Flat consumer spending & strong unit labour costs

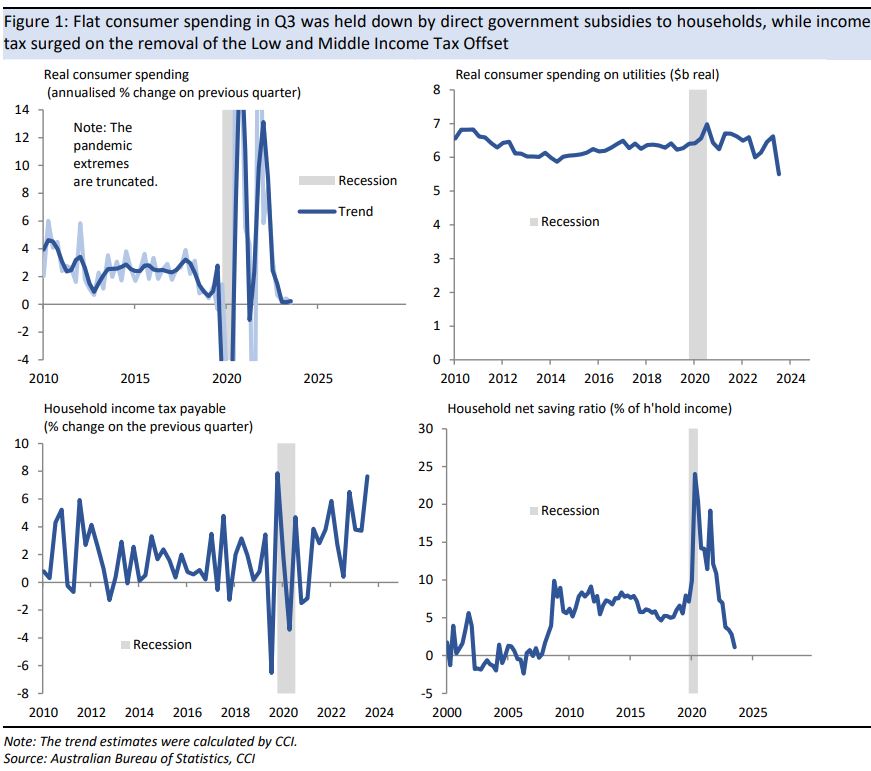

Consumer spending stalled in Q3, held down by direct government energy subsidies, while unit labour costs, which are the key driver in the RBA's mark-up models of consumer prices, continue to grow strongly, placing ongoing upward pressure on underlying inflation.

Two important features of Q3 GDP for the RBA were the flat result for consumer spending and continued strong growth in nominal unit labour costs.

Consumer spending stalled in Q3, with household income falling about 1% in real terms.

The flat result for consumer spending reflected a large drop in spending on goods offsetting faster growth in spending on services.

Importantly, the ABS noted that the flat result for total consumer spending reflected “[direct] government benefits and rebates [reducing] household spending on essential services such as electricity”, where real spending on utilities fell at a record rate of 17% in Q3.

The ABS does not publish data on these energy subsidies, but as a rough guide to what total spending may have been excluding their effect, total spending excluding utilities rose by 0.4% in Q3 after a flat Q2.

(Note that these direct subsidies are captured in GDP via state government consumption, which rose strongly in Q3.)

As for the decline in household income, it was driven by an 8% surge in income tax in the quarter, which was one of the largest increases in decades.

This also reflected the influence of government policy, where tax rose strongly on the removal of the Low and Middle Income Tax Offset.

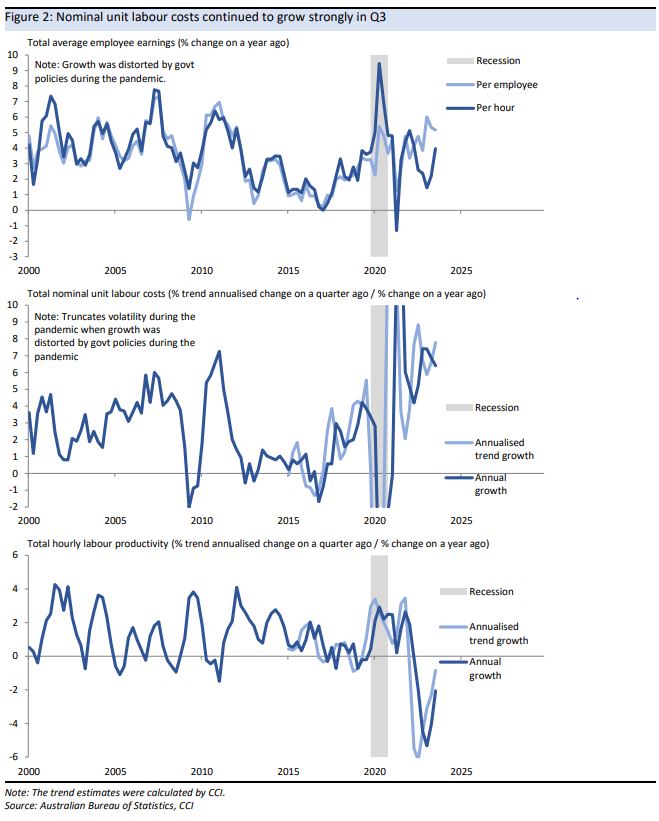

Nominal unit costs - i.e., labour costs adjusted for labour productivity - continued to grow strongly, up 2% in the quarter to be 6½% higher than a year ago (annual growth slowed because a 2½% increase dropped out of the annual calculation).

The strength in unit labour costs reflects faster growth in wages, where annual growth has reached 4%, and weak productivity.

Measuring the trend in labour productivity – which is close to levelling out after a long period of decline – is difficult, but such strong growth in unit labour costs points to continued upward pressure on underlying inflation.

Strong unit labour costs underscore the RBA’s repeated warning that current wages growth is only consistent with inflation returning to the 2-3% target band if productivity resumes growing at a more normal rate.

However, there is a risk that Governor Bullock might choose to focus more on the flat result for consumer spending, albeit with the key qualification about the restraining influence of temporary government energy subsidies etc.

If she took this view, it would raise the hurdle for another rate hike in February at the margin, which largely depends on the critical release of the Q4 CPI in late January.

4 topics