Finding sustainable sources of investment income

Australian investors love dividends. The topic of investment yield was a battleground issue in our most recent federal election, and it’s never far away from the minds of mum-and-dad investors across the nation. When the lightning crash of 2020 caused the ASX’s biggest dividend payers to either cancel or suspend dividends, panic swept through local markets.

In more recent years, mining companies have emerged as yield stocks of choice for local investors – despite warnings from various quarters that such a dependence on the sector ratchets up risk.

But beyond simply piling into the biggest of the local blue-chip sectors, where can investors look for yield stocks? Indeed, is it even wise to think about companies in such terms?

In the first of this three-part series, I ask a couple of fundies and a wealth manager how they dissect companies before selecting them for their income funds or client portfolios. The contributors who provided insights below are:

- Todd Hoare, head of equities, Crestone Wealth Management

- Neil Margolis, CEO and portfolio manager, Merlon Capital Partners

- Peter Gardner, co-founder and senior portfolio manager, Plato Investment Management

“The biggest trap is screening by yield”

Todd Hoare, Crestone Wealth Management

One of the biggest challenges in an equity income portfolio is identifying companies that cannot sustain their dividends. The point to note is that when building an equity income portfolio, it is more instructive to focus on factors that predict dividend sustainability or indeed dividend growth rather than focusing on companies with extraordinary yields.

There are numerous ways to identify how sustainable a company’s dividends might be and to decide what constitutes sustainability. But at a high level, the biggest trap is screening by yield first. Instead, leaving the dividend yield as the outcome of your screening process is our preferred methodology. So, what are some of those screens? In no particular order:

- Profitability metrics such as return on assets (and change in ROA); free cash flow; payout ratio; cash flow from operations beyond accounting profits

- Liquidity and leverage metrics such as net debt to equity/EBITDA, Altman Z-Scores, interest coverage ratios

- Operational trends, including whether margins, revenues and cash flows are increasing or decreasing; is that change accelerating or decelerating; does the company have a track record of firstly, compounding EPS over time and secondly, paying a relatively consistent proportion of that to shareholders?

- Board signalling, looking at how dividends have evolved over the recent past. Does management have a clearly articulated capital allocation policy?

5 factors to isolate yield plays

Neil Margolis, Merlon Capital Management

For Merlon and our investors, “sustainable” in this context means the share price or capital value is preserved over the medium term. We believe that for this to happen, the dividend must be paid from sustainable free cash flow.

There are several factors to consider, as explained below:

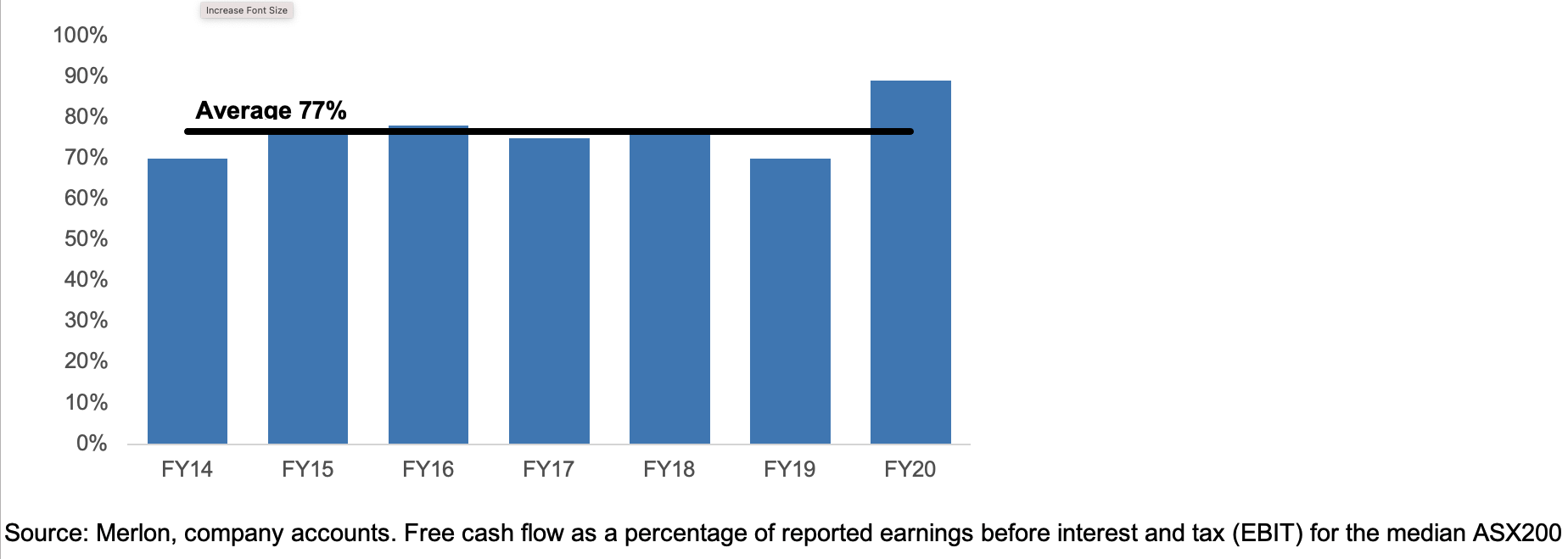

- The focus should be on “free cash flow” which is typically only 77% of accounting earnings as advertised by management (see chart below). After all, dividends not funded by free cash flow must be funded by borrowing money. The shortfall relates to “below the line charges”, working capital and growth capex, with the worst culprits being capital intensive industries such as airlines, builders and even banks.

Free cash flow as a percentage of accounting earnings

Source: Merlon, company accounts. Free cash flow as a percentage of reported earnings before interest and tax (EBIT) for the median ASX200 company

2. Dividends are only sustainable if debt levels are appropriate. The good news is that repaying debt is just as valuable to shareholders.

3. “Sustainable” means macro-economic conditions should be normal rather than inflated or depressed. An example of dividends potentially inflated by very favourable macro conditions would be the iron ore miners. On the other hand, an example of depressed conditions would be the major banks last year.

4. “Sustainable” means the industry is growing, the competitors are well behaved and the company in question is maintaining or growing market share. Supermarkets fair well here, whereas free-to-air television has struggled with new streaming competitors and bidding of sports rights.

5. As minority shareholders, we are reliant on boards and management allocating capital prudently and not getting carried away with acquisitions in far-flung geographies, or even “adjacent” industries closer to home where they lack competitive advantage and expertise. There are many examples but some we have commented on include CBA's $53 billion catastrophic acquisition of Colonial in 2000 and Boral's overpriced acquisition of Headwaters in 2016.

No such thing as “set and forget”

Peter Gardner, Plato Investment Management

There are a number of key characteristics we look for. We prefer companies with improving earnings that are expected to grow over the medium to long term. We also prefer companies with cash flow that supports those earnings.

Importantly, when it comes to the sustainability of the dividend, investors should look at the payout ratio, which is the percentage of a company’s net earnings paid to shareholders. If this figure is too high, then the dividend may not be sustainable.

At the heart of our philosophy is the fact that investors must be dynamic and can’t just “set and forget”. Banks were great income stocks four years ago but since then have been through a tough period before recovering recently.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series. In part two, the contributors will discuss payout ratios, particularly where they sit now and why they move around. And in part three, our trio each discuss some Australian companies they believe offer the best yield prospects.

3 topics

4 contributors mentioned