Opportunity knocks as the Australian Way clears path to net zero carbon emissions

The Federal Government's plan to reach net zero greenhouse emissions by 2050, dubbed the Australian Way, brings with it a range of opportunities for investors.

The plan is underpinned by existing state and federal policies, supported by new concessional funding, and depends on future cost reductions through technology innovation. At the same time, the government has provided assurances that the country is on track to achieve its 2030 emissions reduction target.

In this article, my colleague Christopher James, infrastructure investment analyst, summarises the roadmap and explores how investors may be able to access the opportunities it presents.

The Australian Way in a nutshell

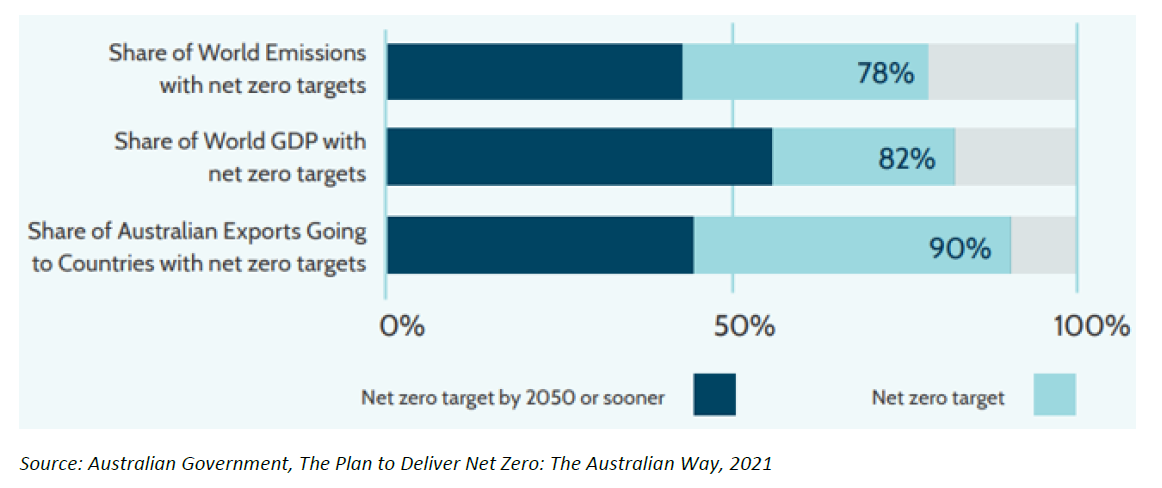

- In October 2021, the government outlined its plan for Australia to target net zero carbon emissions by 2050. It sees Australia join countries representing 82% of the global economy to have net zero targets by 2050-70.

- The plan builds on Australia's 2030 emissions reduction target of 26-28% on 2005 levels (the target itself remains unchanged).

- The plan outlines how an 85% emissions reduction will be achieved, with the residual 15% requiring future technology breakthroughs to deliver economic and practical solutions.

- The plan will involve an estimated investment of at least $100 billion. Execution is expected to deliver an $2000 per capita increase in 2050 national income and create 62,000 jobs.

- The 2050 target will not be formally legislated but will rely on governments, consumers and companies collectively driving emission reductions.

- Along with the global decarbonisation thematic, the plan represents a huge, multi-decade global infrastructure investment opportunity.

What is net zero?

Net zero refers to a position in which annual greenhouse gas emissions released into the environment are balanced by those taken out.

It does not necessarily mean elimination of emissions completely: rather, as more emissions are reduced, less sequestration is required to achieve net zero.

Decarbonisation is the process of reducing the amount of emissions into the atmosphere.

Global momentum is building

The 2015 Paris Agreement on climate change was historic in establishing awareness and momentum for environmental change, with signatories aiming to limit global emissions to net zero in the second half of the century.

The ultimate goal of such initiatives is to limit global warming to well below 2 degrees Celsius (preferably 1.5) compared to pre-industrial levels.

