Investor sentiment, Japan’s hot inflation and rainy England

.png)

This week’s charts begin with a barometer measuring bullish and bearish US stock investors. Turning to Europe, we examine how youth unemployment remains stubbornly high in Greece and remarkably low in the Netherlands. We focus two charts on Japan: with the highest inflation in decades, the central bank is expected to start raising interest rates next year. In Britain, we compare the recent heavy rainfall to the historic trend, discovering it’s above average but far from records. Finally, we examine the collapse in palladium prices and the metal’s link to a changing landscape for electric vehicles.

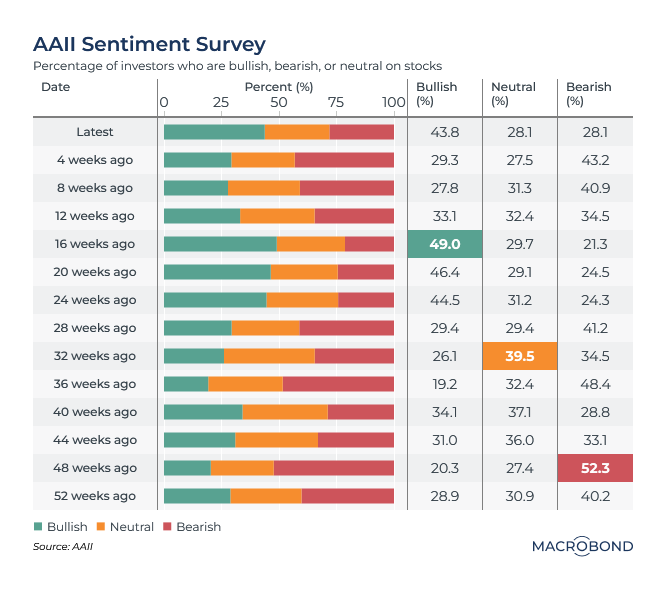

Investors have had mixed feelings about this choppy market

This dashboard tracks US stock-market sentiment using weekly data from the American Association of Individual Investors. (We’ve previously visualised the AAII’s Bull-Bear Spread, another way of thinking about similar data.)

This year is notable because bears, bulls and those in between have all taken turns as “sentiment leaders” – with none of these three categories polling above 50 percent at a given moment. (By contrast, previous years have often had a decided bearish or bullish slant – above 60 percent at times.)

The bulls have perked up lately after November’s S&P 500 rally pushed the US benchmark back toward its mid-summer highs of the year.

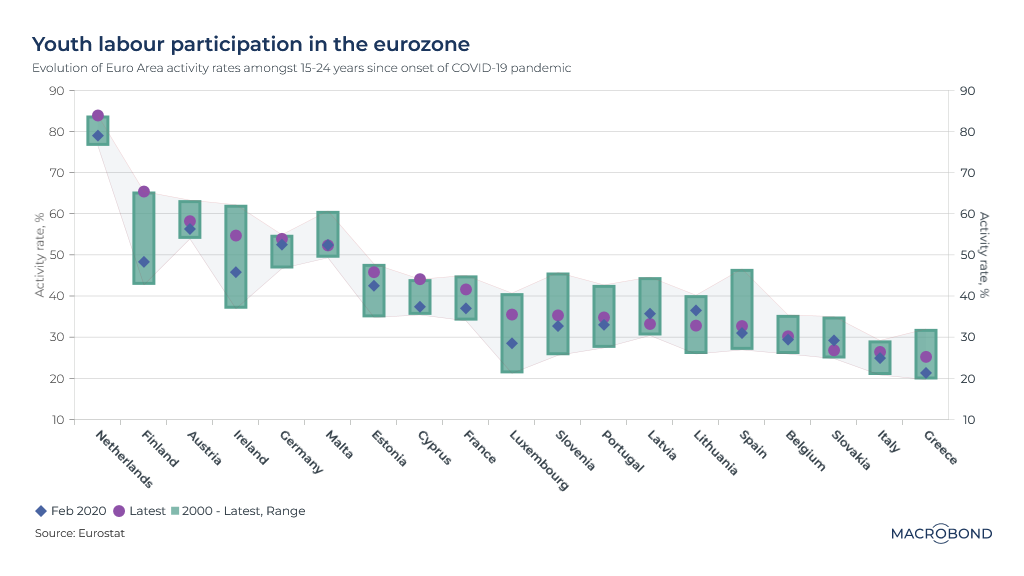

Amid Southern Europe’s rebound, youth unemployment is stubborn

Much of Southern Europe appears to be an economic success story. Greece is said to be in a growth “megacycle”and has regained an investment-grade credit rating. Spain recently revised GDP figures to reflect a stronger-than-expected post-pandemic rally.

