ASX 200 dodges US CPI bullet on surging base and precious metals, energy, and battery stocks

Today in Review

Markets

%20Intraday%20Chart%2011%20Apr%202024.png)

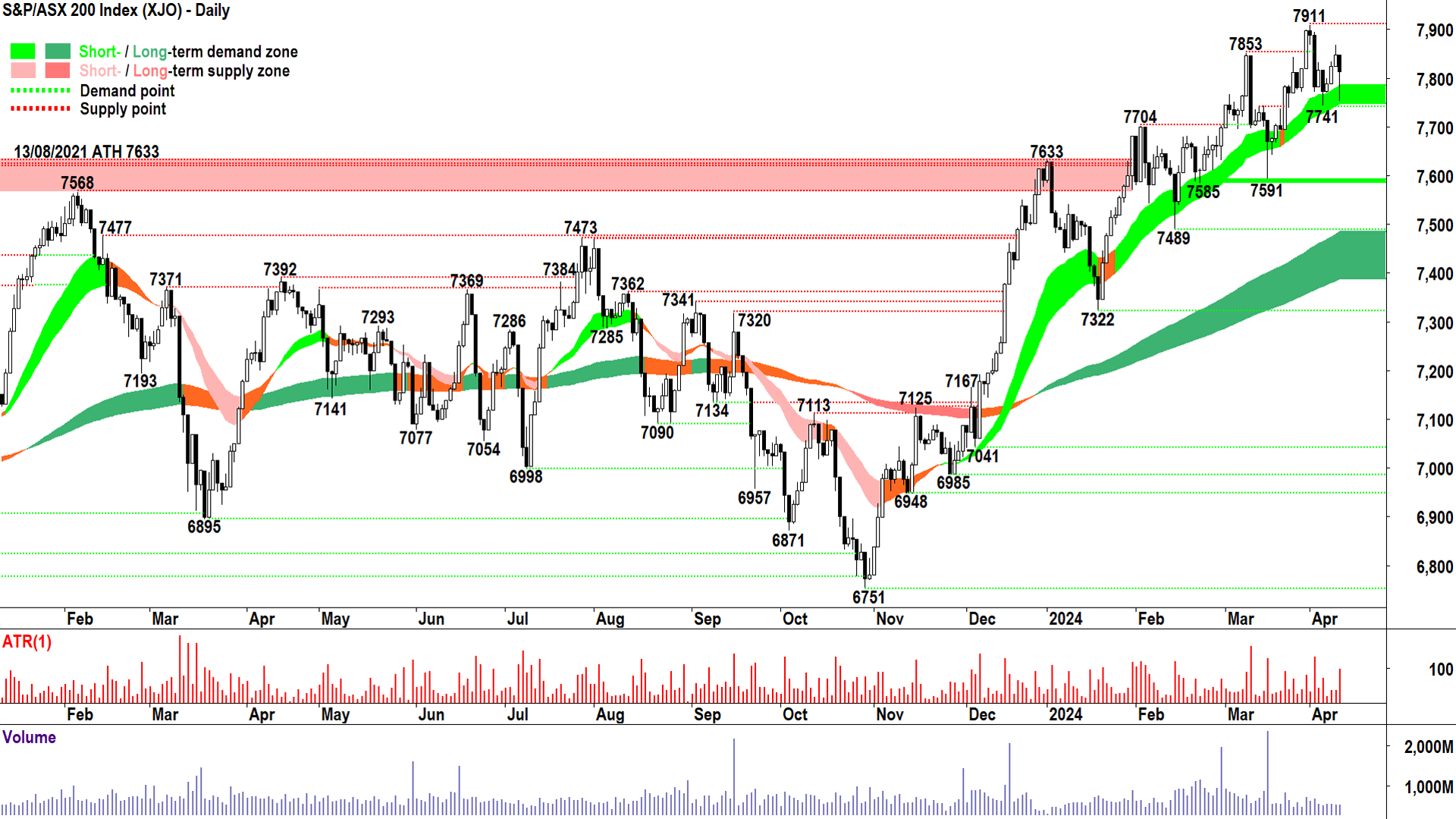

The S&P/ASX 200 (XJO) finished 34.9 points lower at 7,813.6, 0.79% from its session low and just 0.45% from its high. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 90 to to 190.

The Energy (XEJ) (+1.2%) sector was the best performing sector today, likely in response to a modest rise in the price of crude oil and natural gas overnight. This was an important rally for the sector today as it snapped a 3-day losing streak and also confirmed a bounce off key short term trend ribbon support.

