2023: More pain... more gain?

2022 was a year of change for investment markets. Inflation did not turn out to be “transitory” as central banks and governments were leading us to believe. Interest rates soared and economic stimulus, declined – the goldilocks era is over. Corporations and individuals are now expected (and encouraged) to rely on themselves, not the government; behaviour that should have been encouraged and positioned well before 2022.

In February 2022, Lucerne shared our insights for the year ahead with my article “Time to change your mindset: Prepare for a 5pc cash rate”. When this article was published, the RBA cash rate was 0.1%. Since then, the RBA cash rate has increased to 3.10%, with eight months of consecutive interest rate rises from May 2022 to December 2022. The RBA cash rate has already reached the lower end of our December 2023 forecast range (3-5%), and we expect further rate rises in 2023.

Hindsight is a wonderful thing, but the RBA made a real mess of this, and should have been proactive, not reactive – the rate-rising campaign ought to have commenced in 2021 to address the post-COVID headwinds facing global economies. However, asset prices were allowed to keep raising and borrowing rates were kept at all-time lows – the bubble continued to expand.

The RBA’s December minutes confirmed that more interest rate rises are likely. Meaning, more pain ahead for homeowners, businesses, and corporations.

Given how aggressively and rapidly interest rates have risen, we are yet to realise the true impact this has had on the economy, and we expect 2023 to be a very challenging year for markets and traditional investment portfolios.

Is

the 60/40 Model Broken?

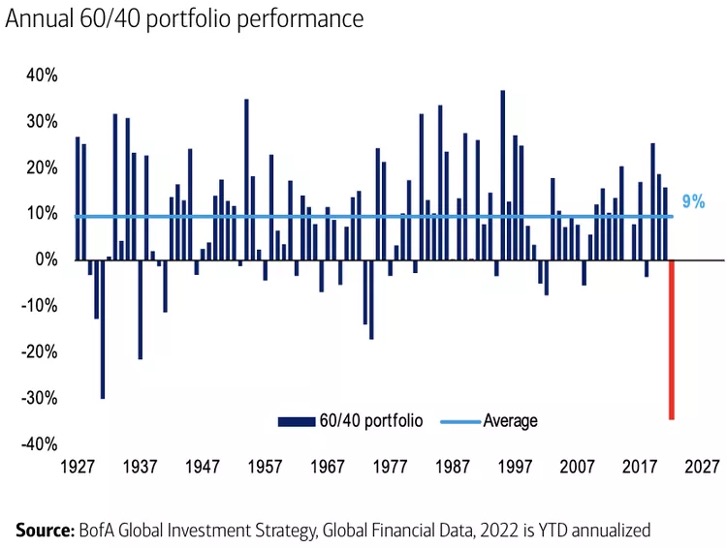

The traditional 60/40 portfolio delivered one of its worst performances in history, down ~20% for FY22 – bonds did not provide protection during this period and like equities, were sold down aggressively. The below chart highlights this performance YTD to 30 Sep 2022. Markets have partially recovered since this time, but the drawdown is still significant, and we expect this trend to continue in 2023.

The Future Fund

Our own sovereign wealth fund, the Future Fund, has been warning investors of this scenario and have been proactively re-weighting their portfolio toward assets that tend to perform better in high inflationary and unstable environments, Alternatives. The Future Fund’s Position Paper – The Death of Traditional Portfolio Construction released in December 2022 can be found here. CIO and CEO of the Future Fund, Dr Raphael Arndt believes there is no “easy way out” of the current economic situation and has repositioned the Future Fund’s portfolio accordingly, which as of 30 September 2022 held ~28.6% in equities and more than 60% across alternatives, including private equity, and infrastructure.

Lucerne shares Dr Arndt’s views and have also been repositioning portfolios over the past 12-18 months to better protect and grow investor capital when market conditions are unfavourable. All three of Lucerne’s funds produced positive results in 2022, and this was primarily driven by protecting investor down-side risk during market corrections.

Portfolio Positioning

Lucerne and our investors have realised sound risk-adjusted returns in 2022 through supporting investment themes including commodities, energy, decarbonisation, and currencies. We expect some of these themes to continue in 2023 and beyond, particularly in resources, commodities, and decarbonisation.

Unlike the GFC where there was a “run for the hills” mentality across the board, the current market environment is still allocating capital to compelling investment opportunities and the recent wave of M&A activity supports this – buyers are becoming opportunistic, and we believe this will accelerate into 2023 as further market dislocations unfold.

As markets deteriorate further in 2023, investors will witness an increase in investment opportunities available to them. However, quality due diligence is necessary due to the current landscape combined with companies increased desperation to sure up balance sheets, which is far more costly given where rates now sit and investors becoming increasingly “risk-off.”

Mandate Flexibility

For the past decade most passive investment strategies have outperformed active. Of late, this thematic has changed and FY22 produced excellent results for some of our preferred long-short active managers. Markets rationalised, and mandates that allow investors to take long positions to themes with strong tailwinds and avoid/short themes facing headwinds, benefited immensely. Examples include the likes of Totus Capital and Bronte Capital, managers we have previously discussed on Livewire. We remain overweight on this positioning and expect 2023 to provide similar opportunities for active management.

Do not be afraid to have an overweight position to cash in the current environment. Remember, wealth is created when markets dislocate, and quality investors continue to time and time again realise value when the broader market returns to its shell. The Buffets and Dalios of this world are now cash heavy and more importantly, patient. Opportunities will present and we believe the opportunity cost of holding cash right now is relatively low.

The Liquidity / Return Pay Off

In 2022, Lucerne increased its positions in private equity, venture capital and unlisted investments. We further added to our positions in HEAL Partners and Ridgeline, and supported Perennial’s latest fund, Perennial Private Ventures Fund. These investment mandates tend to run for 5-7 years, and we expect this timeframe to be very conducive for prevailing market conditions.

Assigning patient capital to high quality managers right now, should produce excellent returns to investors as capital can be allocated opportunistically to sectors of the market that have less demand, i.e., investors have much greater power and control on the terms in which they are willing to invest when compared to public markets. Further, these mandates tend not to get caught up in short-term market volatility that is associated with listed markets.

These allocations have been partially vindicated in late 2022, with HEAL Partners and Ridgeline receiving capital and support from multi-national corporations and proven global institutional investors.

In 2022, we increased our investment in the build to rent thematic, allocating additional capital to Urban Rest, a company that is experiencing phenomenal growth and benefiting from changes in corporate travel trends.

Equity Like Returns in Private Debt

In 2022, Lucerne increased our weighting to non-bank lending first mortgages, and our first mortgage portfolio is now annualising 8% p.a., fully secured over land and property. For context, the ASX200 has annualised ~8% over the past 10 and 20 years, and that involves equity market risk. The risk-adjusted returns in this asset class tend to be high quality.

The return on our mortgage portfolio is expected to increase in 2023 as new opportunities are priced at RBA Cash plus a fixed margin. Just as banks can realise improved lending returns in a rising rate environment, non-bank lenders also enjoy the same, provided thorough due diligence and lending practice are adhered to.

More Pain… But we believe, more gain

In summary, we believe 2023 will be a challenging year for markets, and potentially even worse than 2022. A global recession is on the cards, and we encourage investors to become very prudent in how they invest.

However, it is not all doom and gloom. We are excited about the opportunities that 2023 will provide investors. We expect active mandates to outperform passive, and we wish all Livewire readers are safe and enjoyable festive season, and a prosperous 2023.

3 topics

2 funds mentioned