ASX 200 to fall, S&P 500 and Nasdaq sharply lower on Middle East tensions

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 50 points lower, down -0.64% as of 8:30 am AEST.

S&P 500 SESSION CHART

MARKETS

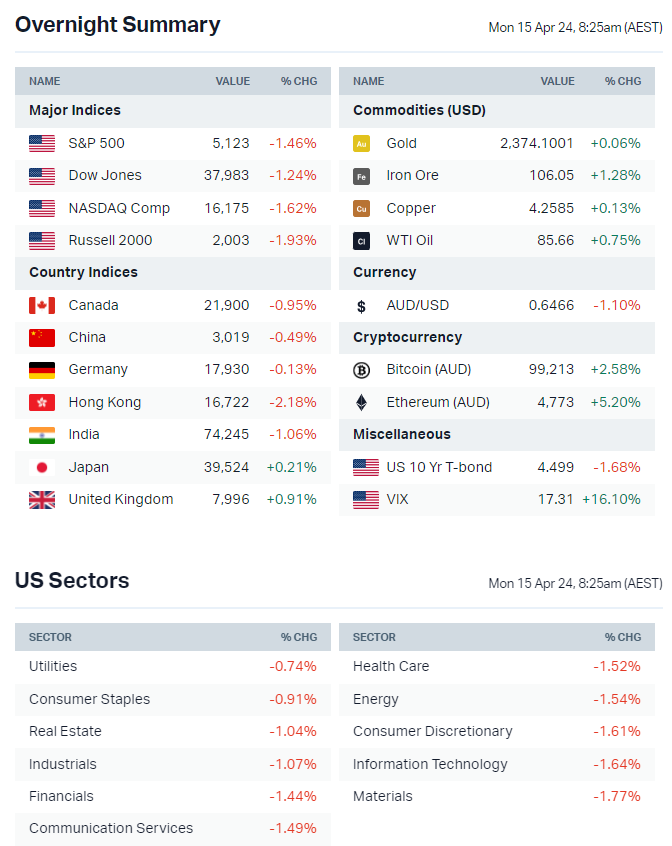

- Major US benchmarks lower in Friday trading, finished near worst levels

- Dow and S&P 500 down for a second straight week, while Nasdaq down for a third

- Risk-off tone attributed to Iran’s major missile attack on Israel and worries that this will spark a wider regional war

- Risk-off atmosphere drove a spike in VIX and US dollar, a selloff in cryptocurrency markets and volatile price action for gold and oil – both finished off session highs

- Global equity funds dumped for second consecutive week on hotter inflation worries and pushback against June Fed rate cut (Reuters)

- EPFR data shows US large cap stocks suffered largest weekly outflow since December 2022 (Reuters)

- Oil likely to rise after weekend's Iran strike but longer-term trends may depend on Israel's response (Bloomberg)

- US and UK launch crackdown on Russian metals trade and limit Moscow's export revenue (FT)

ASX TODAY

- ASX 200 set for a heavy session on Monday, broad-based weakness is to be expected

- Sub sectors that sold off heavily overnight include lithium/rare earths, biotech, airlines and fintech

- Ampol may be interested in EG Group’s Australian service stations (The Australian)

- Gold Road Resources weighing bid for Greenstone Gold Mines (The Australian)

- Incitec Pivot fertiliser deal catches political heat (AFR)

- News Corp plots major shake-up as Meta money ends, Google deal nears (AFR)

INTERNATIONAL STOCKS

- Apple's Mac line up being overhauled with a new M4 chips focused on AI (Bloomberg)

- US regulators probing Morgan Stanley's wealth management unit over money laundering prevention measures (FT)

- Big banks struggling to implement handful of AI products (Axios)

- Cathie Wood's Ark Investment Management discloses stake in OpenAI (Bloomberg)

EARNINGS

- Of the 6% of S&P 500 companies that have reported for Q1, 83% have beaten EPS expectations, better than the 77% five-year average of 77% and aggregate earnings have so far beaten expectations by 12.4%, above the five-year average of 8.5%

- Wells Fargo (-0.4%) earnings top estimates even as lower interest income cuts into profits (CNBC)

- BlackRock (-2.9%) assets hit record US$10.5tn but inflows miss expectations (Reuters)

- JPMorgan (-6.5%) shares slip as outlook overshadows profit rise (FT)

CENTRAL BANKS

- Weak yen complicates BoJ rate hike timing (Reuters)

- ECB likely to enact hawkish cut in June but a strong deviation from Fed path unlikely (Bloomberg)

- Two BoE rate cuts now priced in following hotter US CPI data (London Times)

- BoK unchanged as expected, tweaks guidance for possible 2H24 rate cut (Bloomberg)

- Singapore central bank keeps policy unchanged amid elevated inflation (Bloomberg)

- PBoC expected to leave policy rate unchanged, drain some liquidity (Reuters)

GEOPOLITICS

- Iran launches 300+ drones and missiles at Israel (AP)

- Israel's defence relied on allied cooperation and multi-layered anti-missile systems (FT)

- Biden cautions Netanyahu, US will not participate in counter-offensive on Iran (CNN)

- US pressing countries such as China, Turkey and Saudi Arabia to convince Iran against striking Israel (FT)

ECONOMY

- US consumer sentiment slips, inflation expectations increase up to 3.1% in April from 2.9% last month (Reuters)

- China exports fall in March and miss consensus by big margins in setback to recovery (Bloomberg)

- German inflation eases in March, helped by falling energy and food prices (Reuters)

- UK GDP up 0.1% in February, rebounding from technical recession (Bloomberg)

KEY EVENTS

Companies trading ex-dividend:

- Mon 15 April: WAM Active (WAA) – $0.03, Cadence Capital (CDM) – $0.03, SDI (SDI) – $0.015, New Hope (NHC) – $0.17

- Tue 16 April: WAM Global (WGB) – $0.06

- Wed 17 April: Washington H Soul Pattinson (SOL) – $0.40

- Thu 18 April: The Reject Shop (TRS) – $0.10, WAM Capital (WAM) – $0.077, Horizon Oil (HZN) – $0.015

- Fri 19 April: WAM Research (WAX) – $0.05

Other ASX corporate actions today:

- Dividends paid: Car Group (CAR) – $0.345, Kina Securities (KSL) – $0.05, Cochlear (COH) – $2.0, Saunders International (SND) – $0.02, Civmec (CVL) – $0.02

- Listing: None

Economic calendar (AEST):

- 11:30 pm: US Retail Sales (Mar)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment