The Match Out: ASX bounces into the weekend, but down ~2% for the week

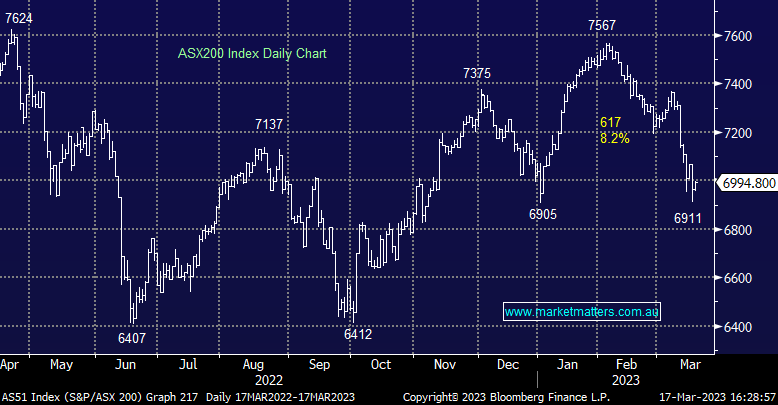

Shares ended a volatile week on a quieter note today, particularly helped by a rally in Energy which had copped the brunt of the selling during the week after rude fell to a 1-year low. Tech and financials were also on the rebound with the banks finding some buyers following global government and private support for banks in crisis. The small gain wasn’t nearly enough to offset most of the week’s losses with the index suffering its sixth consecutive week of declines, the longest since 2008.

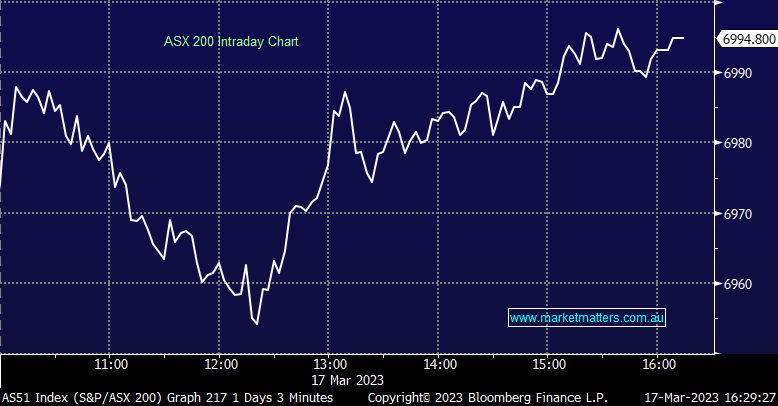

- The S&P/ASX 200 added 29 points / +0.42% to close at 6994.

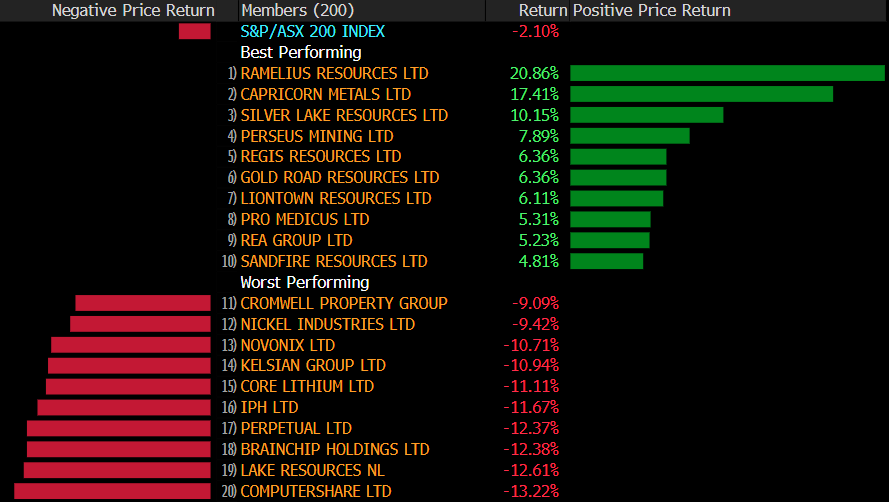

- Energy (+2.30%) were the best on ground, IT (+1.12%) & financials (+0.92%) were also strong

- Real Estate (-1.52%), Healthcare (-0.66%) and Industrials (-0.36%) struggled despite the index closing higher

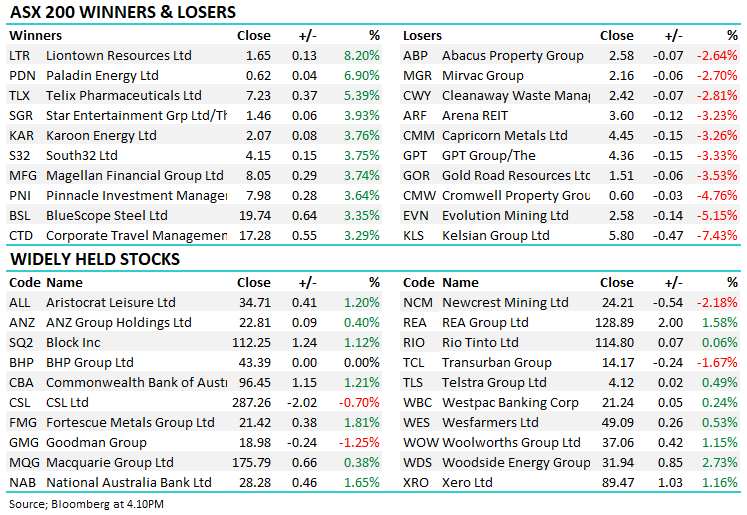

- Life360 (ASX: 360) -2.27% a choppy day for the family tracking software company today following their FY results. Revenue was in line but profit missed, while guidance was a touch soft. Shares finished higher despite the soft numbers.

- Kelsian (ASX: KLS) -7.43% came back online after raising money to fund a US acquisition. Despite the fall, they closed ~4.5% above the raise price.

- Link Admin Holdings (ASX: LNK)+2.97% bounced after announcing it was selling the banking and credit management business for €30m, though only €20m upfront. The move follows the company’s plans to simplify the business and funds will go to reducing debt.

- Lynas Rare Earths (ASX: LYC) +2.33% bounced after Citi put a buy on the stock. The broker noted risks around the Kalgoorlie plant build, but was excited by the NdPr opportunity and Lynas’ key position in the space.

- Gold was strong in Asia today, +US$11/+0.61% to $US1931 at our close, up 6.5% since last Wednesday. Despite the rally, gold equities were largely softer today after seeing a strong rally this week.

- Asian stocks are all up as well, Nikkei +1.13%, Hang Seng +1.70% and China +1.35%.

- US Futures are flat to higher. Nasdaq futures are seeing the best of it, currently +0.18%

ASX 200 Chart - Intraday

ASX 200 Chart -Daily

Sectors for the week

Stocks for the week

Broker Moves

- IPH Cut to Neutral at Jarden Securities; PT A$9.32

- Kelsian Group Raised to Buy at CLSA; PT A$8

- Worley Raised to Neutral at Credit Suisse; PT A$14

- Xero Cut to Accumulate at CLSA; PT A$100

- Lynas Rated New Buy at Citi; PT A$8.20

- Appen Cut to Sell at Bell Potter; PT A$2.25

- Capitol Health Rated New Outperform at Macquarie

Major Movers

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned