Rise of the Machines

Key Points:

• Productivity growth in advanced economies has been lacklustre since the Financial Crisis, which, alongside ageing populations has led to lower potential economic growth.

• Much of the technological innovation in computing over this period has been at best, largely consumer facing, or at worst, a waste of people’s time.

• Rapid innovation in generative artificial intelligence in recent years stands to challenge this trend, with significant business facing applications.

• The optimistic takeaway is that the world could be on the cusp of a goldilocks period of productivity growth, similar to the period following the personal computer revolution.

In this month’s Market Insight, we review recent developments in generative artificial intelligence and the potential impact on global economies and markets. From our perspective, the practical applications of this technology for businesses are greater than anything released since the original iPhone.

The pace of productivity enhancing technological development has been pretty disappointing over the past fifteen years. Video conferencing has got a lot better, workplace CRM, document management and chat has also improved. Much of this sort of improvement has enabled people to communicate with colleagues better, but doesn’t necessarily generate more output. Many also find more communication distracting. Deep thinking work is difficult when constantly distracted by chat pop-ups and video calls. The cloud is useful, but for most people it’s mainly used as an external hard drive that you don’t have to plug in. Microsoft Office hasn’t changed much over the period outside of prettier user interfaces. The more widespread ability to code and / or visualise data is useful, but most people can’t do it, so the overall use case is limited. Nothing really stands out as truly ground-breaking.

Technology and Productivity

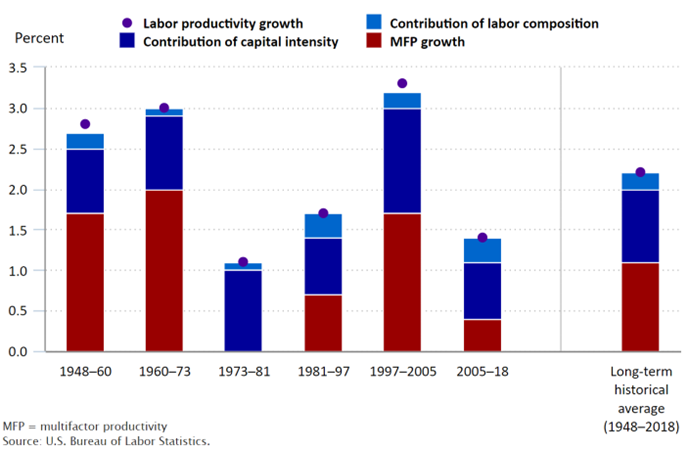

Productivity is the magic that makes economies, and the people who live in them, rich. There are two ways to generate productivity. Pair people with more machines (or in economist talk, capital) and make people better at using the machines they already have. In a sweeping generalisation: In poor countries, adding lots of machines is the way to get richer (capital deepening). In rich countries, where there are already lots of machines, the way to get richer is for people to get more out of the people using the machines (multifactor productivity). The charts below decompose labour productivity into these component parts for the USA and Australia. There are two observations we would highlight from this data. First, overall labour productivity growth has been weak since the Financial Crisis, this has been due to weak multifactor productivity. Secondly, labour productivity growth was quite strong between the late 1980s and the mid-2000s, largely for the opposite reason. The likely, though by no means provable, conclusions from these observations are that:

1. Strong labour productivity growth early in the period was driven by the ubiquitous adoption of personal computers across workplaces in the 1990s. Basically people got better at work because they integrated computers into their workflows; and

2. Low multifactor productivity growth since the Financial Crisis may be a reflection of misdirected technological innovation. Tech companies invented Facebook, which people use while pretending to work, rather than a better MS Excel, which would allow people to do better actual work.

Decomposition of Labour Productivity, USA

There are certainly other drivers of the variation in productivity growth between these two periods[1] , however, since this is an Insight about technology, we will focus on that.

Technological Marvels

Most of our readers will have by now heard about ChatGPT. Many will have played with it, maybe using it to draft a thoughtful card to their husband or wife for Valentine’s Day. Some will be actively using it to improve their performance at work, perhaps without their supervisor’s knowledge, lest they reveal how easily parts of their day-to-day tasks could be automated. Readers may have also sampled programs which generate images from text prompts – see below for an example (if IKEA sold Porsches).

Source: @emollick

The supposed intelligence of these applications and their novelty surprised many, appearing as though technology had made a great leap forward in a short amount of time. However, diving deeper into the outputs of ChatGPT and computer generated images did highlight significant problems. In V1 of publically available ChatGPT, the responses to the prompts often sounded correct, but were often very wrong, particuarly with complicated topics. Sources were sometimes made up, and without doing the actual research yourself, it would not be possible to separate truth from fiction.