It is a mammoth task, to say the least, and needs support from governments and the populace to balance the often-conflicting goals of environmental sustainability while still fostering population growth, economic advancement and social ideals.

As a result, decarbonisation is now a global phenomenon, with most governments around the world moving to net zero targets to limit the impacts of climate change.

Countries representing 82% of the global economy now have net zero targets by 2050-70, up from 10% just two years ago. One hundred and thirty three of the 142 countries with net zero targets are aiming for 2050 or sooner — the US, EU, UK, and Japan have all committed to net zero emissions by 2050, and China has committed to net zero by 2060.

Australia's existing commitment

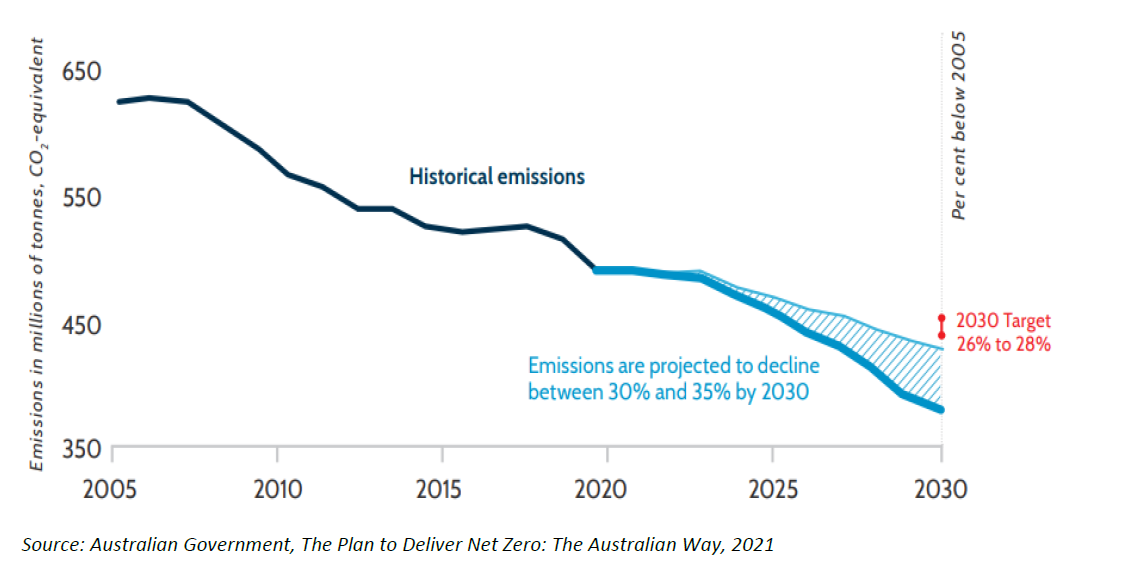

According to the Federal Government’s projections, Australia is on track to reduce emissions by up to 35% by 2030, above the existing target of 26-28%.

This improved trajectory is due to anticipated faster reductions in emissions from electricity generation, which will be almost entirely driven by state-based policies.

Despite the reductions achieved to date and the trajectory outlined, the government has not revised the 2030 target in the current 2050 plan due to heavy resistance from members of the National Party. However, achievement or outperformance of the 2030 target will assist in delivering the goal of net zero emissions by 2050.

