Do higher risk investments earn higher returns?

To test the relationship between risk and reward, we studied the annual Australian dollar returns of the largest 3000 public companies in the world over each of the last 20 years.

We compared the performance of three types of high-risk businesses to all the other companies:

- Unprofitable companies

- Companies with high levels of debt

- Companies based in emerging markets

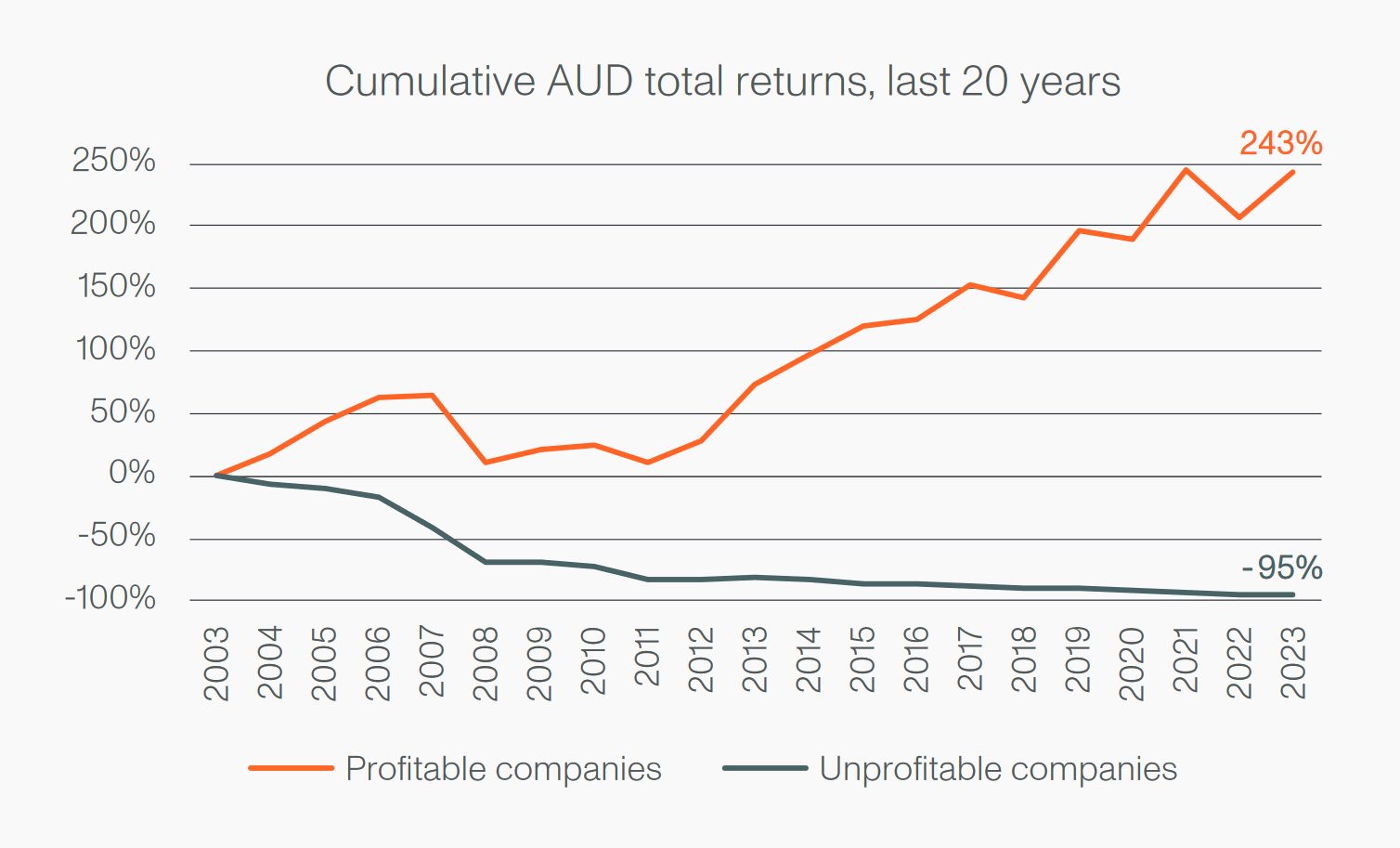

Unprofitable companies

Investors own loss-making businesses in the expectation they’ll eventually become profitable, and that the price they’re paying today is low relative to future profits. The risk they’re taking is that if a business continues to lose money, it won’t be worth anything at all.

While the rare success stories captivate the attention of investors and the media, our study shows that unprofitable companies rarely live up to the promise.

In every one of the last 20 years, the loss-making companies in our study delivered a lower investment return than the profitable ones. Investing in a portfolio of loss-making companies over this period would have left you with just 5% of your starting capital. If you only invested in profitable businesses you would have generated a return of 243%.

Investors can earn better returns by focusing on established, market-leading businesses that have a long history of profitable growth, where they don’t need to make heroic assumptions about the future to justify their valuation.

