ASX 200 futures flat, S&P 500 claws back early losses + US CPI Preview

ASX 200 futures are trading 5 points higher, up 0.06% as of 8:30 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 set to open flat following a mixed session from Wall Street and ahead of key US inflation data

- Bapcor appoints George Saoud (former CEO at Emerging Businesses at Coles) as interim CFO

- Bellevue Gold reports February production, on track for second-half guidance of 75-85,000 ounces

- Ramelius Resources delivers 10-year mine plan at Mt Magnet

- GQG Partners Co-Founder and CIO Rajiv Jain could sell down $300m of stock (AFR)

- Transurban downgraded to Neutral from Outperform at Macquarie but target remains $13.69

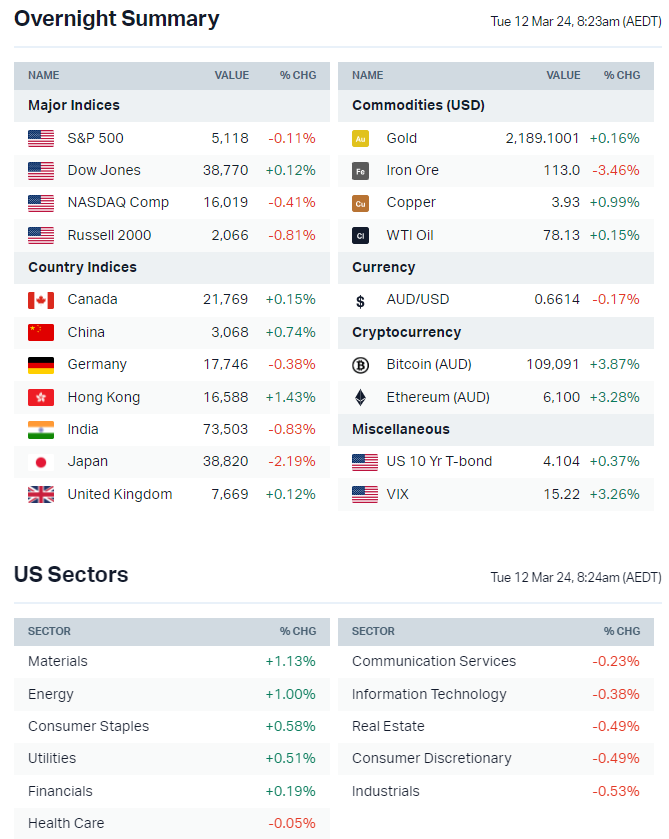

MARKETS

- S&P 500 lower but finished well above session lows of -0.64%

- Market breadth broadening – The equal-weight S&P 500 ETF hit a record high for the first time in two years last week

- Dow and equal-weight S&P 500 finished in positive territory, reflecting strength among defensive and resource sectors

- Gold extends its winning streak to nine (but today's gain was the streak's smallest daily increase)

- Copper closed at its highest level since 28-Dec

- Recession mentions in Q4 conference calls hit the lowest level since the December quarter 2021

- Strong US growth prompting investors to scoop up a broader set of stocks, instead of just surges in US tech megacaps (WSJ)

- Investors placing vast sums into short-volatility bets, including ETFs selling options to boost returns (Bloomberg)

- JPMorgan strategists downplay bubble concerns for Magnificent Seven (Bloomberg)

- Bitcoin continues its recent rally, now up more than 70% year-to-date (Reuters)

- Traders continue to close out short positions in US crude (Reuters)

INTERNATIONAL STOCKS

- Apple set to open its eighth store in Shanghai this month against backdrop of slowing iPhone sales in China (Bloomberg)

- Reddit targets US$6.5bn valuation in pending IPO (CNBC)

CENTRAL BANKS

- BOJ getting closer to exit negative rates in March, though no consensus on the board on timing (Reuters)

ECONOMY

- China CPI turns to positive for first time in six months boosted by Lunar NY spending (Reuters)

- China's housing minister says country strives to stabilise property market but allows some troubled developers to go bankrupt (SCMP)

- China's NPC offers little new for commodity bulls as investors weigh Beijing's goal for growth and market's lack of conviction of it (Bloomberg)

US Inflation Preview

All eyes are on the February CPI print at 11:30 pm AEDT. The consensus numbers for February include:

- Core inflation up 0.3% month-on-month, down from a 0.4% rise in January

- Core inflation up 3.7%, down from 3.9% in January

- Headline inflation up 0.4% month-on-month, up from 0.3% in January

- Headline inflation up 3.1%, unchanged from January

- Firm energy and gas prices to be the key driver of unchanged headline inflation

- Economists looking for further core goods deflation

- Housing rents to further slow from elevated January readings. But the stick services inflation narrative is expected to further weigh on core inflation

The January CPI print (released on 14-Feb) reported hotter-than-expected numbers across the board (core at 3.9% vs. 3.7% consensus and headline at 3.1% vs. 2.9% consensus). The S&P 500 finished the session down 1.37% and chopped around for the next five before megacap tech stocks pushed the index back into all-time highs.