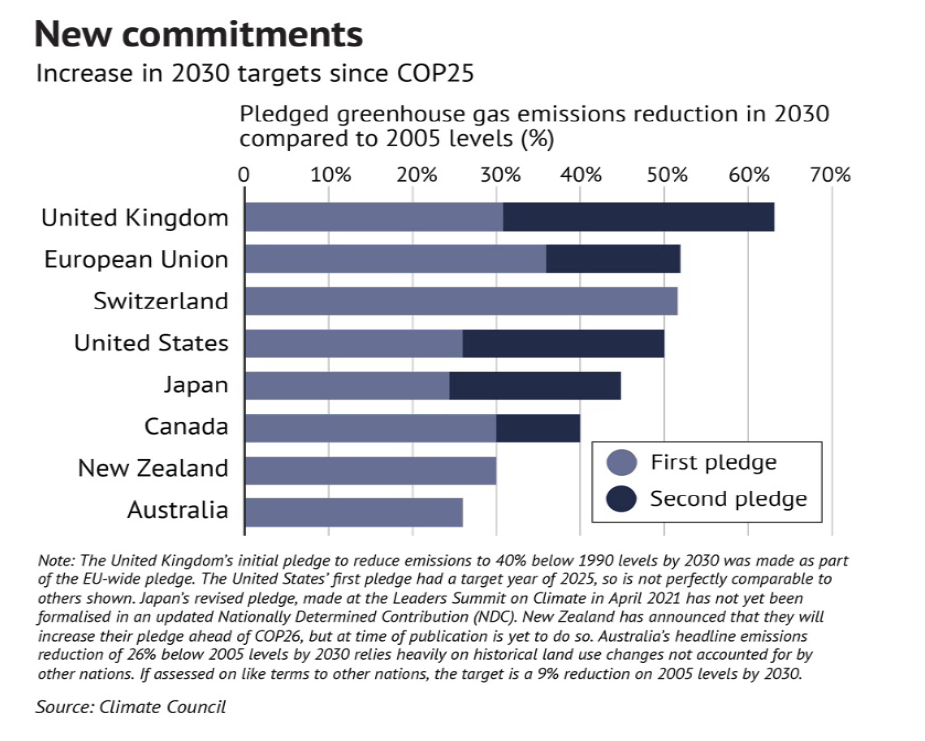

Despite the above commitments and achievements, the Climate Transparency Report ranks Australia among the worst nations for climate action relative to other OECD countries.(1)

Several major developed countries have pledged much deeper annual cuts to reach 50% by 2030, as shown in the table below.

This disappointing showing on the global stage finally saw the government address pushback and release a 2050 plan providing a more detailed roadmap to net zero. But is it enough?

Australia’s plan for 2050

In October 2021, ahead of the UN Climate Change Conference of the Parties (COP26), the Federal Government finally committed to a long-term emissions reduction plan to deliver net zero emissions by 2050. The Prime Minister, Scott Morrison, is promoting the plan as the Australian Way.

