The Magnificent Seven stumble: cracks appear in market titans

It’s not a stretch to say AI has been the primary driver of the current US stock market rally.

And while that makes the major indices look good, the gains have been far from evenly spread.

If a stock is unrelated to AI, it has been largely left behind as the market touches new all-time highs.

Perhaps that’s why 36% of companies on the S&P 500 mentioned AI in their last quarterly earnings calls.

Everyone wants to bask in the reflected glory of AI!

But the market isn’t easily fooled. Most of the money continues to go into a few big-name tech stocks that are genuine players in the AI race.

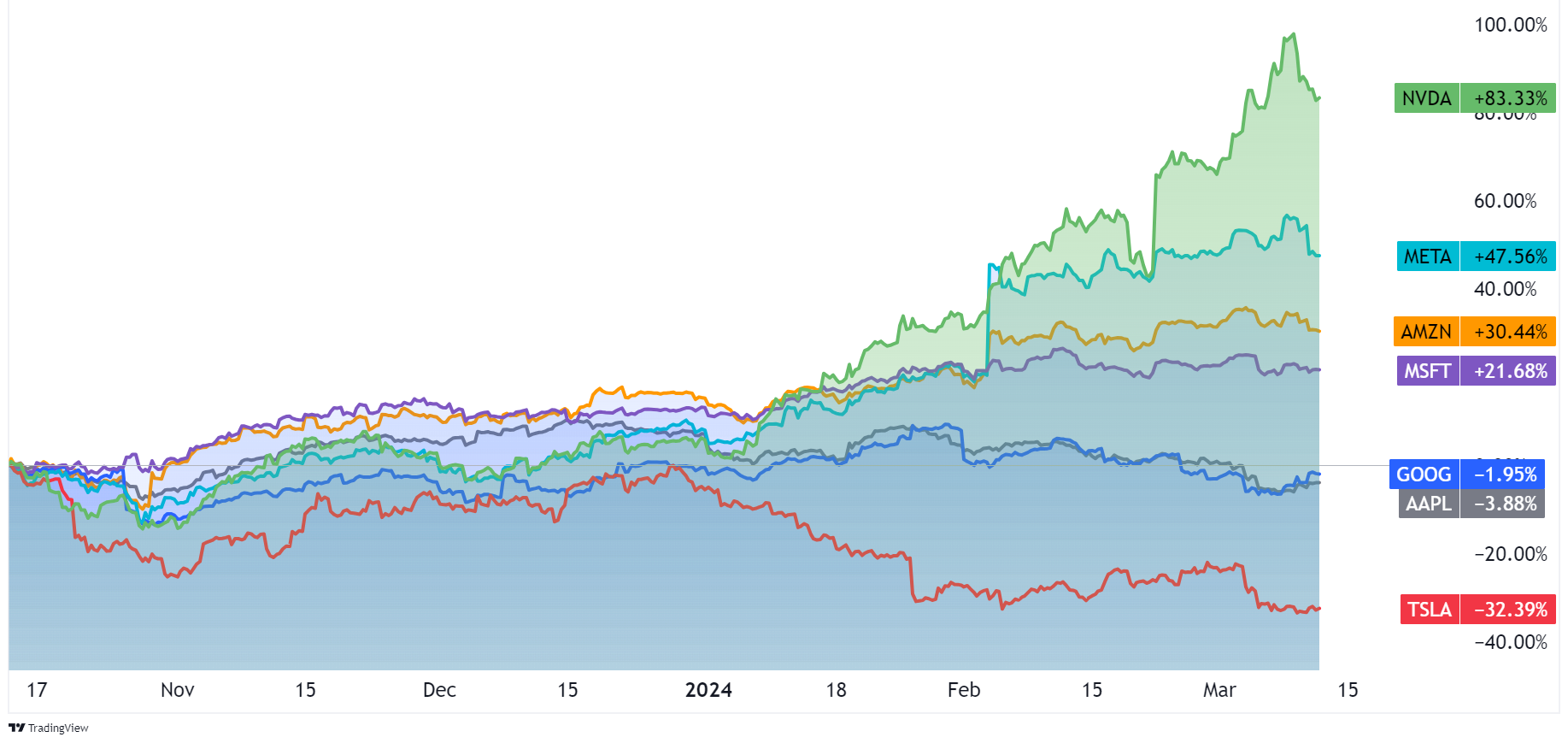

The Magnificent Seven, comprised of Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla, led the charge last year.

These combined seven returned 107% in 2023, doubling the Nasdaq 100’s returns and massively outperforming the S&P 500’s 24% gain.

