Follow the earnings revisions: Why Macquarie is backing these 13 ASX stocks

February 2023 reporting season will go down in history as the one where downgrades outnumbered upgrades and investors (in many cases) were having none of it. While CommSec's data demonstrated that 90% of companies are still profitable, those profits fell significantly as rising costs and inflation bit balance sheets hard. Of the 137 companies in the ASX 200, 22% of them cut its half-year dividend - larger than the long run average.

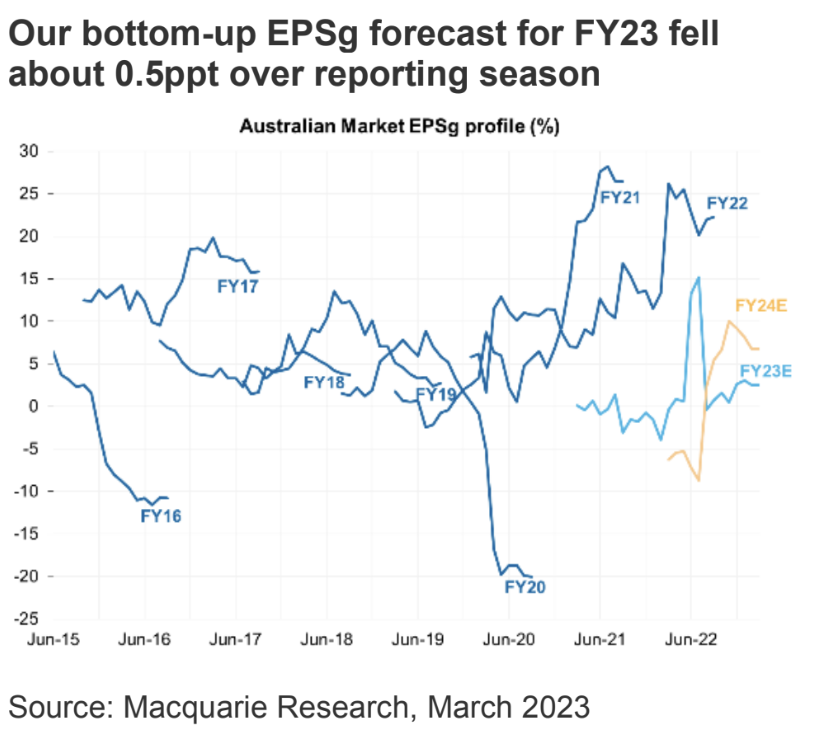

But it wasn't just the past numbers that were affected. Macquarie's sell-side research team found that their EPS forecasts for FY23 and beyond also fell, albeit not by much.

Here at Livewire, we've been with you for most of the season covering more than 40 companies over the last month. If you missed any of that coverage, you can click here. But it's what happens after reporting season that really matters.

In this wire, I'll take you through Macquarie's top post-reporting season investing ideas and the companies that pair with those ideas.

The key quote

First trade idea: Think of the downgrades

To work out which companies have more upside and which have more downside on the way, Macquarie looked at the "contributions" (read: required increase in revenues, profits, and earnings) each company would have to make in order to hit consensus targets.

Only three companies had upside risk to the consensus' EPS forecasts. They are:

In contrast, many more companies like Domino's Pizza (ASX: DMP) and REA Group (ASX: REA) have downside risks priced in. Even more names could see in excess of 10% downside to their H2 EPS figures. Those companies, as highlighted by Macquarie's sell-side team are:

- Flight Centre (ASX: FLT) and Corporate Travel Management (ASX: CTD)

- Healius (ASX: HLS)

- Domain (ASX: DHG)

- LendLease (ASX: LLC)

- Credit Corp (ASX: CCP)

- News Corp (ASX: NWS)

- Sims Metals (ASX: SGM)

Second trade idea: Think defensive

Macquarie's strategy portfolio has had a defensive tilt all year (and part of last year as well). So it makes sense that they are targeting defensive companies with potential for EPS surprise. Defensive sectors also outperformed this past reporting season with the insurers and consumer staples doing particularly well.

Some of their top-rated defensive ideas include:

Third trade idea: Show me the money!

They say cash is king, and cash flows were a key highlight of reporting season. Companies that were able to keep cash in the balance sheet or convert that cash into earnings were rewarded by the market.

Of the ASX 100, some of the best examples for companies that were able to turn cash into profits include Coles, Transurban, and Ampol (ASX: ALD). All three have OUTPERFORM ratings.

Among the low cash conversion stocks/companies, there is only one company with an UNDERPERFORM rating. That company is Cochlear (ASX: COH).

Fourth trade idea: Follow earnings revisions

Some of the better surprises which translated to reality include:

- Transurban

- Endeavour

- Orora

- Qantas (ASX: QAN)

- CSL (ASX: CSL)

- Steadfast (ASX: SDF)

- Auckland International Airport (ASX: AIA)

- AUB Group (ASX: AUB)

- De Grey Mining (ASX: DEG)

- AP Eagers (ASX: APE)

- Perseus Mining (ASX: PRU)

- oOh! Media (ASX: OML)

- SkyCity Entertainment (ASX: SKC)

And as for the not-so-good surprises...

- Reece (ASX: REH) - SELL

NEUTRAL rated stocks:

- Amcor (ASX: AMC)

- Woodside Energy (ASX: WDS)

- Rio Tinto (ASX: RIO)

- Nine Entertainment (ASX: NEC)

- Domino's Pizza

- Downer EDI (ASX: DOW)

- Ansell (ASX: ANN)

Fifth trade idea: Don't rule out ESG

Finally, is there a correlation between companies who report high ESG scores and strong earnings? The answer, at least by Macquarie's standards, is yes. Plenty of the companies already mentioned above do have high ESG scores, and are also represented in buy or outperform lists.

But there were also two sell ideas related to ESG. These are companies that underperformed in their earnings result and also have low ESG scores. The two companies are:

Never miss an insight

If you're not an existing Livewire subscriber, you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics

38 stocks mentioned