Why Aussie house prices will fall circa 20% when the RBA hikes interest rates

When you write about bricks and mortar, it inevitably attracts a lot of hyperbolic attention: you tend to be typecast as a preternatural 'bull' or 'bear'. To be clear, we are neither: our task is to simply try to accurately anticipate what will unfold. After explaining that Aussie house prices would have to correct by 15% to 25% if---heaven forbid---the RBA ever lifted its target cash rate by 100 basis points or more, some readers responded that they had never seen us predict price falls before. While I will address this misperception later, let's first deal with the future direction of the $9 trillion residential real estate market.

Volatility on the rise

Over a decade ago we argued that the community should come to expect much more volatility from residential property because of the huge increase in the household debt-to-income ratio, which had made borrowers far more sensitive to interest rate changes. At the time, we asserted that this would generate a more frequent boom-bust cycle in prices as a result of variations in borrowing rates.

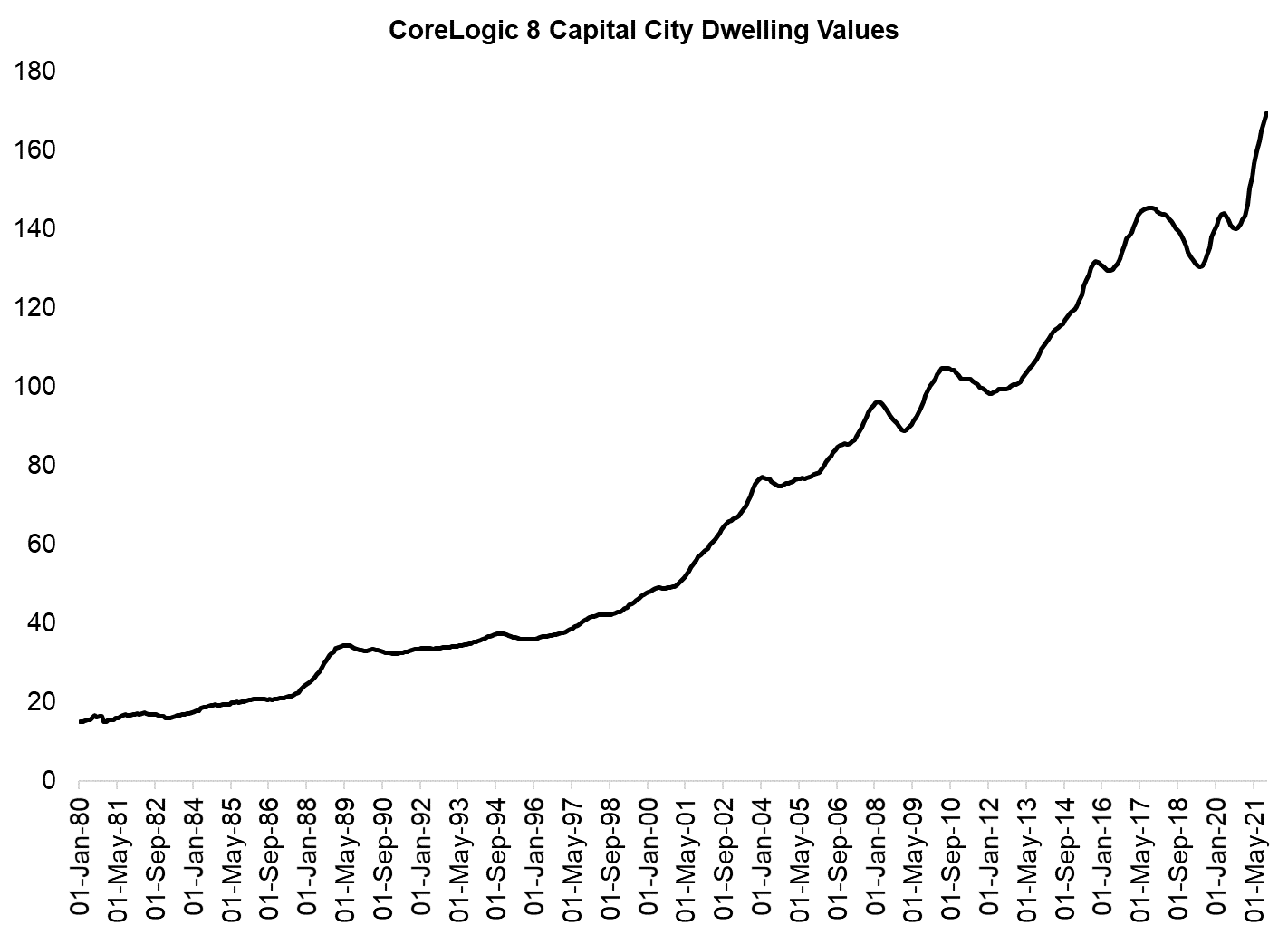

If you look at the enclosed chart of CoreLogic's 8 capital city hedonic index, you can see that substantial drawdowns in prices were relatively rare between 1980 and 2003. And yet since 2003, there have been six distinct episodes in which prices have declined with what appears to be increasing severity. It might come as a surprise that the single biggest fall in Aussie house prices over the last 40 years was the innocuous episode between September 2017 and June 2019 when capital city values dropped by a record 10.2% care of the imposition of APRA's macro-prudential constraints on lending. The losses at this juncture were, in fact, much worse than those experienced during either the GFC or the COVID-19 induced recession.