However, youth unemployment has been a historic problem in the region, and remains so.

This chart compares “activity rates” for persons aged 15 to 24 in the eurozone, comparing the latest figure to the pre-pandemic level and the high-low range since 2000. (Eurostat defines the activity rate as the number of people in the labour force as a percentage of the total population.)

Greece is doing better than it was pre-pandemic but still trails the rest, and Spain and Italy are in the bottom five.

The Netherlands leads the pack by some distance. Dutch unemployment is generally low of people for all ages, but several observers attribute the youth figure to a system where the minimum wage is set particularly low for people below the age of 23.

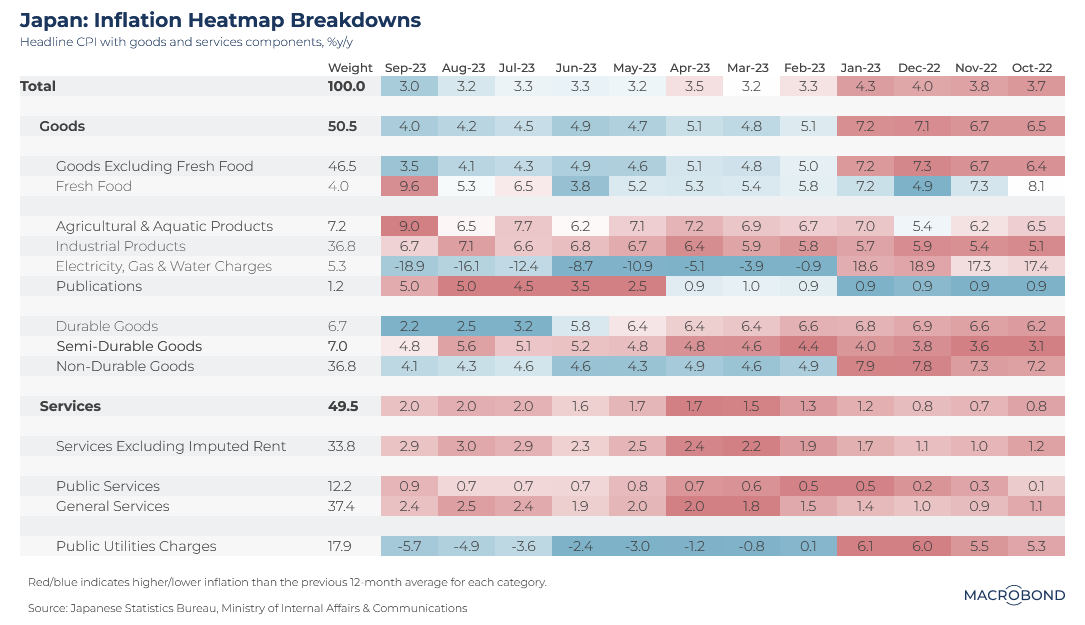

A Japanese inflation heatmap as the BOJ ponders ending negative rates

Japan reports inflation figures on Nov. 24. That’s important because its central bank is looking for a positive wage-price spiral before it abandons the world’s last negative interest-rate policy.

Our colleague Harry Ishihara has written repeatedly about the Bank of Japan’s conception of “good” services inflation, where wage growth snaps the decades-long deflationary funk, and “bad” goods inflation – much of it imported from abroad and exacerbated by the weak yen.

This heatmap breaks down Japan’s consumer price index into goods and services components. Red and blue cells indicate inflation that’s running higher or lower than the 12-month average for each category.

Goods CPI is running hotter than its services equivalent overall, but subcategories differ substantially. Utilities bills are in free fall (thanks to energy subsidies) but food inflation is getting even worse.

Meanwhile, the services component has more red cells as inflation broadly accelerated this year from very low levels. It has plateaued recently at about 2 percent, the BoJ’s long-run target – but an underlying measure (services excluding imputed rent inflation) has approached 3 percent.

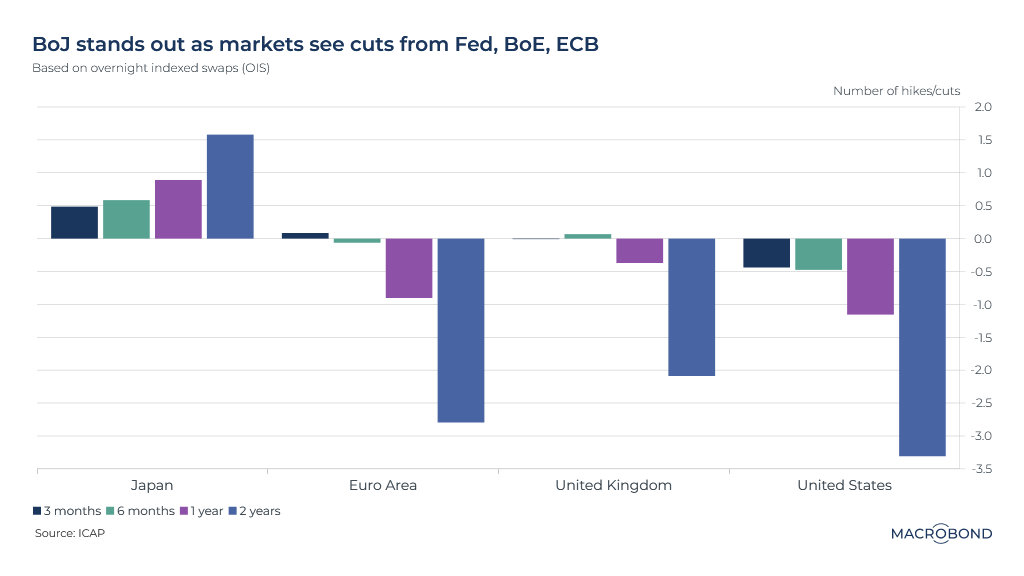

Projecting the Bank of Japan’s coming rate hikes (while others cut)

Note: The following chart uses ICAP data available only for subscribers to Macrobond’s premium data sets.

Japan’s central bank has been an outlier in the global tightening cycle of 2022-23. Markets predict it will be an outlier in 2024-25, as well – this time as the only hawk.

This chart uses data from the swap market to predict the number of rate hikes or cuts coming from different central banks over the next two years. (We’re assuming the increment of each rate move is 25 basis points.)

The markets expect three cuts from the Federal Reserve over the next two years (a rate reduction of 0.75 percent). But traders’ consensus calls for the Bank of Japan to finally execute “lift-off” and execute at least one rate hike over that time period.

