Directors went Christmas shopping: Insider moves for the December quarter

Welcome to the fourth instalment of our quarterly breakdown of ASX insider moves, brought to you by myself, my colleague Kerry Sun, and Dr David Allen from Plato Investment Management.

Dr Allen looks closely at insider moves as part Plato's Red Flag methodology, and he reached out to us, offering to share some of his insights. We were happy to oblige (particularly given the Plato Global Alpha fund that he manages delivered 33.3% last year).

Quick recap

If you're new to the series, you can get a recap on the research that drives the series and the previous instalments via the links below:

- Nine stocks insiders are buying - and why it matters

- Insider trades: The most important ASX insider buys and sells for the June quarter

-

Insider trades: The most important ASX insider buys and sells for the September quarter

As always, who is buying and selling makes for fascinating reading and we’ll be sharing with you the companies that have seen multiple insiders buying and selling during the period, and the top insider buys and sells by dollar amount.

Multiple insiders making moves

I like to look at the number of insiders buying (or selling) their own stock. I find it particularly compelling.

Whilst some companies have one or two directors doing a lot of buying or selling (i.e. many transactions), when three, four, or more directors in the same company are all making the same move, it's a stronger signal. Let's not forget that these people sit around the same board table and respond to the same stimulus.

There were 45 companies (down from 50 in the prior quarter) with three or more different insiders making moves during the December quarter, which are listed below. I've also highlighted a couple of sets of transactions that stand out.