%20chart.png)

Also doing well today was the Gold (XGD) (+0.91%) sub-index, but really, Resources (XJR) (+0.88%) in general had a very good run. This was due to a combination of higher base and precious metals prices overnight, as well as some favourable inflation data out of China. Note the impact of the data on the session chart above, I discuss it in further detail in Economy.

Doing it tough today, and not surprisingly given overnight developments with respect to interest rates, was the Real Estate Investment Trusts (XPJ) (-1.8%) sector. Market yields rose 0.178%, and it's usually a pretty simple equation, yields up equals REITs down.

Other interest rates sensitive sectors like Consumer Discretionary (XDJ) (-1.0%) sector and Financials (XFJ) (-0.91%) were also hit relatively hard.

ChartWatch

Pilbara Minerals Ltd (ASX: PLS)

.png)

Today’s first ChartWatch is based upon a request I received today on Twitter/X from a follower. You are also welcome to send me requests for Evening Wrap ChartWatch analysis. I can’t promise you you’ll like the results, but you’ll always get an honest account of my technical analysis methodology!

(Please don’t clog up the inbox of MI support, it will likely just annoy the poor person who has to forward emails on to me! You can either hit me up on Twitter/X or send them to me directly at carl@livewiremarkets.com.)

As it happens, today is a great day to take another look at Pilbara Minerals anyway. You all know how much I adore big white candles. One really cant get a more emphatic showing of demand-side control.

Big white candles equal big price gains. Think of the psychology of a big price gain.

Economics 101 suggests that when the price of an asset rises, the demand for that asset should decrease. When you have a big white candle with a close at or very near the high, the price has gone up, yet investors were still clamouring to buy right up until the close. They simply didn’t care about the price rise.

What could make them so desperate to get in regardless of price? Well, as a technical analyst I really don’t care. I just care about the interaction between demand and supply, and in this regard, big white candles with high closes equals demand-side control. For me, this is the best time to be involved with a stock.

Apart from today’s impressive candle, the rest of the PLS technical picture is growing more constructive, but it is far from indicating total dominance by the demand-side.

I note rising peaks and rising troughs which indicates a buy the dip mentality among investors. Today’s close took the price back above the short and long term trend ribbons, and this is important because these indicators can often act as zones of dynamic resistance. Today’s rally also solidifies 3.70 as a major point of demand.

4.04 is the closest key historical point of supply, you can see how we touched it exactly today and backed off a touch. A close above here opens up the possibility for a supply vacuum until 4.27. Ultimately, 4.58 is the big daddy of recent historical points of supply, and I suspect the price will need to close above there to commence a new long term uptrend.

In summary, there's plenty to like here, but there are immediate challenges. As long as the price continues to close above 3.70, I suggest the newly developing short term uptrend is intact.

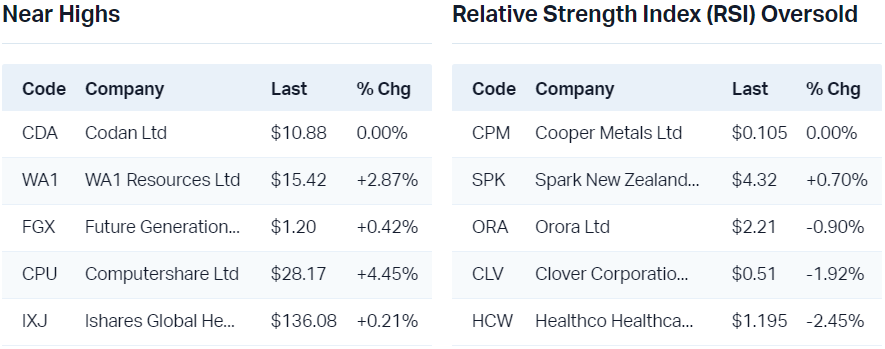

S&P/ASX 200 (XJO)

We haven’t looked at this one this week, and much like the PLS chart, today’s candle warrants further analysis.

You’ve probably heard me group white candles and candles with “downward pointing shadows” together as “demand-side candles”.

A downward pointing shadow, like the one that occurred today, indicates demand side control – but not without that control first being attacked by the supply side. The longer the shadow, the larger the initial attack, and therefore also by definition, the greater the switch back to demand-side control thereafter.

For me, downward pointing shadows are cent-for-cent just as valuable in terms of indicating demand-side control as white candles.

Even better, the early move lower can draw in shorts and kick out weak-handed demand. This is important because when the prices rises back up by the end of the session, these players often realise their error and want out (think about how you would feel if you went short or chickened out of longs right at the low of the session!). In both cases, this means latent demand which could help push prices higher in subsequent sessions.

