Could the Magnificent Seven actually be undervalued?

There is so much to like about the Artificial Intelligence (AI) narrative. Goldman Sachs research suggests that generative AI could add almost US$7 trillion to global GDP and lift productivity growth dramatically in the next 10 years. In Australia, many major corporations including Deloitte, the National Australia Bank (ASX: NAB), and Canva are now instituting heads of AI.

Just this week, ProMedicus (ASX: PME) released an app to complement the equally new Apple Vision Pro headset, allowing doctors to examine 3D models of the human body with generative AI technology.

Even this wire's headline was rated a 5 out of 10 by Bard, Google's chat-based AI assistant.

For investors who were early to the AI megatrend, it's as if there is no downside in sight for the stocks that are most exposed to the theme. But is it too late to get on board or is there still more room to run?

By every traditional metric, the answer to this question should be easy. But we no longer live in a world of traditional metrics (especially if you believe the view of Citi's Scott Chronert).

In this wire, I'll share the views of Swell Asset Management's Sally Fang and Lazard's Ronald Temple - both of whom have differing perspectives on the same question.

Fang's View

Fang shared her thoughts in a recent interview - more of which will appear in my colleague Sara Allen's upcoming wire.

But tackling the macro and price questions first, Fang argues that AI beneficiaries have stretched valuations for two key reasons.

"When you look at the top-level numbers, you see the confusing macro environment that everyone knows. At the same time, you see non-digital world companies like 3M (NYSE: MMM) and UPS (NYSE: UPS), reporting lower volumes and declining revenue growth," Fang notes.

"If you look at what [these stocks] are trading on, compared to historical norms, you can say it's overblown but I think it's a very different time. However, the pace and the impact of AI are often still underestimated. And if you look at their earnings projections going forward, they're very realistic and potentially even underestimated," she adds.

As for what metrics Fang looks at to identify the top performers in this space, she points to the following factors:

- Return on Invested Capital and Return on Equity

- Strong balance sheet, including solid free cash flow yield

- Does the company have multiple distribution and monetisation opportunities?

Which companies will outperform them all? Fang points to the stocks that the Swell Global Fund owns - Google (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Meta (NASDAQ: META), and most importantly, Amazon (NASDAQ: AMZN).

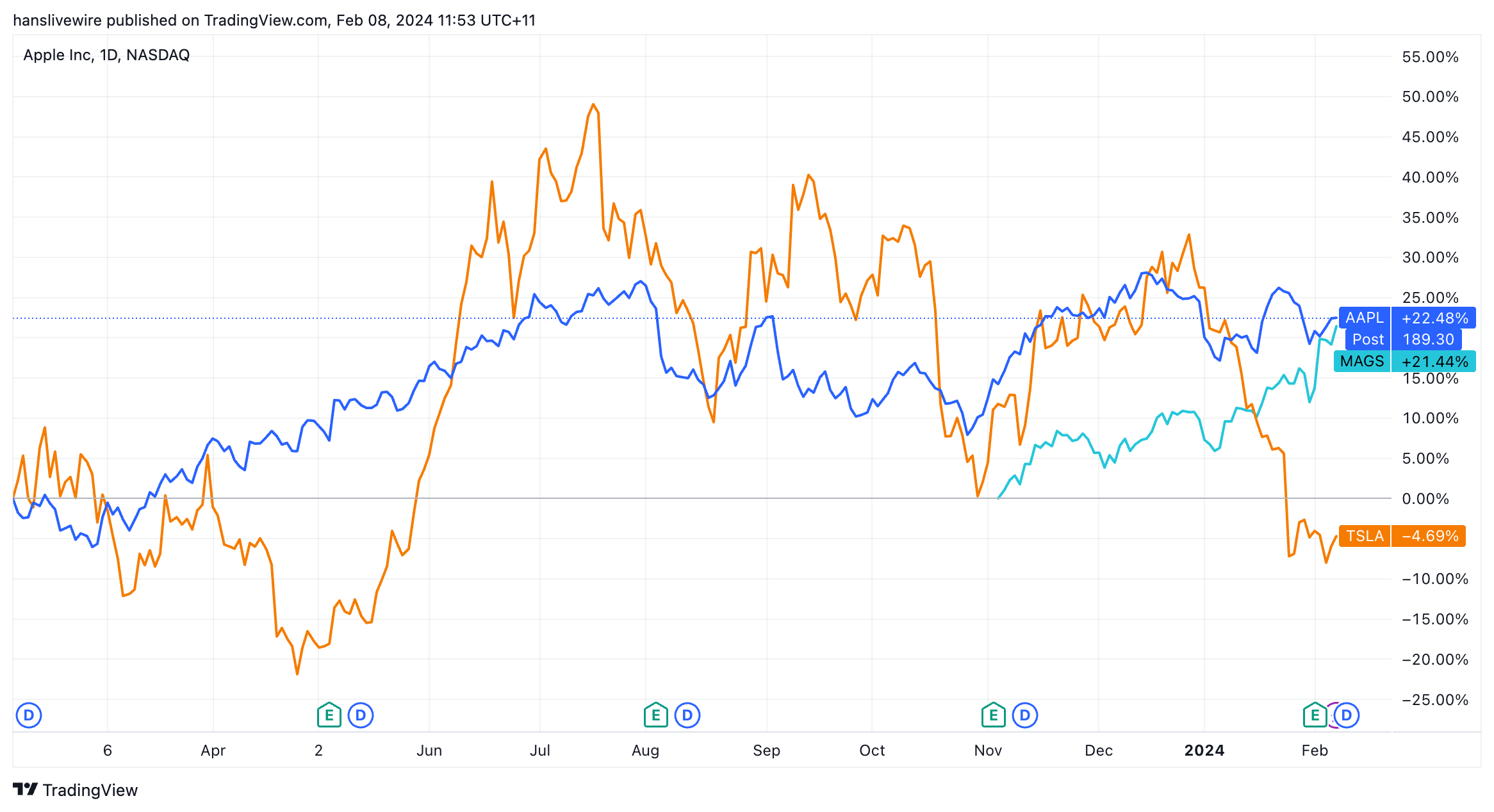

Asked which stocks she thinks will underperform, Fang's response is a toss-up between Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL).

"I do believe Tesla, with their competitive advantage and battery storage design – and the idea of getting their algorithms to work towards autonomous driving – can accelerate at a potentially faster pace than what investors expect," Fang says.

"There is a huge enabler in that trend. But there is a valuation aspect and the market also knows they have a large amount of competition that it is currently facing and it's having to undercut pricing."

Fang also notes that Apple has been under some pressure on the back of its recent earnings announcements – particularly concerning an outlook of lower demand from China.

"But again, one billion customers, a strong moat, and accessibility to a consumer distribution point to distribute devices, and on their earnings call, they said they are going to release a lot of AI in their products in the second half of the year," Fang adds.

Temple's View

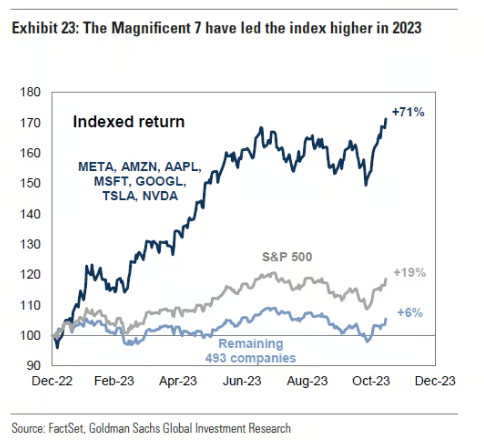

Although equities at the headline level are now expensive (thanks in huge part to the Magnificent Seven), Temple said in a recent Views from the Top interview that he believes equities are priced for perfection.

"For the last year or two, almost all of the earnings growth has been in the Magnificent Seven with the rest of the market having very low earnings growth," Temple says.

"There are seven stocks that everyone knows about which are trading at 30 times forward earnings. The rest of the market is trading at 18 times forward earnings. What we've seen is an increase in valuation in a very narrow part of the market largely on the back of artificial intelligence enthusiasm."

Temple is not a sceptic, saying in black and white that some of the rally is warranted. But he argues the big test is likely still to come.

"The big question around those seven stocks is how high will the cash flows go and how quickly. That's what will determine if they are overvalued, undervalued, or fairly valued," Temple says.

"The only way the AI story can prove to be as good as many people think it will be is if it leads other companies to increase productivity and profitability by using AI. The only way these seven stocks can keep working is if the other 493 get some benefit from this and that's going to show up in earnings."

In other words, the Magnificent Seven have had a great run but the better opportunities now lie in the rest of the market.

Who do you agree with – Ron or Sally? Let us know in the comments below.

4 topics

10 stocks mentioned

3 contributors mentioned