4 sectors to drive 12% earnings growth over the next 12 months

This wire is part of a series of interviews that are taking place at the JPMorgan International Media Summit in London. Livewire is a guest at the event.

Given how expensive US stocks are - and how skewed earnings growth has been toward the Magnificent Seven over the last few years - it may surprise you to learn that the team at JPMorgan Asset Management are forecasting 12% earnings growth for the broader S&P 500 this year.

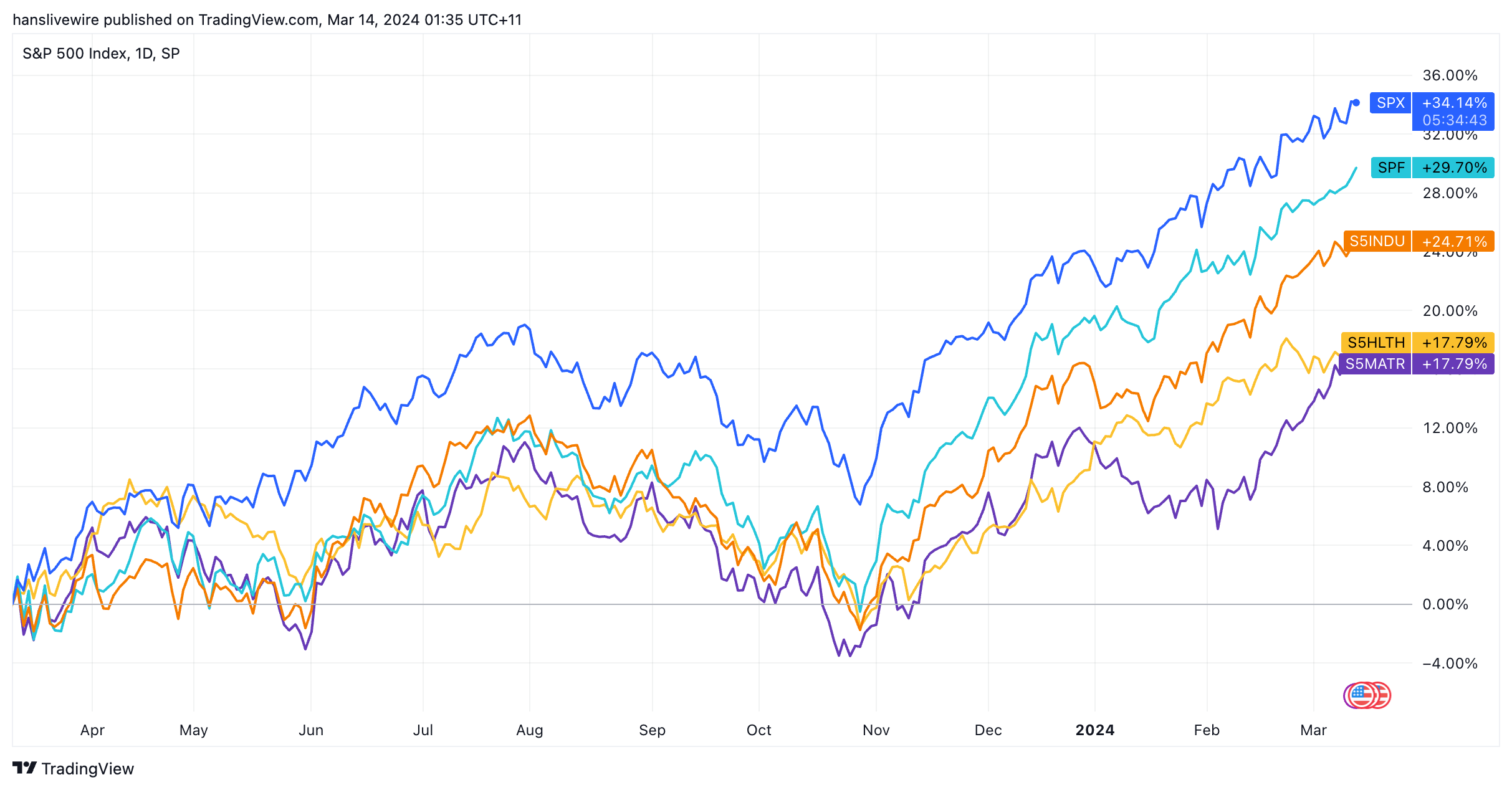

"Unlike last year where the majority of the returns were driven from the Magnificent Seven, both in terms of stock returns as well as in terms of EPS growth, this is changing. We would expect the market to broaden out," says Sven Anders, US Equity Investment Specialist at JPMorgan Asset Management.

