Four quality companies to keep an eye on

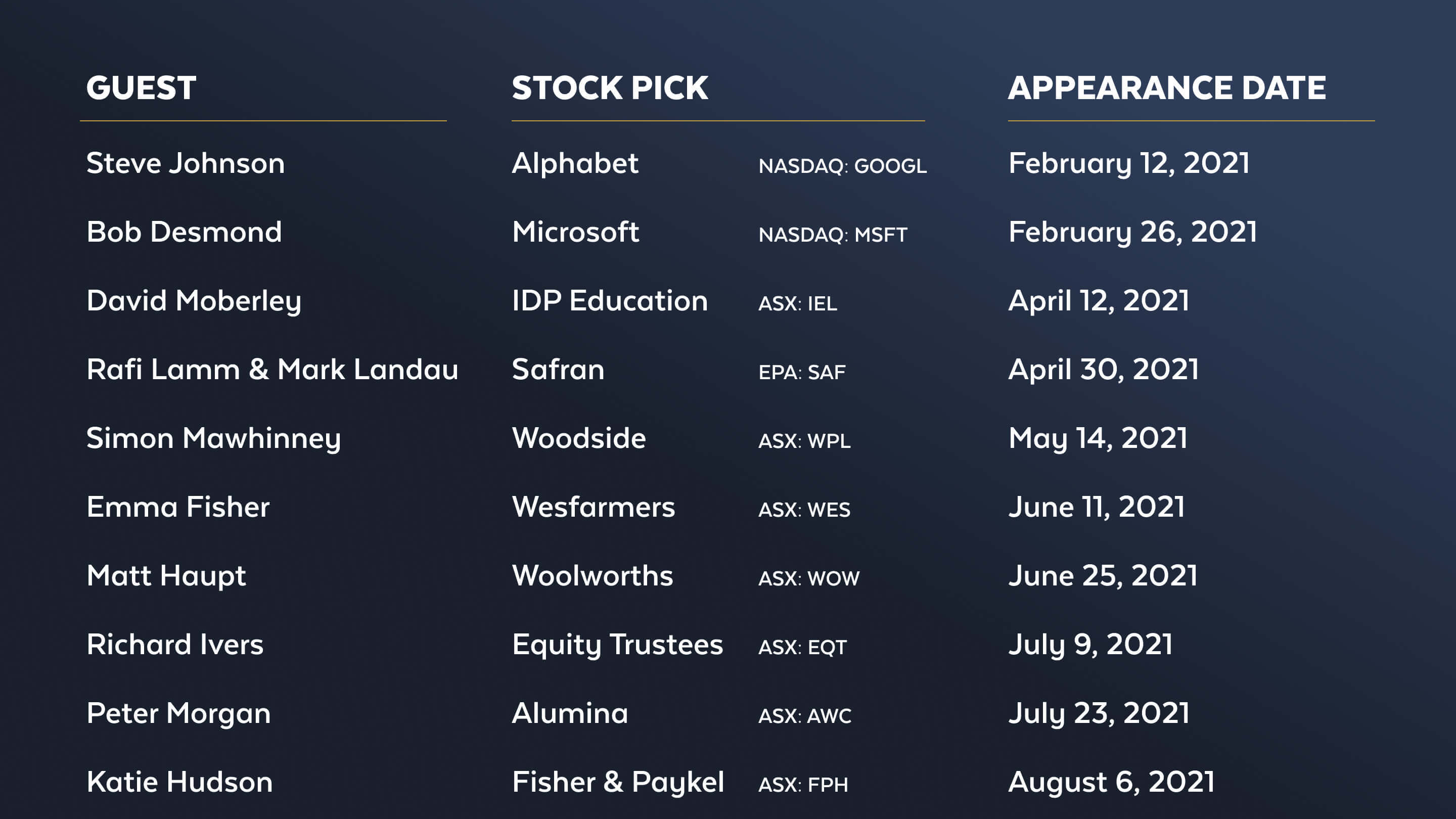

In this three-part interview series with portfolio manager Bob Desmond we first talked about Claremont’s outlook and strategy. We then ran the tape back a year and unpacked their fund’s successful performance and the upcoming opportunities they saw ahead of them.

