4.2% unemployment points to rate hikes in 2022

The lowest unemployment rate in years raises the risk that the RBA not only stops buying bonds next month, which is now widely expected by market participants, but also changes its forward guidance to signal that it could start taking back the emergency rate cuts this year. This risk is reinforced by the fact that a Taylor rule of the cash rate already pointed to higher rates in 2022 based on the RBA’s existing economic outlook. The prospect of the RBA bringing its first rate hike(s) into 2022, as opposed to its previous plan of hiking in either 2023 or 2024, now hinges on crucial inflation data due next week and wages data due in February.

The behaviour of Australia’s labour market during the pandemic has been remarkable, demonstrating unprecedented strength and resilience that places pressure on the RBA to start taking back the emergency rate cuts delivered in 2020 much sooner than it had anticipated.

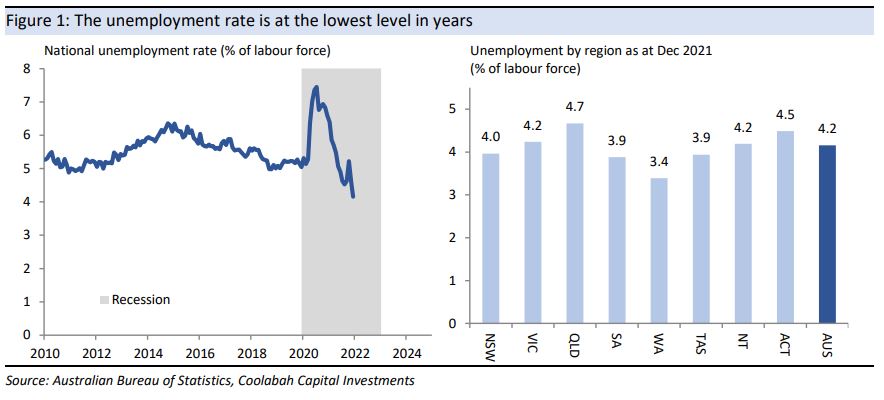

When COVID first took hold two years ago, the economy quickly tipped into recession, with the unemployment rate spiking to 7.4% (or over 12% adding in the workers that were stood down at the time). However, from that low-point, a strong recovery in the labour market has seen the unemployment rate fall sharply, reaching 4.2% in December.

This is an extremely low level of unemployment by Australian standards. The last time the unemployment rate was this low was at the height of the mining boom in 2008 and prior to that in the early 1970s, just before the first OPEC oil shock.

This rapid improvement stands is in stark contrast to past recessions, where recovery in the labour market took years, such that policy-makers had to keep interest rates low for a long time to bring unemployment down.

The unusually rapid fall in the jobless rate is reinforced by the fact that unemployment is low across the country: unemployment now stands at 3.4% in Western Australia, 3.9% in both South Australia and Tasmania, 4.0% in New South Wales, 4.2% in Victoria, and 4.7% in Queensland.

The labour market will likely weaken in January on the back of the latest COVID outbreak, while the re-opening of the international border will ease some labour shortages. However, the near-term deterioration should prove temporary and the RBA did not expect the unemployment rate to be this low until the end of 2022.

Low unemployment is important because it raises the risk that wages growth will accelerate faster than the RBA expects, triggering rate hikes as early as this year. Spare capacity is difficult to measure, but an unemployment rate of 4.2% is well below the RBA's model estimate of the NAIRU of just over 5%, matching Governor Lowe’s judgment-based estimate that the NAIRU has fallen to the low 4s (and possibly the 3s).

With other countries already withdrawing policy stimulus delivered during the pandemic, this suggests that – barring worse news on COVID – the RBA will not only stop buying bonds next month, which is our central case, but also change its forward guidance to indicate it could start raising rates this year. This risk is reinforced by the fact that a Taylor rule of the cash rate already pointed to higher rates in 2022 based on the RBA’s existing economic outlook.

At face value, warning that rates could start raising this year would be an awkward concession for the RBA to make given it has long stressed that hikes were unlikely until 2024, or 2023 at the earliest. The fact that the market has steadfastly ignored this guidance would increase the RBA’s discomfort, particularly when late last year the market forced the RBA’s hand to abruptly end the target for the 3-year bond yield.

However, the RBA could simply frame a change in guidance to emphasise the good news that unemployment has fallen much faster than anticipated, making it more confident that wages will grow strongly enough to ensure it can meet its inflation target of 2-3%.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging more than 15 analysts and 8 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

4 topics