ASX 200 gives it all back, then some, as markets reminded banking crisis lingers

Today in Review

The S&P/ASX200 (XJO) finished 92.5 points lower at 7,588.2, 1.22% from its session high and just 0.11% from its low. In the broader-based S&P/ASX 300 (XKO), advancers lagged decliners by a dismal 40 to 243. Bleh and Bleh!

It was always going to be a big ask for Aussie shares to back up after yesterday's record breaking heroics. Commodity prices were belted last night and US stocks tanked because Jerome Powell is going to make us wait a little longer for a rate cut.

Ebb and flow kind of stuff. I've been watching Aussie stocks trade day-in and day-out for over 30 years. I'm pretty good at looking at a set of input factors at the start of a trading day and calling roughly what we might do by the close. Hey, I'm not Nostradamus, but better than pin the tail on the donkey kinda stuff.

I would have said these two factors (commodities and US stocks) were good for a 40, maybe 50 point pullback after yesterday's pop to new highs. The final result of 92 points, or 1.2%, is not a surprise when I add in the missing piece of today's lousiness: #BankingCrisis.

We all have very short memories in the markets, but around this time last year stocks went into a 4-week swoon due to fears the unprecedented increase in interest rates had hobbled the book values of huge swathes of bond holdings among banks and insurance companies. Additionally, that plunging commercial property values in the wake of the pandemic had put at severe risk the repayment of trillions in real estate sector loans.

Two gentle reminders this issue is still with us today. Last night in the US, New York Community Bancorp Chart (NYSE: NYCB) tanked nearly 38% after it warned investors was cutting its dividend and booking a big loss on certain real estate loans. NYCB also aid it was raising its loan loss reserves to buffer against future loan delinquencies.

The key index you want to watch here is the KBW Regional Banking Index. It closed down 6% Wednesday, which was its biggest one-day decline since March 13 last year, the day Signature Bank collapsed. The technicals suggest it's not panic stations yet, but that big black candle definitely has my attention. Keep an eye on those trend ribbons, we want to stay above those.

