Is it time to get bullish on the supermarkets?

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,845 (+0.36%)

- NASDAQ - 11,853 (+0.62%)

- CBOE VIX - 26.73

- FTSE 100 - 7,108 (+1.17%)

- STOXX 600 - 407.34 (+1.66%)

- USD INDEX - 107.08 (sitting near two-year highs)

- US 10YR - 2.933% (+12bps)

The 2s/10s curve inverted overnight again - the third time in a year. Will lightning strike three times?

- GOLD - US$1,739/oz

- WTI CRUDE - US$98.13/bbl

THE CALENDAR

Locally, it's all quiet on the Western front but it's anything but in the US. Last night, we got the latest Federal Reserve meeting minutes. The document is the best way for investors to get a sense of what the central bankers are thinking (and thinking of doing).

While the data doesn't indicate it officially, the US is most likely now in a recession. The Federal Reserve can kiss its soft landing dreams goodbye.

On job openings (JOLTS), there are still 1.9 job openings for every unemployed person in the US – far higher than the pre-COVID-19 record of 1.2. To contain inflation pressures, the US Fed will need to close this gap between labour demand and supply.

Later, we also get two other prints on the US labour market - namely weekly jobless claims and then payrolls on Friday. Will there still be two job opportunities for every unemployed American?

What a weird time we're living in, hey?

THE QUOTE

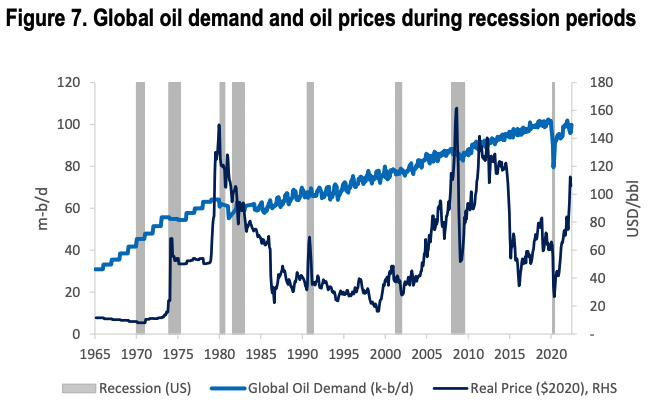

In a recession scenario, we would see oil prices falling to $65/bbl by year-end and potentially to $45/bbl by end-2023, absent intervention by OPEC+ and a decline in short-cycle oil investment.

This quote from the respected energy analyst Ed Morse at Citi probably shook the crude oil market to the core yesterday. A lot of analysts like to talk about how this energy crisis is comparable to the 1970s. But Ed makes a strong case for how things are different this time.

Yes, high energy prices preceded a recession. But since Russian oil exports are still strong, there is some supply still coming onto market - which is different to the 1970s.

Of course, it all comes back to supply and demand. In particular, whether they can meet higher supply targets in a world where infrastructure is ageing and the once-nick-named "black gold" is no longer fashionable. On the demand side, how far will it fall? Will it be like 2008 and 2020 when the worst global recessions caused a negative global oil demand situation? Or will it be like every other time when oil demand actually kept climbing?

History suggests it's most likely the latter.

Incidentally, this quote is at odds with JP Morgan analysts who think that in the worst-case scenario, crude oil could actually climb to US$380/bbl! The good news is that this is a "stratospheric" case. The bad news? Don't rule anything out in this environment.

THE CHART

STOCKS TO WATCH

Today's stocks to watch segment goes to UBS - and their survey of supermarket suppliers. I picked this for two reasons: 1) Cost-push inflation is very real and 2) Supply chains are the story that keeps on giving.

Analyst Shaun Cousins has done the rounds - and the feedback he is getting suggests food inflation is rising at a faster rate than expected (shock!)

But it's not just price and floods. Volume headwinds are also an issue. This, in Shaun's view, is due to limited population growth being deferred. That should support in-home consumption for a time to come.

All this explains why Woolworths (ASX:WOW) was upgraded from sell to neutral, and Coles (ASX:COL) and Metcash (ASX:MTS) keep their neutral and buy ratings respectively. Now all they need is for the margins to follow.

THE TWEET

I've talked before about Bill Ackman's Twitter threads in this series but this one (21 tweets long, if you've got the time) is really interesting. Bill argues that the US is already in a wage-price spiral, a lack of liquidity, and above all, a lack of earnings downgrades (yet).

You may not agree with all the above but I highly recommend the read: you can find it here.

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

3 stocks mentioned