| Ticker | Company | Count | Sum |

| ASX: BAP | Bapcor Ltd | 7 | $422,423 |

| ASX: TAH | Tabcorp Holdings Ltd | 7 | $499,651 |

| ASX: GEM | G8 Education Ltd | 5 | $776,260 |

| ASX: CAZ | Cazaly Resources Ltd | 4 | $153,273 |

| ASX: TNC | True North Copper Ltd | 4 | $33,614 |

| ASX: TIP | Teaminvest Private Group Ltd | 4 | $213,193 |

| ASX: PXA | Pexa Group Ltd | 4 | $300,402 |

| ASX: WHC | Whitehaven Coal Ltd | 4 | $249,547 |

| ASX: MYX | Mayne Pharma Group Ltd | 4 | $289,975 |

| ASX: BXB | Brambles Ltd | 4 | -$1,599,639 |

| ASX: AMA | AMA Group Ltd | 4 | $132,876 |

| ASX: EQT | EQT Holdings Ltd | 4 | $496,108 |

| ASX: PSQ | Pacific Smiles Group Ltd | 4 | $172,795 |

| ASX: PWH | PWR Holdings Ltd | 4 | $444,025 |

| ASX: ALX | Atlas Arteria | 3 | $148,017 |

| ASX: L1M | Lightning Minerals Ltd | 3 | $77,628 |

| ASX: ORN | Orion Minerals Ltd | 3 | $170,000 |

| ASX: MBH | Maggie Beer Holdings Ltd | 3 | $289,739 |

| ASX: FID | Fiducian Group Ltd | 3 | $49,621 |

| ASX: MYR | Myer Holdings Ltd | 3 | $274,690 |

| ASX: PIM | Pinnacle Minerals Ltd | 3 | $54,724 |

| ASX: LCE | London City Equities Ltd | 3 | $113,010 |

| ASX: AKG | Academies Australasia Group Ltd | 3 | $60,803 |

| ASX: MFG | Magellan Financial Group Ltd | 3 | $216,683 |

| ASX: DXS | Dexus | 3 | $118,851 |

| ASX: BOA | Boadicea Resources Ltd | 3 | $37,381 |

| ASX: APL | Associate Global Partners Ltd | 3 | $24,318 |

| ASX: OBL | Omni Bridgeway Ltd | 3 | $469,631 |

| ASX: HLO | Helloworld Travel Ltd | 3 | -$4,685,982 |

| ASX: PPC | Peet Ltd | 3 | -$1,206,654 |

| ASX: IPD | Impedimed Ltd | 3 | $173,749 |

| ASX: MXO | Motio Ltd | 3 | $123,200 |

| ASX: SGM | Sims Ltd | 3 | $280,452 |

| ASX: WPR | Waypoint REIT | 3 | $101,713 |

| ASX: MQG | Macquarie Group Ltd | 3 | $388,578 |

| ASX: TLM | Talisman Mining Ltd | 3 | $145,167 |

| ASX: SHL | Sonic Healthcare Ltd | 3 | $122,295 |

| ASX: SHV | Select Harvests Ltd | 3 | $98,867 |

| ASX: PME | Pro Medicus Ltd | 3 | -$176,017,490 |

| ASX: PVT | Pivotal Metals Ltd | 3 | $29,318 |

| ASX: HLS | Healius Ltd | 3 | $279,713 |

| ASX: MSB | Mesoblast Ltd | 3 | $108,223 |

| ASX: DRO | Droneshield Ltd | 3 | -$1,992,781 |

The big counts

In the September quarter (last quarter), we saw seven directors buying stock in Aurelia Metals (ASX: AMI). I commented at the time that in my 15 years in markets, I hadn't seen that many directors buying in such a short period. Well, lo and behold, two more companies saw seven directors buying in the December quarter;

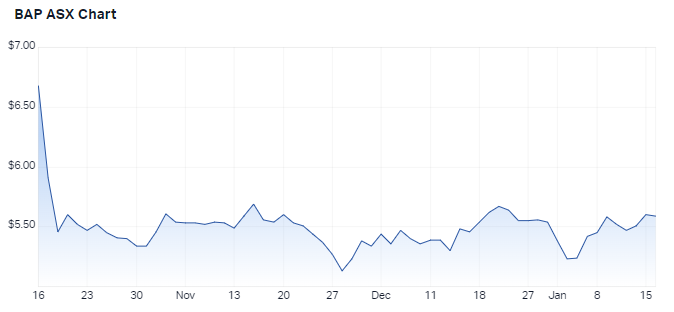

- Seven directors bought stock in Bapcor (ASX: BAP), totalling $422,423

- Interestingly, they bought on 18 and 19 October, just after the big fall seen on the left-hand side of the chart below

- Research shows that insiders are typically adept at buying their own stock when it is "cheap", so it will be interesting to see how these trades unfold

- Seven directors bought stock in Tabcorp Holdings (ASX: TAH) totalling $499,651

- Similar to BAP, the directors buying TAH did so over two sessions - 19 and 21 December

- These purchases occurred just after a large pop in the share price, which was driven by the announcement that Tabcorp had been awarded the new Victorian Wagering and Betting Licence (New Licence) by the Victorian Government.

- The share price has fallen away since that pop, down from a high of around 90 cents to just 73 cents

The biggest and most interesting trades

The analysis below was contributed by Kerry Sun

Pro Medicus’ (ASX: PME) bullish selldown – On 21 November 2023, Co-founders Sam Hupert and Anthony Hall sold a combined 2 million PME shares or a little under 2% of the company. This was the largest set of trades in the December quarter.

“The sale was in response to a strong approach from an individual fund and was done before market at the previous day’s closing price,” the company said in a statement. This is extraordinary because the fund was happy to buy ~$180 million PME shares at no discount and after a 61% year-to-date rally.

Sometimes even insiders get it wrong – APM Human Services International (ASX: APM) is a global health and employment services provider, with operations in 11 countries including Australia, the UK and Europe. Chief Executive Michael Anghie and Founder Megan Wynne totalled six buys in 2023, valued at $9.8 million, with a weighted average of $1.81.

$3.9 million worth of buying occurred in the December quarter - More than any other directors.

The stock finished the year at $1.23.

Back in May 2023, Goldman Sachs viewed the stock as a ‘compelling opportunity’ given its 1) strong track record of providing services to the UK government; 2) clinical expertise with NDIS and allied health segments; 3) trades at a deep discount to global peer Maximus.

