The #1 stock picks for 2022

Well, folks, it's the moment you've been waiting for. We've scoured Australia for the country's finest fund managers, who in this video, will share their highest-conviction call for the year ahead. And this year, we've pulled out the big guns.

For the first time, we've headed down to Melbourne to speak to top-performing fundies like global growth stock picker Nick Griffin and Aussie value investor Richard Ivers. And, of course, we sat down with some of Sydney's best portfolio managers as well (including the top-performing stock pickers from 2021).

A quick look at previous year's picks shows our fundies' favourite stocks reward close attention. In 2021, our 10 fundies picks delivered a total return of 45.14% (when viewed as an equal-weighted portfolio), beating the S&P/ASX All Ordinaries and MSCI World Index's returns of 10.93% and 18.43% respectively year to date.

We know, we know - 2021 was a good year. However, during tumultuous 2020, our fundies picks managed to generate a return of 13.88%, beating the benchmark by a whopping 10.26%.

Meantime, in 2019, our fundies selections roared to deliver a total return of 59% (an outperformance of 35.86%).

So sit back, relax and watch the video below for 18 stock picks for the year ahead. And if you would prefer to read a transcript, or listen to a podcast, check out the article below.

Our featured experts include:

- Anthony Aboud, Perpetual Asset Management

- Chad Padowitz, Talaria Asset Management

- Eleanor Swanson, Firetrail Investments

- Nick Griffin, Munro Partners

- Simon Shields, Monash Investors

- Richard Ivers, Prime Value Asset Management

- David Moberley, Paradice Investment Management

- Mark Landau, L1 Capital

- Hamish Carlisle, Merlon Capital

- Adrian Martuccio, Bell Asset Management

- Bob Desmond, Claremont Global

- Dean Fergie, Cyan Investment Management

- Matthew Kidman, Centennial Asset Management

- Nick Pashias, Antares Equities

- Steve Johnson, Forager Funds

- Steve Black, Pengana Capital Group

- Chris Demasi, Montaka Global Investments

- Michael Steele, Yarra Capital Management

To learn about the background of this series and how we've pulled together these lists, click on the following link.

Note: This vision was shot on the 6th, 7th, 8th, and 14th of December 2021.

Edited Transcript

Ally Selby: Hello, and welcome to Livewire's 2022 Outlook Series. I'm Ally Selby.

Matthew Kidman: And I'm Matthew Kidman.

Selby: And today we'll be asking our fundies what's their number one stop pick for 2022?

Kidman: Makes me really nervous. I hate making those predictions.

Selby: Ah, but I'm so excited.

Kidman: So am I.