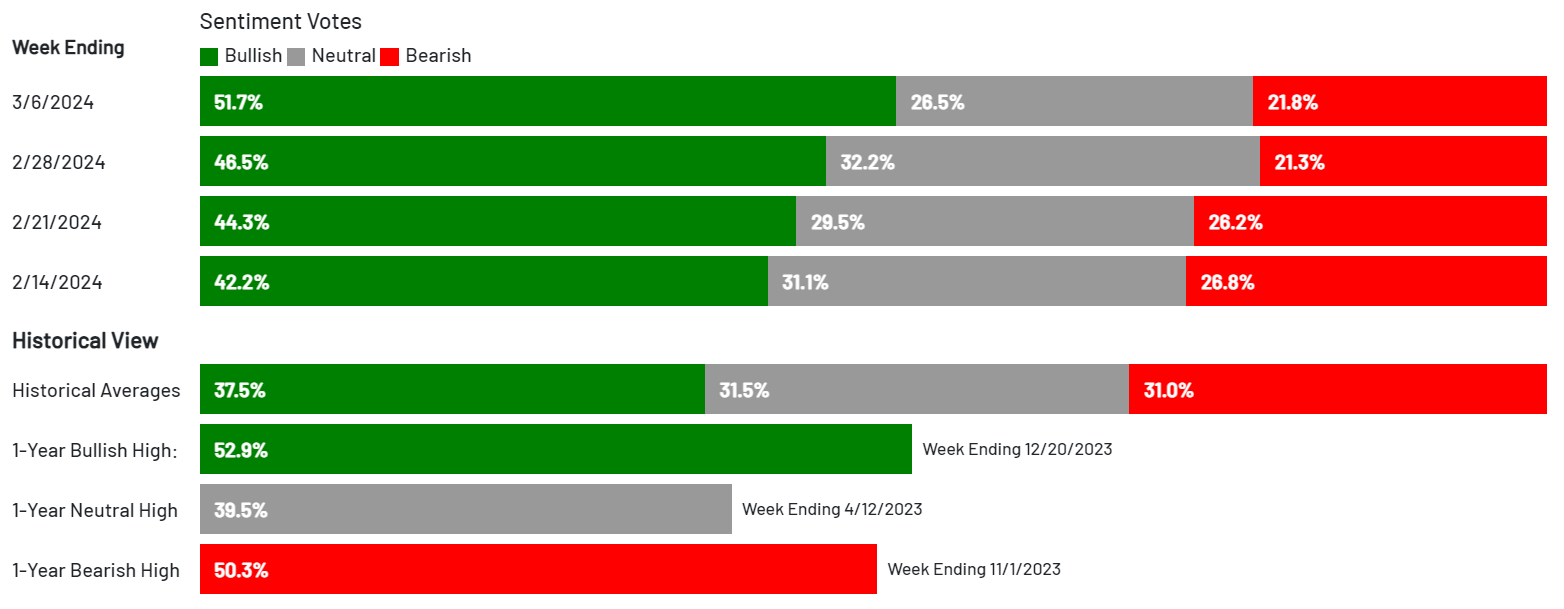

Market Sentiment and Positioning

It might be an opportune time to revisit sentiment and positioning data amid all the market frothiness.

- BofA Bull & Bear Indicator has hit 6.4 but still below the 8.0 level that would trigger a contrarian sell signal (the indicator ranges from 0 to 10)

- JPMorgan says most metrics it tracks around equity positioning and flows suggest risk levels are high and have been elevated for most of this year. The investment bank says its starting to see moderate hedge fund net selling in North America , slowing ETF flows and waning single-stock purchases from retailers

- AAII investor sentiment has 51.7% bullish voters, almost topping the 20 December 2023 high of 52.9%

- AAII bull-bear spread at 30%, the highest level in a year

Putting it all together: The indicators are getting increasingly close to absolute euphoria and contrarian sell levels. There's a bit more wiggle room but the path of least resistance calls for caution.

Sectors to Watch

Lithium: Very strong overnight session for lithium-relate sectors. Global X Lithium ETF rallied 4.37% and VanEck Rare Earth/Strategic Metals ETF up 3.09%. Majors like Ganfeng, SQM and Albemarle rose 7.2%, 6.4% and 5.4% respectively. Chinese lithium carbonate futures finished 3.3% higher on Monday (but still around breakeven in the last five sessions).

Gold: Local gold miners sold off pretty hard on Monday, with most large cap names like Evolution (ASX: EVN) and Northern Star (ASX: NST) down 2-4%. Let's see if such names can muster up some strength following another record session for the underlying commodity. The VanEck Gold Miners ETF finished 1.65% higher overnight, the highest since 2-Jan (and rallied from a -0.1% open).

KEY EVENTS

- Trading ex-div: Newscorp (NWS) – $0.107, PSC Insurance (PSI) – $0.057, Motorcycle Holdings (MTO) – $0.03, Blackwall (BWF) – $0.025, Lifestyle Communities (LIC) – $0.055, Grange Resources (GRR) – $0.02, IGO (IGO) – $0.11, Yancoal (YAL) – $0.325

- Dividends paid: Codan (CDA) – $0.105, McGrath (MEA) – $0.015, Winton Land (WTN) – $0.005

- Listing: None

- 11:30 am: Australia Business Confidence (Feb)

- 6:00 pm: UK Unemployment Rate (Jan)

- 11:30 pm: US Inflation (Feb)

This Morning Wrap was written by Kerry Sun.

2 stocks mentioned

1 contributor mentioned