How the best-performing small cap funds are positioning for a rebound

Markets have often been characterised as a rubber band, stretching to the upside and the downside. The more stretched they are, the faster they revert to the mean.

It might be more apt to think of the market as a series of rubber bands, each representing a market cap segment.

Here, small caps (not to mention microcaps) represent the most stretched rubber. That is to say, they stretch more to the upside, more to the downside, and they snap back with more inertia than other stocks.

In this wire, I draw on data from Morningstar to find out which small cap funds have the best track record to ride a rally in small caps. I also list the top holdings they are getting ready to do it with.

What the fundies are saying

I've spoken to a lot of small cap fund managers lately, and let me tell you - they're expecting some mean reversion to the upside after some underperformance in the sector.

Here are just some of those takes:

"Big corporates are looking down the market cap spectrum to buy growth, and small caps and micro caps fit that bill and you've also got private equity, which needs to de deployed to make money. Debt markets we think will free up, particularly if interest rates come off. So we think the foundations are in place for a good rally for micro-caps and small caps." - Matthew Booker, Spheria Asset Management.

"Why we're excited about small caps and why we think they're bottomed and a due a good run in the next 12 to 18 months is that the June quarter actually represented the first time in the last eight quarters where the actual small cap market beat the broader market. We think there's a turning point right now in the market and we're positioned the portfolio accordingly." - Oscar Oberg, Wilson Asset Management.

"The broad equity selloff last year, and the rally led by just seven large-cap U.S. tech stocks this year, has left valuations for beaten-down global small-cap shares at the cheapest level compared to their larger counterparts in nearly two decades." Roger Montgomery, Montgomery Investment Management.

These are small cap managers, to be fair. So they'll always be naturally predisposed to talking up their own book. That's par for the course.

But let's look at the facts.