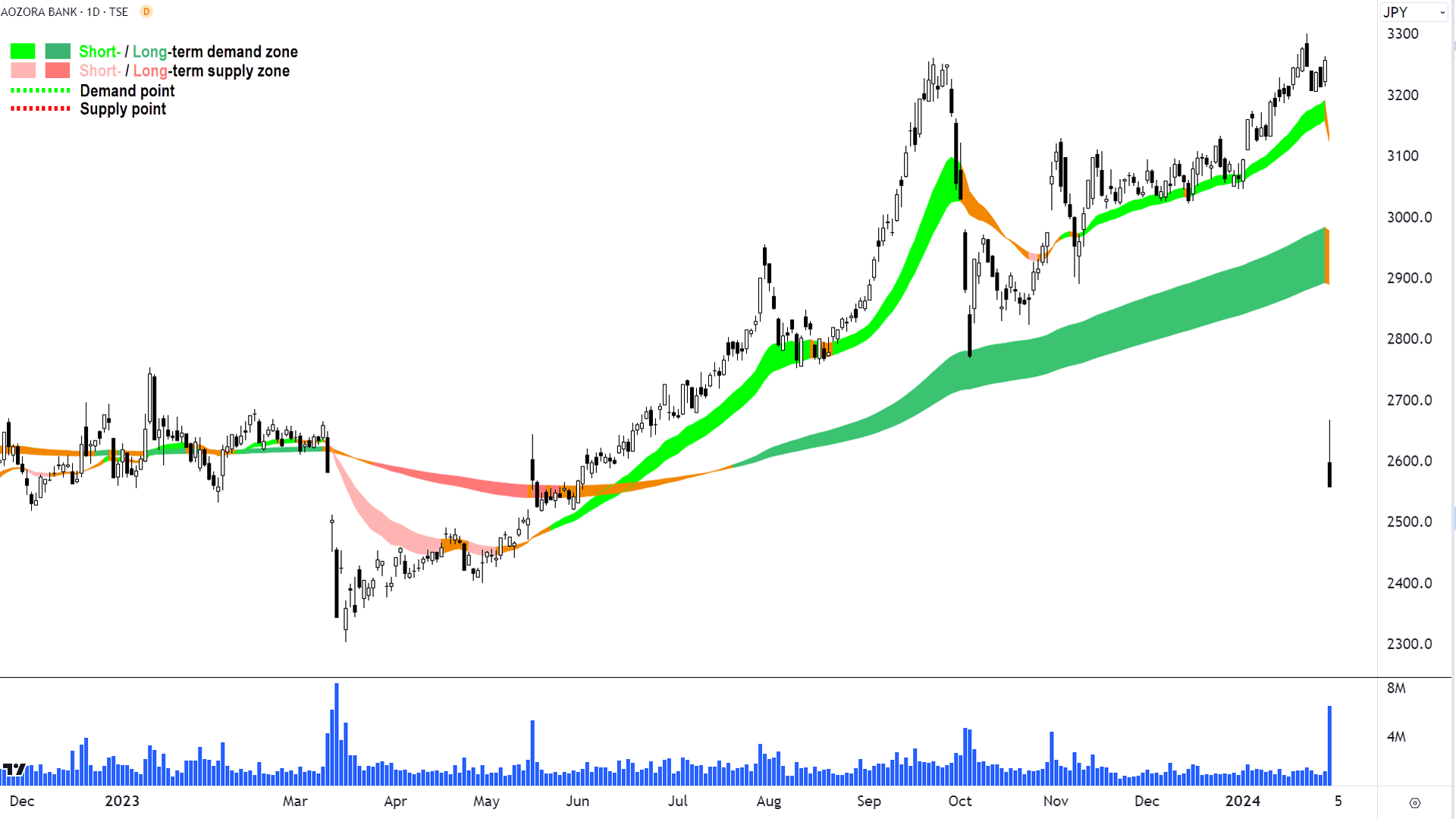

The other "gentle reminder" was a 21.5% drop in Japanese bank Aozora, which announced it would swing to a 28 billion yen net loss for the fiscal year, compared with previous guidance of a 24 billion yen profit. Oops. The reason? The bank has a major exposure to US commercial property loans and many of those have turned sour.