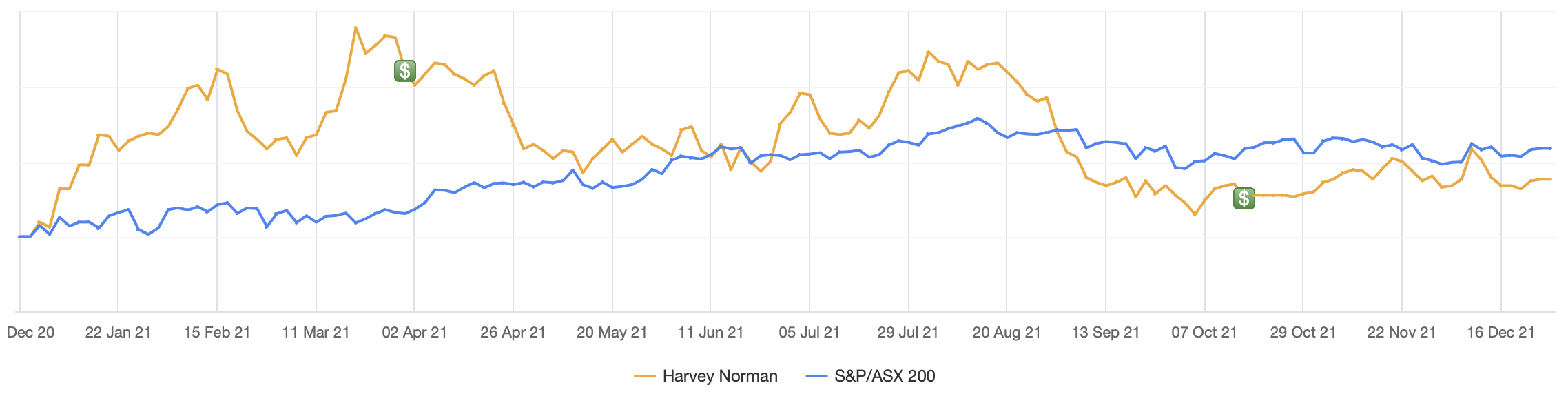

Harvey Norman (ASX: HVN)

Anthony Aboud, Perpetual Asset Management

It's controversial, but Harvey Norman. The bear arguments on Harvey Norman are extremely well known. We've got to watch out for online, Amazon's going to come and destroy them. Are they going to buy more farms as they've done in the past? Et cetera, et cetera. But I flipped that on its head: we like investing in companies where the principal and founder is a major shareholder and a manager. This is because they tend to make decisions based on the long-term rather than on next year's EPS.

For instance, they own $3.5 billion worth of large format retail, ungeared by the end of this year. We feel that the valuation's very, very compelling. Even with retail going back by 30% this year, we see this on 9 times P/E, ex-property, 6.5% fully-franked yield. And we feel that the cash they're generating is massive. We'll either go to rolling out the international strategy or we'll get the return to shareholders.

Kidman: Go, Harvey, go.

Novartis (NYSE: NVS)

Chad Padowitz, Talaria Asset Management

We're very favourably disposed to a company called Novartis. It's a Swiss-based global pharmaceutical company I'm sure you'd be familiar with.

It's about a $200 billion company with around 7% free cash flow yield and paying over 4% dividend, which is very strong and sustainable. Within that valuation, they spend $15 billion on R&D annually. And at the current valuation, we believe you're effectively getting that R&D for free. So any success from that will come through the share price. The company's got no debt. So those characteristics we think are very well placed to do well in an environment that we do think is going to be more challenging and tricky going forward.

Megaport (ASX: MP1)

Eleanor Swanson, Firetrail Investments

Over the next 12 months, we’re super excited about Megaport, a company that facilitates connections for businesses, which allow them to transfer data or information into data centres, office branches. Megaport has a phenomenal base business. We see customers continuing to increase their spending with the company by around 50% per annum very consistently – that's great underlying organic growth.

And what we've seen recently is that Megaport expanded from a $7 billion market into a $14 billion market. They're using their base infrastructure to launch a new product. What really gives us high conviction in Megaport and their ability to execute looking out over the next 12 months is the partnership model they've implemented, where they're partnering with some of the largest names in the networking industry such as Cisco, Fortinet, VMware. These are huge companies. We just think there's huge potential for their revenue growth to absolutely skyrocket over the coming years and we think it's a really attractive potential investment opportunity.

Nvidia (NASDAQ: NVDA)

Nick Griffin, Munro Partners

The stock we've become more confident with over the last few years is the company that's powering AI - Nvidia. Nvidia is one of our best-performing stocks this year and we think it will also be our best next year. We are at the moment of exponential uplift in AI technology. This is happening because every company in the world is effectively becoming an AI company. They are recognising they have large data sets that they need to process very quickly. And if they do that, they keep their customers. Nvidia is the AI enabler for the planet. It is a classic hardware-software model, very similar to Apple at the time. And ultimately, we see exponential growth ahead for this company. We think the earnings can grow more than five times over the next decade and ultimately, the share price should follow that. While it was a really good performer this year, it's still really misunderstood out there. That's probably our best big-cap idea into 2022.