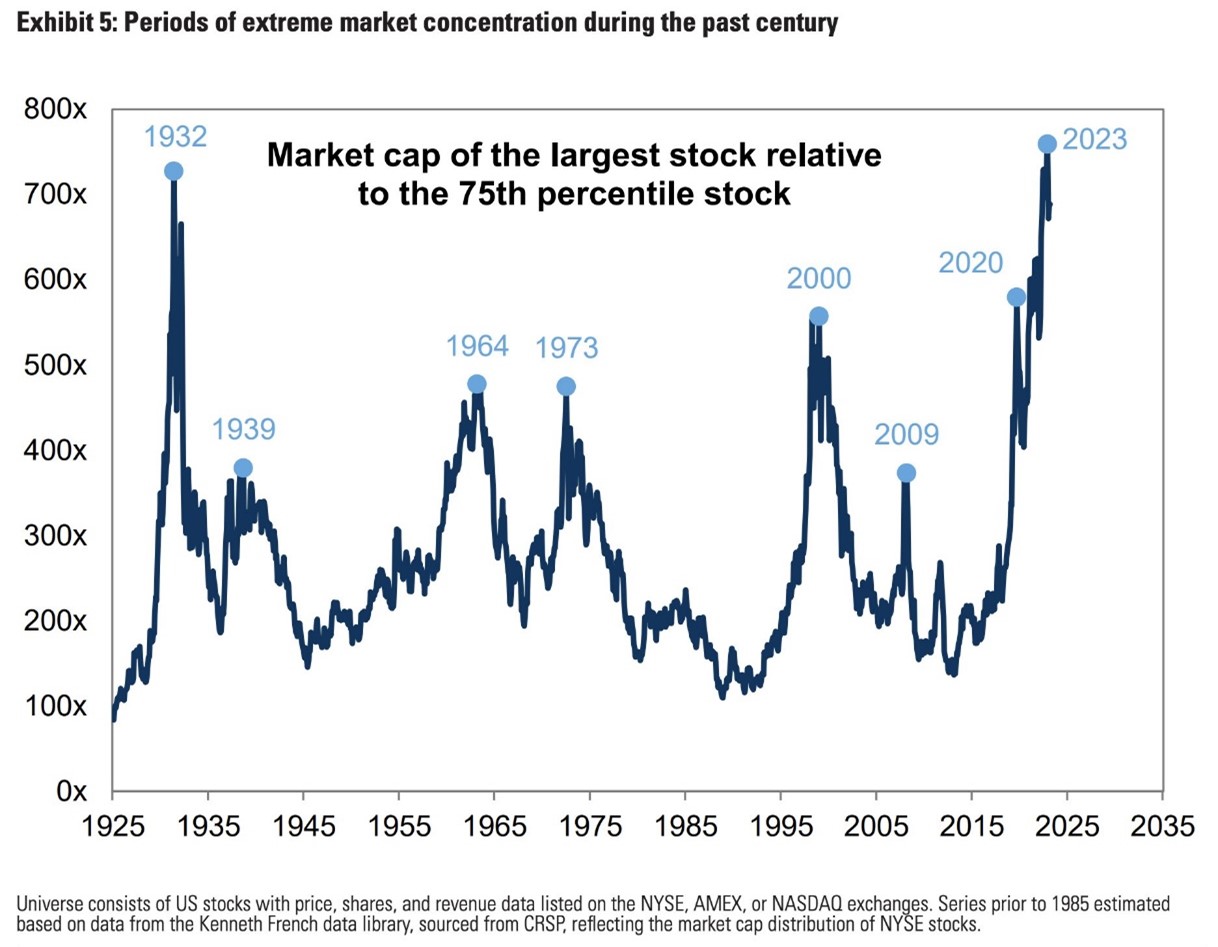

These titans now account for around 30% of the S&P 500 index— a point of historic market concentration.

But as we approach the tail end of earnings season, the Magnificent Seven are dropping off one by one.

Mike O’Rourke, the chief marketing strategist at Jones Trading who coined the term, thinks the era of the Magnificent Seven is over.

‘This big rising tide of seven names lift[ing] all boats in the stock market, is what I see ending,’ O’Rourke said. ‘I don’t see these seven names rising together’.

The once Magnificent Seven are now seeing their trajectories split. Through a combination of fierce competition and public missteps, three are being left behind.

Just last week, we’ve seen Tesla (NASDAQ: TSLA) stock fall over -10% as the EV market fights for the shrinking slice of car sales.

Alphabet (NASDAQ: GOOGL) has stepped from one blunder to the next in its attempt to catch up with OpenAI’s ChatGPT.

