn't be going and making more predictions. You should be questioning whether you should be making predictions in the first place," Brycki said.

"When it comes to building a portfolio, you should be building a portfolio with the humility of accepting that the future is unknowable and making sure that you can weather different potential scenarios."

Of course, that's easier said than done. After all, Australians have a thing for taking a punt (we love our pokies and micro-cap miners). But for Brycki, it's about having the humility to recognise that we don't know much at all.

As Mark Twain said, "It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so."

"Ultimately, when you reach that point as an investor, you are really empowered to do a lot better because you don't need to worry about markets - what they're going to do next week or next month - because you know that there could be a lot of noise. There can be lots of ups and downs. Things can perform in ways you don't expect," Brycki said.

"I think something I've learnt from markets is to always expect markets to do what you don't expect, because if markets did what everyone expected, then it would be too easy.

"Markets do things for weird and wacky reasons and prediction isn't the answer to getting a great result. Accepting that prediction is hard is the great lesson from this year."

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

5 stocks mentioned

5 funds mentioned