Today’s downward pointing shadow also terminated in the short term trend ribbon. This is important because in healthy short term uptrends, this zone should act as an area of excess demand. So, check.

Also important, is the fact that today’s low didn’t move below the point of supply from the last trough at 77.41. Demand continues to lurk in the shadows of supply induced opportunities!

Not so great is the fact that we didn’t close nearer to the high of the session. The supply-side hung on today and that’s somewhat concerning.

7911 remains the key historical point of supply. We need to close above it to further confirm demand-side control. 7741 is an important point of demand. I’d prefer we don’t close below it. Ultimately, though, the uptrend is likely sound if we don’t close below 7585.

Economy

Today

China Consumer Price Index (CPI) - Consumer Inflation

- +0.1% p.a. in March vs +0.4% p.a. forecast and +0.7% p.a. in February

- That's not a month on month figure, it's annual! So consumer inflation in China is very, very low, and between November 2023 and February 2024 it was actually deflating

%20annual.%20Source%20Fair%20Economy%20and%20Forex%20Factory.png)

China Producer Price Index (PPI) - Wholesale Inflation

- -2.8% p.a. in March vs -2.8% p.a. forecast and -2.7% p.a. in February

- Again, wholesale prices are fixed in a deflationary pulse

- Read this and CPI data as the Peoples Bank of China and Beijing have plenty of scope to stimulate the Chinese economy without the fear of juicing inflationary pressures

- The other key aspect here is because China is such an important producer of manufactured goods, Chinese wholesale inflation tends to be exported to the rest of the world, i.e., helping the inflation situation in other countries like the US and Australia

%20annual.%20SourceFair%20Economy%20and%20Forex%20Factory.png)

Later this week

-

Thursday

22:15pm EU ECB Main Financing Rate (4.5% no change forecast)

22:30pm USA Core PPI March (+0.2% forecast vs +0.3% February)

-

Friday

03:00 USA 30-year Government T-Bond Auction

11:00 CHN Trade Balance

-

Saturday

00:00 USA University of Michigan Consumer Sentiment (79.0 forecast vs 79.4 previous)

Latest News

US inflation data torpedoes June cut hopes. What’s the path of US interest rates now?

ASX small caps with a strong growth trajectory: Close the Loop

Why Woodside's underperformance is a buying opportunity: Wilsons

Morgan Stanley: A perfect storm for copper

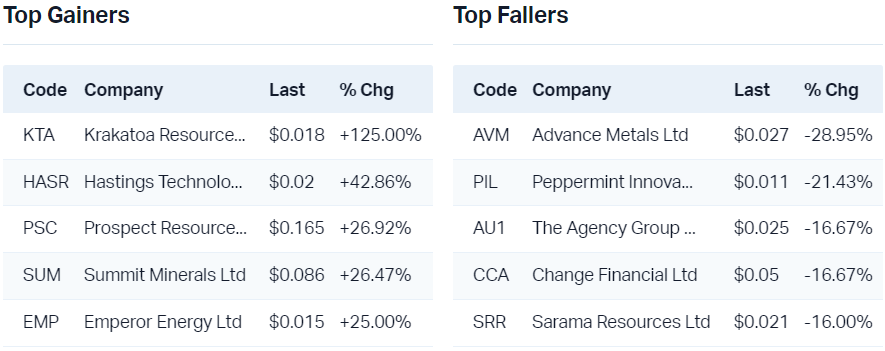

Interesting Movers

Trading higher

+24.1% Vulcan Energy Resources (VUL) - First Lithium Chloride produced from Optimisation Plant, closed above long term downtrend ribbon 🔎📈

+16.7% Winsome Resources (WR1) - Exploration drilling discovers 61.5m at 1.62% Li2O, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+8.9% Alpha HPA (A4N) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+7.5% Calix (CXL) - No news, just about every other beaten down battery metals stock got a boost today, so why not!?

+5.5% Novonix (NVX) - No news, battery metals sector strength, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+5.3% Silver Mines (SVL) - No news, general strength across precious metals stocks today, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+5.2% Pantoro (PNR) - No news, general strength across precious metals stocks today, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+5.0% Latin Resources (LRS) - No news, ditto on beaten down battery metals stocks!

