High inflation, low unemployment signal a high risk of US recession

A simple model

developed by US academics suggests that there is a high risk that the US

economy will enter recession within the next year given the combination of high

inflation and unsustainably low unemployment. This reinforces the inverted yield curve signalling a high risk of recession in late 2023/early

2024 and highlights the difficulty in achieving

a “soft landing” given restrictive monetary policy is required

to lift the unemployment rate above the NAIRU in order to sustainably return

inflation to its target.

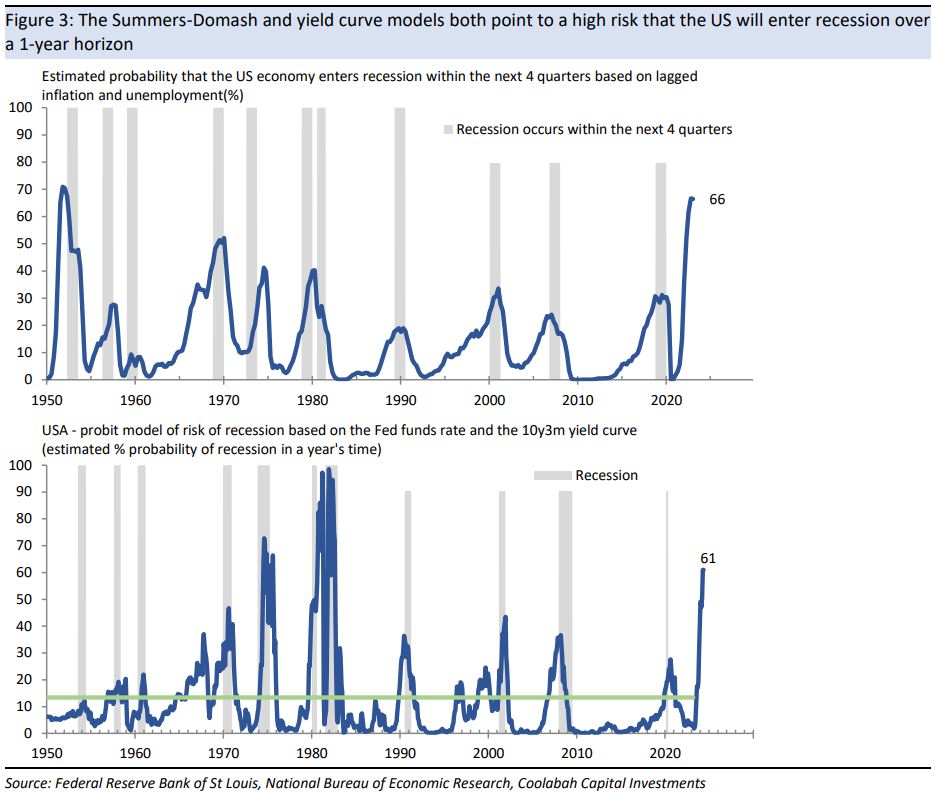

A useful way of estimating the probability that the US economy will enter recession in, say, a year’s time is to extract the signal from the slope of the yield curve, where the signal can be enhanced by accounting for the stance of monetary policy.

The idea behind this approach is that the yield curve will invert ahead of a recession as the market factors in lower future interest rates, where the signal is stronger if the inversion occurs at a higher level of interest rates.

The yield curve does not provide

a perfect warning of recession, but has outperformed other economic and financial

indicators, including stock prices which are more volatile.

An alternative, more general approach to assessing the risk of recession was developed last year by Harvard academics Larry Summers and Alex Domash, which the RBA referenced in its work on the risk of recession in Australia that was recently released under the Freedom of Information Act.

The approach was more general in that Summers and Domash estimated the probability that the US economy will enter a recession at some point over the next one to two years rather than, say, the specific risk of recession in a year’s time.

The risk

of recession was based on the trend in inflation and recent unemployment, where

their benchmark model was:

- The probability that the US economy is not currently in recession but will enter recession at some point over the next “x” quarters = function(average inflation over the past year, unemployment a quarter ago)

The model can be thought of as indirectly capturing the policy response to high inflation and low unemployment, where the Federal Reserve normally needs restrictive monetary policy in order to deal with uncomfortably high inflation and unsustainably low unemployment.