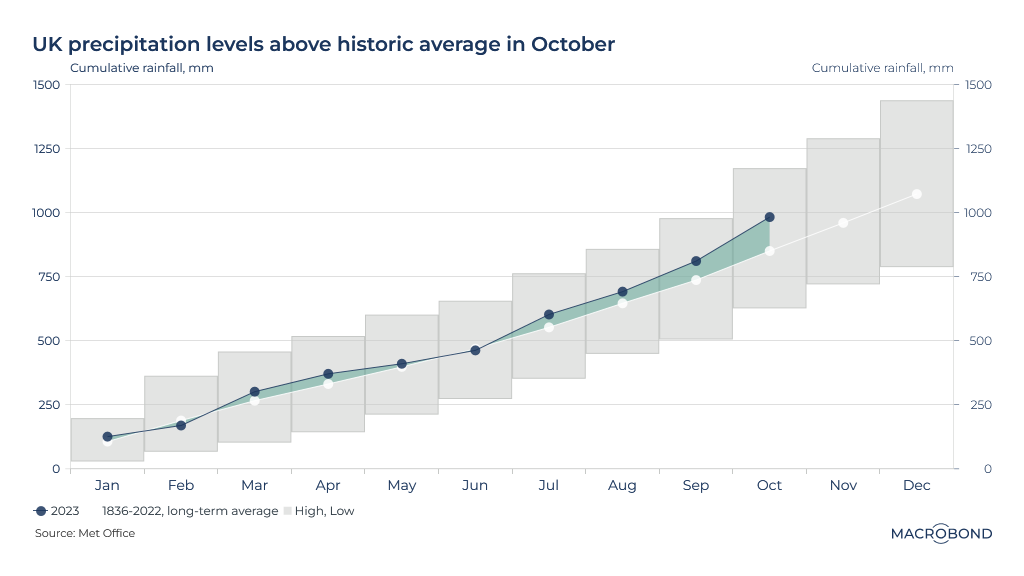

A rainier-than-usual autumn in Britain

Charts of the Week is edited from London, where it has certainly felt as though we’re unfurling our umbrellas more than usual. Data from Britain’s official weather service, the Met Office, confirms the hunch.

This visualisation tracks cumulative rainfall this year (in millimetres) against historic data dating from 1836. With almost two centuries of precedent, we can create a long-term average trajectory over the course of the calendar year. We can also create the historic high-to-low range for every month (the grey boxes).

We can see that 2023 has often indeed been rainier than average – especially since September. But we were never near a trajectory to set historic records. The effect of London’s late spring dry spellis also clearly visible – dragging the cumulative trend line back to the average after the wettest March in 40 years.

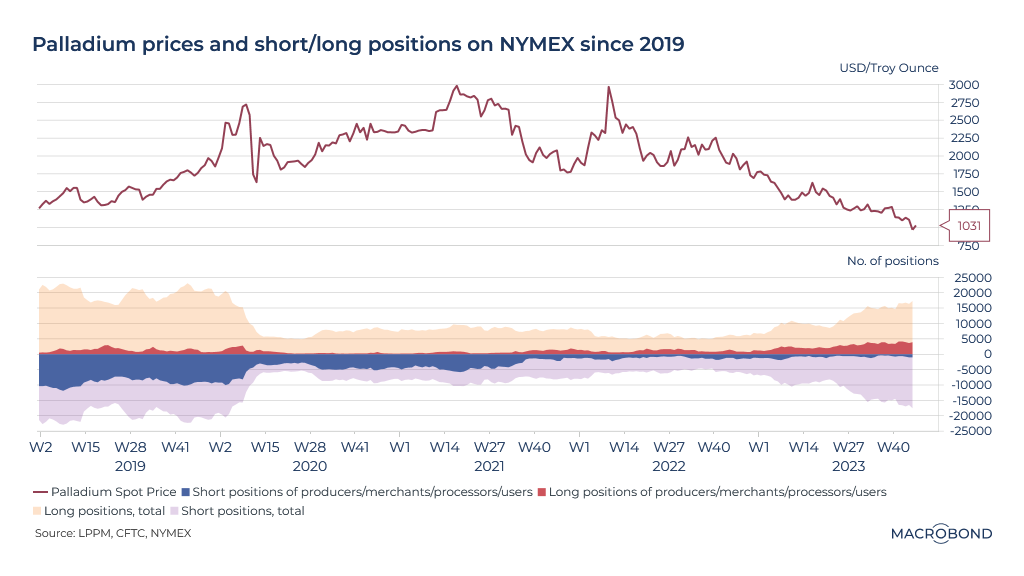

Pollution-fighting palladium slides amid wider adoption of EVs

Palladium prices recently dropped below USD 1,000 per ounce, reaching a five-year low. The main driver: its key use case is gradually becoming obsolete.

The metal is a major component used in catalytic converters, which are used to control emissions in traditional internal combustion engines. But as demand for emission-free electric vehicles picks up, demand for the metal has waned. (When palladium prices approached USD 3,000 earlier this decade, automakers also started switching to platinum.)

The second pane of the chart tracks long and short positions for the metal on NYMEX, breaking them down between industry players like miners and processors and the rest of the market. Amid the recent price action, the palladium industry appears to be betting that prices will rebound (as we highlighted in red).

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)