So what gives them this view - and has them so constructive?

In this wire, we’ll discuss the opportunities that still exist in the world’s most popular stock market. And, we’ll ask whether small caps are just as hot an opportunity in the US as they seem to be in Australia.

Magnificent for good reason

Cast your mind back to the start of 2023 - what were the most touted areas of portfolio growth? Bonds? Emerging markets? European stocks? All that was pushed aside when the Magnificent Seven came to the fore.

Between them, the Magnificent Seven accounted for 83% of the total returns of the S&P 500 last year. NVIDIA (NASDAQ: NVDA), alone, accounted for 25%.

But the start of 2024 has already thrown up some divergence. NVIDIA continues to outperform, but fellow Mag7 names Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) have both struggled on the back of their challenges in China. So will the acronym change yet again?

"We now see those companies that are focused on AI, these are the ones driving the trend forward and are more attractive. I wouldn't be surprised if this acronym changes," Anders says.

Finding quality in the small caps

If one is purely looking at valuations, the interest in small-cap stocks is obvious. The segment has not rallied as hard as large-cap counterparts and many quality companies are looking to have time in the sun.

"We had the biggest gap between valuation in small and large caps in history in the US [last year]. At the beginning of this year, small caps increased, but the gap is still very wide," Anders says. "Coming down, small caps tend to outperform large caps, and this is the expectation," he adds before noting that clients are still not dipping their toe into small caps in perhaps the same way that Australian investors are.

"We see clients still a little bit on the fence, waiting for more certainty in the economy. From an earnings growth perspective, we also expect small caps to grow twice as fast as large caps this year," he adds.

We also asked Anders whether he thinks that investing in the small caps space is as simple as buying a Russell 2000 ETF - or if it's more idiosyncratic.

"I think you need to focus on high-quality companies in the small-cap space, because a big part of the space is still the regional banks, and that is still an area that could continue to be under pressure. I think quality is key."

What does quality mean to JPMAM?

This time last year, I asked several fund managers to identify what "quality" investing meant to them. The global version can be read here and the Australian version can be read here. Given Anders' response about finding quality, I naturally asked him how he and his team define a quality stock. He provided a three-pronged response:

- Quality of management team - How much is the management team engaging with shareholders and the earnings outlook?

- Quality of its business - How competitive is the business in its relative environment?

- Quality of its balance sheet - How much debt is on the company's books?

Where are the best and worst opportunities?

Anders argues that the rest of the US equity market (the so-called "S&P 493") will follow their Magnificent Seven counterparts this year from an earnings and share price growth perspective. But how did Anders and his team arrive at a 12% earnings growth figure this year? Four sectors (and technology) will likely stand out.

"We have positive earnings growth expectations for financials, for health care, for industrial companies, and even some of the commodity names. It's not just tech anymore," he adds.

The macro narrative is also supportive of these sector picks.

"Industrials have the highest positive correlation to US GDP. And the GDP growth was strong last year," Anders says. "Some of these industrial companies still look attractively valued. If I think about some of the railroad companies, if you think about those companies that focus on ventilation heating, for example, this is still in need around the globe."

Within financials, Anders calls out the non-bank financials firms like insurance and capital markets players. And in healthcare, it's not just the underperformance of the sector that is attractive - it's the fact that some stocks in the space are trading at 14-15x earnings.

"A lot of these large-cap biotech companies have 80, 90, or 100 products that are in the pipeline that go through the FDA approval stages. There's just so much research in the market on that, and it looks attractive," he adds.

3 stocks mentioned