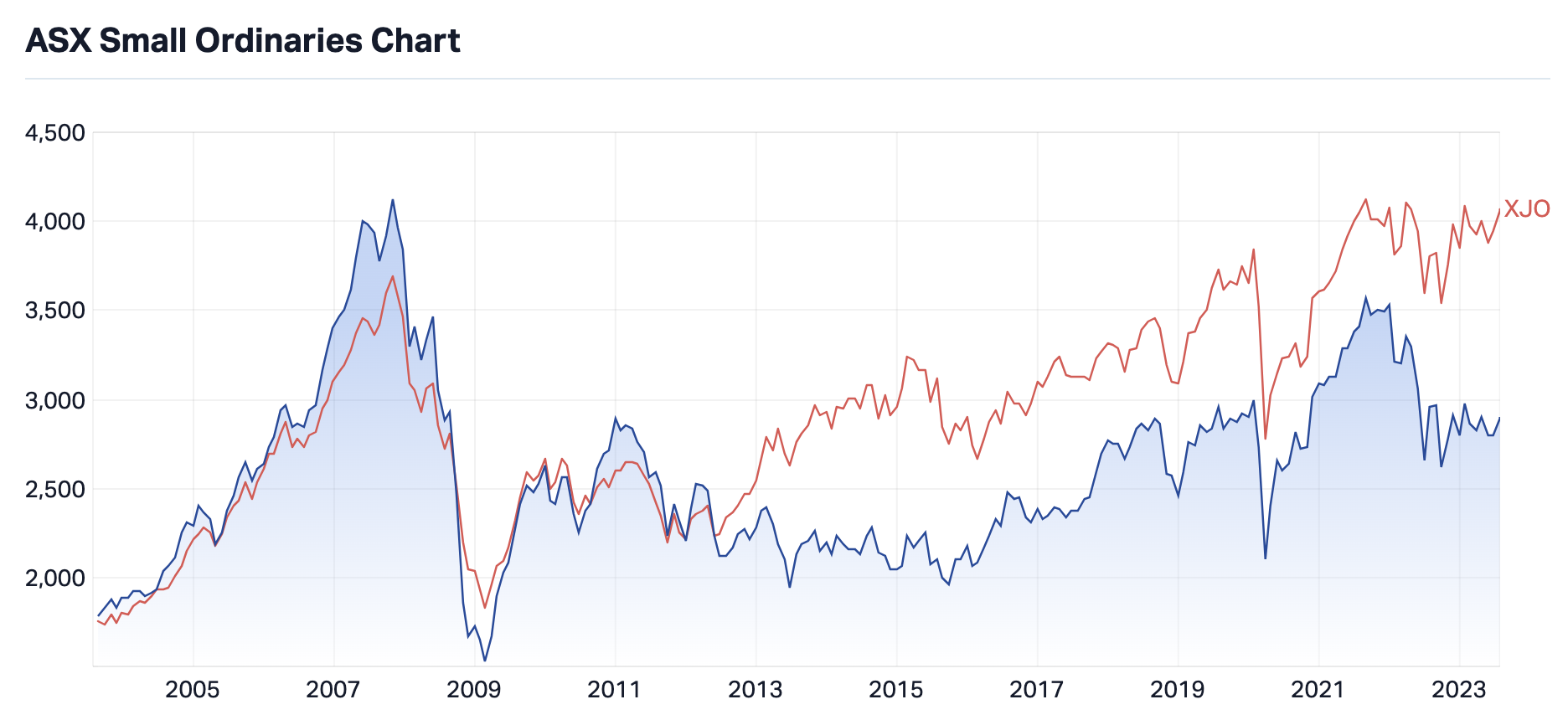

As the above chart shows, small caps have generally fallen faster, and recovered sooner, than their large cap peers.

In other words, the rubber band is stretching further and snapping back faster.

Methodology

Morningstar's data includes funds that invest in "smaller companies", which can include small and mid-caps, categorised across three styles: growth, value, and a blend of the two.

In order to capture their indicative performance through a rally, funds were ranked on their performance from trough to peak during the last Small Ordinaries rally - that being, March 20, 2020 to October 3, 2021. This will be referred hereto as the "rally return".

I then identify the top three performing funds in each category, along with their strategy, objective, and top holdings (where available).

Note: This data is current as of July 3, 2023.

Mid/Small Growth

#1 SG Hiscock Emerging Companies Fund

Inception: 9/10/2001

Rally return: 87.50%

1 year total return: -3.08%

3-year annualised total return: 17.77%

Annualised total return since inception: 12.01%

Strategy: This fund is designed to provide medium to long-term capital growth, by primarily investing in companies that have a market capitalisation of less than $500 million at the time of purchase. This may include resource exploration companies, early stage bio-technology companies and technology start-ups.

Objective: Designed to provide medium to long-term capital growth potential and seeks to outperform the S&P/ASX Emerging Companies Accumulation Index over rolling 3 to 5 years periods after taking into account fees and expenses.

Top Holdings (as of 30 June 2023)

| Lycopodium Limited |

ASX: LYL |

| Big River Industries Ltd |

ASX: BRI |

| Animoca Brands Corp |

ASX: AB1 |

| Emerald Resources NL |

ASX: EMR |

| Market Herald Ltd |

ASX: TMH |

| Generation Development Group |

ASX: GDG |

| Capricorn Metals Ltd |

ASX: CMM |

| Praemium Limited |

ASX: PPS |

| Marketplacer Holding |

- |

| Green Technology Metals Limited |

ASX: GT1 |

#2 DNR Capital Australian Emerging Companies

Inception: 31/8/2018

Rally return: 81.70%

1 year total return: 10.60%

3 year annualised total return: 17.77%

Annualised total return since inception: 11.91%

Strategy: The DNR Capital Australian Emerging Companies Fund offers investors exposure to a long-term, concentrated portfolio of high quality, small cap Australian listed equities.

Objective: The Fund’s investment objective is to invest in a portfolio of Australian emerging companies that aims to outperform the ASX/S&P Small Ordinaries Total Return Index over a rolling five-year period. The investment objective is not a forecast of the Fund’s performance.

Top Holdings (as of 30 June 2023)

#3 Lakehouse Small Companies Fund

Inception: 16/11/2016

Rally return: 71.07%

1 year total return: 28.56%

3 year annualised total return: -1.56%

Annualised total return since inception: 10.50%

Strategy: The fund invests in fast growing small companies listed in Australia and New Zealand. They’re not companies that most investors would’ve typically heard of. They’re much smaller, aren’t as widely followed, and have much more potential upside.

Objective: The fund seeks to outperform the S&P/ASX Small Ordinaries Accumulation Index over rolling 5-year periods.

Top Holdings (as of 30 June 2023)

Mid/Small Value

#1 Regal Emerging Companies III

Inception: 1/8/2019

Rally return: 87.44%

1 year total return: -10.09%

3 year annualised total return: 12.37%

Annualised total return since inception: 25.02%

Strategy: The strategy seeks to take advantage of a gap in the Australian market for the funding of emerging companies that do not fit the mandates or criteria of traditional investment firms. Regal aims to generate attractive returns by investing in pre-IPO and other unlisted opportunities, in addition to listed micro-cap companies.

