Lithium in 2023: M&A, takeovers and government intervention

Unless you’ve been living under a rock, you’ll know that Lithium is a key ingredient in lithium-ion batteries, which are used in electric vehicles (EVs), energy storage systems, and other clean energy technologies. Again, it should be quite clear that as the world transitions to a clean energy future, demand for lithium is expected to grow significantly in the coming years.

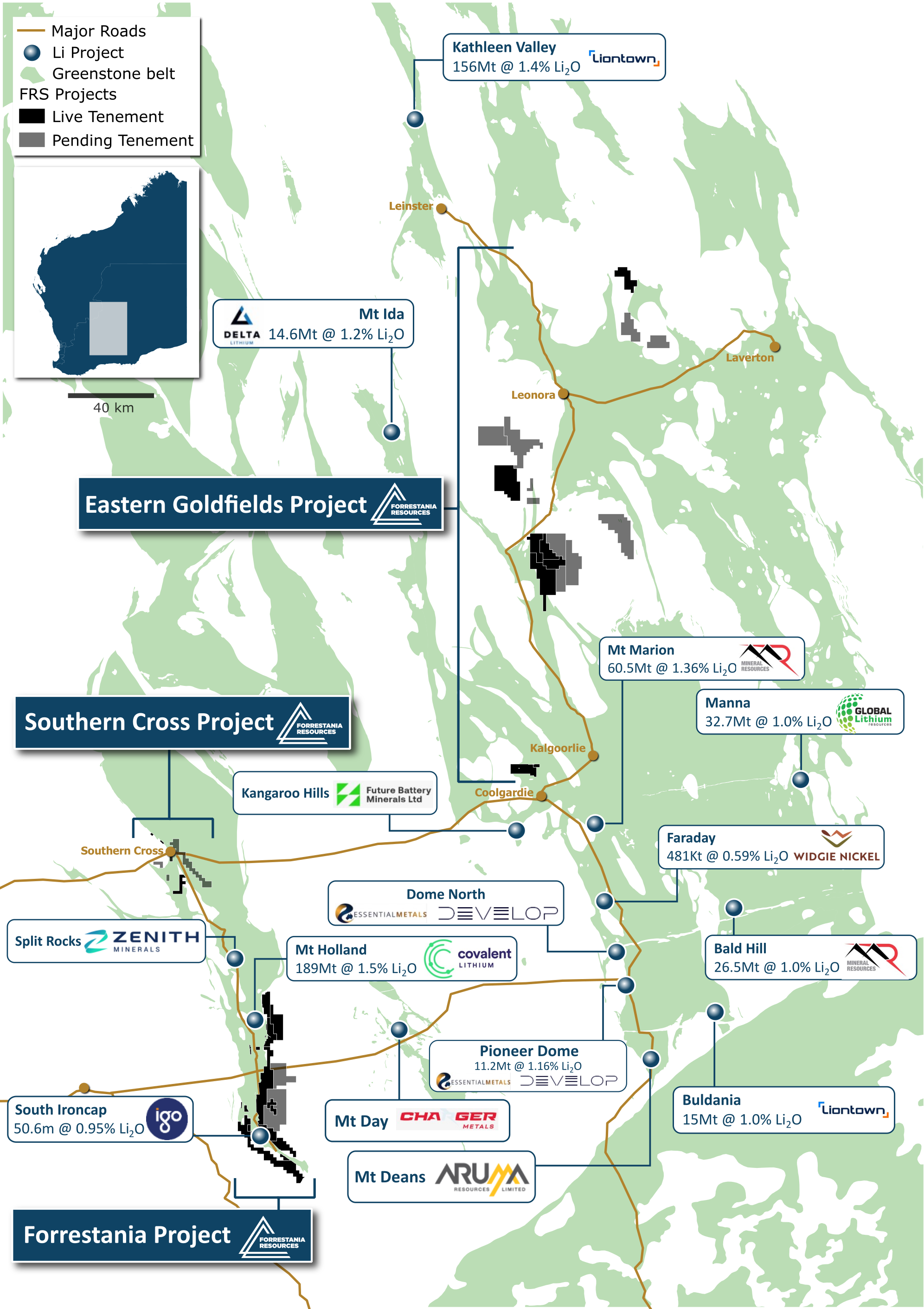

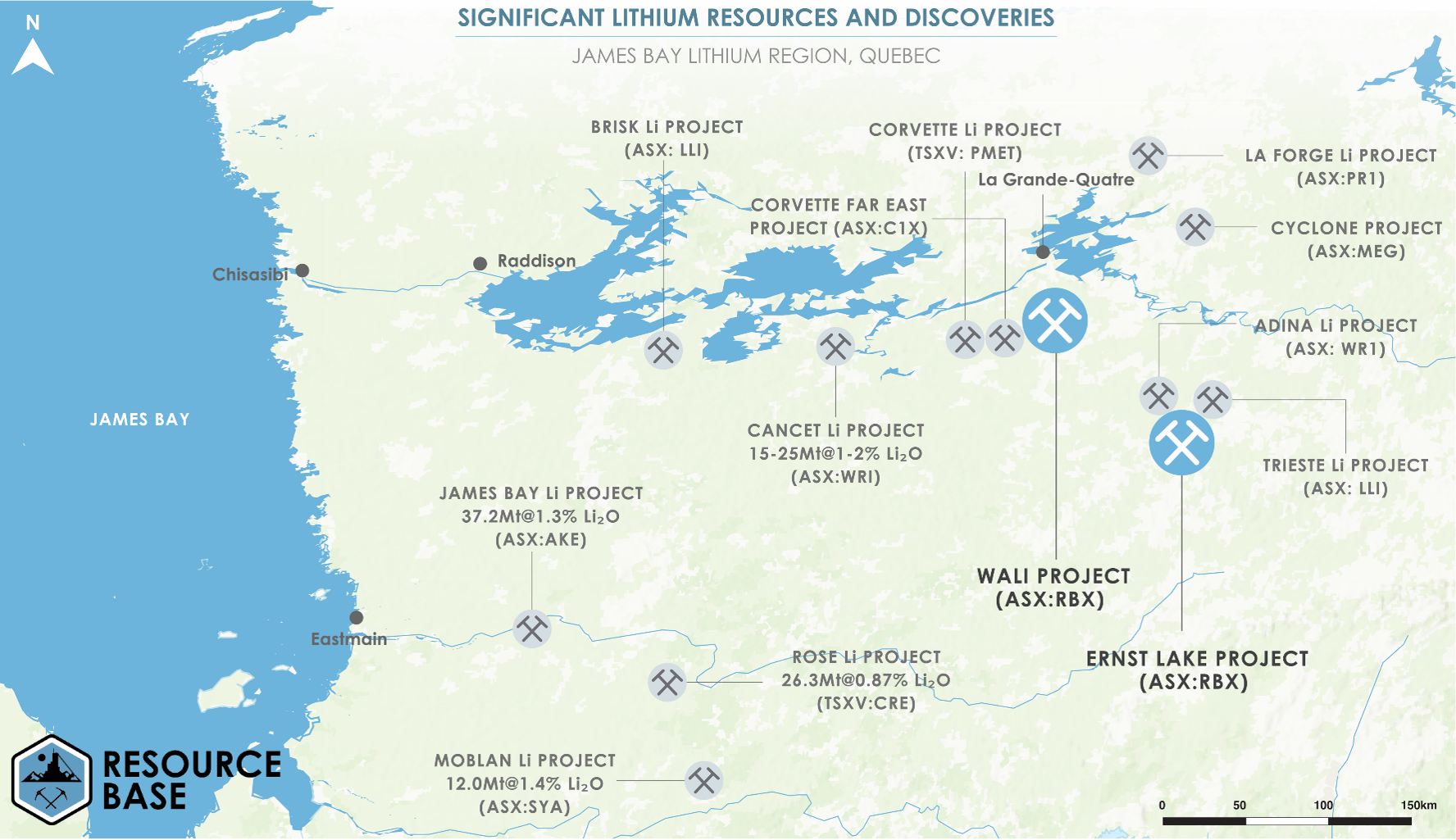

Western Australia and the James Bay region of Quebec are two of the world's premier lithium mining jurisdictions. Both regions are known for their abundant lithium resources, sound ESG practices, and reduced risk for investors. In contrast, 2023 has highlighted the risks of developing nations and lower-quality mining jurisdictions. Many international lithium projects in developing countries have faced challenges this year, due to factors such as political instability, regulatory uncertainty, and environmental concerns. This highlights the importance of mining in a stable and well-regulated jurisdiction.

