The consumer, inflation and small caps: Three big “what ifs” for 2023

The word “but” is a dangerous one for investors. I know you can’t pick the bottom of markets, my investors tell me, but they still don’t want to invest until they are “sure” the worst is behind us.

I know you can’t predict markets, as Livewire tells me. But why don’t you give it your best shot anyway? Most forecasts are wrong, and the ones that are right are usually a result of the inevitable tail actually getting pinned on the donkey through random chance.

So, we are not going to start this sentence with the word “but” and have a crack anyway. We are, instead, going to run some "what if" analysis. I’ll posit a few what-ifs for 2023, and you can spend some time thinking how likely that is and what it might mean for your portfolio.

How bad does it get for the Australian consumer?

Let’s start with the Australian consumer.

You don’t get any points for pinning the tail on this donkey - 2023 is clearly going to be tough. The Reserve Bank of Australia has raised interest rates by 3% since March this year and is expected to add another 0.5-1% to that by March 2023.

Thanks to a proliferation of fixed rate loans, significant amounts of prepayment through the pandemic and a lag for rates to be passed on to borrowers, most of the pain of these rate rises is yet to be felt. It will, though, through 2023 and 2024.

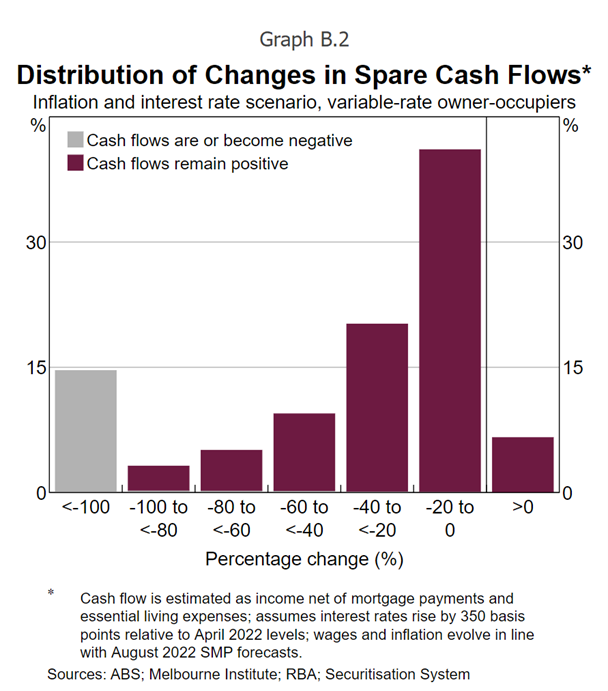

The RBA estimates that some 15% of variable rate mortgage holders do not have enough spare cash flow to absorb the hit. At an aggregate level, Australia’s debt service ratio (the percentage of disposable income dedicated to servicing loans) will rise from approximately 13% to 18%, the highest level since 2008.

On the flip side, the savings rate has already fallen from almost 20% of income during COVID lockdowns to 7% in September 2022. The day of reckoning can be delayed as those COVID savings get used up, but at some point the Australian consumer needs to curtail his and her spending.

That is already factored into a lot of share prices. But for the likes of JB Hi-Fi (ASX: JBH) and Nick Scali (ASX: NCK), where the level of sales and profit margins were already unsustainably high, there isn’t enough buffer priced into most discretionary stocks for me to be trying to solve this problem.

What if inflation falls hard?

There is growing evidence for a significant fall in inflation throughout 2023. The Manheim index of used car prices - the single most significant contributor to US inflation over the past year - has now fallen 16% from its peak in January. Oil prices are down more than 30% since June, shipping costs have more than halved and lumber prices - after quadrupling through 2021 - are now back to historical levels. Moreover, global food prices look like they are about to turn negative, a stark difference from the 20-40% year on year rises witnessed through 2021 and the first half of 2022. The price of wheat is now below where it was prior to Russia’s invasion of Ukraine.

When the 2022 highs for these items are used as the base for inflation calculations in 2023, they will be meaningful negative contributors and headline inflation numbers will fall dramatically (and possibly be negative).

I, for one, hope zero rates are a thing of the past. It makes my job - finding cheap stocks - nigh on impossible and causes serious distortions in asset prices and misallocation of capital in the real economy.

And this could be a temporary reprieve, of course. Job markets remain extremely tight and wage inflation is a more instransigent issue.

But it is worth thinking about a scenario where inflation becomes less of a problem. Maybe it was transient after all, just a much longer transit period than economists first thought. That would allow the RBA to nurse the consumer through a difficult adjustment period with a lot more care.