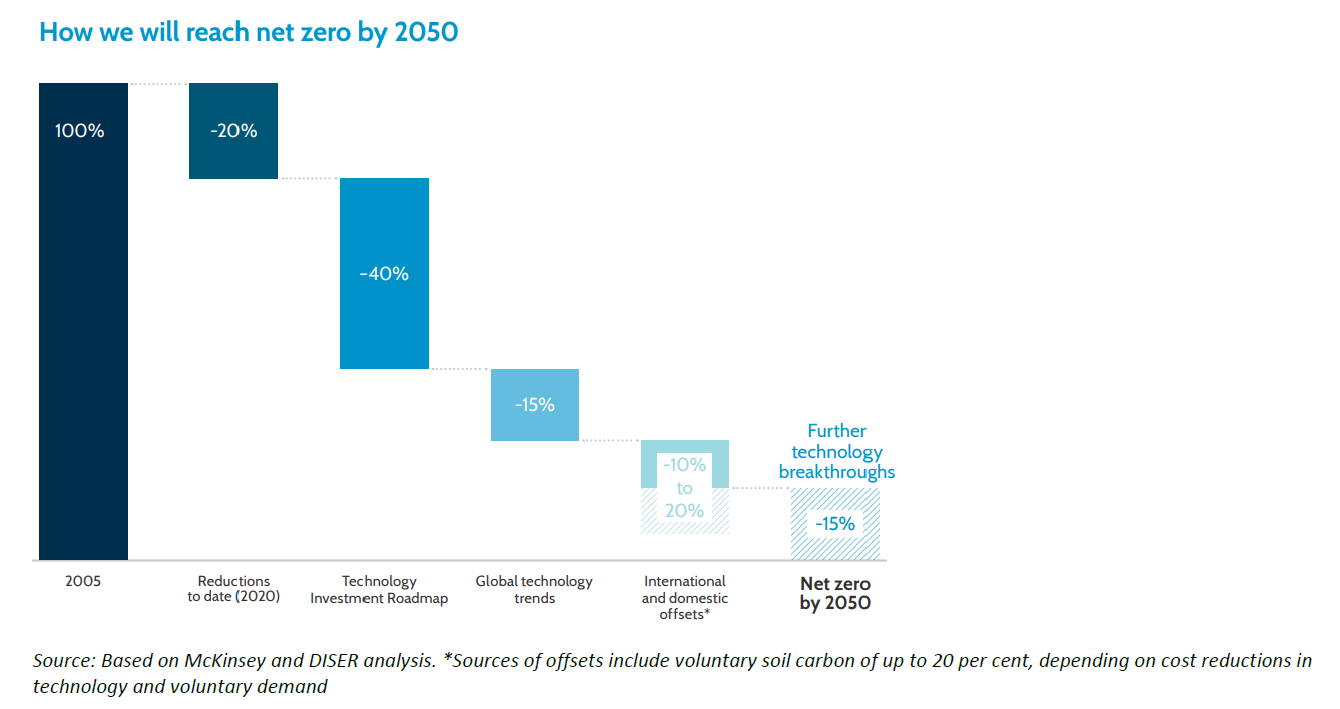

Having already reduced emissions by 20% relative to 2005 levels, the plan builds on existing state and federal policies, concessional funding, offsets and technology innovation to guide Australia to net zero.

The plan outlines how Australia will achieve 85% of its emissions reductions, while it is believed the residual 15% requires future technology breakthroughs to be achieved. Australia is not alone in relying on technology advancement in order to achieve net zero goals.

Like the 2030 target, the plan will not be legislated, thus relying on the Commonwealth, states, territories, consumers and companies to drive emission reductions.

Australia’s targeted emission reductions by category to 2050 are reflected in the chart below.

Already achieved

The starting point for the roadmap to net zero is that Australia has already reduced emissions by 20% on 2005 levels. Most of the reductions have come from changes in the land sector, with the remainder largely from the rollout of renewable energy in the power sector.

Technology investment roadmap

Under the plan, the bulk of the emission reductions (40%) will be delivered through the technology investment roadmap, (TIR), which is itself a collation of concessional funding, research and innovation projects.

The TIR initiative, which was conceived in September 2020, provides a framework that prioritises investment in new and emerging technologies, aiming to accelerate development and commercialise low emission solutions.

The TIR includes a $1.9 billion investment package to be deployed over the next decade towards funding future technologies to lower emissions. While priorities will be continuously reviewed, the initial focus and goals will be directed towards:

-

Clean hydrogen, reducing production costs to under $2/kg from current costs of $4.60/kg

-

Energy storage, providing firming for intermittent generation at under $100/MWh from current costs of $150/MWh

-

Low-emissions steel, reducing production costs to under $700/tonne from current costs of $900/tonne

-

Low-emissions aluminium, reducing production costs to under $2,200/tonne from current costs of $2,700/tonne

-

Carbon capture and storage, providing C02 compression, hub transport and storage for under $20/tonne of C02

-

Soil carbon sequestration, reducing soil organic carbon measurement to under $3/hectare per year from the current costs of $30/hectare per year.

The plan also added ultra-low cost solar to its list of priorities, with the goal to generate solar electricity at $15/MWh, around a third of today’s cost.

For these ambitious goals to be achieved, the plan relies on a combination of further supply chain development, large-scale deployment and installation of more renewable generation capacity and further technology innovation to facilitate the reductions in the costs required to make these feasible.