Since the end of the 2017 correction, capital city home values have climbed by a robust 30%. The capital gains following the much more mild COVID-19 retrenchment have been 21%. Going back to the end of the 2010 to 2011 downturn, we find that home owners have profited from a 72% increase in the value of their most important asset. That means that dwelling values have appreciated at a circa 6% annualised pace over the last decade. And that is at the overall asset (or property) level, assuming no gearing. Accounting for the use of significant amounts of leverage, the actual tax-free return on equity home owners have captured has been much higher again.

What will happen when the RBA hikes?

The RBA has made it abundantly clear that it is going to be highly resistant to lifting its cash rate until it observes consistent annual wage growth of 3% to 4% coupled with core inflation sustainably sitting at or above the mid-point of its target 2% to 3% band. This implies that it will not touch rates until sometime between late 2022 and mid 2023.

As I explain in more detail below, we are still forecasting ongoing house price appreciation until the RBA hikes and/or banks materially lift mortgage rates. More specifically, home values should climb by another 5 to 10 percentage points from present levels. So there is some upside left in this trade.

Yet if and when the RBA does seek to normalise the cash rate, prices should fall, as night follows day. And if the RBA is able to lift rates by 100 basis points or more, it will likely be the largest correction on record.

Assuming rates increase relatively promptly over, say, a 12 month period, we would expect national home values to decline by 15% to 25%. It is possible that the adjustment is smaller if the RBA moves more slowly and the value of residential real estate mean-reverts partly via household income growth over the effluxion of time. But our central case would be a circa 20 per cent decline after the first 100 basis points of hikes.

It's worth noting that if we apply the RBA's internal housing valuation model to this question, we get somewhat larger numbers. The model developed by Peter Tulip and Trent Saunders, which we have replicated and refined, suggests dwelling values could drop by about 33% following 100 basis points of hikes. While renters might embrace this prospect, home owners would obviously rather avoid it.

Bull vs bear backstory...

I want to conclude with some comments on the relentless 'bull' versus 'bear' stereotyping. We are neither: we are just trying to divine the direction of the market.

By way of background, we were the first to call a 10% correction in Aussie house prices in 2017, which is what transpired between September 2017 and June 2019. We were also the first to anticipate a 10% rise in prices in April 2019, which is what materialised prior to the COVID-19 shock.

To the best of our knowledge, we were the only forecasters to predict both a modest 0% to 5% drop in home values between March and September 2020 (they fell 2.7% across the capital cities) and a subsequent 10% to 20% increase in prices starting in September of that year (see here).

Since September 2020, capital city dwelling values have appreciated 21%. Our 10% to 20% forecast for future capital gains following a modest dip between March and September 2020 was predicated on the assumption of 100 basis points of rate cuts. Accounting for the steeper fixed-rate mortgage reductions that ensued care of the RBA lending $188 billion of ultra-cheap, 3-year money to banks, we adjusted our expectation for the price rise to 20% to 30%, which we are on track to achieve.

Going back further in time, we forecast that prices would soften in late 2010 following a series of aggressive RBA rate hikes, which they did (capital city prices declined by 6% between late 2010 through to the end of 2011). Yet in 2010, doomsayer Jeremy Grantham had other ideas, claiming that Aussie house prices would plunge 42%. We bet Grantham $100 million against the CoreLogic index that prices would be higher, not lower, in 3 years' time even though we were a little bearish on the immediate term outlook. Over the period covered by this proposed wager, dwelling values did indeed climb by 5.8%.

In early 2012, we got into a debate about whether the housing market was starting to recover: our data suggested it was, whereas others felt prices were still falling. We now know prices began appreciating in January of that year.

In 2013 we argued that the RBA's rate cuts would trigger a housing boom and years of double-digit price growth, which would eventually morph into a bubble. The RBA panned the proposition at the time. Yet that's precisely what we got between 2013 and 2017, which eventually compelled APRA to aggressively intervene.

Finally, way back in 2008 we argued that the national housing correction wrought by the GFC would be modest, regularly debating the likes of Steve Keen and others who predicted much more calamitous 30% to 40% price falls. In practice, dwelling values retrenched by just 6.4% in 2008 and promptly rebounded by 12.2% in 2009.

So we have a bit of history with housing. My own introduction to the topic was a result of co-authoring the 2003 Prime Minister's Home Ownership Task Force report on the demand- and supply-sides of the market. I also happened to co-found a business that developed the daily hedonic house price indices that CoreLogic now publishes and the associated automated property valuation models that leverage off the same technology.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $8 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

3 topics