More importantly for us, the share prices of many tech companies have been smashed on the prospect of higher and higher rates. If there are only a couple more rate rises to come, investor focus might shift to the resilient nature of these companies’ revenues through what will be an inevitably difficult economic environment.

What if 2023 is a great year for small caps?

They say you should never ask a barber whether you need a hair cut. Well, never ask a guy who has a massive portfolio skew to small cap stocks whether small caps are going to perform.

At least I am on the record making the opposite argument a few years ago. But feel free to read this through scepticism-coloured glasses: What if 2023 is is a great year for small caps?

That might seem counterintuitive. Everyone is telling you to buy defensive, resilient businesses, right?

Well, in and of itself, that is often a good contrarian indicator. But global small cap fund manager Global Alpha recently released some research suggesting there is more to my question than a simple contrarian view point.

- Dramatic underperformance during 2022 has led to starting relative valuations for US small companies that are the lowest since 1992. Here in Australia, the ASX Small Ordinaries Index was down 17% to the end of November, versus an All Ordinaries Index that was roughly flat. For non-mining companies, the performance was even worse. Starting prices matter more than anything else.

- Small companies tend to perform better in a recession than most investors anticipate. They can be nimble and agile and are often run by a founder or significant shareholder who has a strong incentive to make tough decisions early.

- Acquisitions become far more attractively priced in an economic downturn and they tend to be far more important for small companies than large ones. That is both for companies that are doing the acquiring and those that get bought. Our Forager Australian Shares Fund received takeover offers for five different companies in the second half of 2022, out of a portfolio of just 30 stocks.

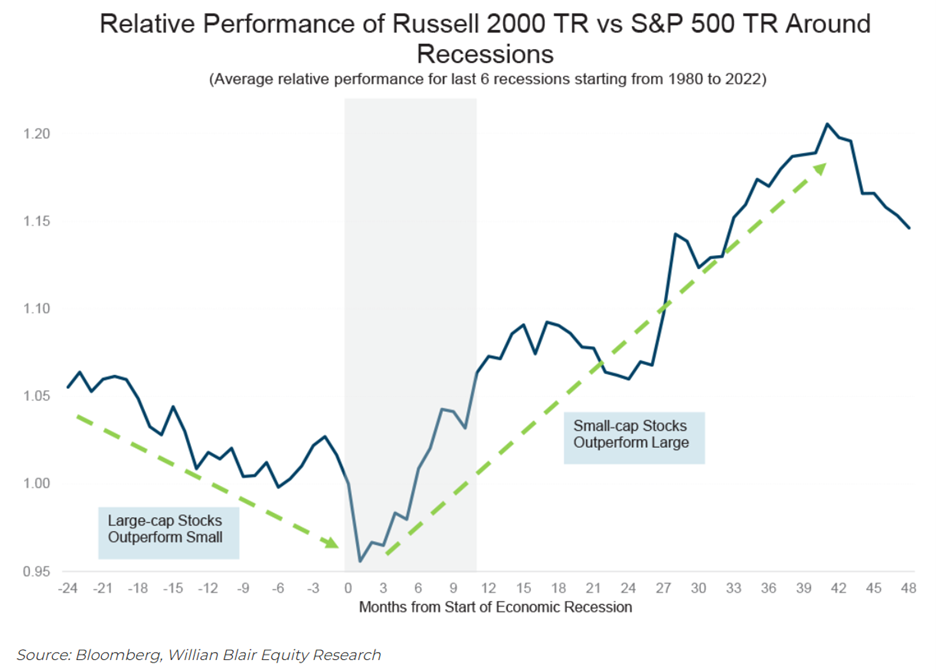

The combination of low expectations embedded in share prices and companies performing much better than anticipated through recessions. Global Alpha’s research was US centric but showed that, historically, small caps have started outperforming large caps from the time a recession hits, not just once it is over.

In the US, small caps were the best performing asset class for the five years post the 1973/4 market meltdown, through a recession and a decade of high inflation.

Most clients I talk to think they have plenty of time before worrying about the smaller end of the market. What if that turns out to be a mistake in 2023?

Access a unique portfolio of global shares

If you share our passion for unloved bargains and have a long-term focus, Forager could be the right investment for you. Click 'FOLLOW' below for more of our insights.

More from Outlook Series

Heavy Hitters, Big Calls, Bold Predictions, Top Stocks

- How the #1 picks for 2024 are tracking (and the stock up 67%)

- How your portfolio can benefit from Australia’s strong fundamentals

- We asked you where markets will be in 2024: Here's what 5000 of you said

- Top 3 stocks for income in 2024 (and why investors need an equity allocation)

2 topics

2 stocks mentioned