Senior bond holders rise from the Credit Suisse rubble

As the market digests the implications of the full US$17 billion write-off in Credit Suisse AT1 bonds, the stand-out winner from the UBS acquisition have been the CS senior bond holders.

Not only were CS senior bond holders effectively made-whole – avoiding a bailing-in – they will also soon benefit from holding higher-quality UBS risk as the outstanding CS senior bonds will be fully absorbed by UBS.

This has seen the major rating agencies place CS senior debt on positive outlook with intentions to equalise the ratings with UBS if the proposed merger completes on the terms announced. For CS holding company senior debt, this spells a 2-3-notch upgrade from BBB-/Baa2 (S&P/Moody’s) to A-/A3. We note the rating agencies have placed UBS on negative outlooks to reflect the execution risks with the CS integration.

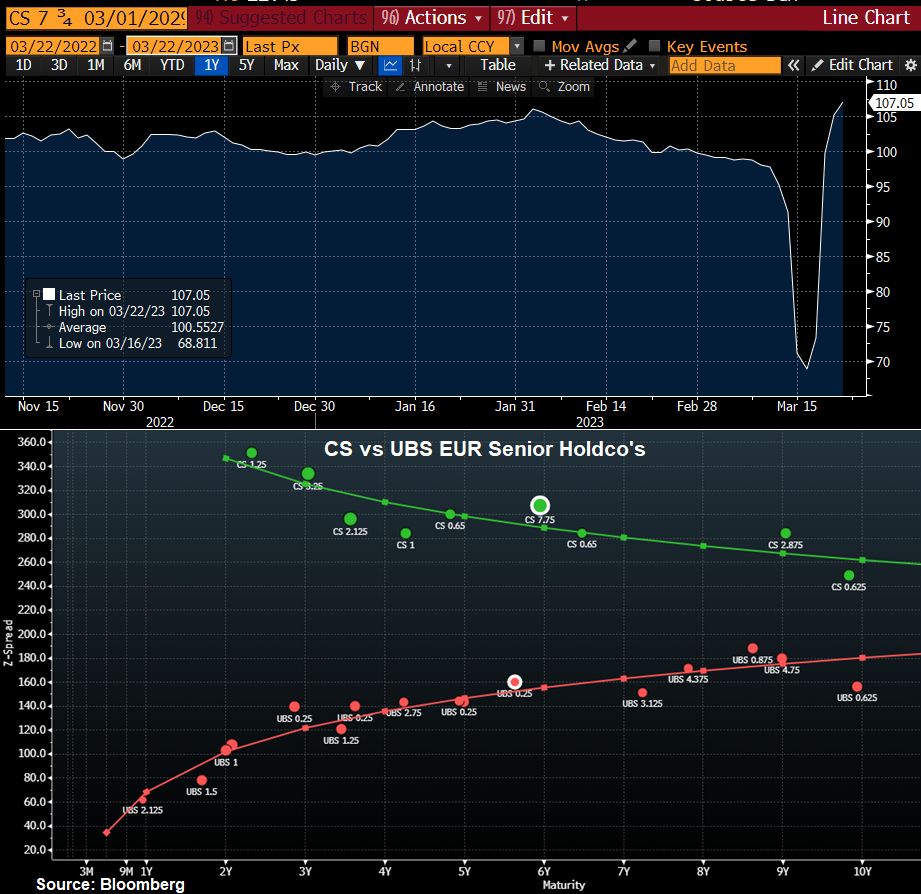

Despite the strong gains for CS senior holders, we note that opportunities remain as CS senior debt continues to trade at a large discount to UBS. For example, the CS € 7.75% 03/2029 bond is trading more than 150 basis points cheaper than the comparable UBS bond; this equates to more than 6% of potential capital upside (as at 22-Mar-2023). Indeed, we expect this differential will materially and swiftly compress as the transaction is expected to close by 2Q23 with the support of expedited regulatory approval.

Realm is your partner

Our clients are our lifeblood. With deep experience investing in Australian credit and fixed income markets, Realm is results-oriented in being always focused on delivering client outcomes.

1 topic