ASX 200 sniffs record as Ramsay beats, lithium short squeeze continues

Today in Review

Markets

%20Intraday%20Chart%2029%20Feb%202024.png)

The S&P/ASX200 (XJO) finished 38.3 points higher at 7,698.7, 0.89% from its session low and just 0.07% from its high/low. In the broader-based S&P/ASX 300 (XKO), advancers beat decliners by an impressive 182 to 93.

It's important to remember broad-based moves which close near the session's high are more likely to be sustainable. With today's close just 0.7 points shy of a record we're in the box seat for a very good start to March. 🤞

The Real Estate Investment Trusts (XPJ) (+1.7%) sector was the best performing sector today, likely in response to some big moves in sector heavyweights Lendlease Group (LLC) (+4.1%) and Goodman Group (GMG) (+3.7%). Lendlease enjoyed a rare bounce after the severe selloff following its first half results, while GMG continues from strength to strength after its results were well received.

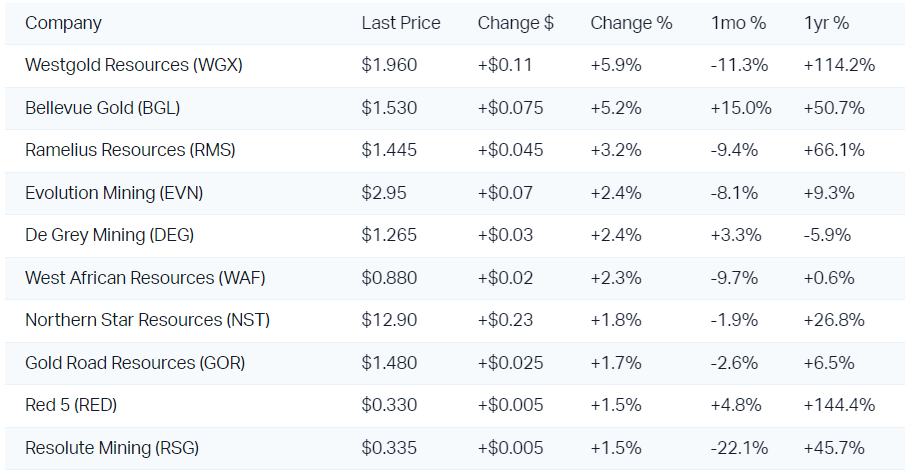

Also doing well today was the Gold (XGD) (+1.5%) sector. Gold prices are largely steady, but a weaker Aussie dollar is likely helping here. Earnings from Westgold Resources (WGX) (+6.0%) helped it to the top of the sector leaderboard.

ChartWatch

S&P/ASX200 (XJO)

