A miserly outlook for franking credits

While all eyes have been focussed on falling dividends this year, there has been little discussion around the negative impact this will have on the franking credit benefits that are attached to these Australian yields.

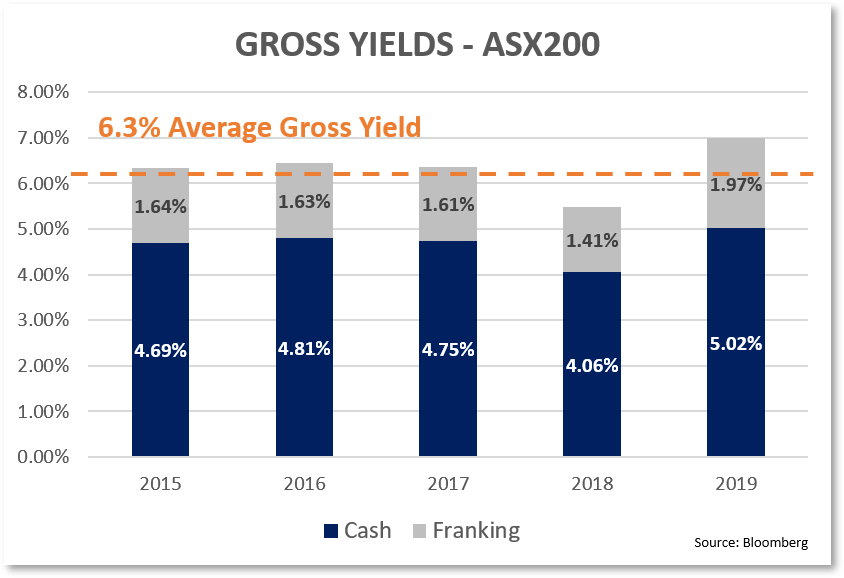

Franking credits provide an important source of cash return to many eligible investors, on average accounting for around 1.65% of total return over the past 5 years.

Investors would have been particularly pleased with calendar 2019, a bumper year for franking credits with nearly 2% returned as companies boosted dividend payments ahead of the Federal election. Franking credits are calculated and paid on a fiscal year basis, however analysis of the calendar year is useful to provide some guidance on where franking credit returns are likely to head in the future.

A more miserly 2020 for franking credits

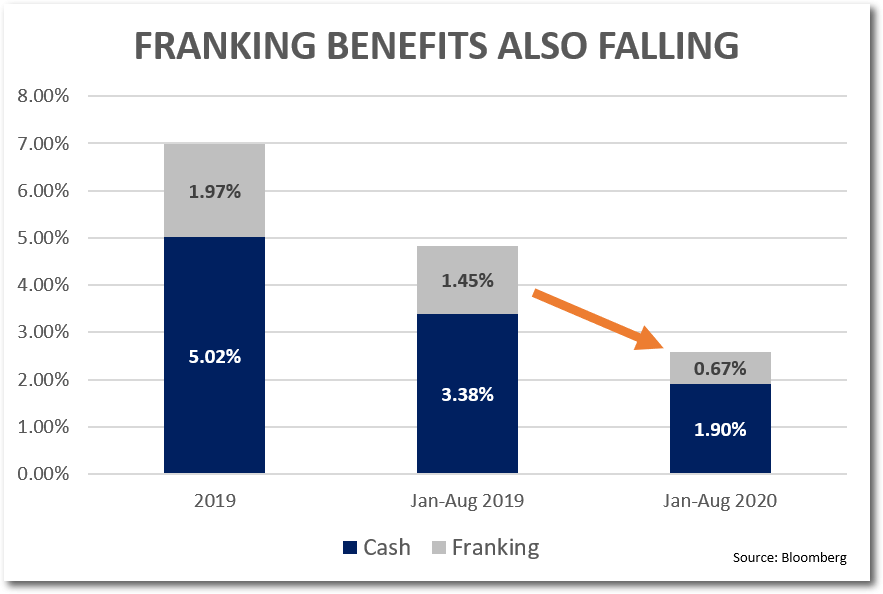

On this basis, returns from franking credits this year are likely to be far more miserly than 2019. We estimate that the calendar year to date contribution from cash dividends to shareholder return has fallen by over 40% for the 8 months to 31 August 2020, from the prior equivalent period.

Given the magnitude of the fall, a decline in franking credits is no doubt also expected. On our estimates, returns from franking credits this calendar year have only totalled 0.67% versus the 1.45% generated at the same point last year, with the percentage decline more than matching the decline in cash dividends.