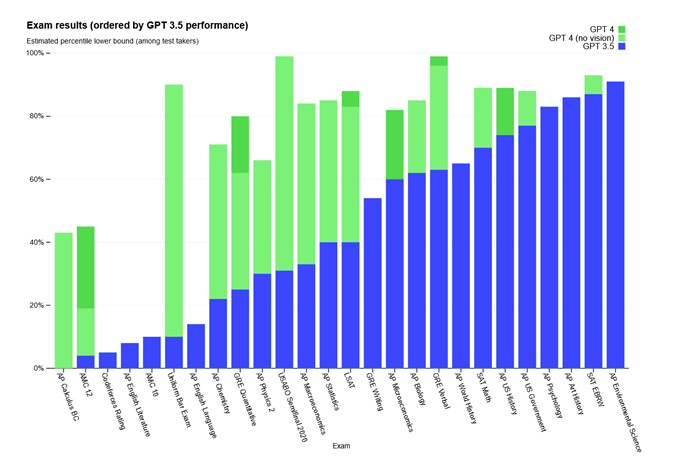

However, progress isn’t binary. This month, an updated version of GPT (GPT 4) was released, showing significant improvements over the currently freely available GPT 3. The figure below shows the test scores of the two versions of the program across a variety of exams. GPT 4 now passes the bar exam and many advanced university level subjects.

Since its release, we have also seen GPT 4 create a webpage based on a hand drafted sketch, create example recpies based on a photo of a refrigerator, explain why a joke image is funny and automate online dating swipes, responses and date scheduling. GPT 4, in combination with text based image generators and AI based video and audio synthesisers, has even created short films based solely on text prompts.

The practical application of this technology, even as it is available now, is meaningful. A teacher could prompt an AI to generate ideas for lesson plans. Doctors could seek AI input into diagnosis, prompting with medical history, test results and current symptoms. Lawyers could ask AI to summarise all historical precedent related to a specific topic. Developers can use AI to help write code – this is a big one and the improvements here will be enormous. Marketers can ask AI to help generate potential campaign images and videos. There are real practical applications from this technology now and we imagine the workplace enhancements in one, three or ten years time will be manifestly greater still.

Early studies suggest that pairing people with AI can generate a substantial improvement in productivity. One study of programmers found a 55.8% improvement in productivity when using GitHub Copilot, a generative AI simpler than ChatGPT[2] . Another found a 37% improvement in the pace of writing strategy documents, memos and policies in white collar professionals when using ChatGPT[3] .

Investment Implications

From an investment perspective, the key considerations are the impact this technology and future variations will have on economic growth and which sectors and companies will be the winners and losers in the years ahead.

Assuming that generative AI leads to a boom in productivity growth similar to that seen post the adoption of personal computers, we would expect there to be a direct translation into higher overall economic growth. While many have noted the risk of widescale employment losses due to jobs being fully replaced with AI, we think a more likely outcome is workers using AI to be better at the jobs they already have. Some jobs may be made redundant, but AI will likely create new jobs in other areas. This is quite different to the decimation of the manufacturing sector in many rich economies in the 1990s following the de-regulation of global trade barriers and the emergence of China as the world’s factory. There are unlikely to be many jobs where AI can act as a perfect substitute.

Stronger economic growth driven by productivity should lead to better investment returns, through higher corporate earnings. However, in a productivity boom the neutral level of real interest rates may also rise. The net effect of the two themes will likely differ by asset class and market. More detail on this front will be forthcoming in this year’s Strategic Asset Allocation Review, where we will feature an AI driven productivity boom as an upside capital market assumption scenario.

In terms of the relative winners and losers from this technology, the answer may not be as simple as “buy technology companies”. The provision of AI is likely to be highly competitive. For example, there are already a number of text to image generators, each with their own quirks, but no one seems to be a clear standout or have much pricing power. Generative AI is trained using publicly available data and the barrier to entry is still relatively low – everyone has access to the internet. Throw enough processing power at the task and a new model can be trained. This is quite unlike the business model of much of the existing big tech companies, where the goal is to harvest as much private personal data as possible from an individual user. As new entrants do not have access to that private data, they cannot compete.

Also, at least currently, most of the output from these models looks like it will be available via APIs or other open infrastructure. This is a departure from the walled gardens built by existing big technology companies. Again, this may change, but in a largely homogenous product, it is hard to force users to avoid other options. Finally, at least until one model or solution is established as a dominant player, there are unlikely to be any significant network effects flowing to any one provider. This also may never be the case. AI subscriptions could be closer to choosing a mix between YouTube, HBO, Netflix, Disney, Paramount+, Binge and Stan than making a one-off, almost permanent, decision between an Apple or Android phone.

As a result of the above, much of the benefit may flow to the users of the technology, rather than those who sell it, at least initially. Given the productivity boost is more likely to flow towards knowledge workers, we expect companies in the professional services, education, finance and software development sectors will see the earliest benefits.

For the first time in a long time, the future of technology appears bright. We think there is a reasonable chance that the nature of knowledge work will change for the better over the next decade, improving the lives of all.

[1] For example, the emergence of China as amanufacturing sector, a commodity price super-cycle, the financialisaton of theeconomy, a stagnant microeconomic reform agenda

[2] (VIEW LINK)

[3] (VIEW LINK)

2 topics