Rebounding populations contribute to higher real house prices and rents

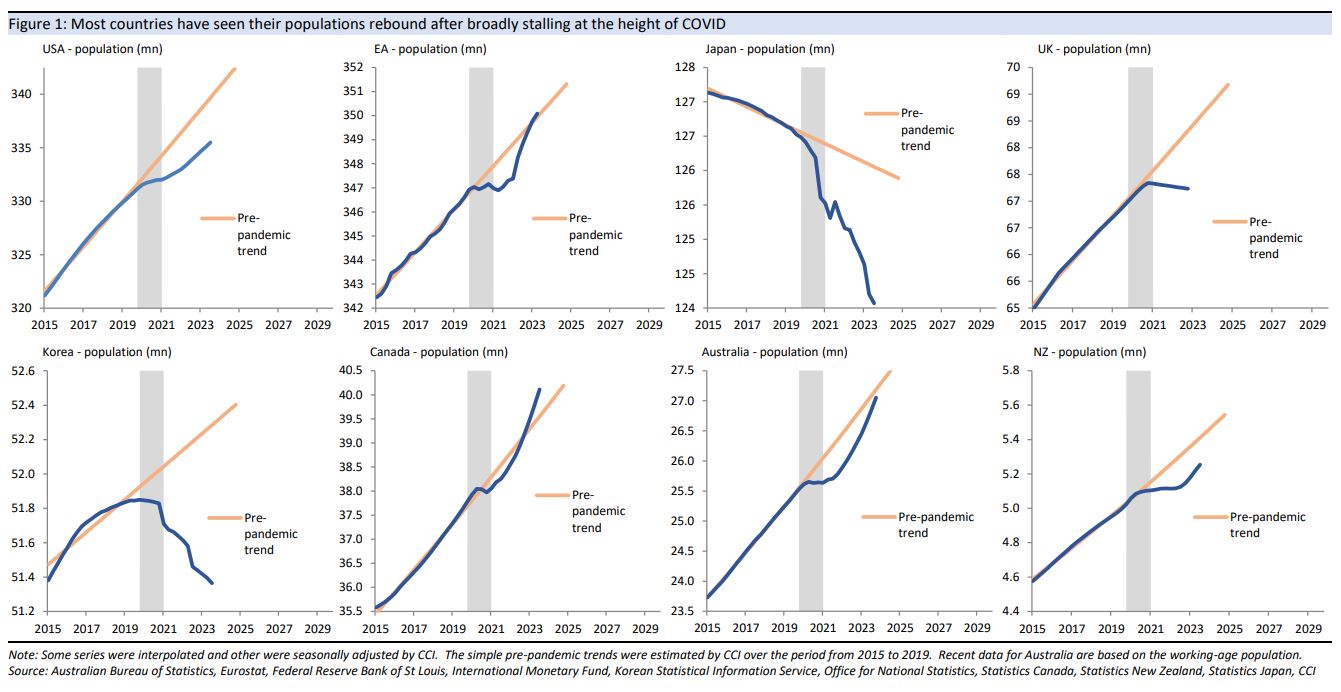

Australia's population has rebounded strongly and is almost back at its pre-pandemic trend, placing Australia near the top of the global range, where most countries have seen their populations recover from COVID. Rebounding populations look to have contributed to higher real house prices and rents this year across the advanced economies, along with well-off households shrugging off higher interest rates and some households expecting central banks to soon cut rates.

As we have previously noted, the surge in Australia’s population should soon see the level of the population return to its pre-COVID trend.

This strength in population has supported economic growth, simultaneously boosted supply and demand in the labour market, while also placing some pressure on the housing market.

Working out where Australia stands relative to large advanced economies, as well as New Zealand, most countries have seen their populations rebound over the past couple of years after broadly stalling when migration flows ground to a halt at the height of the pandemic. However, Australia’s strong recovery places it near the top of the global range.

- Canada is leading the pack, where its population is now well above its pre-COVID trend, which raises the question of whether Australia’s population could retain its significant momentum heading into next year.

- The euro area is back at its pre-COVID trend, although this is almost wholly due to refugees fleeing the Russian invasion of Ukraine and ending up in Germany.

- The US and New Zealand are still catching up, where New Zealand is a long way behind its pre-pandemic trend.