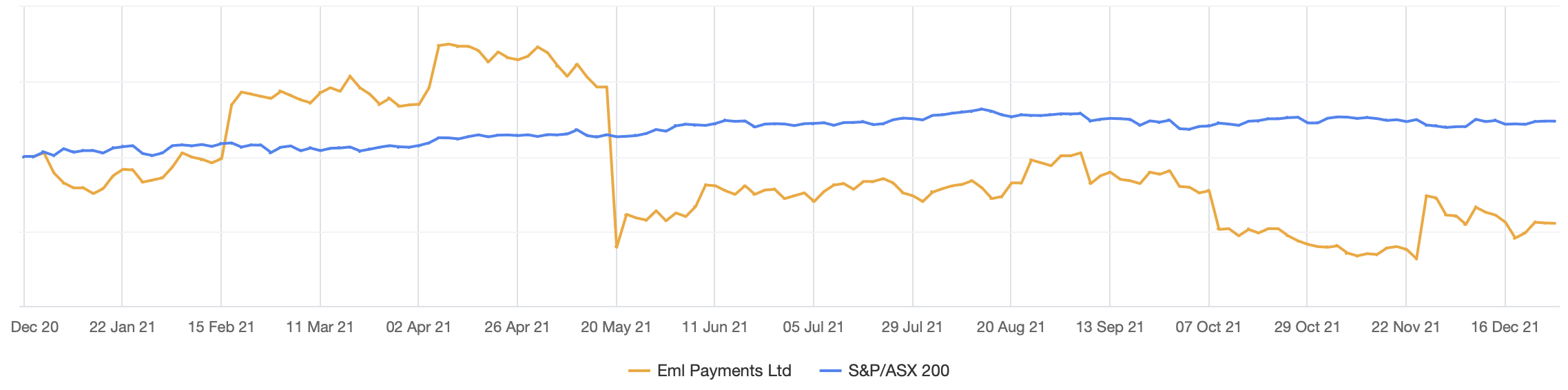

EML Payments (ASX: EML)

Simon Shields, Monash Investors

Without a doubt, it's going to be EML Payments, with a stock that is growing strongly. The only thing that went wrong with it during the year was the Central Bank of Ireland had concerns about how strongly EML was growing. After looking into it, the company had to make a disclosure and the share price collapsed by about 50% all up.

Now, six months later, the Central Bank of Ireland has back-tracked. As much as a central bank or regulator can do so, they're saying, "Oh, look, there's nothing to see here. We're actually not concerned at all." Well, the stock price hasn't recovered yet. But we see no concerns at all about EML Payments. The growth is going to continue and there's a lot of space for that stock price to move back into.

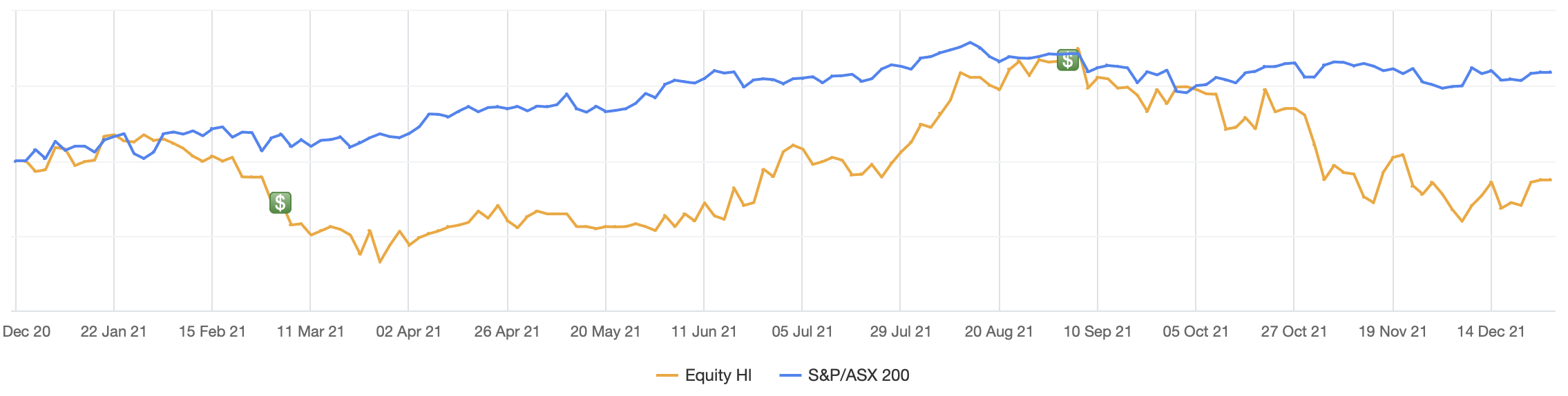

Equity Trustees (ASX: EQT)

