Why Flight Centre shares are soaring again

The good news on coronavirus vaccines has boosted the value of travel stocks, like Flight Centre (ASX:FLT), Webjet (ASX:WEB) and Corporate Travel (ASX:CTD). While a return to normal is still a fair way off, many investors clearly don’t seem to mind, and are looking ahead to better times. So, are they being realistic, or is this a case of irrational exuberance?

I had previously written on FLT following its capital raising in the early days of the coronavirus pandemic, where the outlook remained extremely uncertain and society was still trying to understand the longer-term implications of coronavirus on areas like travel.

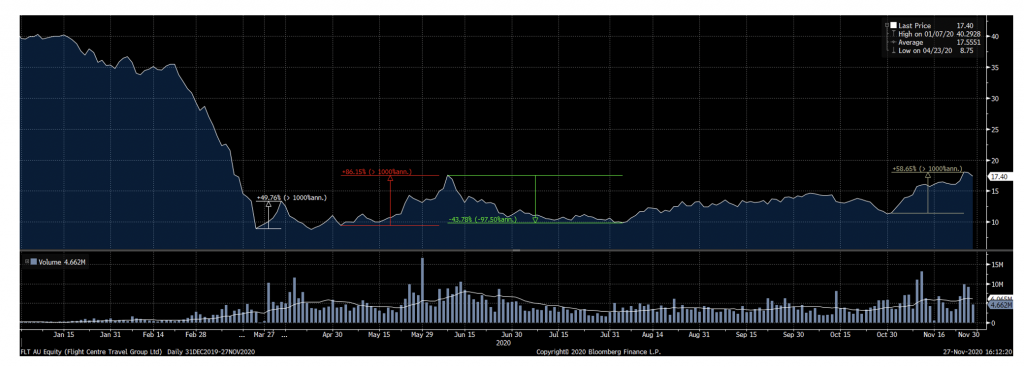

Around the time of the blog post and immediately after the capital raising, Flight Centre shares had spiked up to $14 before drifting back down to $10 in May. In the heady days of early June when the reopening trade was the craze, Flight Centre shares again soared, this time to above $17, before a sudden change in sentiment caused by a realisation that COVID-19 was here to stay (at least in the Northern Hemisphere) saw it drift back down to $10.

With the various positive news on vaccines, however, we have seen FLT again rise – hitting $18 per share last week. It is arguable that the rally in the shares this time is more sustainable – an effective vaccine within the next 12-24 months appears significantly more likely rather than a possibility. Question marks remain on the duration profile and longer-term safety, but investors have assumed these are likely to be addressed with science.

Flight Centre (FLT AU) share price

Source: Bloomberg

It certainly has been a wild ride for any holder who held FLT shares during this period. Given the trading range between $10 and $18, buying and selling at the appropriate times would have netted very attractive profits, although, had you succumbed to the positive / negative sentiment that has dominated the direction of these companies, it may have resulted in material losses.

In Part 2 of my previous blog, I detailed how we assess Flight Centre shares as an investment. With the positive vaccine news, it’s worth considering how this may have changed.

Adjusting forecasts for the vaccine

Market share dynamics

As part of the raising, FLT embarked on a material cost reduction program including a reduction in store footprint by around 50 per cent (approximately 45 per cent in Australia and 60 per cent globally). With this having occurred, there is unlikely no significant change to the short-term store outlook, limiting FLT’s capacity to recapture its entire TTV in the first 12 months when travel starts returning “back to normal”.

There is also likely to be a greater shift to online, albeit again this is harder to quantify and it remains uncertain whether FLT will be able to capture a greater presence in this regard.

Timing on when market returns to “normal”

At the time, I wrote normal was unlikely for at least 6-9 months. With COVID-19 restrictions now having been in place for around 9 months, it appears assuming a level of cash burn and testing liquidity for at least that duration was prudent. It does appear increasingly likely however that FLT has more than sufficient cash to withstand the downturn, which gives the business some flexibility later on.

Estimates on “normalised” profitability

This remains largely intact as per Part 2.

Percentage take of total transactional volume (TTV) – there is still some level of uncertainty as to the competitive dynamics. It is possible some weaker competitors have exited the industry, but it is likely that existing players have all embarked on a similar cost-reduction strategy. With a smaller market initially, it is possible there will be significant price competition given the lower cost structure of these businesses.

Operating costs – FLT has updated the market on its current operating cost run-rate. While costs will naturally increase as activity improves, it would be safe to assume there has been a level of structural cost eliminated from the business.

Total TTV – It remains highly uncertain the longer-term impacts on travel resulting from COVID-19. It is likely we see a very strong bounce back given pent-up demand, but whether this is sustainable remains to be seen. It’s quite possible that preferred travel destinations take into account the COVID-19 situation of the country, i.e. a shift of the pie to different destinations rather than a shrinking of the pie itself.

Share price reflects reduced uncertainty

Based on a similar analysis as part 2 will yield a range of scenarios. At the time, I suggested a net income range of $100-150 million for FY22, which was broadly in range of consensus earnings at the time. However, given the longer delay, it appears that market estimates for FY22 have come down to around $75 million, before bouncing back given the strong exit-run rate forecast for FY23 when the market is assuming COVID-19 restrictions will be a distant memory.

The major difference is the level of “uncertainty” as ascribed by the earnings multiple. FY23 projections assume revenue around 25 per cent below FY19, which would account for the smaller store footprint. On this basis, the projected net earnings is $170 million versus $250 million in 2019.

To reflect the greater confidence the market has in these forecasts however, the current share price of $17.40 per share implies a Price Earnings ratio of 21x for FY2023 net income.

Of course, there is the likelihood of an increasing store footprint over time as the travel industry recovers, but with FLT shares have traded within a range of 12-22x pre-COVID in the past, it would not be a stretch to say investors in FLT have looked past COVID-19 and have already assumed a significant recovery in earnings for the business.

You can read my previous articles on Flight Centre here:

After raising capital, is Flight Centre now a good investment?

Why Flight Centre needed to raise capital – and fast

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

3 stocks mentioned