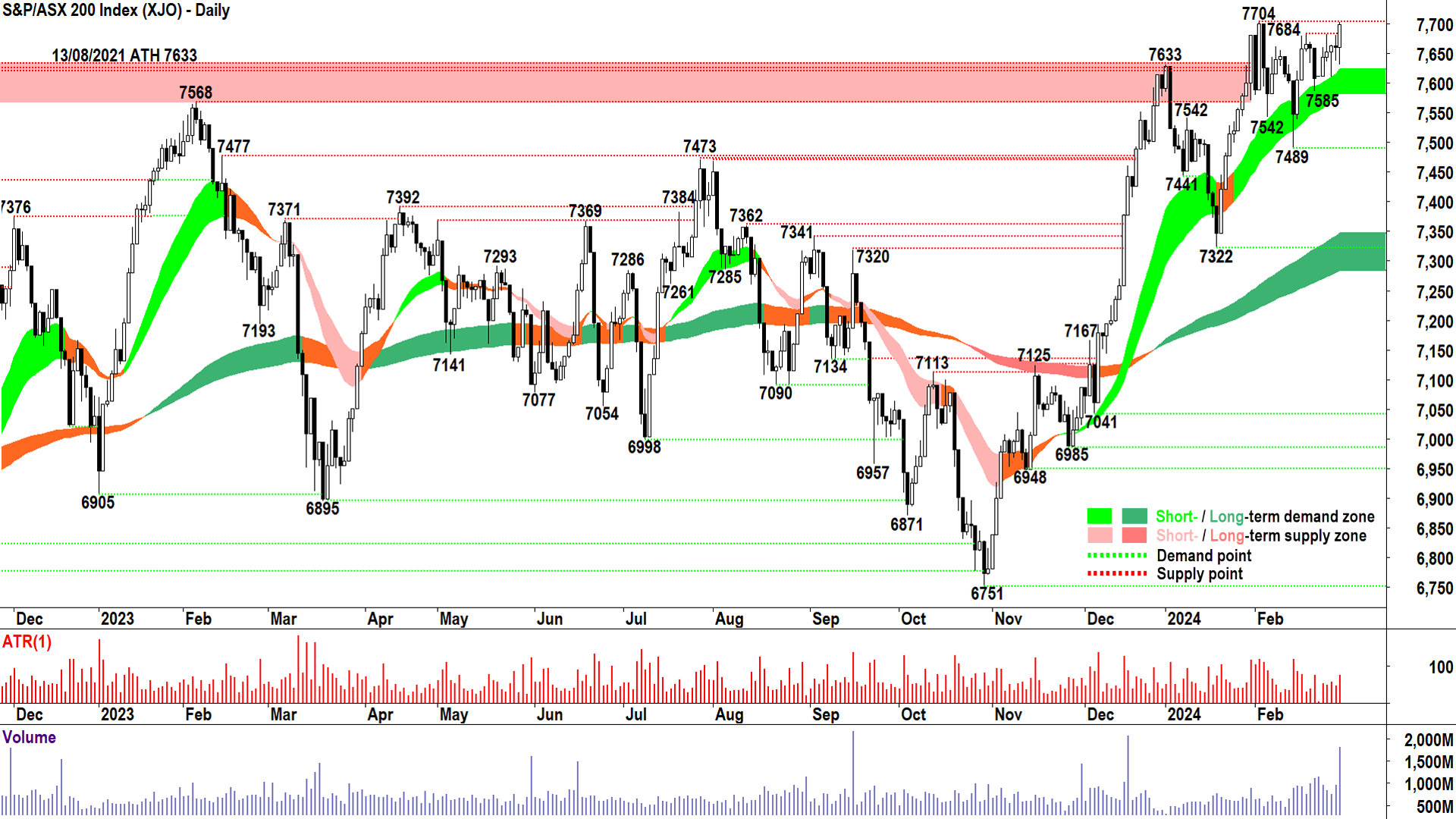

February was a bit of a wonky month, but it appears to have finished with the price action and high close we wanted.

Short and long term trends remain intact, and to be fair, the short term trend ribbon was never really challenged. The price action has returned to higher peaks and higher troughs indicating supply removal and buy the dip activity respectively.

Candles are generally white, or with downward pointing shadows, a solid sign of programmed buy orders working in the system to accumulate stock.

Demand rises to 7585. Only one point of supply remains in the form of 7704, and a close above it puts us exactly where the best bits of any bull market occur – in blue sky territory!