Richard Ivers, Prime Value Asset Management

It's a bit of a boring one, but it's a good one that's become really cheap recently and for no real reason. And that's Equity Trustees. It's relatively boring in the terms of being a trustee for financial services, business asset managers typically, and that's a very sticky business. But it's winning new clients, which is the equivalent of inflows for fund managers. And the stock has come off in the last few weeks. It was up around $30. It's now about $25, which puts it on a P/E next year of around 17 times. So, it's trading at a discount to market, it's a high-quality business. That stickiness of its customer base means it has a duration of earnings.

And then finally, you've got the potential for acquisitions as well. So its balance sheet is net cash and there's a couple of acquisitions out there that they could make, which could add the icing on the cake. It's a great quality business that gives you growth and value, which is a really attractive combination that is quite rare in this market.

IDP Education (ASX: IEL)

David Moberley, Paradice Investment Management

I really like IDP Education. I know it's had a big run in the last 12 months but I think there's still significant upside in that name. It's got one of the best management teams in the market and on a two to three-year view, I can see significant upside in that stock.

Entain (LON: ENT)

Mark Landau, L1 Capital

I have lots of favourites in the portfolio, but Entain is the one I would pick. It's a UK-based company and is one of the top players in US sports betting and also in i-gaming. This is a market that's just starting to emerge. State by state, the US is legalising sports betting. And Entain is one of the dominant players. What's exciting to us is that it trades on a P/E of only 15 times. We think it can grow earnings at least 20% per annum for many years to come. On our numbers, they'll actually triple their business over the next five years.

It's also exciting that their main competitor and their joint venture partner have both bid for the company over the last 12 months. Just recently, DraftKings bid for the company at £28, the share price stays only £16. So, the people who know the industry best are voting with their actions and they're saying, "We would love to own this business long term". So we think it's really well-positioned and really well priced.

QBE Insurance Group (ASX: QBE)

Hamish Carlisle, Merlon Capital

I think QBE looks fabulous. The company is leveraged to higher interest rates globally, which fits into this inflation thematic as it plays out. And the pricing cycle in insurance markets is stronger than it's been probably since the World Trade Centre attacks more than 20 years ago. It has a very good operating backdrop and is highly leveraged, from a financial perspective, to tighter monetary conditions and inflation.

Selby: Well, you're really insuring your bet for 2022.

Carlisle: Yeah, I guess so.

Zebra Technologies (NASDAQ: ZBRA)

Adrian Martuccio, Bell Asset Management

My number one stock is black and white, it's an easy choice, it's Zebra Technologies. A US-based firm with about 50% market share in mobile computing. Every time you get a parcel delivery and you see the guy with the scanner, or when you're in the supermarket, or you see people taking inventory within a warehouse (they're using a mobile computer) these guys are going rampant. And with the switch to omnichannel, all retailers moving online, there's been a dash to buy these products and roll out their platform. They're growing by probably 30% this year and should keep that up into next year. It's a huge addressable market of $10 billion. And they've got over half the market share with all their competitors growing at half the rate and only single-digit or low double-digit market share. So, we think they'll be able to consolidate their lead and generate some great profits into next year.

Visa (NYSE: V)

Bob Desmond, Claremont Global

My number one pick would be Visa. It's a company we've owned for a long time. That whole space has been under pressure. There are concerns around crypto and disruption and stable coins and cross-border recoveries. But when we actually look at the fundamentals of the business, they've come through COVID even stronger than they were going in. That trend of cash to cards has just accelerated, the trend of digital and online commerce has only grown. If you look at their total payment volume over two years, that's up 22%. You can easily see a path to plus 15% earnings growth over the next few years. And that valuation's starting to look really attractive.