But APM failed to execute, with its November AGM pointing to lower first-half FY24 earnings due to lower volumes in employment, rising interest costs and higher tax rates. Between 10-14 November, APM shares sold off 37% to fresh all-time lows.

Pushing up the share price – Intelligent Monitoring Systems (ASX: IMB) provides monitored security, fire and 'Internet of Things' solutions that ensure the safety and protection of Australian businesses, homes and individuals Non-Executive Director Peter Kennan bought 9 times during the December quarter, totalling $1.5 million. IMB averaged is a thinly traded and illiquid stock that averaged around 60,000 daily volume in early November. The recent buys from Kennan have all been in parcels of 250,000 to 700,000 shares. It’s fair to say that his buying was responsible for the stock’s ~100% rally in the last two months.

IMB’s latest trading update expected December sales of $710,000, up 1,767% compared to last year. “Notably, the December result, should it be delivered, surpasses any monthly expectation in the ADT acquisition business case, which had a forecast period out to June 2027,” the company said in a statement.

The most profitable trades

These were some of the most profitable insider buys from the December quarter – Of course, these are just paper profits as none of the directors have sold the below positions.

Sezzle (ASX: SZL) – Chief Executive and Co-Founder Charlie Youakim bought three parcels between 14-16 November totalling $1.46 million at a weighted average price of $16.30. Sezzle shares closed at $24.35 on Friday, 12 January – It has since been removed from the ASX and trades on the Nasdaq.

Fatfish Group (ASX: FFG) – Non-Executive Chairman Larry Gan bought $110,000 worth of shares at 1.1 cents on 23 November. The company is a publicly traded tech venture firm with a focus on the Southeast Asian region. The only major announcement to have taken place since Gan’s purchase was a heavily oversubscribed $3.25 million placement, which was held at a 25% premium to the stock’s 15-day volume weighted average price. Fatfish shares closed at 4.2 cents on Tuesday, 16 January.

Livehire (ASX: LVH) – Livehire is a recruitment and talent management software company with a market cap of around $15 million. It’s a fairly illiquid and thinly traded stock – So when the Chief Executive bought $674,600 worth of shares on-market at 3.5 cents per share, the stock soared 24.4%. Livehire shares closed at 5.1 cents on Tuesday, 16 January.

A Fund Manager's Perspective

The analysis below was contributed by Dr David Allen

Liontown Resources (ASX: LTR)

Plato Global Alpha shorted Liontown Resources at the end of October due to a very high number of red flags (16), combined with dire Lithium sentiment. There are warning signs aplenty that the growth in EVs is slowing. An interesting data point is that Hertz is selling 20,000 of its EVs and replacing them with fossil fuel-powered vehicles. Meanwhile, there does not appear to be a significant Lithium supply curtailment. The $1.27 million sale of Liontown stock by CEO Tony Ottaviano only added to our conviction, given its size, the position of the person selling, and, critically, it was at a time when the share price was around 50% of its peak.

Insiders are four times more likely to sell stock when the share price is high relative to history.

Selling after the price has been battered is unusual and typically a strong signal that the worst is yet to come.

Cochlear (ASX: COH)

Plato Global Alpha is long Cochlear. The company ranks 73rd out of the 553 Australian companies we cover, and eighth in its sector. It is underpinned by a massive addressable market (20% of the global population suffers from hearing loss) and metronomic revenue growth.

Buttressing our thesis are the recent director buys - two in the last quarter and six in the previous. These buys came at a time when the share price was flirting with all-time highs.

Typically, insiders take profits at these levels, so the fact they were loading up is very positive.

Indeed, the share price is up a further 17% since the last of the two insider purchases in November.

Over to you

Are there any stocks that you have been following closely that insiders have been buying or selling?

Let us know in the comments below.

4 topics

51 stocks mentioned

2 contributors mentioned