As we reach the end of this series, investors are asking the same questions. How much cash should I be holding? And what should I buy?

In this wire, Bob opens up on how much cash the portfolio is holding and why it is a lower number than last year. He also expands on four quality global stocks whose resilience and prospects over the next three to five years could make them appealing additions to investor wishlists.

Key takeaways:

- Bob Desmond explains how his views on certain companies clashes with the wider community

- Gives insights and opinions for Alphabet, Microsoft, Visa and CME*

- Reveals why Claremont has their cash fully invested

Edited Transcript

Has the landscape provided a test for Alphabet/Microsoft’s earnings?

Bob Desmond: Well, obviously, the recent results were sterling, right? You've got companies that are that big. I am trying to remember. I think Alphabet's was a 26 or 27% constant currency revenue growth. Alphabet. Microsoft was low 20, if I recall. Really, really strong growth, rock solid balance sheets. I mean, it's interesting. I'm always amazed that people say,

"Oh, the tech stocks have had it and interest rates will kill them, long duration and they're expensive."

But they're actually not. Alphabet, I think is 18 or 19 times earnings, Microsoft's 24 or 25, and their earnings are today. They're earning a lot of money today. So they're what I call tech staples. So I think they've just got both incredibly strong positions.

In search, Alphabet's over 90% share. I mean, every time it pops up on my screen, I can't... If I get Bing on there, I can't get it all fast enough. I mean, actually, one of the most searched terms or something on Bing is something around, "How do I get onto Google?" YouTube is a powerhouse. They've got an emerging business in cloud. It's all losing money. Got a really strong Google Play and the services business is really strong.

So yeah, I feel easily can see mid-teens top-line growth there over the foreseeable future. Same with Microsoft. Yeah, just they're both benefiting hugely from digital cloud, all those key themes we love, high margin, lots of growth, good balance sheets. Yeah, so I feel pretty good about them.

Deep dive into Visa

Visa is an interesting one, actually, and it was kind of a good example of stories last year. So it was actually interesting. I'm trying to remember.

Middle of last year, PayPal was worth more than Mastercard, which made absolutely no sense to me. If you look at what Mastercard have, the scale they have, the retail presence, the rails. They're accepted at a hundred million locations. I mean, I know you asked me about Visa, but just there was a story last year. I found this amazing.

In talking to Visa, people were asking me, if they were saying that they were seen as a dinosaur because they were only growing mid-teens. So the story last year around Visa was, buy now, pay later, crypto, Amazon, disruption was all going to kill them, but actually, their numbers weren't saying that, and actually, through COVID, it was actually brilliant for Visa because it's just accelerated that whole move to digital, to online, cross-border e-commerce, contactless.

So the last number they did, 17% revenue growth, but of that, the key number is cross-border, which is coming back. I think it was 46 or 47% growth.

This year, travel will go above where it was pre-COVID, but they've built a whole lot of new businesses on top of that. People are using debit cards more. They're going online. Every time you're online, their cyber services kick in, fraud, all that type of stuff. We're all using e-commerce more, so you have to use a card, and then cross-border e-commerce. And they've got all these new payments flows as well, B2B.

So it's amazing in America how many people still write checks. So businesses couldn't go into the office and they've suddenly realised what an Achilles heel that is. They have to make that digitised. So that's a new flow, P2P, government disbursements, and cross-border remittances.

From being a credit business 30 years ago, a lending business, then it became a spend business, which was just using cards, and it's actually now becoming a network of networks. Wherever you want to move money, whoever you want to pay, they can do it.

