How the US economy is standing out from the crowd

While other major economies stagnated or contracted in the second half of 2023, the U.S. economy has been thriving and has thus far weathered the most vigorous period of interest rate hikes in nearly forty years. The strength of the economy has driven U.S. equity market outperformance—a trend that is likely to persist.

Amidst the backdrop of an unprecedented central bank rate hiking cycle, the resilience of the U.S. economy stands as a beacon of stability. By contrast, the UK and Japan grapple with technical recessions, the Euro area remains mired in stagnation, and China contends with deflationary pressures.

The U.S. economy defied global trends in the second half of 2023, posting a quarterly GDP growth rate of 4.1%. Projections from the Atlanta Fed's GDPnow indicator suggest that this above-trend growth will likely extend into 1Q 2024.

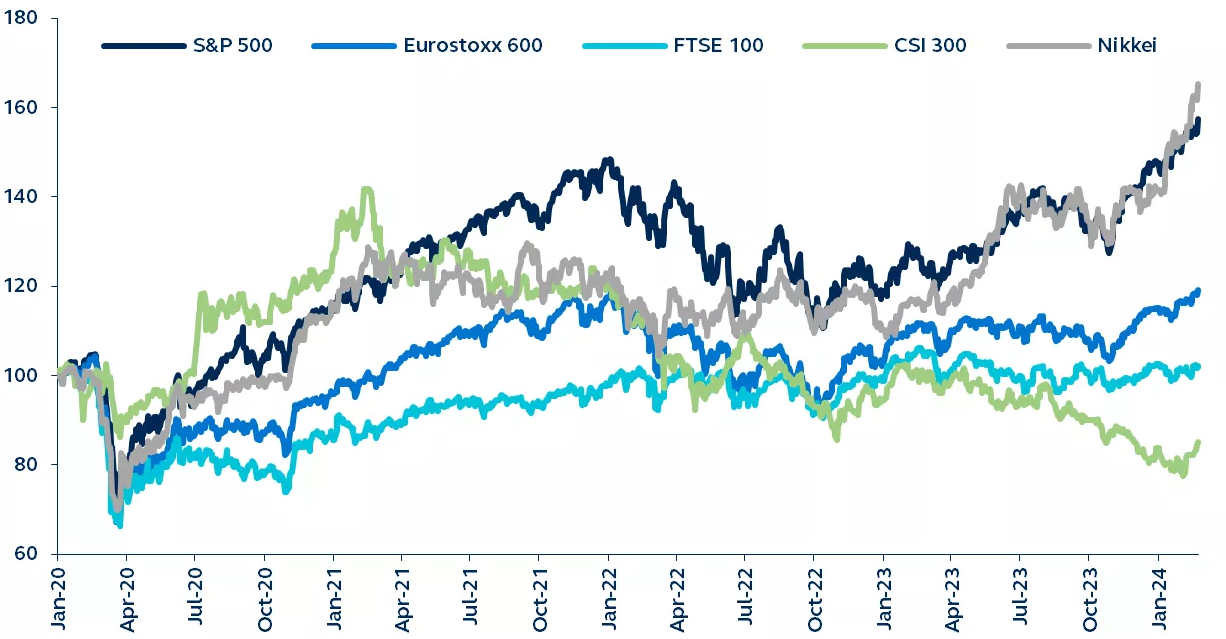

The sustained economic strength of the United States has been a driving force behind the outperformance of its equity markets. Since the onset of the pandemic in early 2020, the S&P 500 has risen 57%, compared to 20% for the Eurostoxx 600, 2% for the UK FTSE 100, and a 15% drop for China’s CSI 300 index. Japan's NIKKEI index has been up 65% since early 2020, but this has followed years of weakness, and the index has only just regained its previous 1989 record high.

Looking ahead, and in contrast to other major economies, the outlook for the United States remains optimistic. Buoyed by a robust labor market and tangible real wage gains, consumer confidence remains upbeat. As overweight exposure to the technology sector continues to bolster earnings expectations, the enduring strength of the U.S. economy should continue to drive outperformance in markets.