GFEX Lithium Carbonate Futures

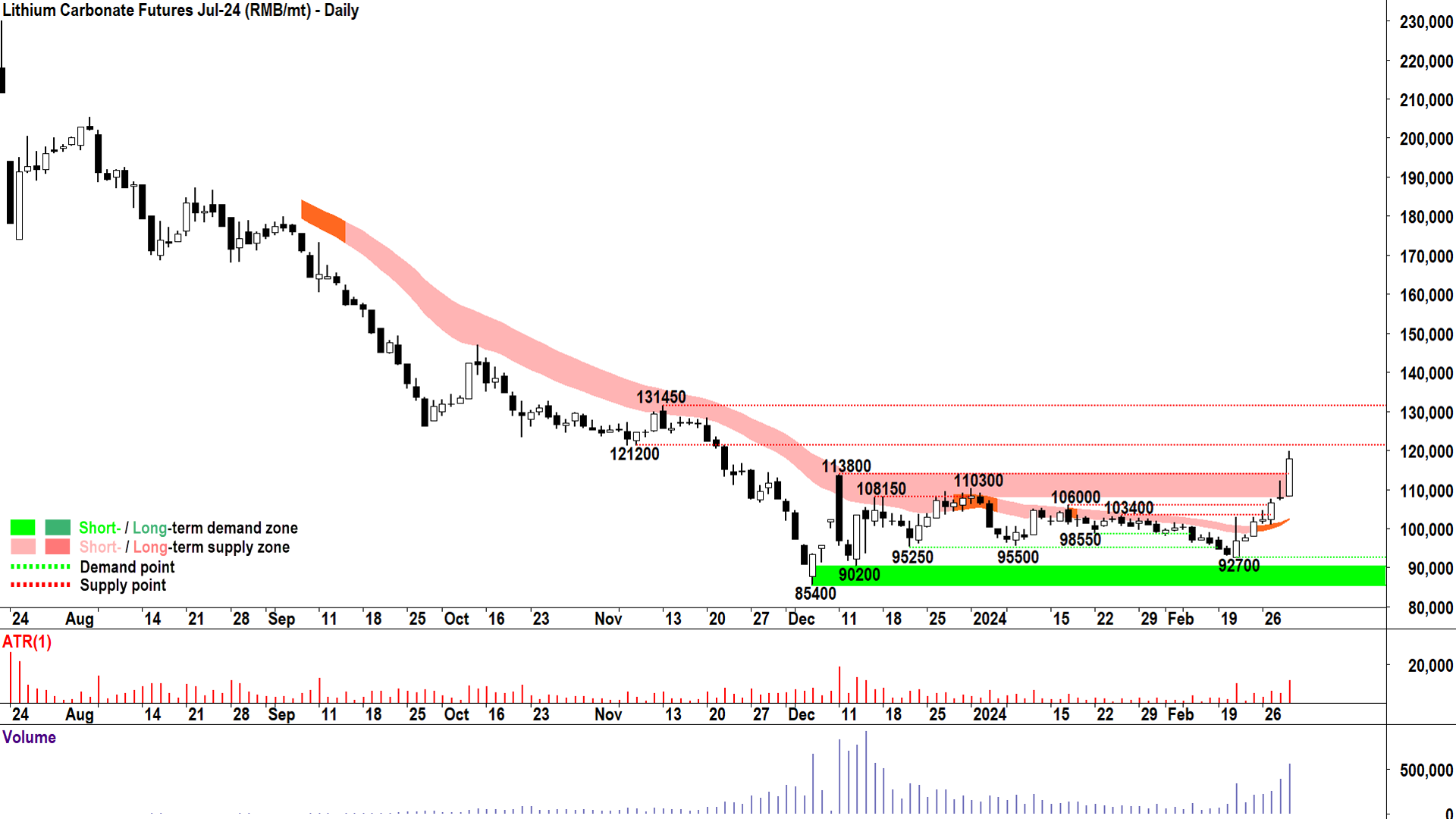

It wasn't just any old seven in a row day for GFEX lithium carbonate futures. It was an emphatic surge which consumed any excess supply which may have been lurking around the key historical resistance points of RMB 110300/t and RMB 113800/t.

The short term trend ribbon appears on the verge of transitioning to "up" for the first time in this contract's history, but I propose the price action and candles indicate we're already there.

Demand should move to the historical peak at RMB 113800/t, but I expect RMB 106000/t is the key support point going forwards. As long as the price continues to close above this level, the new short term uptrend is intact.

The next point of supply is RMB 121200/t, but more likely a zone of supply exists, reaching up to RMB 131450/t.

Lithium bulls should be pleased with the progress made here so far, but also mindful that the longer term trend remains down. Watch out for black candles and or upward pointing shadows, particularly in the aforementioned supply zone, as signals the supply-side is once again asserting itself.

Economy

Today

AU: Retail Sales (1.1% p.a. actual vs +1.6% p.a. forecast vs -2.1% p.a. previous)

Later this week

-

Thursday

USA: Prelim GDP December quarter (+3.3% p.a. forecast vs 3.3% p.a. previous)

AU: Retail Sales January (forecast +1.6% vs -2.7% previous)

-

Friday

USA: Core PCE Price Index January (+0.4% forecast vs +0.2% previous)

CHN: Manufacturing PMI (49.1 forecast vs 49.2 previous) and Non-Manufacturing PMI (50.7 forecast vs 50.7 previous)

CHN: Caixin Manufacturing PMI (50.7 forecast vs 50.8 previous)

EU: Eurozone Core Consumer Price Index CPI (+2.9% p.a. forecast vs +3.3% p.a. previous)

-

Saturday

USA: ISM Manufacturing PMI (49.5 forecast vs 49.1 previous)

Latest News

Although he pioneered small cap value investing, Ken Fisher's top 4 positions are "Magnificent"

Ramsay Health Care gets much needed adrenaline shot from H1 results

Dividend yield scan: The highest yielding ASX stocks – Week 9

The bull case for NextDC: AI demand to be 3-5 times cloud demand

6 key takeaways from Flight Centre's earnings call

What these 5 bellwether ASX company results taught us this reporting season

Interesting Movers

Trading higher

+10.9% Develop Global (DVP) - No news, short covering rally in several beaten down mining companies continues

+9.6% Weebit Nano (WBT) - Becoming a substantial holder from MUFG

+9.4% EML Payments (EML) - Continued positive response to yesterday's First Half FY24 Results

+9.1% Macquarie Technology Group (MAQ) - First Half FY24 Results, rise is consistent with prevailing short and long term uptrends

+8.3% Predictive Discovery (PDI) - No news, stronger gold sector today, move wasn't accompanied by large volumes 🤔

+8.3% The Star Entertainment Group (SGR) - First Half FY24 Results

+7.3% Ramsay Health Care (RHC) - First Half FY24 Results

+7.0% Polynovo (PNV) - Continued positive response to Tuesday's First Half FY24 Results, rise is consistent with prevailing short and long term uptrends

+6.7% Adriatic Metals (ADT) - Stronger gold/precious metals sector today, continued positive response to yesterday's First Concentrate Production at the Vares Project

+6.7% Tyro Payments (TYR) - No news, bounce after sharp sell off following Tuesday's First Half FY24 Results

+6.5% Playside Studios (PLY) - No news, big sell down by co-founders, but on market purchase of 100k shares by another director, rise is consistent with prevailing short and long term uptrends

+6.4% Audinate Group (AD8) - No news, rise is consistent with prevailing short and long term uptrends

+6.4% Objective Corporation (OCL) - Continued positive response to last week's First Half FY24 Results

+6.1% Zip Co (ZIP) - No news, second day's bounce after sharp sell off following Tuesday's First Half FY24 Results

+6.0% Pepper Money (PPM) - Full Year 2023 Results, rise is consistent with prevailing short term uptrend, long term trend transitioning to up

+5.9% Westgold Resources (WGX) - First Half FY24 Results, stronger gold sector today, bouncing off long term uptrend ribbon

+5.3% Select Harvests (SHV) - FY23 AGM

+5.2% Bellevue Gold (BGL) - No news, stronger gold sector today, closed back above long term uptrend ribbon

+5.1% Siteminder (SDR) - Continued positive response to Tuesday's First Half FY24 Results, rise is consistent with prevailing short and long term uptrends

+4.8% Silex Systems (SLX) - No news, uranium sector recovery into fourth day

+4.8% Latin Resources (LRS) - Lithium sector rally continues…

Trading lower

-17.1% Ainsworth Game Technology (AGI) - Full Year 2023 Results, closed below long term uptrend ribbon

-10.3% Chalice Mining (CHN) - No news, fall is consistent with prevailing short and long term downtrends

-10.2% Australian Finance Group (AFG) - First Half FY24 Results, closed back below long term downtrend ribbon

-9.2% Opthea (OPT) - First Half FY24 Results

-6.8% Integral Diagnostics (IDX) - No news, closed back below long term uptrend ribbon

-6.6% Vulcan Energy Resources (VUL) - No news, fall is consistent with prevailing short and long term downtrends

-5.9% Healius (HLS) - No news, continued negative response to Tuesday's First Half FY24 Results, fall is consistent with prevailing short and long term downtrends

-5.3% Zimplats Holdings (ZIM) - No news, continued negative response to Tuesday's First Half FY24 Results, fall is consistent with prevailing short and long term downtrends

-4.5% Resmed Inc (RMD) - No news, closed back below long term downtrend ribbon

-4.5% Piedmont Lithium Inc (PLL) - No news, fall is consistent with prevailing short and long term downtrends

-4.5% Seven West Media (SWM) - No news, fall is consistent with prevailing short and long term downtrends

-4.4% Nine Entertainment Co. Holdings (NEC) - No news, fall is consistent with prevailing short and long term downtrends

Broker Notes

4DMEDICAL (4DX) retained at buy at Bell Potter; Price Target: $1.10 from $1.25

-

Australian Clinical Labs (ACL)

Retained at buy at Citi; Price Target: $3.35 from $3.60

Downgraded to neutral from positive at E&P; Price Target: $2.80

-

APM Human Services International (APM)

Downgraded to hold from speculative buy at Canaccord Genuity; Price Target: $2.00 from $1.35

Upgraded to buy from hold at Jefferies; Price Target: $1.80 from $1.32

Articore Group (ATG) retained at equalweight at Morgan Stanley; Price Target: $0.55 from $0.70

Australian Vintage (AVG) retained at hold at Bell Potter; Price Target: $0.41 from $0.46

Boss Energy (BOE) upgraded to buy from hold at Bell Potter; Price Target: $6.34 from $6.41

Bigtincan Holdings (BTH) retained at overweight at Morgan Stanley; Price Target: $0.38 from $0.73

Brambles (BXB) retained at buy at UBS; Price Target: $17.10

Cooper Energy (COE) retained at neutral at Goldman Sachs; Price Target: $0.17 from $0.15

Cyclopharm (CYC) retained at buy at Bell Potter; Price Target: $3.80

DGL Group (DGL) retained at buy at Bell Potter; Price Target: $0.75 from $1.20

Droneshield (DRO) downgraded to hold from buy at Bell Potter; Price Target: $0.90 from $0.50

Frontier Digital Ventures (FDV) retained at buy at Bell Potter; Price Target: $0.77 from $0.74

-

Flight Centre Travel Group (FLT)

Retained at neutral at Barrenjoey; Price Target: $20.70 from $20.00

Retained at buy at Citi; Price Target: $24.15 from $23.60

Retained at outperform at CLSA; Price Target: $23.75 from $21.00

Retained at positive at E&P; Price Target: $27.37 from $36.97

Retained at neutral at Goldman Sachs; Price Target: $20.10 from $20.00

Upgraded to buy from overweight at Jarden; Price Target: $23.50 from $22.00

Retained at hold at Jefferies; Price Target: $19.00

Downgraded to neutral from overweight at JPMorgan; Price Target: $21.50 from $22.00

Retained at neutral at UBS; Price Target: $22.50 from $23.00

Fortescue (FMG) downgraded to underperform from hold at Jefferies; Price Target: $21.00 from $23.40

G8 Education (GEM) upgraded to buy from hold at Moelis Australia; Price Target: $1.44 from $1.08

Genesis Minerals (GMD) initiated at neutral at UBS; Price Target: $1.75

Johns Lyng Group (JLG) downgraded to outperform from buy at CLSA; Price Target: $7.20 from $7.25

-

Kelsian Group (KLS)

Upgraded to buy from outperform at CLSA; Price Target: $7.00 from $7.50

Retained at positive at E&P; Price Target: $8.85

Retained at overweight at JP Morgan; Price Target: $6.80

Retained at outperform at Macquarie; Price Target: $7.70

Retained at sector perform at RBC Capital Markets; Price Target: $6.00 from $6.50

-

Nextdc (NXT)

Retained at buy at Citi; Price Target: $15.45

Retained at positive at E&P; Price Target: $22.94 from $22.01

Retained at buy at Goldman Sachs; Price Target: $18.80 from $16.60

Retained at buy at Jefferies; Price Target: $20.48 from $15.30

Retained at overweight at JP Morgan; Price Target: $18.00 from $14.70

Retained at add at Morgans; Price Target: $20.00 from $14.50

Retained at buy at UBS; Price Target: $20.10 from $17.20

-

Perpetual (PPT)

Retained at neutral at Barrenjoey; Price Target: $22.30 from $23.00

Retained at neutral at Citi; Price Target: $25.70 from $26.30

Retained at outperform at CLSA; Price Target: $26.25 from $27.40

Retained at overweight at Jarden; Price Target: $26.90 from $27.50

Retained at neutral at JP Morgan; Price Target: $25.00 from $26.00

Retained at overweight at Morgan Stanley; Price Target: $28.10

Retained at neutral at UBS; Price Target: $25.00 from $27.00

Pacific Smiles Group (PSQ) upgraded to market-weight from underweight at Wilsons; Price Target: $1.40 from $0.88

Resimac Group (RMC) upgraded to buy from hold at Bell Potter; Price Target: $1.30 from $1.19

RMA Global (RMY) retained at buy at Bell Potter; Price Target: $0.12 from $0.14

Regis Resources (RRL) retained at sell at Citi; Price Target: $1.25

-

Steadfast Group (SDF)

Retained at overweight at Barrenjoey; Price Target: $6.85

Downgraded to neutral from overweight at Jarden; Price Target: $6.10 from $6.25

Retained at neutral at JP Morgan; Price Target: $6.45

Retained at equalweight at Morgan Stanley; Price Target: $6.10 from $6.20

Retained at buy at UBS; Price Target: $6.70 from $6.80

Strike Energy (STX) retained at buy at Bell Potter; Price Target: $0.32 from $0.46

Tyro Payments (TYR) upgraded to overweight from market-weight at Wilsons; Price Target: $1.30 from $1.08

Woodside Energy Group (WDS) retained at neutral at Goldman Sachs; Price Target: $31.30

-

Worley (WOR)

Retained at buy at Citi; Price Target: $20.50

Upgraded to neutral from underweight at JPMorgan; Price Target: $15.35 from $13.50

Retained at buy at UBS; Price Target: $22.00 from $21.30

Wisetech Global (WTC) retained at neutral at Citi; Price Target: $90.00

Scans

This article first appeared on Market Index on 29 February 2024.

5 topics

11 stocks mentioned