Australian CPI rises by 1.0% q/q, US corporate earnings mixed with a positive bias

Let’s hop straight into five of the biggest developments this week.

1. German PMI mixed, however, services expanded at 53.3

The German private sector returned to growth at the start of the second quarter, the latest survey compiled by S&P Global showed, driven by a solid rise in services business activity. Manufacturing remained in contraction, the rate of decline in factory production eased and confidence amongst goods producers towards the outlook reached the highest for a year.

2. US Flash manufacturing PMI rises but at a slower pace

US business activity continued to increase in April, but the rate of expansion slowed amid signs of weaker demand. The latest rise in output was the smallest in the year-to-date reflecting reduced rates of growth and falling orders in both the manufacturing and services sectors. This data point shows a degree of weakening demand.

3. Australian CPI rises by 1.0% q/q

Australian CPI rose 1.0% over the prior quarter. Over the twelve months to the March 2024 quarter, the CPI rose 3.6%. The most significant price rises this quarter were Rents (+2.1%), Secondary education (+6.1%), Tertiary education (+6.5%) and Medical and hospital services (+2.3%). If this trend continues, it shows that there may be further work to do on the inflation front in Australia.

4. USD Advance GDP 1.6% q/q, missing estimates of 2.5%

US gross domestic product (GDP) increased at an annual rate of 1.6% in the first quarter of 2024, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2023, real GDP increased 3.4 percent. This missed expectations significantly, demonstrating that higher interest rates are starting to have a negative impact on growth.

5. US corporate earnings mixed with a positive bias

On the US corporate earnings front, we have had a myriad of financial results, with generally most beating expectations. MSFT, TSLA, GOOGL all beat expectations, while META, IBM, CAT all missed expectations. These announcements have been fuelling the volatility seen in markets this week.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

.PNG)

The last week in global commodity markets has been relatively quiet across the full universe, with most trading within the range of +3.5% to -5.0%. The most significant movements came from Wheat, which rose by +9.26%. This was on the back of differing weather conditions in the US. The VIX was down -12.53%, as equity markets rebounded after the prior two-week sell-off. There continue to be solid trends in most markets, with strong trends in Copper, Aluminium, Iron Ore, Cocoa, Coffee, and precious metals, all making significant long and short-term trends.

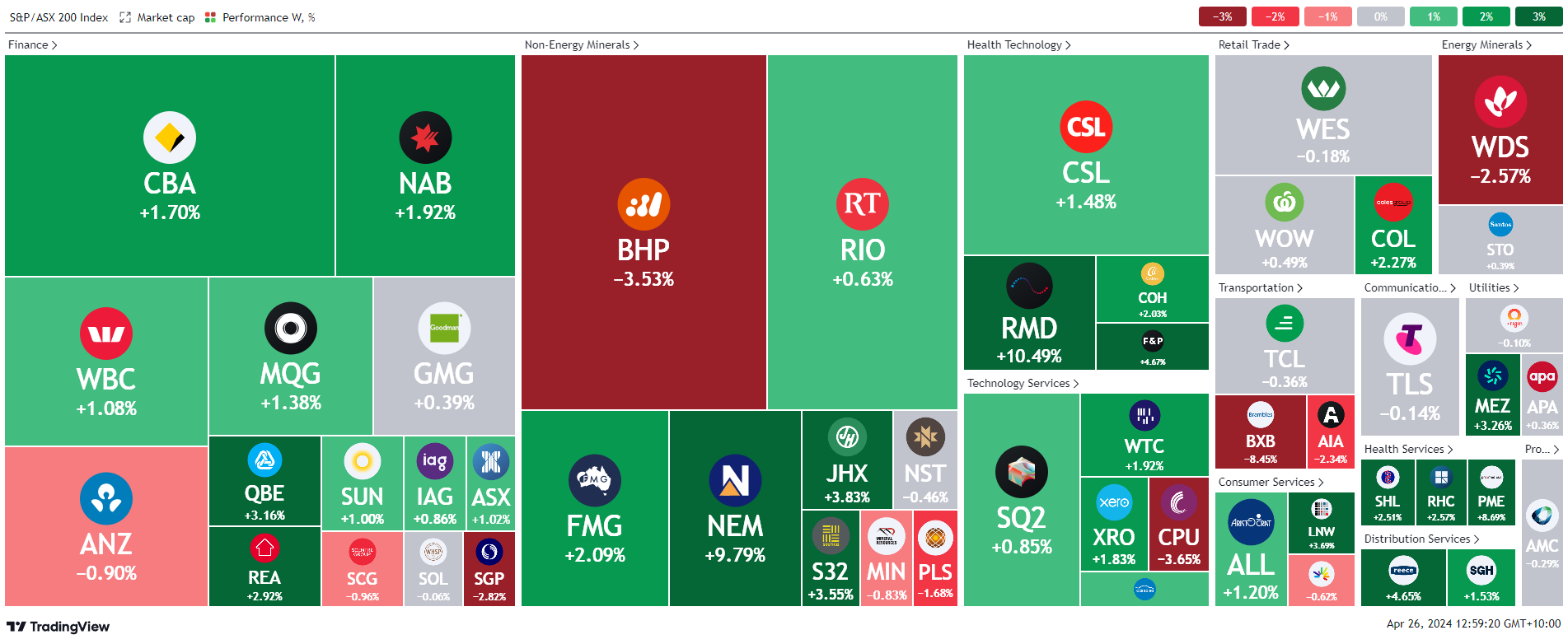

Here is the week's heatmap for the largest companies in the ASX.

The ASX has had a little bounce back over the last week, however the volatility under the surface continues. In a shortened week, we saw solid buying action, however, that turned to sell as the market received the CPI figure earlier in the week. Financials, coming off Friday's lows have bounced back, with CBA and NAB both up >1.5%. Health care continues to do well, with RMD, CSL, and COH, all performing very well this week, however, RMD was the outstanding performer. Gold continues to do very well, with NEM rising by +9.79%, as they released their earnings.

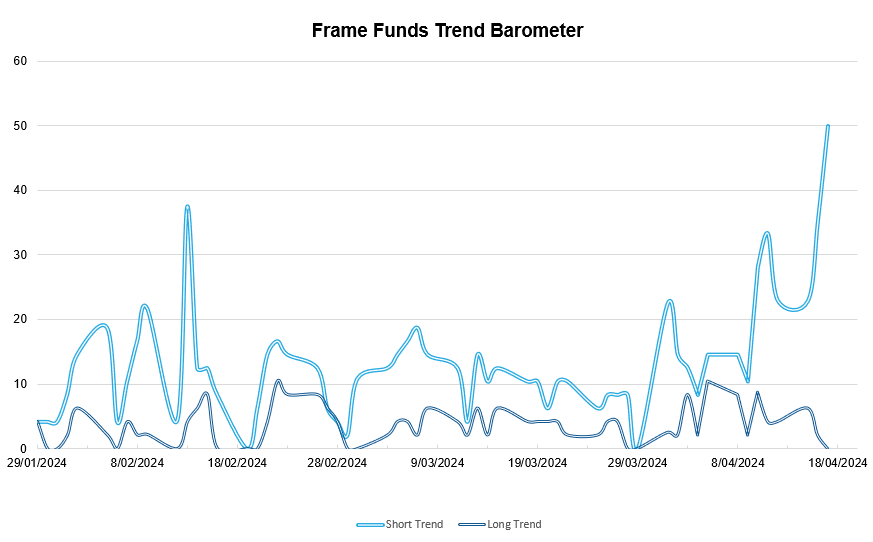

Below is our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.

5 topics

5 stocks mentioned