Embracing Private Credit: What investors need to know

Private credit is a form of non-bank lending where debt is not issued or traded in public markets. In Australia, private credit may refer to loans directly originated on a bilateral (one lender) or multilateral (multiple lenders) basis or loans syndicated by an intermediary across several lenders. It can include loans to corporates (often backed by private equity sponsors), asset-backed loans or loans secured by commercial real estate properties. Private credit transactions can span the risk-return spectrum from relatively conservative senior secured loans to higher yielding loans incorporating potential equity upside or even loans to distressed companies.

The Australian private credit market has grown considerably in recent years. This has been driven by a number of factors including changes to bank lending practices and regulations as well as increased borrower awareness of the opportunity in private lending. Furthermore, increased M&A activity and private equity sponsorship has driven demand for private lending partners in transactions such as leveraged buyouts.

Despite recent growth, the Australian market is still in its early stages of development compared to other regions such as the United States and Europe where the asset class has a longer history and has reached significant size. Private credit offers an opportunity for investors to benefit from the diversification, lower volatility and enhanced risk return dynamic offered compared to traditional fixed income.

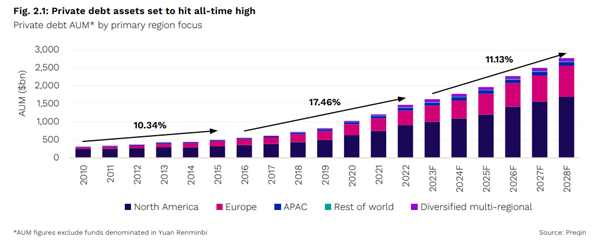

Global private credit assets under management expected to grow to US$2.8tn by 2028, a CAGR(1) of 11.1%

Source: Preqin

Benefits of Private Credit

Attractive risk-adjusted returns

Private credit transactions can provide enhanced returns above those of public markets. Being less developed, private credit markets are generally less efficient and less competitive than public markets. Borrowers value the speed and certainty of execution available through non-bank lenders. They are often willing to pay a premium for a tailored capital solution with flexibility and in terms that are a better fit for their funding needs than traditional lenders. Moreover, lenders are generally rewarded for complex deal origination and structuring through upfront fees in addition to the loan margin which can contribute to higher investor returns if they are passed through to investors.

Illiquidity premium

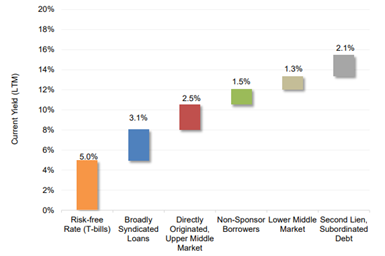

As private credit is not publicly traded, once issued, loans are not actively bought and sold. They are generally held to maturity, therefore commanding an illiquidity premium. This helps to generate a higher level of return for investors comfortable with lower liquidity than traditional fixed income securities. The illiquidity premium on private credit investments can be meaningful; Cliffwater estimates that investors receive an illiquidity premium of 2.5% for moving from liquid US leveraged loans to illiquid US direct senior loans.

Risk premiums in direct US middle market loans

Source: Cliffwater. Yields measured and averaged over the four quarters ending 30th September 2023

Lower volatility and diversification

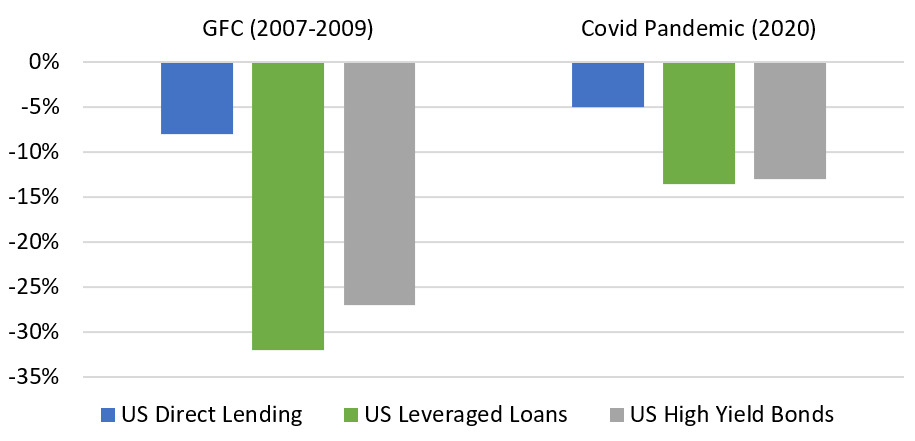

When marked to market, private credit assets will exhibit capital price volatility. However, they have historically demonstrated lower volatility of returns than publicly traded credit, complementing other defensive assets within a portfolio and helping to smooth portfolio returns. Data from US markets shows that historically, private direct lending has exhibited lower volatility than public leveraged loans and high yield bonds, with notably milder drawdowns during market downturns including the GFC and the early 2020.

