The Match Out: Banks and Healthcare stocks underpin a solid start to the week

A rebound in the Banks and Healthcare stocks underpinned a solid start to the week with the ASX treading its own path today ahead of a public holiday (no trade) in the US tonight. Resources have been on fire so far this month, with the Material Index +7% in June to date, however, we wouldn’t be surprised to see some performance reversion in the short term, particularly if the $US finds some support – that was certainly the case today.

- The ASX 200 finished up +43pts/ +0.60% at 7294

- The Healthcare sector was best on ground (+1.90%) while Staples (+1.61%) & Utilities (+1.16%) were also strong i.e. it was a day for the defensives

- Energy (-0.60%) and Materials (-0.55%) the weakest links.

- Banks found some love with Commonwealth (ASX: CBA) +1.17% punching back up through $100 and looking strong. ANZ was the best of the big 4 up +1.46% to $23.62.

- The ~2% advance by the healthcare sector was underpinned by CSL which recouped 2.3% of last week’s ~10% sell-off. The easy trade has always been to buy the dips in CSL, however, we see no rush in doing this for now.

- We note the volume in today’s buying was very light compared to the high volume selling over the past 3 sessions. Normally volume will reduce on days 2 & 3 after a weak update, but that wasn’t the case with CSL, day 3 down was actually the highest volume. We think CSL is at risk of more selling.

- Iluka (ASX: ILU) -4.27% was hit today after UBS downgraded to SELL, they say the ~25% appreciation CYTD is too much relative to the broader resources sector up ~4%, particularly given the macro-driven headwinds likely to impact Mineral Sands, and more importantly for ILU’s current valuation, Rare Earths. We own ILU in our Flagship Growth Portfolio

- Lake Resources (ASX: LKE) -20% whacked after saying their lithium project in Argentina will be delayed by six years and cost around twice as much as originally anticipated – not a good combo! We spoke about the challenges in Lithium projects in last week’s Webinar Here

- Abacus Property (ASX: ABP) +5.81% rallied after raising $225m to de-staple their Storage King business and list it in its own right. More on this below.

- Macquarie’s 7 ‘safe haven’ stock picks adorned the front page of the AFR this afternoon – they reckon the best bets to stay defensive are: 1. AGL Energy (ASX: AGL), 2. Coles (ASX: COL), 3. (ASX: CSL) , 4. Endevour Group (ASX: EDV), 5. Resmed (ASX: RMD), 6. Treasury Wines (ASX: TWE) & 7. Telstra (NYSE: TLS) – hardly earth-shattering stuff!

- Of those mentioned, we own AGL, although think the lion’s share of the gains are in the rear view mirror, RMD, TWE and TLS, again, it’s hard to get excited and be a buyer of TLS here, we have recently trimmed our position.

- Ship builder Austal (ASX: ASB) -1.6% said its US division has secured a $US71m contract with the US Navy for the construction of a Navajo class ship.

- Lynas (ASX: LYC) -1.5% fell after the rare earths company announced a slight delay to the Kalgoorlie processing facility’s gas supply and treatment. The company still expects the first Mixed Rare Earth Concentrate production by August, largely in line with expectations.

- Iron Ore was flat in Asia today trading ~US$115/Mt

- Gold was largely flat at $US1954 at our close.

- Asian stocks were lower, Hong Kong down -1.2%, Japan -0.71% while China was off -0.50%

- US Futures are closed

ASX 200 Chart

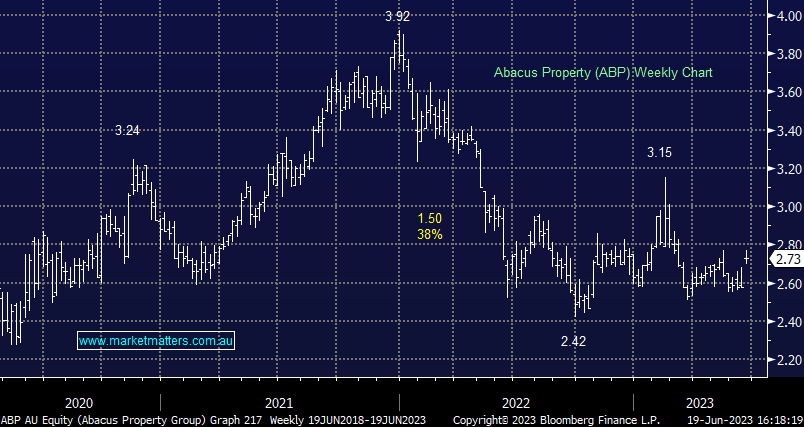

Abacus Property Group (ASX: ABP) $2.73

ABP +5.81%: a strong return to the boards today from the property group after announcing a $225m capital raise. They plan to list Abacus Storage King (ASK) on its own by early August with the capital raise going towards paying down debt and funding new developments. Overall it looks to be a smart deal for shareholders with Abacus trading on a ~25% discount to NTA vs National Storage REIT (NASDAQ: NSR) trading more or less in line with their NTA, though we suspect the commercial exposure, which will trade under ABG, will come on at a slight additional discount to where the headstock currently trades (relative to it’s NTA)

Broker Moves

- Capricorn Metals Rated New Overweight at Jarden Securities

- Coronado GDRs Rated New Buy at Jefferies; PT A$2.20

- Whitehaven Reinstated Buy at Jefferies; PT A$8.15

- Aurelia Rated New Buy at Jefferies; PT 12 Australian cents

- Mineral Resources Cut to Neutral at Citi; PT A$77

- DGL Group Cut to Speculative Buy at Canaccord; PT A$1.55

- AGL Energy Cut to Neutral at JPMorgan; PT A$10.25

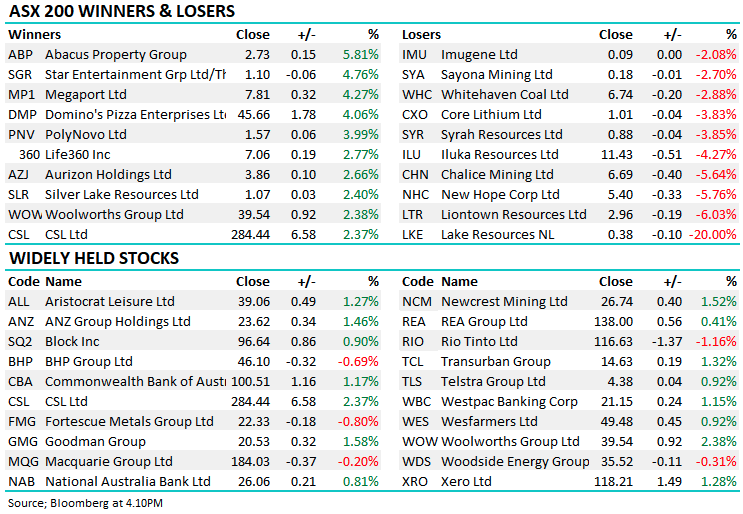

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned