One down, two to go

In our Livewire piece last week, we highlighted the record Australian gold price. We then highlighted our top three gold picks and why we felt that they were worthy of consideration.

On Monday morning, we arrived at the pleasant news that one of the three stocks – Tietto Minerals Limited (ASX: TIE) - had received a takeover offer. And at a reasonable premium (albeit still below our assessed value).

This is not surprising, as all three companies we highlighted were considerably undervalued. However, we believe that the other two companies have as good or even better prospects for a takeover. And we would not be surprised to see corporate activity for both Regis Resources Limited (ASX: RRL) and De Grey Mining Limited (ASX: DEG).

In the case of RRL, part of the reason we believe that it is a compelling takeover proposition is that it is ‘cheaper to buy than build’ given the current inflationary environment. In our assessment, the array of mines, processing plants and infrastructure at RRL’s Duketon operations and its 30% share of Tropicana, would cost more to replace than its current market capitalisation.

And then there is the ever-increasing approval timelines.

Environmental approvals and native title agreements are now lengthier and more fraught with risk than at any time in history. From discovery to production, a company is looking at a minimum of 7-8 years on even the most optimistic of timelines. This point is too often overlooked or underappreciated. But for a reality check on the impact that this can have on a project, have a look at the pathway ahead of Chalice Mining Limited (ASX: CHN).

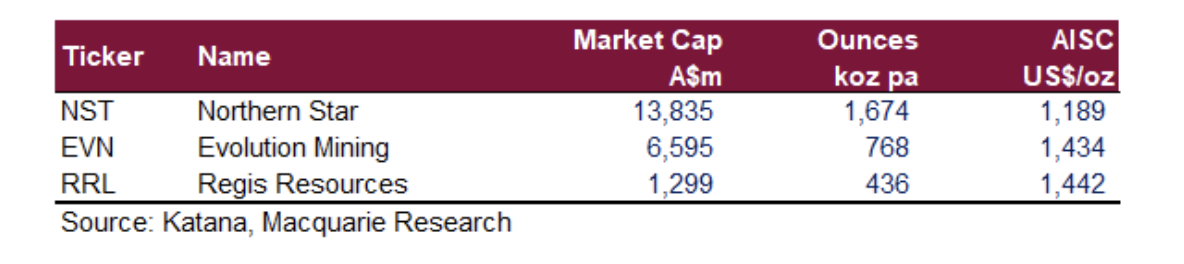

Additionally, gold mining is all about scale. With the recent takeover of Newcrest Mining Limited (ASX: NCM), Regis is now the third largest ASX-listed domestic gold producer behind Northern Star Resources Ltd (ASX: NST) and Evolution Mining Ltd (ASX: EVN).

But even a cursory glance at the table below reveals it is trading at a fraction of the market capitalization of these two companies. For example, EVN has less than double the production but is trading on more than 5 times the valuation. If you are looking globally to buy gold assets, there is no better jurisdiction than Australia. And in Australia, there is no cheaper large-scale producer than RRL.

In the case of DEG, a number of these characteristics also apply. DEG is Australian based, and in fact not just Australian based, but Pilbara based. Few if any mining districts in Australia boast better credentials than the Pilbara region in terms of access to skills, infrastructure, logistics, efficiency and certainty of approvals.

DEG also has scale – global scale. In the recently released Definitive Feasibility Study (DFS), DEG highlighted that the Hemi mine would average 530koz per annum. This would elevate the project into the realm of the top three producers in Australia. At 530koz per annum, it is also the third largest undeveloped gold project globally. And importantly the only one in the top three that is based in Australia.

Impressively this production is based purely on reserves. There is substantial upside to come from drilling out the resource categories for both Hemi and nearby prospects, as well as ongoing exploration. And the all-in sustaining cost (AISC) of <A$1,300 per ounce is amongst the lowest of any new development. For cashed-up global producers, this stock must surely be the standout on all metrics.

3 topics

7 stocks mentioned

.jpg)

.jpg)