- The UK, Japan and Korea are at the other end of the spectrum, with large and growing gaps with their pre-pandemic trends. The UK’s population kept growing at the worst point of COVID, but has edged lower over the past couple of years. Meanwhile, Japan and Korea’s populations are declining at relatively rapid rates.

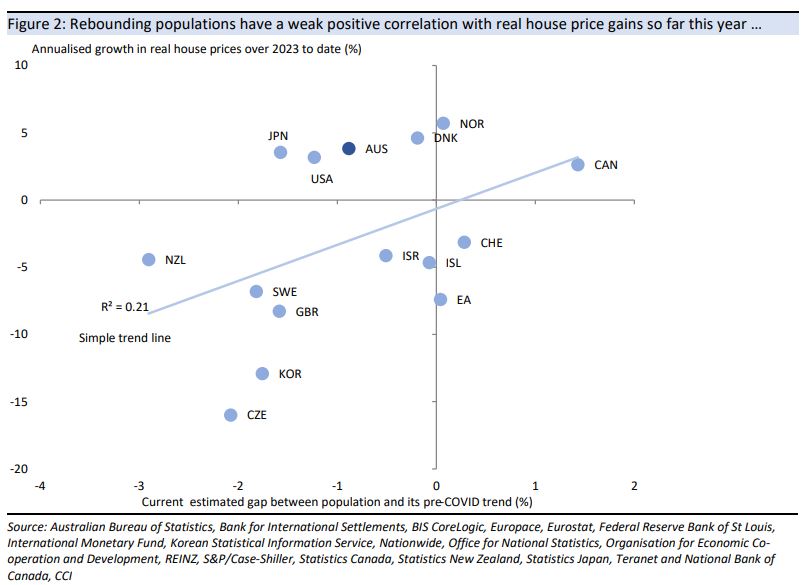

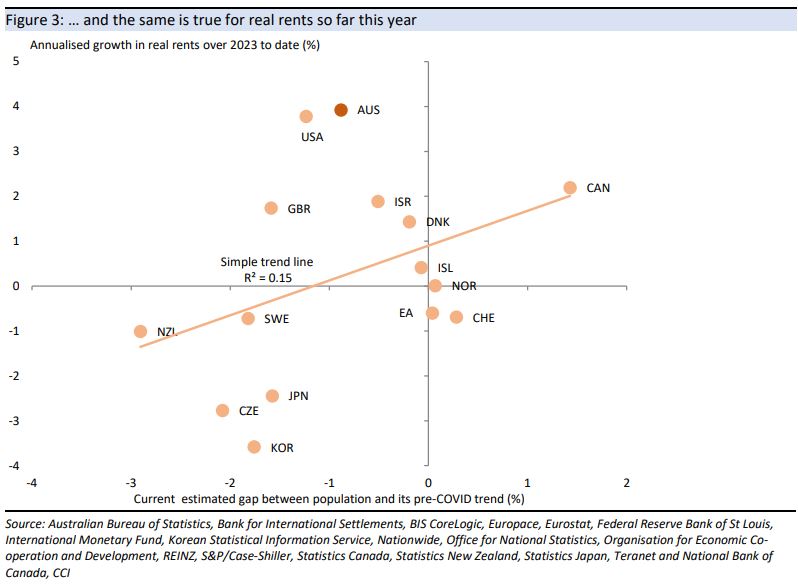

Comparing population growth with the performance of housing markets is difficult because of publication delays, where most countries publish population data with a lag, contrasting with relatively timely statistics on house prices and rents.

That said, some sense of the relationship between population growth and both prices and rents is provided by the charts below, which compare the latest estimated gaps between the level of the population and the pre-COVID trend for nearly all advanced economies with annualised growth in real house prices and rents so far this year (house prices and rents are expressed in real terms to compare across countries with different inflation rates).

The charts show a weak positive relationship in both cases, such that countries that have made more progress in returning to their pre-COVID population trends have tended to see growth in real house prices and rents.

This suggests that the recent recovery in supply-constrained housing markets across most advanced economies is partly due to the rebound in populations post COVID, along with high interest rates failing to restrain well-off households, as well as other households believing that high interest rates will not last and central banks will soon start cutting rates.

5 topics