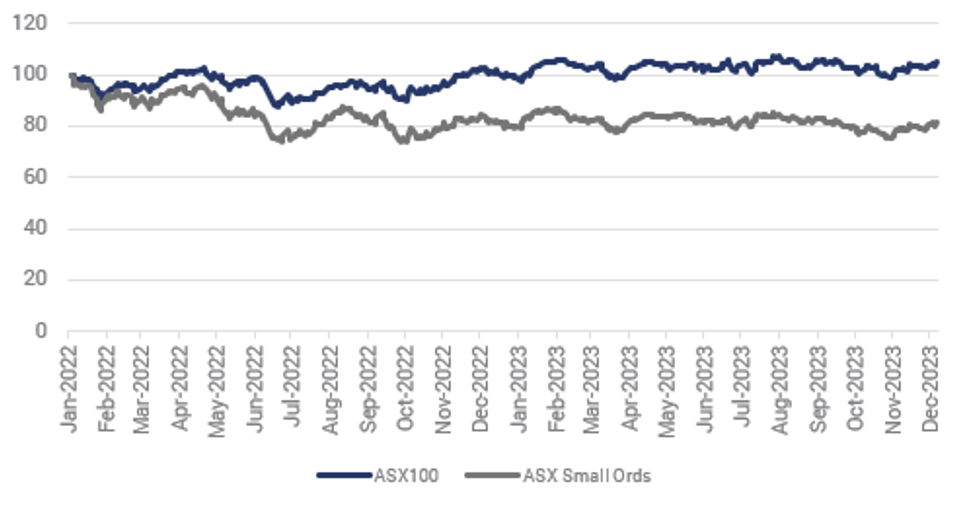

Small cap sector underperformance is creating an opportunity

The Australian Small Cap sector (ex-ASX 100) has underperformed its Large Cap (ASX 100) counterpart by 24% since the start of 2022 (refer Chart 1), consistent with the broader “risk off” trade. The sector now looks extremely attractive, with higher earnings growth available at a significant valuation discount. Small Cap earnings have been resilient and are well-placed to deliver double digit growth in FY24 in contrast to the flat earnings forecast for the ASX 100.

Chart 1: ASX 100 vs. Small Ords Total Return

Social inequality is widening

Every cycle is different and this one has been no exception. A key learning from 2023 has been that consumers are feeling the impact of rising interest rates very differently. For possibly the first time in a rising interest rate cycle, we have a large cohort of Australians with no mortgage and large savings via superannuation. This is in stark contrast to a group of Australians feeling significant pressure from rising rates.

The widening of this social inequality is evident in the economy, in the demand for products and in the differentiated performance of companies. It has significant implications for society and policy going forward, and requires investors to understand the long-term structural implications of this trend.

Navigating a deflationary environment requires a different approach

Most industries have navigated the rapid onset of inflation remarkably well. There have been a few notable exceptions, in particular the health services sector (radiology, pathology) where the inability to pass on price increases (largely due to the reliance on government funding) has impacted margins. For the most part, though, Australian companies have successfully passed on higher costs through rising prices, which has helped sustain margins.

Navigating a deflationary environment, however, may prove to be more challenging, particularly as we move into a softer demand environment. We are already seeing evidence of some companies holding onto cost deflation benefits while others rapidly pass them through, reflecting more competitive markets. Price deflation and weaker volumes is a tough combination for corporate margins, particularly for retailers where operating leverage is high and rising costs of rent/wages tend to lag.

One upside is staff availability which has been a constraint on growth in a number of sectors – in particular healthcare, transport, technology and resources – is now improving.

Taking market share in a low growth environment is key

It is evident that we are likely heading into a period of sustained lower economic growth. This will reinforce the benefit of companies that are growing market share over those that are reliant on market growth. Small caps can have the benefit of being in a growth phase, taking share in existing markets through innovation or establishing new markets for forward facing products and services. We have companies in our portfolio taking market share across the transport, financial services, property, media and technology sectors, significantly outpacing the broader economic growth.

As an example, outdoor media leader oOh!media (ASX: OML) continues to grow revenue despite a decline in broader media spending. Outdoor media is taking share reflecting the cost efficiency and effectiveness of the digital media product relative to incumbents like free-to-air TV (FTA).

Portfolio implications: opportunities across the small cap market are compelling

We are finding compelling opportunities across the small cap market, with the exception of the Energy sector, where elevated coal and uranium prices appear unsustainable over the longer term.

Our portfolios are currently overweight the Financials sector with exposure to a wide variety of end markets across insurance broking, funds management, trustee services and platforms through companies such as AUB Group (ASX: AUB), Equity Trustees (ASX: EQT), Pinnacle Investment Management (ASX: PNI) and Netwealth (ASX: NWL).

We are starting to see select opportunities in the property trust (REIT) sector, where the sell-off has been indiscriminate. In particular, opportunities are emerging in the industrial and funds management parts of the REIT market. Public markets have been faster to reset valuations than private markets and valuations tend to be a lag indicator.

We are attracted to the Industrial property sector where ongoing rent growth is likely to largely offset the negative effect of cap rate compression on valuations.

Opportunities across the technology sector emerged in late 2022 post the broad-based sell-off. From a starting point of being underweight the sector we have been adding select companies where valuations now look more attractive. A number of technology companies have been testing their customer value proposition with price increases (e.g. Megaport ASX: MP1 and Infomedia ASX: IFM). Pleasingly there has been surprisingly little churn evident to date and prices have largely held, highlighting the strength of innovation being delivered.

Many companies are starting to highlight the productivity and innovation opportunity from the adoption of artificial intelligence (AI). While it is too early to understand the value being created, 2024 will see a sharp acceleration in the use cases identified. Increasing adoption of AI will drive higher demand for software upgrades, data networks and data centres.

In hindsight, we have been a little early buying into the recovering health diagnostic services sector (pathology, radiology) with volumes taking longer to normalise than expected. However, we believe there are attractive assets trading well below long term value (and below private market valuations). Volumes will return over time.

We have a strong pipeline of new ideas competing for capital in our portfolios, which is always a sign that the small cap market looks attractive heading into 2024.

Discover our outlook for 2024

Throughout December, we will be releasing all of our 2024 outlooks across the Yarra Capital suite of asset. Stay up to date with all our insights here.

7 stocks mentioned