Objective: The Fund aims to outperform the Hurdle, after all fees and Fund expenses over the Term. The Fund may not be successful in meeting this investment objective.

#2 Perennial Value Smaller Companies Trust

Inception: 7/3/2002

Rally return: 72.55%

1 year total return: -7.83%

3 year annualised total return: 2.04%

Annualised total return since inception: 8.41%

Strategy: Invests in a range of smaller listed companies predominantly outside the ASX top 100 Index which the Perennial Smaller Companies team believes have sustainable operations and whose share price offers good value. The cornerstone of this approach is a strong emphasis on company research. The aim is to develop a detailed understanding of each company before committing investors’ funds.

Objective: We aim to grow the value of your investment over the long term via a combination of capital growth and by investing in a diversified portfolio of Australian small cap shares predominantly outside the S&P/ASX 100 Index, and to provide a total return (after fees) that exceeds the S&P/ASX Small Ordinaries Accumulation Index measured on a rolling three-year basis.

Top Holdings (as of 30 June 2023)

| RPMGlobal Holdings | ASX: RUL |

| Navigator Global Investments | ASX: NGI |

| Alliance Aviation | ASX: AQZ |

| Cooper Energy | ASX: COE |

| Experience Co | ASX: EXP |

| Superloop | ASX: SLC |

| QORIA | ASX: QOR |

| PeopleIn | ASX: PPE |

| GTN | ASX: GTN |

| Enero Group | ASX: EGG |

#3 Microequities Value Income Fund

Inception: 31/1/2019

Rally return: 58.64%

1 year total return: 8.71%

3 year annualised total return: 16.78%

Annualised total return since inception: 12.02%

Strategy: The Fund invests primarily in ASX-listed securities, which at the time of initial investment are generally outside the ASX200 index. The Fund holds a concentrated portfolio generally not exceeding 40 companies. All securities selected for the Fund have met a rigorous investment selection process. They need to be paying regular dividends, and have robust business models in place that provide solidity and security in the dividend income stream. In addition, securities purchased by the Fund are acquired at a large discount to our assessed intrinsic value.

Objective: The Fund aims to protect capital, provide a sustainable income stream to investors and attain long term capital growth. The Fund’s investment strategy will be based on the HIMF. It intends to provide semi-annual income in the form of cash distributions (paid January and July). Returns are not guaranteed.

Mid/Small Blend

#1 Regal Australian Small Companies Fund

Inception: 2/2/2015

Rally return: 132.41%

1 year total return: 26.91%

3 year annualised total return: 20.16%

Annualised total return since inception: 22.35%

Strategy: The Regal Australian Small Companies Fund invests using a long/short approach and allows investors to benefit from both the rise and fall in the value of selected Australian small companies. The fund uses an active extension or “130/30” style and seeks to outperform the S&P/ASX Small Ordinaries Accumulation Index by applying Regal’s fundamental investment process. The fund is suitable for investors who have a longer term investment horizon (three to five years).

Objective: The fund seeks to outperform the S&P/ASX Small Ordinaries Accumulation Index over a rolling five year period and is suited to wholesale investors with a longer-term investment horizon.

#2 Altor Alpha

Inception: 1/2/2019

Rally return: 112.77%

1 year total return: -8.83%

3 year annualised total return: 20.76%

Annualised total return since inception: 30.27%

Strategy: The Fund seeks investment opportunities which offer commensurate returns for the risks involved. Investment opportunities are based on a broad set of principles: Investing in micro, small and mid-capitalisation companies; Asymmetric risk/return profile and catalyst driven investment; Investing in companies where securities are being issued or sold below assessed intrinsic valuation; Investment based on large macro-thematics; Investing in a range of structures including equity, hybrids, options and term debt; Going short indices or specific companies; and Pre-IPO unlisted opportunities (within portfolio limits).

Objective: Not available

#3 Firetrail Australian Small Companies Fund

Inception: 18/2/2020

Rally return: 97.36%

1 year total return: 0.36%

3 year annualised total return: 13.43%

Annualised total return since inception: 11.72%

Strategy: The Firetrail Australian Small Companies Fund is a concentrated portfolio of our most compelling Australian Small Company ideas. The strategy is built on fundamental, deep dive research guided by the philosophy that ‘every company has a price’.

Objective: The Fund aims to outperform the S&P/ASX Small Ordinaries Accumulation Index over the medium to long term after fees.

Top Holdings (as of 30 June 2023)

3 topics

30 stocks mentioned

2 funds mentioned

3 contributors mentioned