A rebound for global listed property as policymakers pivot

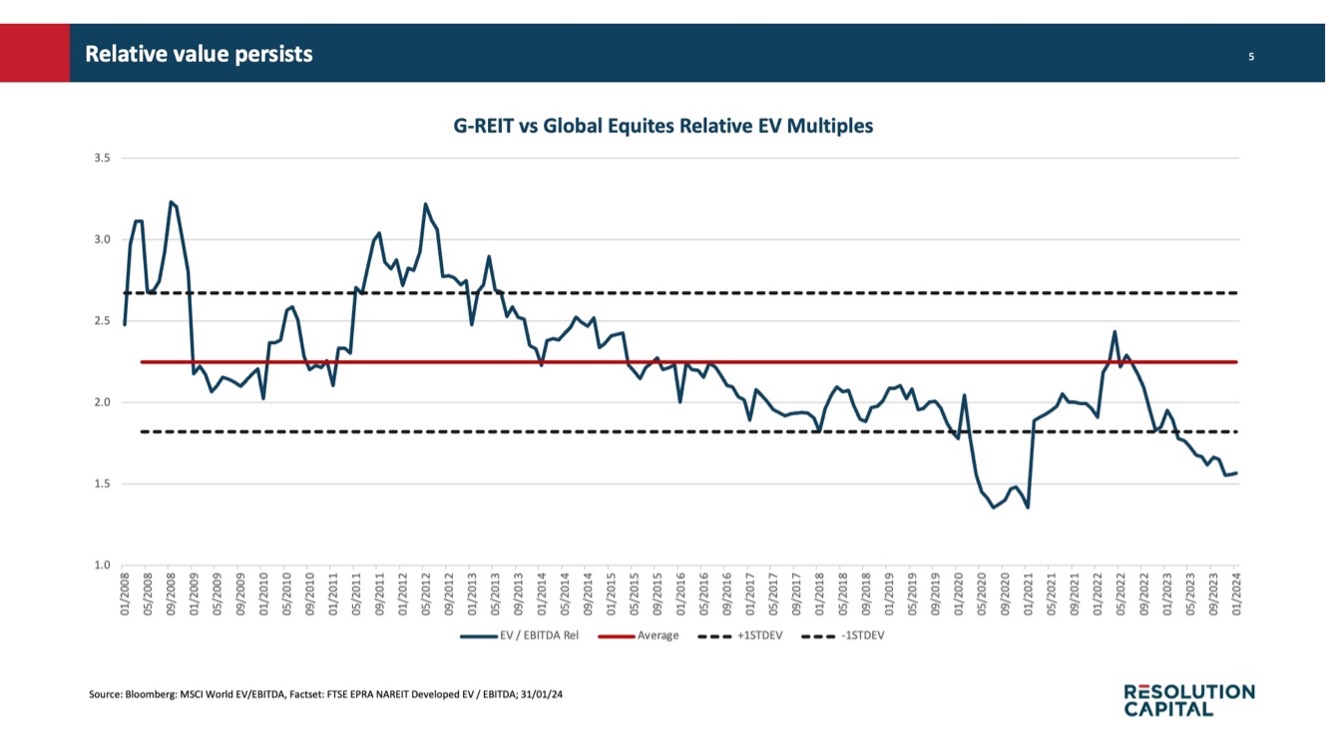

After a difficult period for REIT returns, the final quarter of 2023 saw a healthy rebound for the sector with fundamental value back on the table.

Resolution Capital Global Portfolio Manager Julian Campbell-Wood provided some insight into what led to the change in a recent investor update.

“The major catalyst was the shift in tone from policymakers. So clear evidence that inflation was easing, clear evidence that interest rate increases are coming to a close – and then the market looking ahead to interest rate cuts. And what that did for REITs is really just allow some of that fundamental value to shine through.”

From a macro perspective REITs have been trading at meaningful discounts to replacement costs.

“REITs have experienced a pretty significant drawdown, yet construction costs continue to increase and that's a good value benchmark for the sector.”