Max drawdown of US direct lending, leveraged loans and high yield bonds

“US Direct Lending” = Cliffwater Direct Lending Index. “US Leveraged Loans” = iBoxx USD Leveraged Loan Index. “US High Yield Bonds” = Bloomberg US Corporate High Yield Total Return Index Value Unhedged USD. Source: Bloomberg, Cliffwater

Furthermore, the varied suite of borrowers in private credit markets provides sector diversification away from public credit markets which are dominated by financials in Australia.

Protection from higher interest rates

Private credit loan facilities often have a floating rate and therefore can provide protection against higher interest rates. Floating rate coupons rise in line with increases to the prevailing bank bill swap rate. This can reduce correlation to traditional fixed income assets that carry interest rate risk and improve portfolio diversification.

Meaningful downside protection

Private credit transactions can include strong downside protection in the form of security and covenants. While private lending can span the whole capital structure including unsecured and mezzanine financing, the vast majority of private credit deals are secured to assets, such as the cash flows or hard assets of a corporate borrower, the underlying assets in an asset-backed security (such as a mortgage or loan receivable) or the land/property in a real estate transaction. This stands in contrast to the public bond market which is mostly unsecured. The underlying security provides downside protection as in the event of default the assets can be sold to reduce losses. Private lenders also seek to limit downside risk through negotiating structural protections such as covenants. Covenants are legally enforceable terms that may either require or prohibit actions by the borrower with the intention to ensure the borrower maintains the ability to make interest and principal payments. Examples of covenants include a limit on the borrower’s leverage ratio or a maximum debt service cover ratio.

Risks of Private Credit

While private credit presents a significant opportunity, investors should be aware of the risks involved in this growing asset class.

Illiquidity Risk

As most private credit investments do not have established secondary markets, they cannot easily or quickly be liquidated meaning investors may be subject to extended holding periods. Redemptions are generally met through the natural amortisation of loans in the portfolio and therefore a shorter tenor of investments can facilitate more effective liquidity management. Investors should be aware of both the opportunity cost of locking oneself into an illiquid investment and the risk of investing into a fund where the redemption terms may not match the liquidity of the underlying portfolio. For example, open-ended private credit funds may offer periodic liquidity such as monthly and quarterly windows, but only a certain proportion of the fund may be available for redemption and redemptions may only be fulfilled on a best endeavours basis.

Credit Risk

As private credit usually involves sub-investment grade lending, credit risk is an important consideration for investors. This refers to the risk of loss if a borrower fails to meet loan requirements including payments of interest and principal. This risk can arise due to adverse macroeconomic conditions, a financing mismatch between resources and obligations and borrower-specific factors. Along with structural protections like covenants, rigorous due diligence of potential deals and risk management processes can help to protect against the likelihood of loss. A manager’s track record and experience through multiple cycles, including in workouts of impaired loans, are important criteria indicating whether a manager has the appropriate skillset to build and manage a robust private credit portfolio.

Another aspect of credit risk involves movements in credit spreads. When investments are marked to market, the capital price of loans in the portfolio can fluctuate as credit spreads widen or tighten. In a private credit fund this marking to market is important to ensure investors enter and exit at fair value.

Income Risk

While floating rate investments benefit investors in an environment of rising interest rates, so too do they have a negative impact on yield when interest rates are falling. Coupons received from a floating rate private credit portfolio will decrease as interest rates fall, meaning the income stream from private credit can fluctuate over time.

As the Australian private credit market continues to develop, it presents a compelling opportunity for a broad variety of investors to consider this asset class. The importance of manager discipline in understanding and quantifying credit, liquidity and complexity risks cannot be overestimated. Offering attractive risk-adjusted returns and historically lower volatility compared to traditional fixed income securities, private credit should not be overlooked when constructing robust and well-diversified investment portfolios.

Learn more

Fidante is a global investment manager business which forms long term alliances with best-in-class investment managers to provide investors access - across equity, fixed income and alternative assets. Find out more here.

.jpg)

.jpg)