The Match Out: Energy hit on growth concerns, ASX at 2-month lows.

The daily Match Out for Tuesday 14 March with Market Matters' James Gerrish.

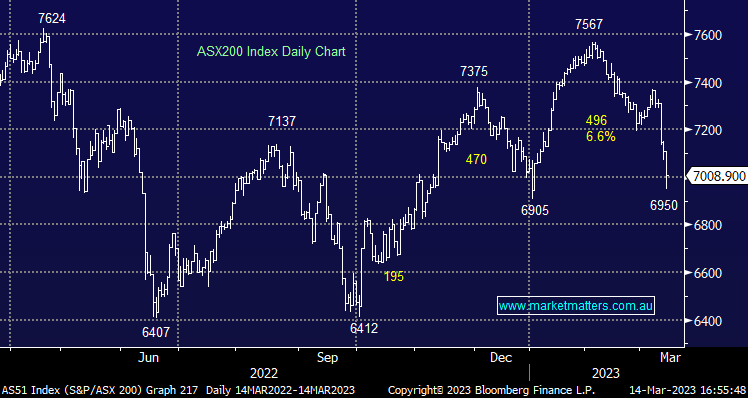

Risk assets continued their sell off today with broad-based weakness seen across the ASX. The index fell below the psychological 7000 level for the first time since January 4, though it showed some fight to close marginally above that level in the end. Energy felt the brunt of the pain today as the global growth concerns were caught up in the bank contagion fears. Tech was also a surprising underperformer given the relative strength of the Nasdaq overnight and in US Futures during our session today. The relative safety of Utilities and Real Estate was preferred, though both sectors still closed lower.

- The ASX 200 finished down -99pts/ -1.41% at 7008

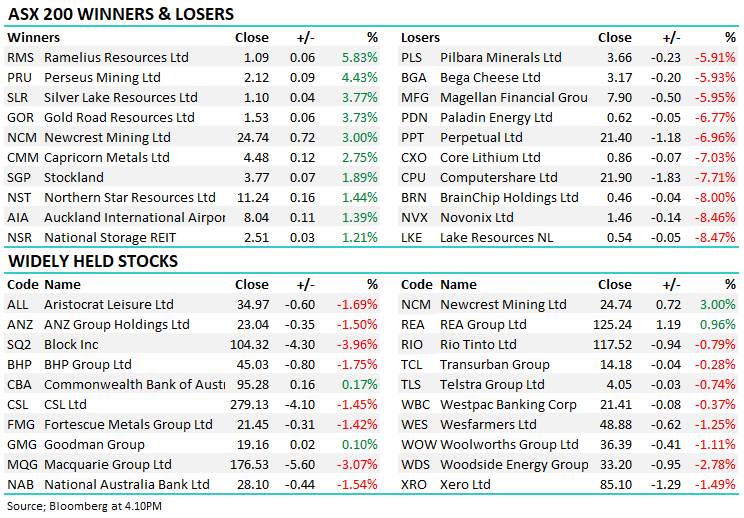

- The Real Estate sector was best on ground (-0.27%), closely followed by the Utilities (-0.29%)

- Tech was the weakest sector (-3.44%) while Energy was also in the firing line (-2.78%). 5 other sectors fell by more than 1%

- Kelsian (ASX: KLS) was in a trading halt today as they look to purchase a charter bus company, All Aboard America!, for $500m.

- Neuren Pharmaceutical (ASX: NEU) +9.68%, now up 30% in 2 days following FDA approval of their Rett syndrome treatment.

- Energy stocks were hammered as crude trades down ~8% in a week. Traders aren’t just concerned about the impact of SIVB on the financials market.

- We stepped up to add to our banking exposure in to weakness today with the view that this event is very much a company-specific issue and unlikely to cause a major rift in financial markets. We have already see regulators talk to supporting deposits in the US to prop up the system in an attempt to build confidence.

- Iron Ore was ~0.43% higher in Asia today, though it was little help for the miners today with BHP still down -1.75%

- Gold was once again the place to be on the equity front, though it gave back some strength in Asian trade today following its +$US30 move overnight to fall $US10/-0.53%. Ramelius (ASX: RMS) once again the top performer in the space, up +5.83%.

- Asian stocks were struggled, Nikkei -2.37% while China and the Hang Seng are currently down ~2%.

- US Futures are once again the in the green, S&P and Nasdaq Futures both up 0.3%.

ASX200

Market Matters In the Media

The Market Matters Research Lead Shawn Hickman joined Ausbiz this morning for a timely chat about the Silicon Valley Bank’s issues and it’s impact on the local banking sector.

Broker Moves

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is the Lead Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & portfolios open for investment. He is also a Senior Portfolio Manager at Shaw and Partners heading up a team that manages direct domestic and international equity & fixed-income portfolios for wholesale investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

2 topics

6 stocks mentioned

Comments

Comments

Sign In or Join Free to comment