ChartWatch

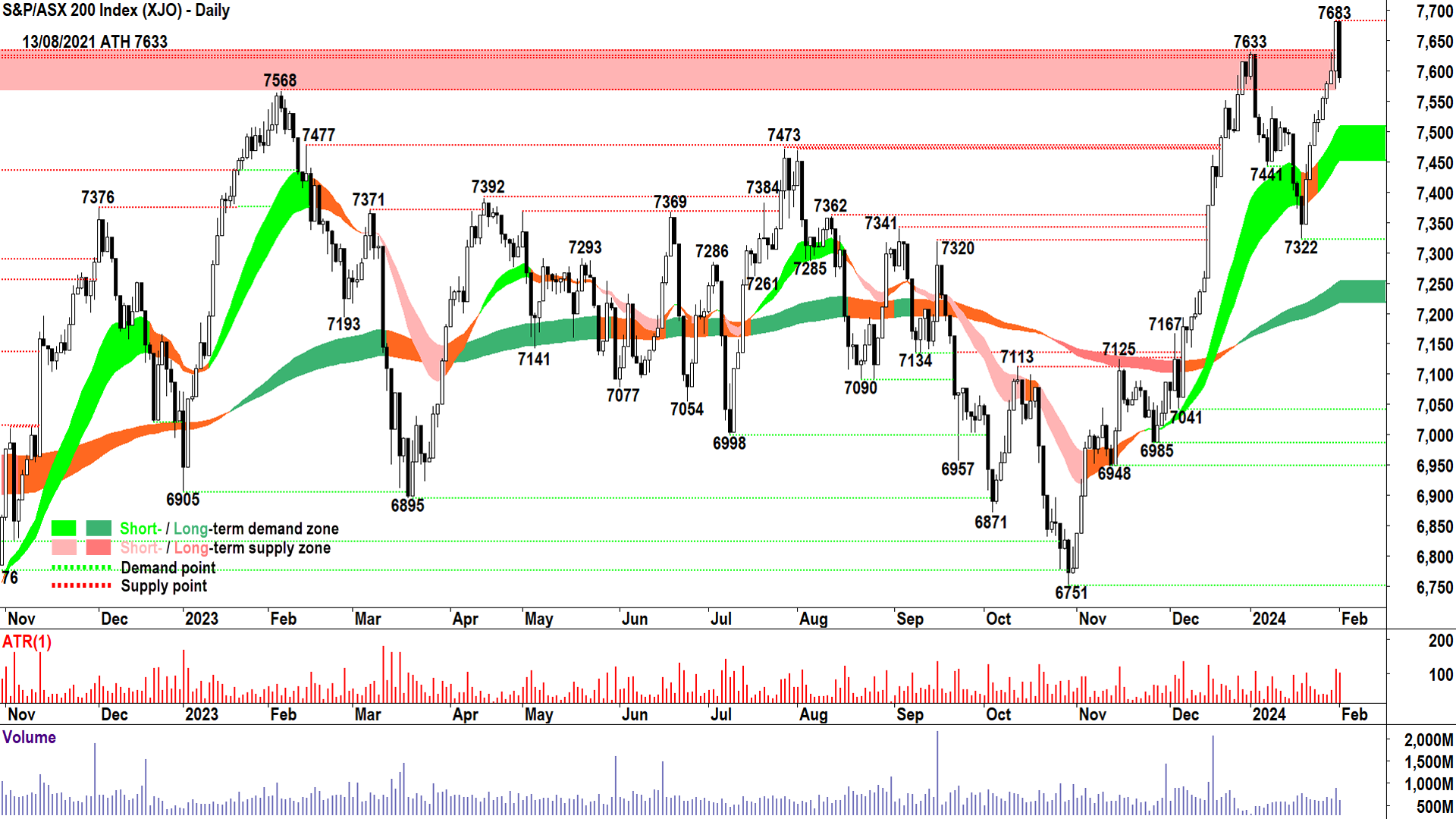

S&P/ASX 200 (XJO)

Just a quick squiz at the S&P/ASX 200 today after what proponents of Japanese Candlestick analysis would call "Dark Cloud Cover". That doesn't sound too good, right?

Dark cloud cover is a two-candle pattern where the first, white, bullish candle, is followed by a bearish, black one. Today's pattern is made worse by the fact the bearish candle has closed below the low of the bullish candle, and by the large magnitude of both candles. It represents a sudden and decisive switch in investor sentiment, indicating the market moved sharply to a state of excess demand.

I don't like to predict too much further out than the next candle with any pattern, prediction is not my style, but today's dark cloud cover puts me on notice. I need to be attentive for further confirmation the supply side is growing in strength, and or the demand side is shrining away from its record beating heroics.

Confirmation could come in the form of further supply-side candles (i.e., black bodies and or upward pointing shadows), lower peaks, lower troughs, and closing below the short tern uptrend ribbon. If there's some good news today, it's now you know what to look for too!

Economy

-

Australian Building approvals December, actual -9.5% vs consensus 0.5% vs 0.3% November (revised down from 1.6%)

Private sector houses fell 0.5%, apartments & other fell 25.3%

Victoria -18.4% and South Australia -11.8% worst vs Queensland +8.2% and Western Australia +7.9 per cent best

What to watch out for...

Later this week:

Thu: 06:00 US FOMC Cash Rate, statement, press conference, consensus no change 5.25%-5.50%

Fri: 02:00 ISM Manufacturing PMI for January, consensus 47.0 vs December 47.4

Sat: 00:30 US Non-farm payrolls, average hourly earnings, and unemployment rate for January, consensus +177,000, +0.3%, 3.8% vs December +216,000, +0.4%, 3.7%

Latest News

"Everything is looking appealing" in the uranium market, according to Keller

Is it time to fix that term deposit rate? What to expect from the RBA and interest rates in 2024

5 key charts for Big Four Bank investors

5 stocks that could enter the ASX 200 Index next month

The Federal Reserve abandons interest rate guidance: What's next for rates

The 5 biggest themes for investors in 2024

Interesting Movers

Trading higher

+7.6% Playside Studios (PLY) - Continued positive response to 31 Jan Quarterly Activities/Appendix 4C Cash Flow Report, retained at BUY at Shaw and Partners and price target increased to $0.90 from $0.80, rise is consistent with prevailing short and long term uptrends

+6.5% Select Harvests (SHV) - Continued positive response to 31 Jan Strong 2024 Crop Volumes and Strengthening Market Pricing

+6.2% Skycity Entertainment Group (SKC) - Update On Austrac Proceedings And Accounting Provision

+5.6% Credit Corp Group (CCP) - Positive response to 31 Jan Credit Corp Group H1 of 2024 Media Release

+5.0% Tabcorp Holdings (TAH) - No news 🤔

+4.8% Red 5 (RED) - Positive response to 31 Jan December 2023 Quarterly Activities Report

+4.3% Resimac Group (RMC) - Appointment of Chief Financial Officer, rise is consistent with prevailing short and long term uptrends

+3.4% Pepper Money (PPM) - Completion of purchase of HSBC New Zealand Mortgage Book

+2.7% The A2 Milk Company (A2M) - No news, has closed above its long term downtrend ribbon three days in a row

Trading lower

-8.5% Chalice Mining (CHN) - No news since 31-Jan December 2023 Quarterly Activities & Cashflow Report, fall is consistent with prevailing short and long term downtrends

-8.4% Emerald Resources (EMR) - No news since 30-Jan Quarterly Report, possible negative reaction to 31 Jan downgrade to UNDERWEIGHT from OVERWEIGHT at Barrenjoey, price target $2.90

-6.7% Omni Bridgeway (OBL) - No news, fall is consistent with prevailing short and long term downtrends

-5.8% Resolute Mining (RSG) - December 2023 Quarterly Activities Report and 2024 Guidance

-5.8% Alpha HPA (A4N) - No news, short term trend has turned down, has closed below long term trend ribbon (neutral) and below key technical support levels

-5.6% Kingsgate Consolidated (KCN) - Sydney Mining Club Presentation

-5.5% Regis Resources (RRL) - Tropicana Gold Mine Royalty Claim

-5.5% Lotus Resources (LOT) - No news, pullback after recent strong price performance

-4.7% Alumina (AWC) - No news, pullback after recent strong price performance

-4.3% Centuria Capital Group (CNI) - No news, pullback after recent strong price performance

-4.2% IGO (IGO) - Tropicana Gold Mine Royalty Claim, several broker price target cuts and one rating downgrade (See Broker Moves section below), fall is consistent with prevailing short and long term downtrends

-3.9% Silex Systems (SLX) - No news, pullback after recent strong price performance

-3.9% Liontown Resources (LTR) - No news, fall is consistent with prevailing short and long term downtrends

-3.8% Seven West Media (SWM) - No news, fall is consistent with prevailing short and long term downtrends

-3.7% Insignia Financial (IFL) - No news, fall is consistent with prevailing short and long term downtrends

Broker Notes

Life360 Inc. (360) retained at buy at Goldman Sachs; Price Target: $10.50

29METALS (29M) retained at overweight at Morgan Stanley; Price Target: $0.70

4DMEDICAL (4DX) initiated at buy at Ord Minnett; Price Target: $1.20

The A2 Milk Company (A2M) retained at hold at Bell Potter; Price Target: $5.15

Abacus Group (ABG) retained at buy at Shaw and Partners; Price Target: $1.20

Audinate Group (AD8) downgraded to neutral from outperform at Macquarie; Price Target: $15.80 from $13.50

Ampol (ALD) retained at equalweight at Morgan Stanley; Price Target: $35.43

Altium (ALU) upgraded to buy from neutral at Citi; Price Target: $56.50 from $46.65

Atlas Arteria (ALX) retained at hold at Ord Minnett; Price Target: $5.85

Abacus Storage King REIT (ASK) initiated buy at Shaw and Partners; Price Target: $1.25

Antipa Minerals (AZY) retained at buy at Shaw and Partners; Price Target: $0.06

Black Cat Syndicate (BC8) retained at buy at Shaw and Partners; Price Target: $0.74

Burgundy Diamond Mines (BDM) retained at buy at Bell Potter; Price Target: $0.45 from $0.50

Beach Energy (BPT) retained at equalweight at Morgan Stanley; Price Target: $1.65 from $1.63

Bubs Australia (BUB) retained at hold at Bell Potter; Price Target: $0.14

Credit Corp Group (CCP) retained at hold at Ord Minnett; Price Target: $15.80 from $15.00