While Apple (NASDAQ: AAPL) has seen its stock continue to fall as regulation and fierce competition squeeze earnings.

The New ‘Fantastic Four’

Whether these share price drops herald a sustained shift away from the remaining ‘Fantastic Four’ remains to be seen.

But this could be the turning point where the market concentration seen in the past 12 months begins to shift.

Markets have historically struggled to broaden beyond the top players, who remain some of the most profitable in the world.

However, when things are stretched, investors will eventually shift to investments that present better value.

Today, the S&P 500’s forward P/E is 23.4, while the equity risk premium (ERP) is only 3.5%.

Historically, this is around 5%, so from a risk-adjusted view, you’re not getting good value in the long term at these prices.

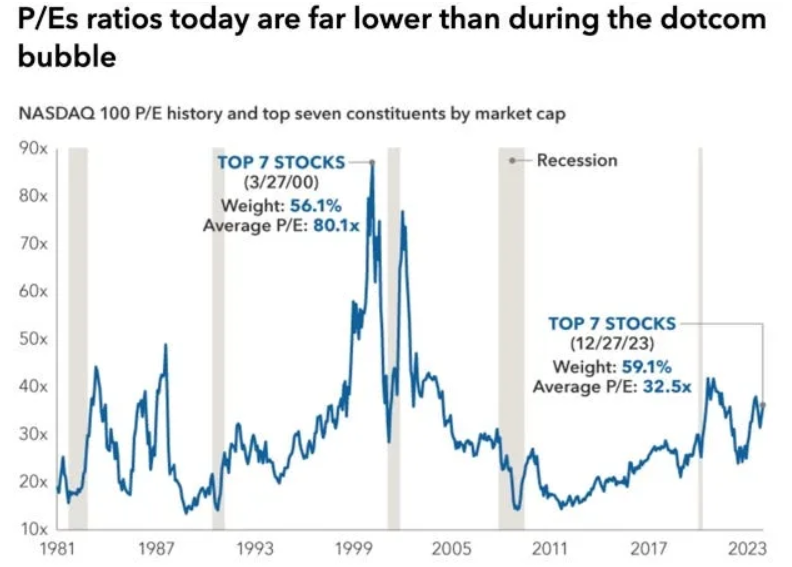

Is this because the market is overheated? Unlikely.

Comparisons to the dot-com bubble miss the clear difference in earnings and cash flow from then to now.

Just compare the top seven Nasdaq stocks' average P/E at the dot-com peak to the end of 2023.

One has only to open Nvidia’s (NASDAQ: NVDA) blockbuster earnings last month to see a company with real demand and solid earnings.

The day after those earnings, Nvidia added an astonishing US$277 billion to its market cap. That’s the equivalent of a Bank of America or Chevron in a single session.

But the top-heavy nature of the market has meant that concentration risk is not the only factor at play.

Goldman Sach’s Hedge Fund Trend Monitor shows that 6 of the 10 largest holdings in over 700 aggregated hedge fund portfolios are these ‘Mag 7’ stocks.

Hedge funds, ETFs, and passive traders are crowding around the same portfolio of expensive stocks.

This resembles the 1960s obsession with the Nifty Fifty. The market converged around ‘quality’ stocks, but their best days of growth were behind them.

The Nifty Fifty ultimately flatlined for nearly two decades.

That’s not to say the Mega caps won’t perform from here. It's just that smaller caps will simply catch up.

The possibility of soft landing and interest rate cuts by mid-2024 presents an opportunity for market broadening.

Interest rate relief will allow smaller cap’s earnings and margins to flesh out in the second half of this year.

This and an open field of disruption with tech like AI, should mean smaller players shine again.

However, picking the smaller caps requires a deeper understanding of what went wrong with the bigger players this year.

The stumbling three: Apple, Alphabet, and Tesla

Now, these are truly global stocks that defy oversimplification in many ways.

But I will press on with a series of themes that can be taken to investing in smaller tech stocks.

Lesson #1: Walled gardens crumble

In May of last year, a leaked memo, allegedly from a Google researcher, circulated within AI circles and caused a stir. It started with:

‘We Have No Moat: And neither does OpenAI‘We’ve done a lot of looking over our shoulders at OpenAI. Who will cross the next milestone? What will the next move be?

‘But the uncomfortable truth is, we aren’t positioned to win this arms race and neither is OpenAI. While we’ve been squabbling, a third faction has been quietly eating our lunch.‘I’m talking, of course, about open source. Plainly put, they are lapping us…

‘…While our models still hold a slight edge in terms of quality, the gap is closing astonishingly quickly. Open-source models are faster, more customisable, more private, and pound-for-pound more capable.

‘They are doing things with $100 and 13B parameters [AI size] that we struggle with at $10M and 540B. And they are doing so in weeks, not months.’

Now, I won’t guess the memo's origin, but I will discuss its relevance to the Big Seven.

The closed ecosystems that have defined companies like Apple and Google in the past are starting to fall away.

Apple’s brilliant marketing meant consumers looked past their overpriced hardware into something that meshed design and aesthetics in holy matrimony.

But its closed system and ‘cult of product’ have pushed it into a corner where it struggled to maintain those lofty product expectations.

It’s also restricted them from innovating as fast as their competitors, who all add value to open-source ecosystems like Android.

Last week, the EU punished Apple for its closed approach, issuing a nearly US$2 billion fine for anti-competitive behaviour on its app store.

The EU also pushed through a landmark law that will open all the major tech titans to new competition.

It’s also scrapped its US$1 billion EV project and has yet to find a new product that has captured consumer attention.

Some may point to the Apple Vision Pro as its next big frontier. For now, it's too early to tell if AR/VR is really a mainstream product.

Initial sales point to serious competition from Meta’s (NASDAQ: META) Quest 3.

Why? Because Meta’s product already has a robust ecosystem of open-source features at one-seventh the price.

Newer markets like Virtual Reality or AI aren’t going to replicate the iPhone era of old.

If Apple can no longer keep people engaged within its systems, it will continue to bleed sales to competitors.

The lesson here is if companies want to maintain their growth, they'll need to do so in open ecosystems where developers and customers reside.

Lesson #2: Respect your customers

The flubs and outright fabrications of Google’s Gemini launch have raised worries about Google’s market position.

The recent hot-button issue of Gemini creating racially biased images has certainly garnered the attention of the media and investors.

Companies like Google have seen pushback from consumers fed up with paternalistic behaviour.

In a rare public appearance over the weekend, Google co-founder Sergey Brin acknowledged the recent mistakes, saying the company ‘definitely messed up’.

Meanwhile, CEO Sundar Pichai described the results as ‘completely unacceptable’.

This came not long after Gemini’s first major misstep —and greater sin, in my opinion— when the company was forced to admit its initial ‘hands-on’ video of Gemini was a fabrication.

Google later claimed the staged six-minute video represented ‘what Gemini could look like’ and was intended to ‘inspire’ rather than misinform.

The market disagreed.

A similar story is playing out with top talent at the Magnificent Seven. After rounds of layoffs at the big firms, burnout and lack of agency have hit a tipping point.

The eye-watering salaries are no longer enough to hold talent.

Since September, Google has lost four lead developers of Gemini, and similar exits have occurred across others.

This exodus of top developers and mass layoffs has spread the seeds of the next generation of scrappy AI startups backed by aggressive VC capital.

And this sea change brings us to my last point.

Lesson #3: No moat is unbreachable

The poster child of growth Tesla (NASDAQ: TSLA) has finally faced the reality that its once green fields are now filled with fierce competitors.

Many of these are Chinese EV upstarts. Fuelled by $57 billion in state subsidies, which from 2016–2022, pushed China to become the world's biggest EV producer.

Combined with China’s stranglehold on battery mineral refining and production, price competition has squeezed out Tesla’s margins.

Despite still managing 19% sales growth in 2023, Tesla’s gross profits fell 15% amid a 5pp drop in gross margins.

The average revenue per vehicle sold has fallen from a peak of US$57,300 in Q2 2022 to just US$44,500 in Q4 2023.

Tesla was once thought to have a sizable technological moat. Their future promises of self-driving cars and big data services set them apart.

As Elon Musk famously quipped:

‘If you buy a Tesla today, I believe you are buying an appreciating asset, not a depreciating asset.’

Those sentiments have now evaporated faster than the resale value of a Tesla Model 3.

The lesson is illustrative when looking at other Magnificent Seven members.

Whether that’s Google’s near 90% stranglehold on search or Amazon’s control over the cloud.

Competition is heating up.

There is no doubt that these companies led an incredible market run, but when market cycle leaders start to underperform, it’s a sign that trends are starting to shift.

Looking ahead, I see a market that favours stock picks over passive investing.

But that will require more discernment from investors who want to follow the AI wave to its next shores.

If you’d like to hear where I think tech and AI are headed next or more thoughts like this, you'll appreciate the free daily insights from Fat Tail Daily. Dive into our analysis and get ahead of the curve. Sign up here to cut through the noise.

If you want to see my major trends for AI in 2024, here is my January article, which has already seen predictions come to pass.

5 topics

5 stocks mentioned

%20cropped.png)

%20cropped.png)