Raiz Invest (ASX: RZI)

Dean Fergie, Cyan Investment Management

I've been on this stock for a while now and it hasn't performed quite as well as I would've expected. But it's Raiz Invest, a micro-investing platform that has around 300,000 clients in Australia. I think all investors in Australia want to take control of their own finances and they want to do it in a cost-effective way. They've seen what's happened with the AMPs and the Westpacs and the like, so people don't trust the financial planning network. They want to do their own investing. They feel empowered because they can do it through an app. But I also think, over time, it's going to become a really valuable asset for some of the bigger financial players to look at. It has great fundamentals, great tailwinds, potential acquisition, but also really good metrics behind it, plus incredibly transparent financials. So there's a lot of things to like about it.

Envirosuite (ASX: EVS)

Matthew Kidman, Centennial Asset Management

The one that I want to give you is a company called Envirosuite. It's got a market cap of about $260 million. EVS provides software products for a range of industries that help them control their pollution. They sell to the water industry. They sell to the mining industry. They sell to the airline industry and it's only just getting started. It's got enough capital, it's global – in Australia, the US and Europe. The company has a new management team and I think their sales team is now in place and it's ready for growth. Don't be surprised if it gets taken over, especially by a northern hemisphere group because they're forged into those markets.

Sims Limited (ASX: SGM)

Nick Pashias, Antares Equities

It's Sims. It's a company probably a lot of people haven't heard of. So Sims is a global business. They have recycling facilities all around the world. They're the world's biggest recycler. And they recycle ferrous, which is steel, iron, and they recycle non-ferrous material, which is copper and aluminium. In a decarbonizing world, the amount of carbon produced by recycling something is a lot less than taking the ore and processing it into steel or whatever it might be. There are also a few steak knives that get thrown in with Sims that perhaps people don't appreciate. And that is a business called Lifecycle, which repurposes things. If you think of a data centre that's past its useful life, instead of taking the servers and scrapping them, Lifecycle repurposes them. They take the good bits and reuse them to build a new server or a new computer from an old hard drive to a new hard drive. I think this will appeal to the likes of Microsoft, Google, Amazon, all of these guys, I think it's a much better approach.

RPMGlobal (ASX: RUL)

Steve Johnson, Forager Funds

RPMGlobal is the largest holding in our Australian fund. It's in the mining software space. We've had a lot of growth stocks sell-off over the past three or four months. It hasn't really participated in that sell-off and I think there are good reasons for that. Its main competitor here in Australia just announced it's being taken over by a Scandinavian equipment supplier. I think that is the game for RPM as well. And I think we're getting increasingly close to that endpoint. If you take the multiples at which its competitor is being bought and apply it to RPM, you've got another 100% upside to the share price today. I don't think that's out of the question. And I think in a market where relying on market multiples is going to get more difficult, this takeout option is a pretty good one for our portfolio.

Kidman: A nice piece of foraging.

Hansen Technologies (ASX: HSN)

Steve Black, Pengana Capital Group

I'll say Hansen Technologies, which is a top-five holding in our fund. I see it as a three to five-year play rather than one year, but we're still very excited about it next year. So in brief, Hansen Technologies is an enterprise software company providing backend billing software capability for telecommunication and paid TV companies. We're excited because it has an incredible history, around 17 years, of delivering about 13% per annum EPS growth. And with the same management team trading on a P/E of only about 17 times next year's earnings, it will be one of the cheapest software stocks on the Australian market.