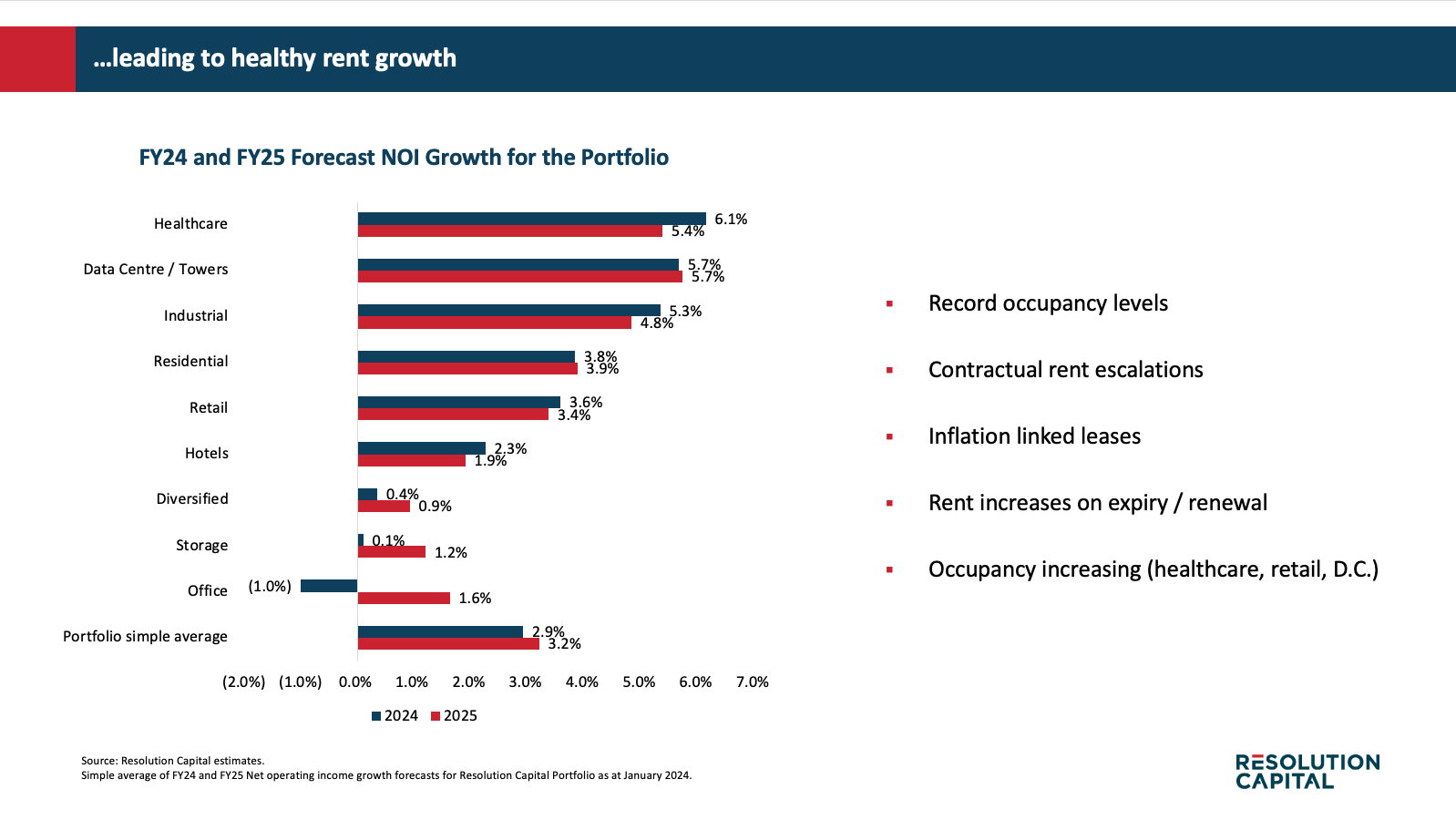

Rents increasing and tightening supply across property sectors

The operating performance of REITs across property sectors is largely solid.

“There are pockets of weakness there, and office is one which we often point to, but the vast majority of property sectors you’ve still got rents increasing.”

The Resolution Capital team invests in global real estate primarily through a property sector lens and when we look at the years ahead in terms of supply, the amount of new building starts to come down fairly substantially.

So that reduction in future supply will really help to underpin the returns for the sector as we look to the future.