+4.8% Karoon Energy (KAR) - No news, general energy sector strength today on rise in crude oil price overnight, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+4.4% Computershare (CPU) - No news, buyback remains in play, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.2% Meteoric Resources (MEI) - No news, rise is consistent with prevailing short and long term uptrends 🔎📈

+4.1% Gold Road Resources (GOR) - No news, general strength across precious metals stocks today, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+4.0% Emerald Resources (EMR) - No news, general strength across precious metals stocks today, rise is consistent with prevailing short term uptrend, long term trend is transitioning from down to up 🔎📈

+3.3% Metals X (MLX) - No news, tin price is going up exponentially likely something to do with it!, rise is consistent with prevailing short and long term uptrends 🔎📈

+3.2% Core Lithium (CXO) - Finniss Mineral Resource Increased by 58%, ditto on beaten down battery metals stocks!

Trading lower

-11.8% Wildcat Resources (WC8) - Possible continued negative response to yesterday's NEW DISCOVERY AT TABBA TABBA - LUKE PEGMATITE 41M @ 1% Li20, fall is consistent with prevailing pattern of falling peaks and falling troughs 🔎📉

-11.6% Avita Medical Inc (AVH) - AVITA Medical Updates Expected First Quarter 2024 Revenue, fall is consistent with prevailing short term downtrend and falling peaks and falling troughs, closed below long term uptrend ribbon 🔎📉

-5.5% 29METALS (29M) - No news 🤔

-5.0% Netwealth Group (NWL) - March 2024 Quarterly Business Update, closed below short term uptrend ribbon 🔎📉

-5.0% Imugene (IMU) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.7% Healius (HLS) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.6% Iress (IRE) - No news, fall is consistent with prevailing short and long term downtrends 🔎📉

-4.3% Zip Co (ZIP) - No news 🤔

-4.0% Polynovo (PNV) - No news 🤔

Broker Notes

Ampol (ALD) downgraded at sell at Goldman Sachs; Price Target: $38.30 from $36.80

-

ANZ Group (ANZ)

Retained at overweight at Morgan Stanley; Price Target: $27.90 from $27.80

Retained at hold at Ord Minnett; Price Target: $31.00

-

Bendigo and Adelaide Bank (BEN)

Retained at overweight at Morgan Stanley; Price Target: $10.20 Retained at hold at Ord Minnett; Price Target: $10.50

BHP Group (BHP) retained at buy at Citi; Price Target: $48.00

-

Bank of Queensland (BOQ)

Retained at underweight at Morgan Stanley; Price Target: $5.60 from $5.70

Retained at hold at Ord Minnett; Price Target: $8.00

-

Commonwealth Bank of Australia (CBA)

Retained at underweight at Morgan Stanley; Price Target: $93.00 Retained at hold at Ord Minnett; Price Target: $90.00

Capricorn Metals (CMM) retained at buy at Bell Potter; Price Target: $6.15 from $5.95

-

Centuria Capital Group (CNI)

Retained at neutral at Macquarie; Price Target: $1.70 from $1.68

Retained at hold at Ord Minnett; Price Target: $1.75

Chorus (CNU) retained at outperform at Macquarie; Price Target: $8.32

Catalyst Metals (CYL) initiated at buy at Argonaut Securities; Price Target: $1.30

Elders (ELD) retained at buy at Bell Potter; Price Target: $9.10 from $9.50

Inghams Group (ING) retained at outperform at Macquarie; Price Target: $4.20

Judo Capital Holdings (JDO) retained at hold at Ord Minnett; Price Target: $1.20

-

Macquarie Group (MQG)

Retained at overweight at Morgan Stanley; Price Target: $225.00

Retained at hold at Ord Minnett; Price Target: $175.00

-

National Australia Bank (NAB)

Retained at equal-weight at Morgan Stanley; Price Target: $30.60

Retained at lighten at Ord Minnett; Price Target: $31.00

Rio Tinto (RIO) retained at buy at Citi; Price Target: $137.00

South32 (S32) retained at buy at Citi; Price Target: $3.50

Suncorp Group (SUN) retained at lighten at Ord Minnett; Price Target: $13.50

-

Westpac Banking Corporation (WBC)

Retained at underweight at Morgan Stanley; Price Target: $23.00 from $22.40

Retained at hold at Ord Minnett; Price Target: $28.00

Westgold Resources (WGX) downgraded to neutral from outperform at Macquarie; Price Target: $2.20 from $2.70

Whitehaven Coal (WHC) upgraded to outperform from neutral at Macquarie; Price Target: $9.00 from $6.00

Worley (WOR) retained at buy at Citi; Price Target: $20.00 from $20.50

Scans

This article first appeared on Market Index on Thursday 11 April 2024.

5 topics

14 stocks mentioned