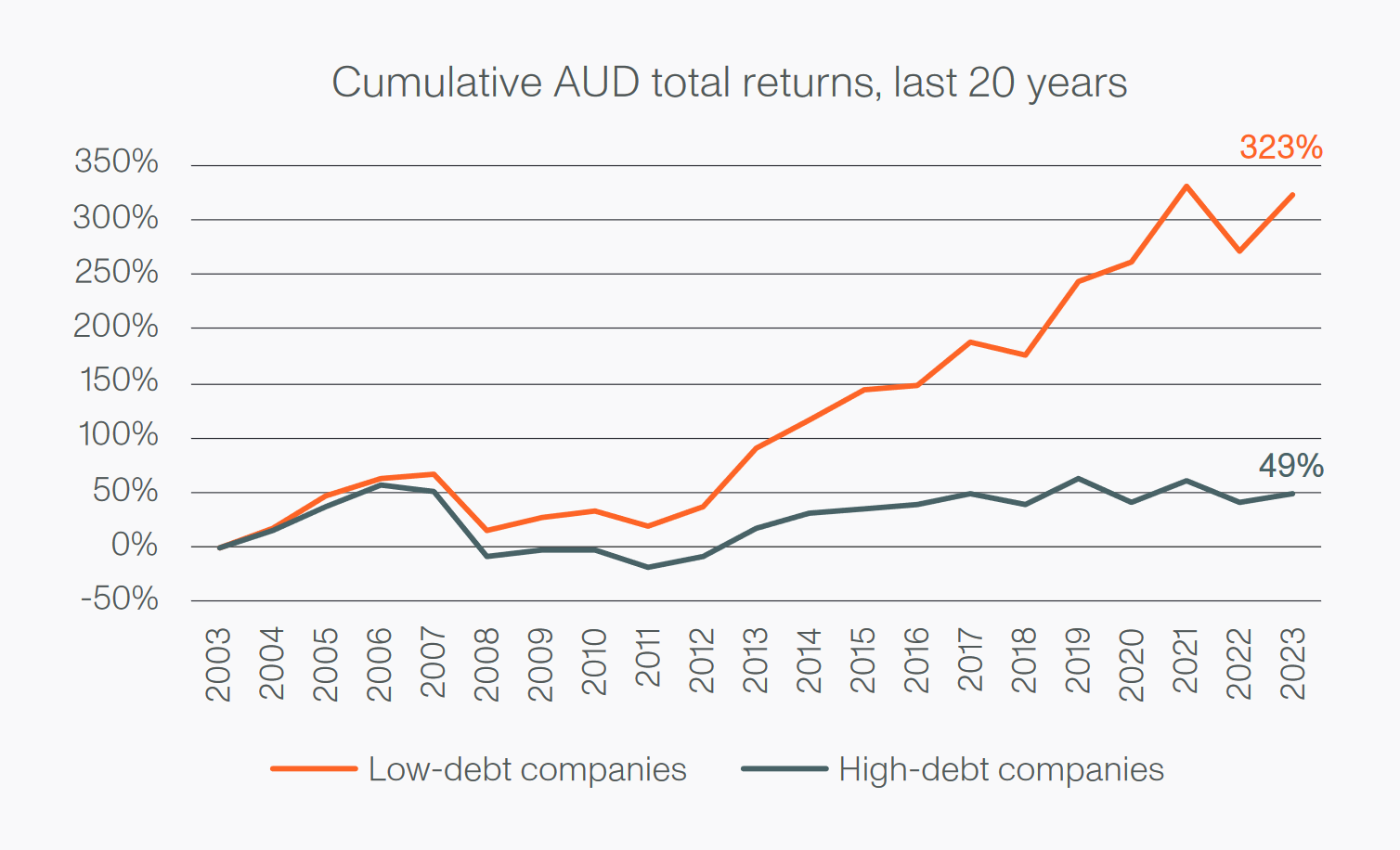

Companies with high levels of debt

The additional funding from debt can magnify a company’s profits. This may seem fine when a business is experiencing favourable conditions and interest rates are low.

But debt also amplifies any natural down cycles or business problems, and it leaves companies exposed to future increases in interest rates. A company with too much debt may be forced to cut essential spending to meet its interest billl, which can compromise its growth prospects.

We consider companies with Net Debt to EBITDA of over 3x to be highly indebted. Over the last 20 years a portfolio of these companies would have returned returned just 2% p.a. compared to 7.5% p.a. from those with better balance sheets.

Investors would be better served by owning businesses with conservative balance sheets, which can not only weather any downturns but also use them as opportunities to widen the gap to their less well-positioned peers and to make strategic acquisitions.