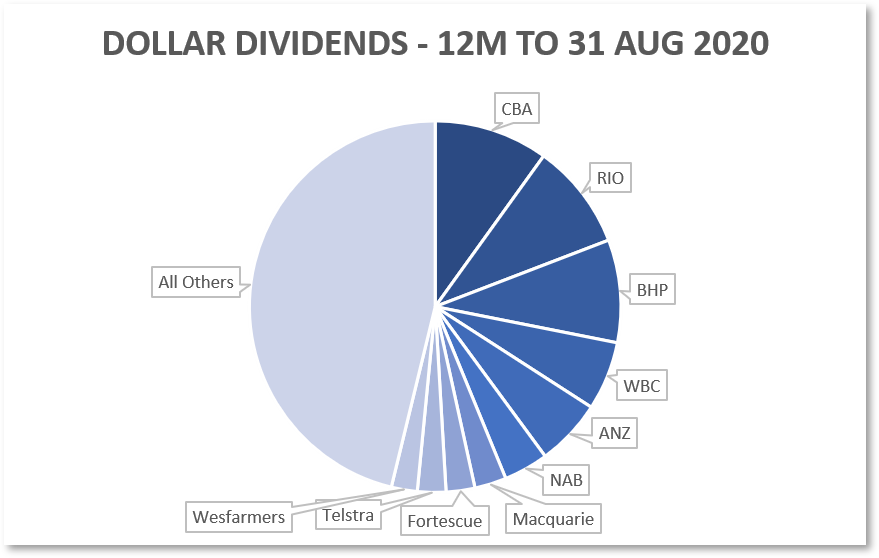

The marked decline in franking benefits corresponds with the fact that the largest cuts to dollar dividends have been made to previously fully franked dividends, for the most part. The major cuts to bank dividends, which are all fully franked (except ANZ), in addition to the withdrawal of special dividends from BHP and RIO have all contributed to the material 'shrinkage' of the franking credit pool in 2020.

As these 6 stocks accounted for over 43% of the total cash dividend on the ASX200 in the past 12 months, and they were mostly all fully franked, the pool of fully franked dividends has declined more than the broader cash dividend generated by the ASX200 in percentage terms (as the broader index includes many stocks with partial or no franking credits attached, that did not see the same quantum of declines).

Furthermore, the pool of available franking credits from the banks seems likely to be impaired for the foreseeable future, especially in light of the new APRA dividend rules (where banks can only pay out up to 50% of profits). Depending upon share prices, we believe investors should expect returns from franking credits will be closer to 1.2% in coming years, down from the 1.65% average of the past.

Alternative sources of yield

Increasingly we believe the need for alternative, replacement sources of yield becomes more valuable. Within equities there are three areas that may be worthy of consideration:

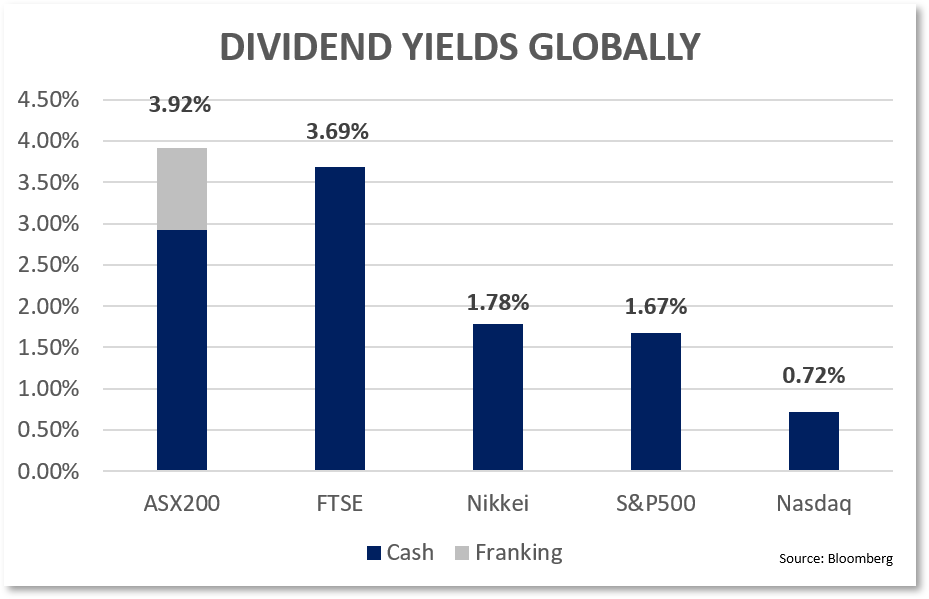

- Global shares - with the decline in Australian yields, offshore yields have become more appealing. Yields in the UK for example, on a 12m forward basis, are now comparable with Australian yields, with the added advantage of increased diversification across different sectors. Major cash dividend payers in the UK include global pharmaceuticals (GlaxoSmithKline), major energy (BP, Royal Dutch Shell), advertising (WPP) and defence (BAE Systems), all of which yield over 5% at current levels

- Active management - many Australian managers target after-tax returns for eligible Australian investors, and as a result deliver enhanced income (and franking credit) generation relative to the broader Australian market. In our analysis above we assume the entire S&P/ASX200 index is owned. Active management, when done well, could enhance income generation and not sacrifice capital.

- Alternative yield - BuyWrite strategies generate yield from the receipt of option premium and can often exceed the income generation from conventional sources (dividends and franking). BuyWrite strategies can also diversify the sources of yield, as the yield is not dependent upon dividend policy or corporate profitability. One caveat with these approaches (and NB Wheelhouse specialises in income-producing derivative overlays) is to generate a genuine 'earned' yield, that does not simply erode capital over time.

Be the first to receive more income insights

Hit the 'like' button if you enjoyed this article and click 'follow' on my profile if you'd like to receive future articles about investing for income.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

10 stocks mentioned