S&P 500 higher, Deutsche Bank credit default swaps spike, ASX 200 futures flat

ASX 200 futures are trading 3 points lower, down -0.04% as of 8:20 am AEDT.

The S&P 500 books a second consecutive week of gains, European stocks under pressure as Deutsche Bank default insurance jumps to its highest level since 2019, the US 2-year Treasury yield falls to its lowest level since September 2022, Goldman Sachs remains positive on oil and why Commercial Real Estate could be the banking crisis' next pain point.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- A relatively uneventful session last Friday but the S&P 500 closed the week 1.4% higher

- US 2-year Treasury yield continues to ease, down 6 bps to 3.78% or the lowest level since September 2022

- German DAX Index falls -1.7% on concerns about widening CDS spreads in Europe

- Bullish focus points: No additional US bank failures, no increment stress on bank deposits, Fed pivot expectations gaining more traction with 100 bp of rate cuts priced into year-end, two-thirds of Fed's QT reversed and early Q1 results beating consensus expectations

- Bearish focus points: CDS spiking in Europe, mixed messaging from US officials about uninsured deposit protection, central banks continue to tightening despite bank turmoil, Commercial Real Estate flagged as next shoe to drop

- Markets pricing in rate cuts, which could be negative for stocks (Bloomberg)

- Bond traders go all-in on US recession bets that defy Fed view (Bloomberg)

- Strategists highlight flight-to-safety shift in markets (Bloomberg)

- Traders betting on further gold rally after touching US$2,000 last week (FT)

STOCKS

Activision Blizzard (+5.9%) shares rallied after EU regulators dropped some of the concerns with the potential takeover by Microsoft

Apple (+0.8%) CEO Cook highlights symbiotic relationship with China

- "We could not be more excited. Apple and China ... grew together, and so this has been a symbiotic kind of relationship ... Innovation is developing rapidly in China, and I believe it will further accelerate.” - CEO Tim Cook

Deutsche Bank (-3.1%) Credit Default Swaps surged to the highest point since they were introduced in 2019

BANKING CRISIS

- Deutsche Bank shares down more than 20% this month as CDS jump more than 300 bps in two days (CNBC)

- Banks are still drawing on the Fed for US$164bn of emergency cash (Bloomberg)

- Fed data shows nearly US$100bn in deposits pulled in last week (CNBC)

- US mulls more support for banks while giving First Republic more time (Bloomberg)

- Biden says FDIC could guarantee deposits above $250,000 if other banks fail (Reuters)

ECONOMY

- Japan core inflation eases off 41-year high (Reuters)

- UK retail sales jump as consumer confidence improves (Bloomberg)

- UK consumer sentiment hits one-year high (Reuters)

- US durable goods orders decline but business equipment orders rise (Bloomberg)

- US core PCE, the Fed's preferred inflation measure, expected to remain elevated in February (Bloomberg)

Deeper Dive

Commercial Real Estate: The Next Shoe to Drop?

- "We expect about 21% of commercial mortgage backed securities outstanding office loans to default eventually, with a loss severity assumption of 41% and forward cumulative losses of 8.6%... Applying the 8.6% loss rate to office exposure, it would imply about $38 billion in losses for the banking sector," said JPMorgan, reports Markets Insider.

- "There is $1.5 trillion in commercial real estate debt maturing in the next 3 years. The bulk of this debt was financed when base interest rates were near zero. This debt needs to be refinanced in an environment where rates are higher, values are lower, & in a market with less liquidity," Scott Reachler, CEO of real estate company RXR Realty.

- Between 4Q19 and 4Q22, national US vacancy rates increased ~5% while rents fell ~2.3%. Places like San Francisco recorded the highest increase in vacancy rates (13.5%) and the biggest decline in rents

Goldman Sachs on Oil

- "Through the recent bout of macro volatility, oil has remained a stark underperformer as a combination of broad portfolio selling, less fundamental protection from a US slowdown and crowded options positioning created a sharp-selloff."

- "As we expect lower oil prices and downside growth risks to keep the October OPEC production cut in place for longer, we maintain our longer-term bullish outlook and expect Brent to reach US$97 a barrel in 2Q24, with sharp rises in EM oil demand pushing the market into deficits from June onwards."

- "The Fed may be near a pause today, and the physical commodity markets are still very much intact."

Sectors to Watch

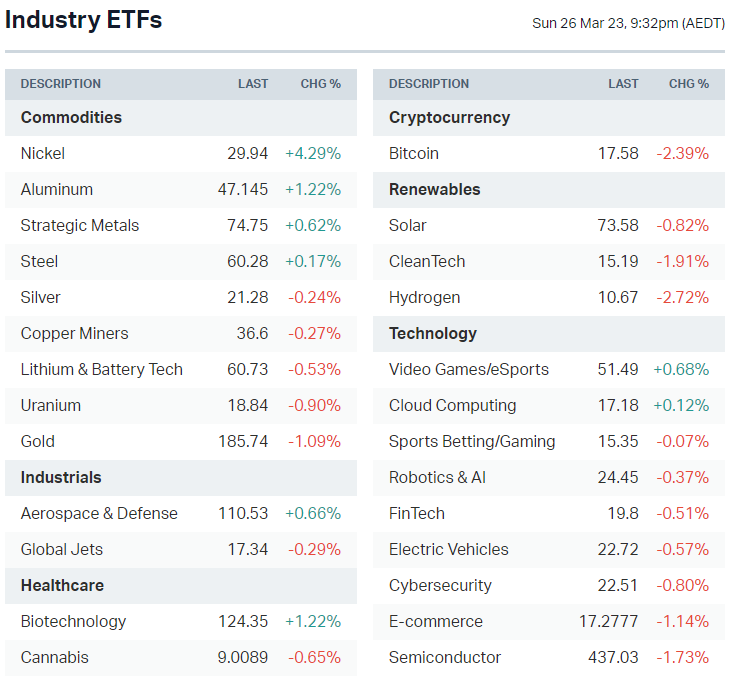

- Nickel: Bloomberg Nickel Subindex (tracks the performance of various nickel futures contracts) rallied 4.3% overnight. However, prices have tumbled around 25% since the start of February.

- Defensives: Utilities, Real Estate, Staples and Healthcare were the best performing S&P 500 sectors, up between 1.3% to 3.1%. Will this see positive flows for local defensives?

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Australian Clinical Labs (ACL) – $0.07, Lycopodium (LYL) – $0.36, Cyclopharm (CYC) – $0.005

- Dividends paid: Healthia (HLA) – $0.02, Breville (BRG) – $0.15, Gold Road (GOR) – $0.05

- Listing: None

Economic calendar (AEDT):

7:00 pm: Germany IFO Business Climate Index

This Morning Wrap was first published for Market Index and written by Kerry Sun.

1 contributor mentioned