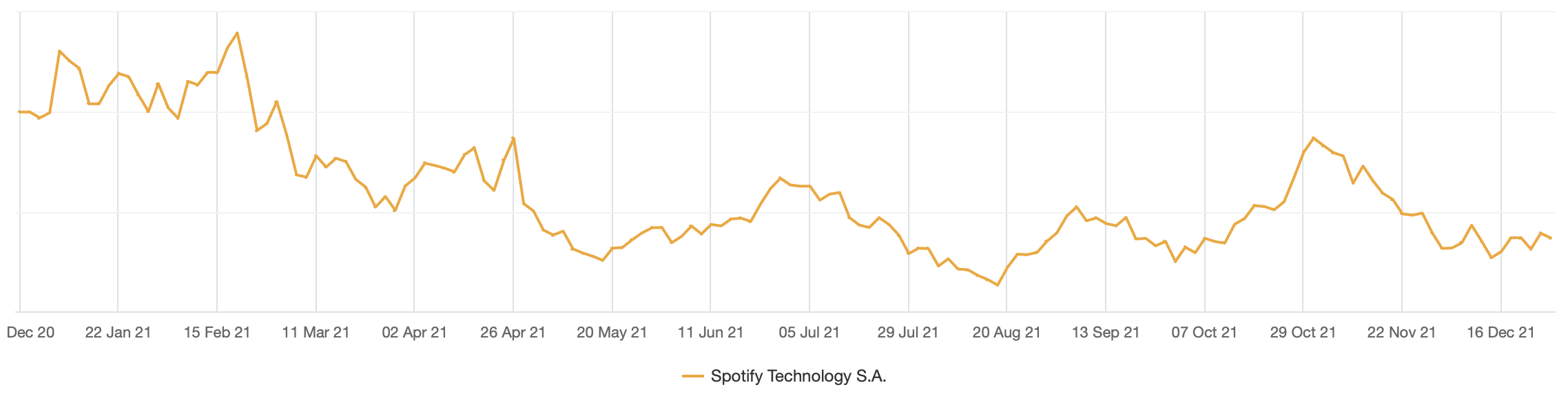

Spotify (NYSE: SPOT)

Chris Demasi, Montaka Global Investments

I'm going to say Spotify. And Spotify's the largest digital music and podcast streaming service in the world. It's got almost 400 million users, 70 million music tracks, 3.2 million podcasts on the platform. And over the last three years, that company has increased its leadership position, doubled its user base and expanded into new addressable markets – but the share price has done almost nothing. But we think it's all about to change. And there are two really good reasons for that. The first is that we think the user base can continue to grow. When you look around the world, there are about 3.5 billion smartphones, only 10% of them have paid music subscription accounts, and that's going to continue to increase over time.

And we think Spotify's going to end up with almost a billion paid subscribers by the end of the decade. But probably even more importantly than that, they're in the early innings of monetising that massive audience space with both advertisers and creators. But none of this we believe is reflected in Spotify stock price today.

Megaport (ASX: MP1)

Michael Steele, Yarra Capital Management

Our number one stock pick for '22 and longer-term as well is Megaport.

Selby: We've had two Megaports in this series. I'm excited. Tell me why.

Steele: Megaport is a software-defined network provider. It's a global business that's got global leadership, which really is quite unusual in the technology space. And also, they've got a clear leadership on the number of customers they have, at least a five-times leadership versus their newest competitor. There's a notable increase in the opportunity going forward though with new products. So the total addressable market more than doubles going forward as they add additional data transmission products when you move out to SD-WAN or 5G. When you put that together, it's a company that's got a total addressable market that's well over eight billion compared to their current revenue of only $110 million.

What is your #1 stock pick for 2022?

The fundies have revealed their top stocks for the year ahead, so let's turn the mic to you. Let us know what stock you are backing for the year ahead in the comments section below.

Be sure to catch the rest of our 2022 Outlook Series

Hit the ‘follow’ button below for our fundies’ number one picks for the year ahead and other great content from our 2022 Outlook Series. Enjoy this wire? Hit the ‘like’ button to let us know or click the button below to view all the content on the dedicated landing page.

More from Outlook Series

Heavy Hitters, Big Calls, Bold Predictions, Top Stocks

- How the #1 picks for 2024 are tracking (and the stock up 67%)

- How your portfolio can benefit from Australia’s strong fundamentals

- We asked you where markets will be in 2024: Here's what 5000 of you said

- Top 3 stocks for income in 2024 (and why investors need an equity allocation)

3 topics

10 stocks mentioned

19 contributors mentioned