Western Australia

The lithium industry in Western Australia is booming, with a number of major deals and announcements made in 2023 so far.

One of the biggest stories has been the takeover of Liontown Resources (ASX: LTR) by Albemarle. Albemarle is the world's largest lithium producer, and its $6.6 billion offer for Liontown will give it a major presence in Western Australia. Liontown owns the Kathleen Valley lithium project, which is one of the largest and highest-grade lithium projects in the world.

This is the third offer from Albemarle, increasing each time as the board of Liontown has rejected each prior offer. The board has now supported this bid and expects it to complete. Well, they did, until Gina Rinehart entered the equation. As of today, Gina has accumulated a 16.69% stake in the budding lithium developer. Watch this space!

Another major deal was the merger of Allkem (ASX: AKE) and Livent (NYSE: LTHM). Allkem is a Western Australian lithium producer, while Livent is an American lithium producer. The merged company will be one of the largest in the world, with assets across Western Australia, Canada, South America, and Europe.

In addition to these major deals, there has also been a lot of activity from smaller lithium companies in Western Australia. For example, Develop Global has acquired Essential Metals, and SQM has made a takeover offer for Azure Minerals.

There has been significant investment from majors into higher risk, earlier stage projects. This is evident in Mineral Resources stake in Delta Lithium, with founder Chris Ellison joining the board as Chairman.

The strong interest in lithium companies in Western Australia is a reflection of the state's world-class lithium assets. Western Australia is home to some of the largest and highest-grade lithium deposits in the world. The state also has a strong track record of mining and exploration

James Bay, Quebec

Patriot Battery Metals has made a world-class lithium discovery at its Corvette project in James Bay, Quebec. The Corvette deposit has a resource of 109.2Mt at 1.42% Li2O, making it one of the largest and highest-grade lithium deposits in the world.

Patriot has also received a $109 million investment from Albemarle. This investment will help Patriot to develop the Corvette deposit and bring it into production.

These developments have put a lot of eyes on James Bay as a district-scale lithium opportunity. However, the James Bay region has been affected by wildfires in recent months, which have temporarily halted many exploration programs.

In the meantime, Jody Dahrouge, who is best known for securing the ground in which Patriot made its discovery, has been busily dealing on prospective ground to a number of ASX listed explorers who will be conducting significant fieldwork in the coming months.

The challenges in second-rate mining jurisdictions

The recent spate of government intervention in key lithium-producing jurisdictions is raising concerns among investors and miners.

One of the most high-profile cases is that of AVZ Minerals, which owns one the biggest deposits in the world, the Manono lithium deposit in the Democratic Republic of Congo (DRC). The DRC government revoked AVZ's mining license in March 2023, citing concerns about the company's environmental and social practices.

Another company that has been affected by government intervention is Leo Lithium (ASX: LLL), which owns the world-class Goulamina project in Mali. In August 2023, the Mali government requested the company suspend their direct shipping operations. This led to a trading halt on the ASX, where Leo Lithium is listed. Just one month later the company was suspended again whilst they received correspondence from the Mali government relating to the application of the mining code. Leo is yet to trade again since this halt.

In April 2023, the Chilean government announced plans to nationalize the country's lithium industry. Chile is the world's second-largest producer of lithium, and this move was seen as a major blow to foreign investors.

These are just a few examples of the government intervention that is taking place in the global lithium market. While it is too early to say what the long-term impact of this intervention will be, it is clear that it is creating uncertainty and risk for investors and miners alike.

In my 34 years in funds management, I've never seen global majors invest so aggressively in the junior space. We expect this consolidation to continue. Bonza!

12 stocks mentioned