So it is a healthy outlook for the sector,” said Campbell-Wood.

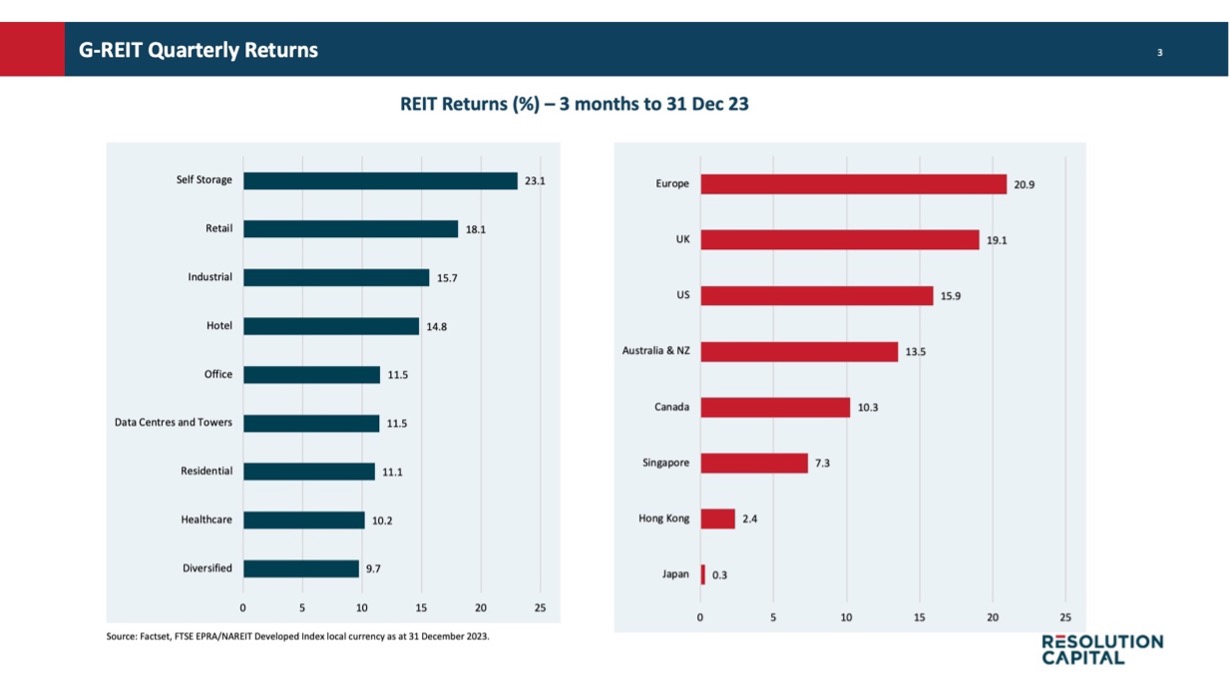

Global REIT sectors and regions of note in Q4

There was some rotation in G-REITs during the last quarter of 2023, but the result in aggregate was positive returns for all regions and property sectors.

Julian Campbell-Wood provided some insight into the positioning of the Resolution Capital Global Property Securities Fund (Managed Fund) (ASX: RCAP) portfolio.

“American Tower, in the US was a quite strong performer for us and then to the UK and Europe, you had the storage sector companies performing very well. From a regional perspective positioning in Japan and Hong Kong were supportive for us. We haven't had as much exposure in those markets and also stock selection was quite good.“

“On the negative side of things cash was a drag in such strongly rising markets. We also saw quite strong returns for some of the more highly levered REITs given that shift in positioning from central banks. Some of that rotation did impact us in terms of office companies and some of the more levered German residential businesses.”

The Resolution Capital Investment team continues to see good value in less than 50 companies that make up the portfolio.

The Resolution Capital Investment team continues to see good value in less than 50 companies that make up the portfolio.

Watch Resolution Capital's full Q4 2023 investor update

You can watch our recent investor update with Julian Campbell-Wood below.

For more information about the Resolution Capital Global Property Securities Fund (Managed Fund) (ASX: RCAP), visit our website: (VIEW LINK)

2 topics

1 stock mentioned

1 fund mentioned