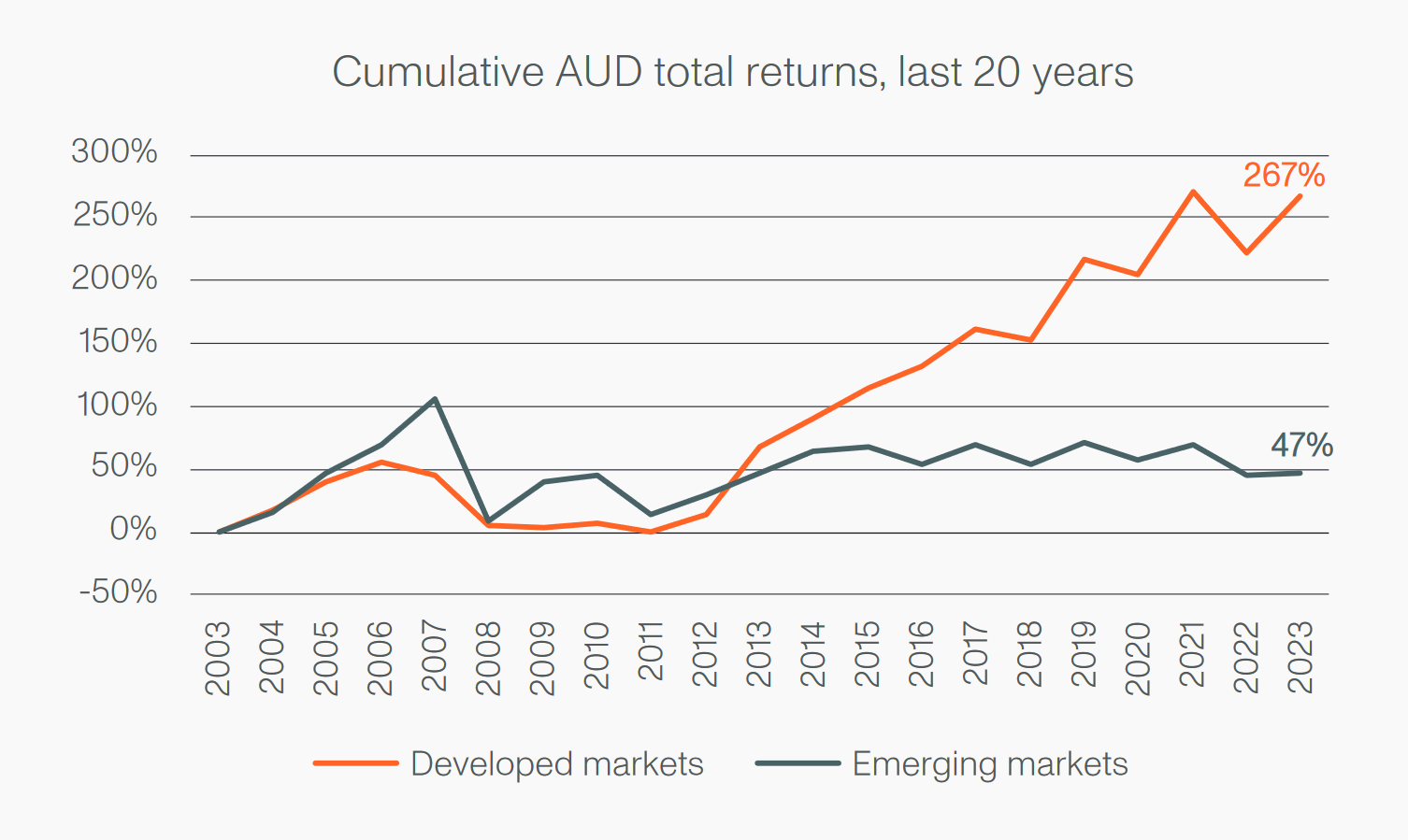

Companies based in emerging markets

Investors expect that a faster rate of economic growth in emerging countries will translate into superior returns. However, investing in these less developed economies comes with a laundry list of additional risks:

-

Persistently high inflation and currency depreciation that detract from investors' AUD returns.

- Corruption and poor rule of law. Companies based in emerging markets may struggle to protect their intellectual property or win business without engaging in bribery.

- Poor corporate governance, such as opaque ownership structures, a high incidence of related-party transactions, and limited protections for foreign investors.

- Lower accounting and reporting standards. Investors may receive limited financial information and find it difficult to validate and trust the numbers they do see.

- Political instability and interventions.

Our data shows that investors haven’t been adequately rewarded for these risks. The emerging market companies in our study underperformed those in developed markets in 15 of the last 20 years. Over that period emerging market companies have returned on just 1.9% p.a. in AUD versus 6.7% p.a. for developed market companies.

Investors don’t need to bear all the additional risks of doing business in emerging countries to participate in their economic growth. Instead, they can choose to own businesses that operate around the world but are based in developed countries where the numbers are trustworthy and the rule of law is established and reliable.

Key takeaways

Contrary to common financial theory, investors who assume greater risk have not been rewarded with higher returns.

At Aoris, we believe wealth is best created through the ownership of low-risk businesses that become more valuable over time. We aim to minimise the risk of permanent loss of our clients’ capital by avoiding the types of businesses mentioned in this article.

You can find out more about our selective and conservative approach on our website.

5 topics