City Chic Collective (CCX) retained at buy at Bell Potter; Price Target: $0.64 from $0.55

-

Champion Iron (CIA)

Retained at buy at Goldman Sachs; Price Target: $9.40 from $9.20

Retained at buy at Citi; Price Target: $9.60 from $9.20

Close The Loop (CLG) retained at buy at Shaw and Partners; Price Target: $0.70

Deterra Royalties (DRR) downgraded to sell from underperform at CLSA; Price Target: $4.95 from $4.85

Eagle Mountain Mining (EM2) retained at buy at Shaw and Partners; Price Target: $0.30

Evolution Energy Minerals (EV1) retained at buy at Shaw and Partners; Price Target: $0.40

Global Lithium Resources (GL1) retained at buy at Shaw and Partners; Price Target: $3.20

GTI Energy (GTX) retained at buy at Shaw and Partners; Price Target: $6.50

-

IGO (IGO)

Downgraded to neutral from buy at UBS; Price Target: $8.30 from $9.50

Upgraded to outperform from underperform at CLSA; Price Target: $8.75 from $10.00

Retained at buy at Goldman Sachs; Price Target: $8.85 from $9.70

Retained at buy at Citi; Price Target: $8.60 from $8.90

Retained at equalweight at Morgan Stanley; Price Target: $7.25 from $8.85

-

Karoon Energy (KAR)

Retained at accumulate at Ord Minnett; Price Target: $2.65

Retained at overweight at Morgan Stanley; Price Target: $2.49 from $2.51

Lotus Resources (LOT) retained at buy at Shaw and Partners; Price Target: $0.72

Mach7 Technologies (M7T) retained at buy at Shaw and Partners; Price Target: $1.30

Matador Mining (MZZ) retained at buy at Shaw and Partners; Price Target: $0.19

Nickel Industries (NIC) retained at buy at Bell Potter; Price Target: $1.53 from $1.80

-

Origin Energy (ORG)

Retained at buy at UBS; Price Target: $9.60 from $7.40

Retained at overweight at Morgan Stanley; Price Target: $8.88

Retained at overweight at Morgan Stanley; Price Target: 8..88

Pacific Current Group (PAC) retained at buy at Ord Minnett; Price Target: $12.20

-

PointsBet Holdings (PBH)

Downgraded to hold from buy at Jefferies; Price Target: $1.01 from $0.91

Downgraded to overweight from buy at Jarden; Price Target: $1.00 from $0.94

Retained at buy at Ord Minnett; Price Target: $1.05 from $0.95

Retained at buy at Bell Potter; Price Target: $1.08

Peninsula Energy (PEN) retained at buy at Shaw and Partners; Price Target: $0.34

Playside Studios (PLY) retained at buy at Shaw and Partners; Price Target: $0.90 from $0.80

-

QBE Insurance Group (QBE)

Retained at buy at Goldman Sachs; Price Target: $18.52

Retained at overweight at Morgan Stanley; Price Target: $20.00 from $18.20

Red 5 (RED) retained at buy at Ord Minnett; Price Target: $0.37

Rio Tinto (RIO) retained at overweight at Morgan Stanley; Price Target: $144.50

Sandfire Resources (SFR) downgraded to accumulate from buy at Ord Minnett; Price Target: $7.50 from $7.10

-

Select Harvests (SHV)

Retained at neutral at UBS; Price Target: $4.20 from $4.50

Retained at buy at Bell Potter; Price Target: $4.70 from $4.60

Strickland Metals (STK) retained at buy at Goldman Sachs; Price Target: $0.50

Sayona Mining (SYA) downgraded to neutral from outperform at Macquarie; Price Target: $0.04 from $0.06

-

Syrah Resources (SYR)

Retained at buy at Shaw and Partners; Price Target: $1.30

Retained at buy at UBS; Price Target: $1.00 from $1.05

Tamboran Resources Corporation (TBN) retained at buy at Shaw and Partners; Price Target: $0.37 from $0.42

Treasury Wine Estates (TWE) retained at buy at UBS; Price Target: $14.00

Viva Energy Group (VEA) retained at equalweight at Morgan Stanley; Price Target: $3.34

Scans

This article first appeared on Market Index on February 1 2024.

5 topics

10 stocks mentioned