In talking to Visa... they were saying that they were seen as a dinosaur because they were only growing mid-teens.

Deep dive into CME

So CME is a terrific business. Obviously, the world's biggest interest rate futures exchange, which is 25, 30% of their revenues, also got really, really strong positions in contracts across equities, and commodities. So it's a business that benefits from volatility.

It's a 65% operating margin business, incremental margins in the 80s, natural monopoly, natural network effect. Again, very low cost to value ratio.

If you're a business and you're buying commodities and you have to hedge that, it's going to cost you not that much to hedge it, but if you get the hedge wrong and you run unhedged, it could potentially blow up your business, or if you're an insurer and you're insuring your assets against interest rates rising your bond portfolio, obviously, if you don't do that, it could potentially blow up your business. So it has a real great cost of value.

The financial metrics, as I said, are amazing. But when we bought it, I think interest rates were half a percent and it was going to be QE forever, no more volatility.

Jerome Powell, "We're not even thinking about raising interest rates."

Philip Lowe, "Yeah, we're not raising rates till 2024"

Which is extraordinary, I felt, an irresponsible thing to say. No one knows what's happening in a year, let alone in three years. So that gave us the opportunity. We'd followed it for years, and so the stock had sold off because people were going, "Well, it's going to be QE forever." So last result, they did 13% revenue growth.

Average daily contract value was up 19%. And if you read the transcripts, you can see just a lot of drivers in that business, rising interest rates, increasing volatility.

It's a nice business to own because it tends to be countercyclical. So what's been actually quite interesting in the last month has actually sold off quite a bit, because suddenly, everyone's thinking, "Oh, maybe interest rates aren't going up that much, breakevens come back again." But when you think rates are going up, more volatility, it tends to go the other way. Yeah, terrific business. Yeah.

That must have been very satisfying ...

Bob Desmond: Yeah. It's not the fastest grower. It's probably going to be 6% top-line story, high single digits. They pay terrific dividends, a very settled management team. They're always very generous when we travel. They roll out the whole board, which is very generous of them. Not quite sure they want to talk to us. But yeah, no, it's amazing business.

How much cash should be held in portfolios right now?

Bob Desmond: So last year, our target return is 8 to 12% per annum. We were sort of gently pushing, saying to clients it's not the best entry point because we just couldn't see a path to getting them to those returns. Definitely this year, we've been much more constructive with clients.

So we have been investing cash. So we came into the year with 9%. We can only go to 10%. So we had 9% cash. We've run that down to 5%, which is about fully invested for us. We have to keep working capital and capital for forward, so we're pretty much fully invested.

It's not to say if you hold off, you might get a 15% per annum return and you might get the bottom.

There's no doubt in the short term, you can see headwinds, and straits are going up. We don't know what the second derivative of that is.

But in terms of the macro, I mean Jamie Dimon this morning was pretty extreme saying there's a hurricane coming. I've learned that at the end of the day, we always look two to five years out.

At the end of the day, we are going to hold these businesses for five years. So with all of these businesses, they are not undiscovered and they tend to trade at high multiples, and the only way you're going to ever get them at a fair price is to lean into uncertainty. That could be business uncertainty, it could be market uncertainty.

So I'm not going to call the market, but I do think that when I say it to clients our 8 to 12% per annum return, I feel nudging them towards the right side of that equation over five years.

%20(1)%20(1).jpg)

High conviction investing

Claremont Global is a high conviction portfolio of value-creating businesses at reasonable prices. Stay up to date with all our latest insights but clicking follow, or visit our website for more information.

3 topics

1 fund mentioned

1 contributor mentioned

Matt Buchanan is a former Head of Content at Livewire Markets. Matt is an avid investor and a big fan of the Livewire community, which he first joined in 2017.

Expertise

Matt Buchanan is a former Head of Content at Livewire Markets. Matt is an avid investor and a big fan of the Livewire community, which he first joined in 2017.