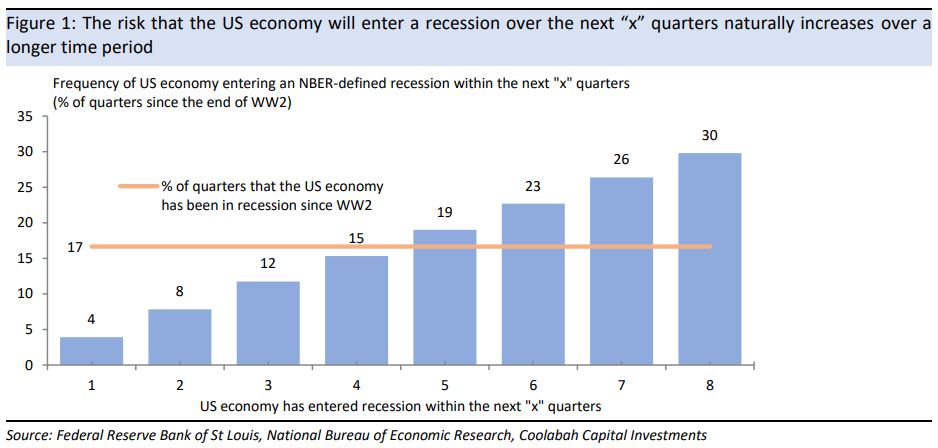

In judging the Summers-Domash model, it is important to note that that the risk that the US will enter recession naturally increases in line with the time horizon.

For example, since WW2, the US economy has entered a recession within the next quarter about 4% of the time. Extending the time horizon, the US has entered a recession within the next year about 15% of the time, increasing to around 30% of the time over a two-year horizon.

These probabilities may seem high, but the US has experienced a NBER-designated recession about once a decade in the post-WW2 period, and sometimes more than once a decade.

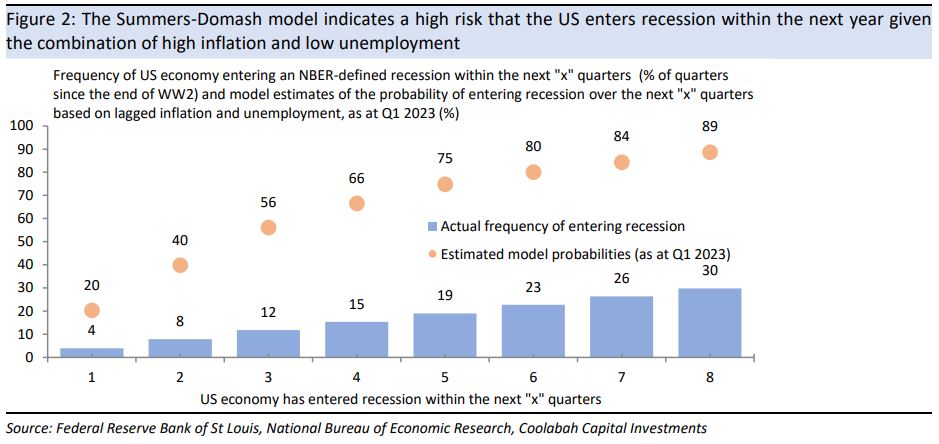

Estimating the benchmark Summers-Domash model over the post-WW2 period for time horizons extending from the next quarter to two years, the results are reasonable but are sometimes imprecise (more formally, the pseudo-R-squareds range from about 20 to 25% when the models are estimated from 1950 to now).

That is, the model results occasionally miss episodes where the US entered recession in earlier decades and more commonly give a relatively modest signal of the risk of recession for a slightly longer period than needed (see, for example, the chart below of the model performance in estimating the risk that the US enters recession within the next year).

That

said, the performance is better than most other recession indicators and not

too far from the track record of yield curve models of the risk of recession at

a fixed point in the future.

The model results suggest that at the start of this year the estimated probability that the US will enter recession with the next quarter is about 20%, rising to about 66% over the coming year and further increasing to about 90% within the next two years.

The latter are high probabilities by the standards of the model and well above the observed historical risk that the US will enter a recession, which is not surprising given that inflation recently reached its highest level since the 1980s and unemployment fell to its lowest level in about fifty years.

Comparing the estimation results with predictions from the yield curve model, both approaches point to a high risk of recession, within the next twelve months for the Summers-Domash model and in late 2023/early 2024 for the inverted yield curve.

Again this is not surprising, in that the yield curve is capturing the Federal Reserve raising interest rates to a restrictive level in order to lift the unemployment rate to above the NAIRU so as to sustainably return inflation to the bank’s 2% target.

3 topics