Gold is money. Everything else is credit

There are few things that get us as excited as value investors as identifying an unloved sector or company with an asymmetric risk / reward trade off.

So, when looking at the small and mid cap space for gold and silver companies on the ASX we were very excited to see that many stocks in the space were trading at more than a 50% discount to our assessment of their intrinsic values.

The Case for Gold and Silver

It is relevant to recognise that gold and silver have long been desired by both private and institutional investors as a store of wealth and as a hedge against extreme volatility in financial markets. However, the drivers of demand for both gold and silver extend well beyond volatility hedging and wealth storage, with industrial and retail applications also underpinning buying behaviour.

In fact, despite most people not realising it, silver is the most widely used commodity in the world after oil, with utility in battery technology, Electric Vehicles, Solar panels, Medical devices (due to its anti-bacterial properties) and conductive wiring.

Its worth noting that both gold and silver have seen a substantial increase in demand over the last couple years despite supply constraints. And yet, that demand and the related increases in the price of the commodities have not been reflected in share prices.

We think that the 35% spread between gold prices and the gold miners index (as illustrated above) can be generally explained by the following:

- Lack of exploration leading to depleted mine lives and reduced assets on balance sheets across established producers;

- Reduced production levels and reduced earnings / profits due to staffing and resourcing constraints;

- Hedging practices (often via put/call collar arrangements) which precluded producers from fully participating in strengthening spot markets, thus weighing on profit/loss accounts;

- Relatively higher levels of interest in commodities more acutely focused on the transition to renewable energy (notwithstanding the significant exposure silver has to both the solar and electric vehicle sectors); and

- Market concerns relating to potential capital raises (small to mid-cap sector) and cost inflation eroding any benefit gained from higher spot prices (both in an operational and explorative context).

Certainly, not all companies are the same, and there are many out there that don't suffer from the above issues. Nevertheless, when market sentiment is strongly negative, it hardly matters what the fundamentals are - all companies suffer.

What might drive a sectoral re-rating?

We see four key catalysts for a re-rating of global gold companies over the medium term. They include:

1) A pause or pivot in central bank policy.

It appears increasingly likely that global economies have reached (or are nearing) peak interest rates for the current cycle. As rates reduce, the opportunity cost of holding gold decreases.

In the face of an increasingly fragile consumer and heavily leveraged public sector, tension will continue increase. Subsequently we think Central Banks will likely feel pressure to reduce rates, and as a result gold and precious metals prices are likely to increase.

Silver in particular can move quite rapidly compared to gold given the smaller, less liquid market for the commodity and the more diverse demand side participants.

The question is: what are the specific drivers that might lead to a pivot?

Whilst the precise timing and sequencing of any shift in central bank policy in the U.S.A. is unknown, it is relevant to note that interest payments on federal debt is at record highs as shown in the chart below. So too, interest repayments as a percentage of tax receipts in the US has spiked considerably over the last 2 years.

Consequently, the potential for interest rates to continue on an upward trajectory or stay at elevated levels for extended periods of time is limited as such policy settings would only serve to cripple the U.S.A’s own Treasury department.

To that end, the prospect of inflation remaining at elevated levels and real rates of interest decreasing is, in our view, a highly likely scenario.

2) Company level operational performance improvements.

As mine lives are extended, and resources are firmed up, company balance sheets naturally expand. Along with that expansion comes the benefit of potentially higher prices as markets assess prospects on a multiple of book value or JORC resource.

As operational issues improve, markets are likely to appreciate those improvements with a willingness to pay more reasonable multiples. Against a current environment where markets are all but disregarding fundamentals, the upside for this type of recognition could be substantial. This is particularly true as companies achieve economies of scale, which see the cost of production fall even as gold prices increase.

Of course, investors want to be cautious when selecting their exposures, with a specific focus on companies ability to fund their growth. There is a risk that companies find themselves short of the capital they require which can lead to dilutionary capital raisings. Investors want to be discerning when making their selections with regard to the life cycle and stage of any prospects.

One framework investors may consider using when undertaking such considerations is the Lassonde Curve as shown here:

Our preference is for late stage explorers and early stage producers in order to mitigate funding, technical and exploration risks, with an emphasis on small to mid-cap companies where market sentiment (or less efficient price discovery) can cause more extreme pricing dislocations than can be found in larger companies.

3) Merger and acquisition activity in the sector.

Where distressed assets in tier 1 jurisdictions are acquired by larger counter-parties, future growth can be achieved at potentially lower costs (and with less operational uncertainty) than via organic exploration activity. This pathway can see share prices move quickly and with confidence, especially under circumstances where there is a logical strategic counter-party to the transaction.

This sort of activity draws additional interest to the sector and can create a situation in which many undervalued assets are suddenly considered through the lens of acquisition.

4) Heightened geo-political risks pushing investors to safe haven assets.

Armed conflict in both Europe and the Middle East, each with the potential for escalation and wider participation, has a two-fold impact on gold and precious metals.

Firstly, the move to a safe haven asset by institutional and private investors driving demand Secondly via the shifting preference of central banks (often in emerging economies) towards an increased gold and precious metal allocation over and above their U.S. dollar exposure.

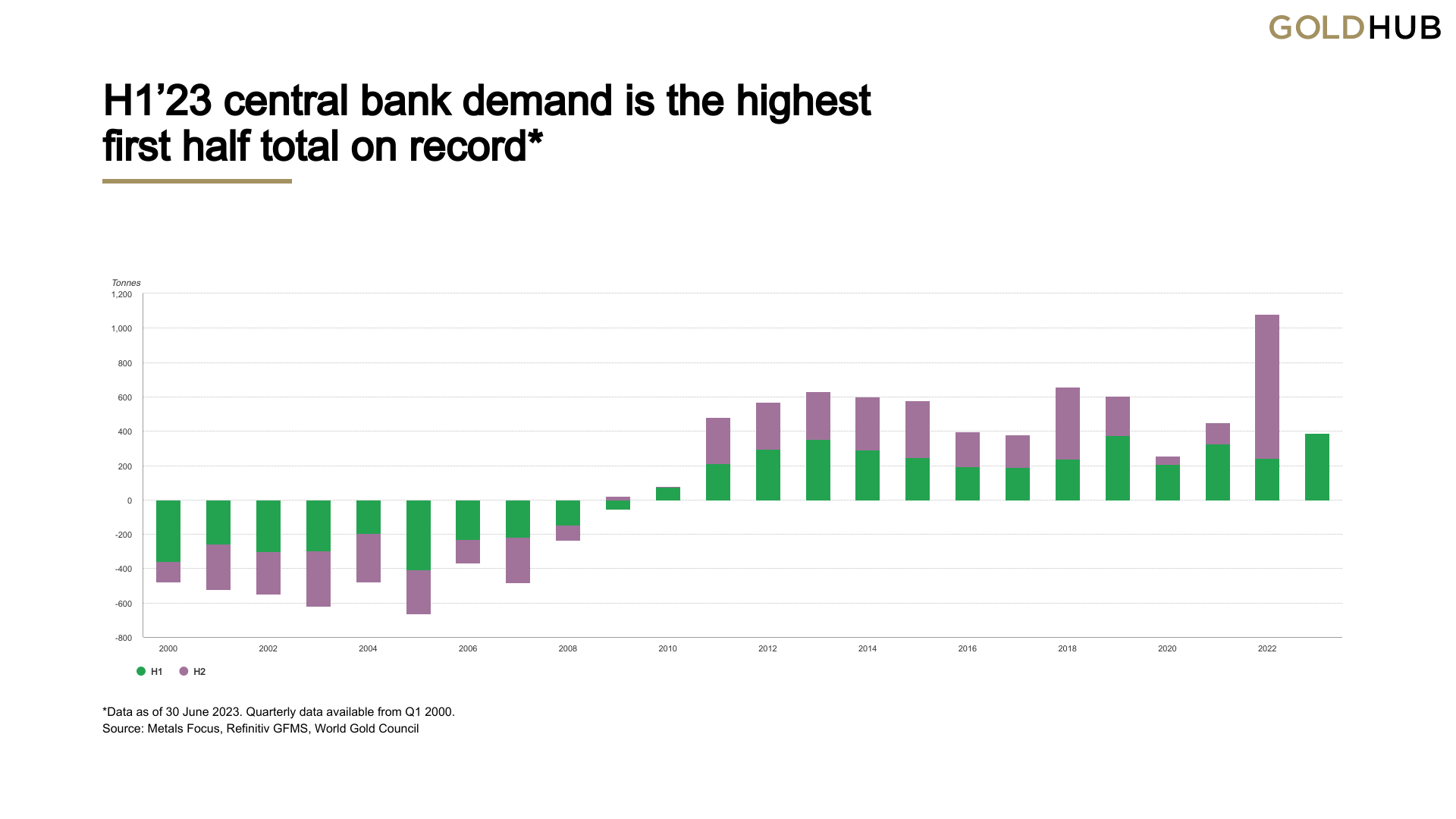

The chart below shows record levels of central bank gold buying over the course of the last ten years, with the second half of CY2022 being especially notable.

More

recently, looking to the September 2023 quarterly buying figures, it is

noteworthy that substantial activity has been occurring in Eastern European

countries on both the buy and sell side of the ledger

Conclusion

The outlook for the gold and precious metals sector is compelling. In the listed space there is additional potential due to the leverage available to operating companies, and the steep discounts the sector appears to be currently trading at.

For investors with patience and a willingness to invest in unpopular areas, we believe that select mid and small cap gold and silver companies present an exciting mix of both contrarian and deep value investing opportunity.

Collins St Asset Management believe that the potential for medium term re-ratings in the realm of >50% total return are achievable, driven by a potent tailwinds mentioned above, including shifting monetary policy, geo-politics, operational performance and the flow on to merger and acquisition activity.

Notwithstanding these tailwinds, risks are very present and the path forward is unlikely to be linear. For that reason, investor conviction needs to be tempered with both patience and risk tolerance in order to allow the investment thesis the fullest opportunity to develop into profitable medium-term outcomes.

3 topics