Global technology trends

The plan anticipates that current available technology will deliver up to 15% in emission reductions. This refers to initiatives already viable and underway, such as the electrification of transport, the staged retirement of coal generation, renewable/low emissions generation installations and development of supply chains.

Abatement

A further 10-20% in reductions will be met through abatement from international and domestic offsets. Abatements are emissions reduction units generated by real projects/initiatives which promote sequestration — that is, the prevention, reduction, removal or capture of emissions from the atmosphere.

Common activities include, but are not limited to, renewable generation, energy efficiency, emissions capture, reforestation and other vegetation management practices. A surplus of units creates credits, which can be traded on a domestic and international scale.

Abatements have a legitimate place in reducing greenhouse gas emissions, so long as the underlying emissions reductions are genuine, as they have the same effect on global climate outcomes as domestic reductions.

Voluntary abatement action under the plan is expected to cost up to $24/t CO2-e basis, while international offsets are available to Australia at the global price of $40/t C02-e.

Future technology breakthroughs

The plan recognises the need for real investment in low emissions technology, at the same time highlighting that there are currently significant cost differentials and limitations which hinders the ability for such technologies today to fully bridge the gap to net zero in a socially acceptable way.

Future technology breakthroughs will therefore be vital in bridging the cost barrier to a point of parity with higher emitting alternatives, to provide both economic and practical solutions.

The plan anticipates that new and emerging technologies will reduce emissions by a further 15% through to 2050. In addition to the six priority technologies outlined above within the TIR, the other high potential emerging technologies under consideration are:

- Livestock: technological solutions for reducing methane emissions from livestock through feed supplements (e.g. red algae, chemical inhibitors and tannins), alternative forage feeds and genetic selection and breeding for low methane traits

- Low-emission cement: energy storage and carbon capture use and storage deployed along various points of the value chain.

To facilitate the plan, significant investment is required.

The Federal Government will provide $20 billion for investments in low emissions technology, which is expected to unlock a total of $80 billion in private and public investment.

The plan includes five-yearly reviews that will enable the evaluation of progress and adaption for any technology advancements.

Huge, multi-decade opportunity

Decarbonisation must happen, and the goal of net zero is just not achievable without the right forms of infrastructure investment across both the energy and transport sectors. This represents a significant opportunity for infrastructure investors, such as 4D, who want to be part of the climate solution.

In Australia, numerous infrastructure owners and operators are committed to climate change action, though building and operating sustainable infrastructure.

Transurban, Sydney Airport, APA and even Aurizon (coal-freight operator) all have net zero emission ambitions by 2050 or earlier, on which we can capitalise.

Moving beyond the domestic listed market, key global listed infrastructure operators are also looking to capitalise on Australia’s net zero plan.

These include Iberdrola of Spain, which continues to build its renewables footprint in the country; Italy’s Enel through its solar generation portfolio; Canada’s ATCO which operates one of the most efficient and environmentally friendly gas-powered generation facilities; and Neoen of France, which was responsible for the world’s first big battery (150 MW/193.5 MWh) in Hornsdale, South Australia.

Invest in net-zero opportunities

4D manages a diversified portfolio of stocks across the utility and transport sectors.

We prioritise both countries and companies with strong management teams, defined strategic environmental goals that integrate with an ESG policy and strong balance sheets to support much-needed investment, and those that are best in class within their sector in building a sustainable infrastructure footprint.

This applies whether it be pure play renewable operators, toll roads supporting electric vehicles and a reduction in congestion, or airports that are themselves targeting net zero.

4D Infrastructure is a Bennelong Funds Management boutique that invests in listed infrastructure companies across all four corners of the globe. For more insights on global infrastructure, visit 4D’s website.

Source:

1. The Climate Transparency Report 2021

5 topics

4 stocks mentioned

1 fund mentioned

1 contributor mentioned