Good news on US inflation points to the Fed on hold next month

Good news on US inflation suggests that the Fed will hold the funds rate steady at its last meeting of the year.

The Federal Reserve meets for the final time this year on 12-13 December, where the November CPI report is published on the first day of the meeting, barring a delay caused by a possible government shutdown.

In September, the Fed had forecast one last rate hike this year, but unless the November report shows a spike in inflation, it seems likely that the FOMC will keep the funds rate on hold at 5¼-5½% next month given the improvement in inflation to date.

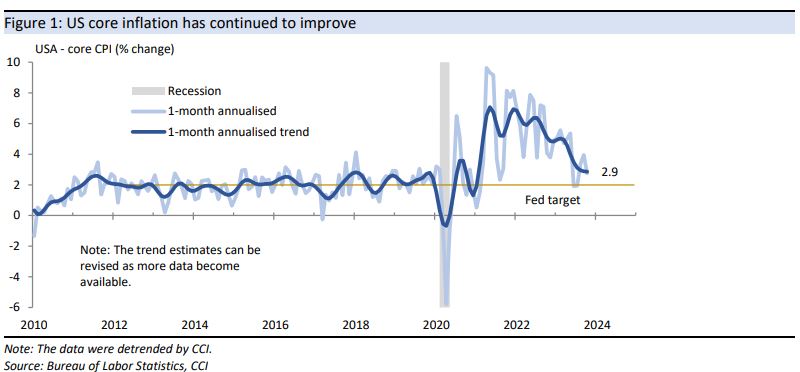

For example, last night’s data showed that core US inflation came in below expectations in October, increasing by 0.2% in the month, which was the smallest monthly increase since July.

In trend terms, annualised monthly inflation is has been steady at just under 3% for the past few months, which is the best result since early 2021.

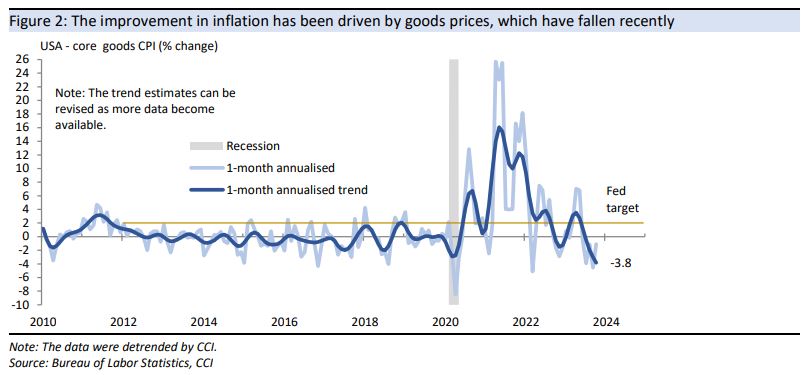

Core goods have driven much of the improvement, as goods prices continue to fall, down for the fifth month in a row, with annualised disinflation running at 3¾% in trend terms.

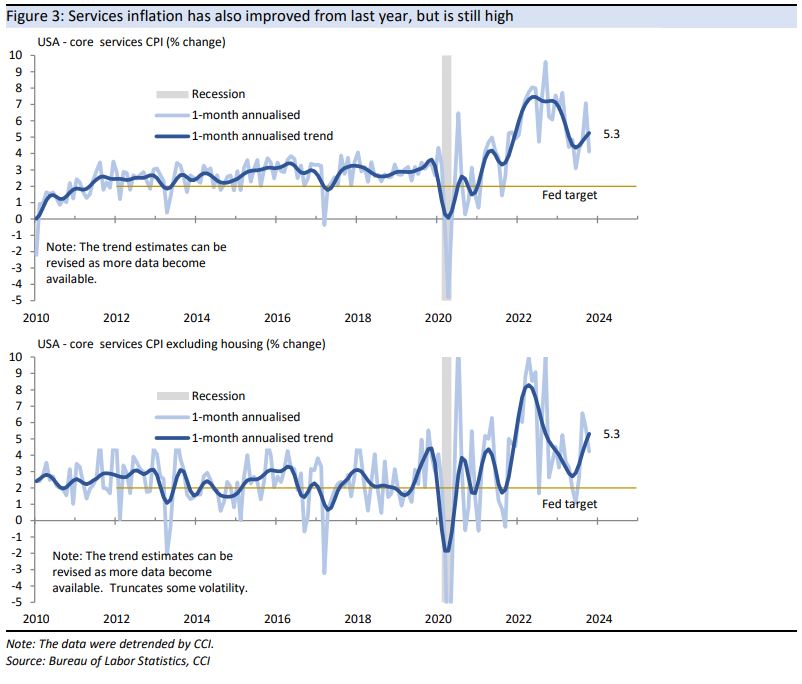

Core services prices rose by 0.3%, which was the smallest increase since June, although one month’s improvement was not enough to stop the annualised trend inflation rate edging up to a still-high 5¼%.

Core services excluding housing showed a similar story, with annualised trend inflation rate edging up to 5¼%.

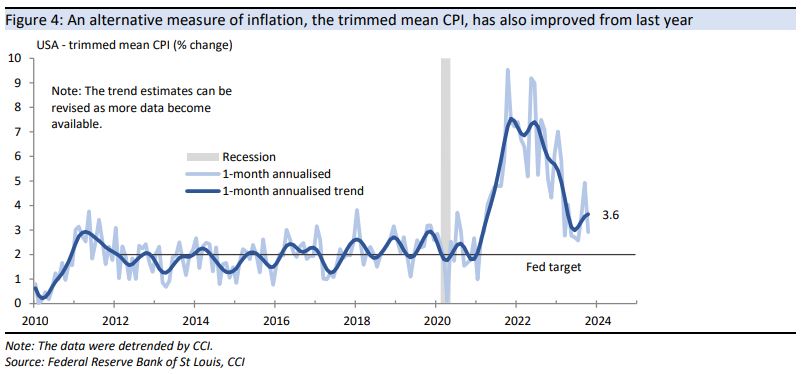

As an alternative measure of underlying inflation, the trimmed mean CPI also increased at a slower rate of 0.2%, although the annualised trend inflation rate was unchanged at 3½%.

3 topics