The Match Out: Iron ore continues to rally, shares storm higher into the weekend

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The stars aligned for a strong finish to the week, and the ASX delivered with its best one-day rally in more than 8 weeks today. All sectors were higher today, led by a resurgent materials sector thanks to strong commodity prices. It was a very broad-based rally today with 80% of the ASX200 finishing higher with money keen to pile into the market. The index posted a gain of 122pts/+1.71% this week, recouping the losses of last week.

- The ASX 200 added +92pts/ +1.29% to 7279.

- The Materials sector was best on ground (+2.54%) while Tech (+1.93%), Energy (+1.68%) & Consumer Discretionary (+1.09%) were also notable gainers.

- While still closing higher today, Utilities (+0.28%) and Healthcare (+0.29%) were the key laggards.

- Data out of China was strong as Industrial production (+4.5% YoY) and Retail Sales (+4.6% YoY) were better than expected, further supporting the rally, particularly in China-facing stocks. The buying followed on from yesterday’s surprise stimulus in the form of a cut to the Reserve Requirement Ratio (RRR)

- Metcash (ASX: MTS) -0.54% hosted their AGM today. Sales YTD were up +6% for food ex-tobacco, +3.2% for Hardware and +1.7% for Liquor. Tobacco sales (-11%) have been impacted by illicit trade while further signs of consumer weakness have been noted despite the growth so far in FY24.

- Novonix (ASX: NVX) +37.96% continues to surpass targets at their Tennessee battery facility with costs, volumes and sustainability numbers in line with expectations, lifting production capacity targets.

- QANTAS (ASX: QAN) +0.36% took another hit, the ACCC rejecting their collaboration with China Eastern today.

- Telco data showed Telstra and TPG are losing market share, mostly to Aussie Broadband (ASX: ABB) and Vocus.

- Iron Ore rallied a further 1.51% in Asia today taking Rio to a one-month high, up 3% in the session.

- Gold was up 0.4% to US$1919 at our close, most gold stocks enjoyed the move.

- Asian stocks were mostly higher, Hong Kong +1%, Japan +1.1% while China was off -0.50%

- US Futures are higher, all by around 0.2%

ASX 200 Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

Broker Moves

- Clean Seas Seafood Rated New Buy at PAC Partners

- Monadelphous Raised to Overweight at Jarden Securities

- Myer Cut to Reduce at CLSA; PT 64 Australian cents

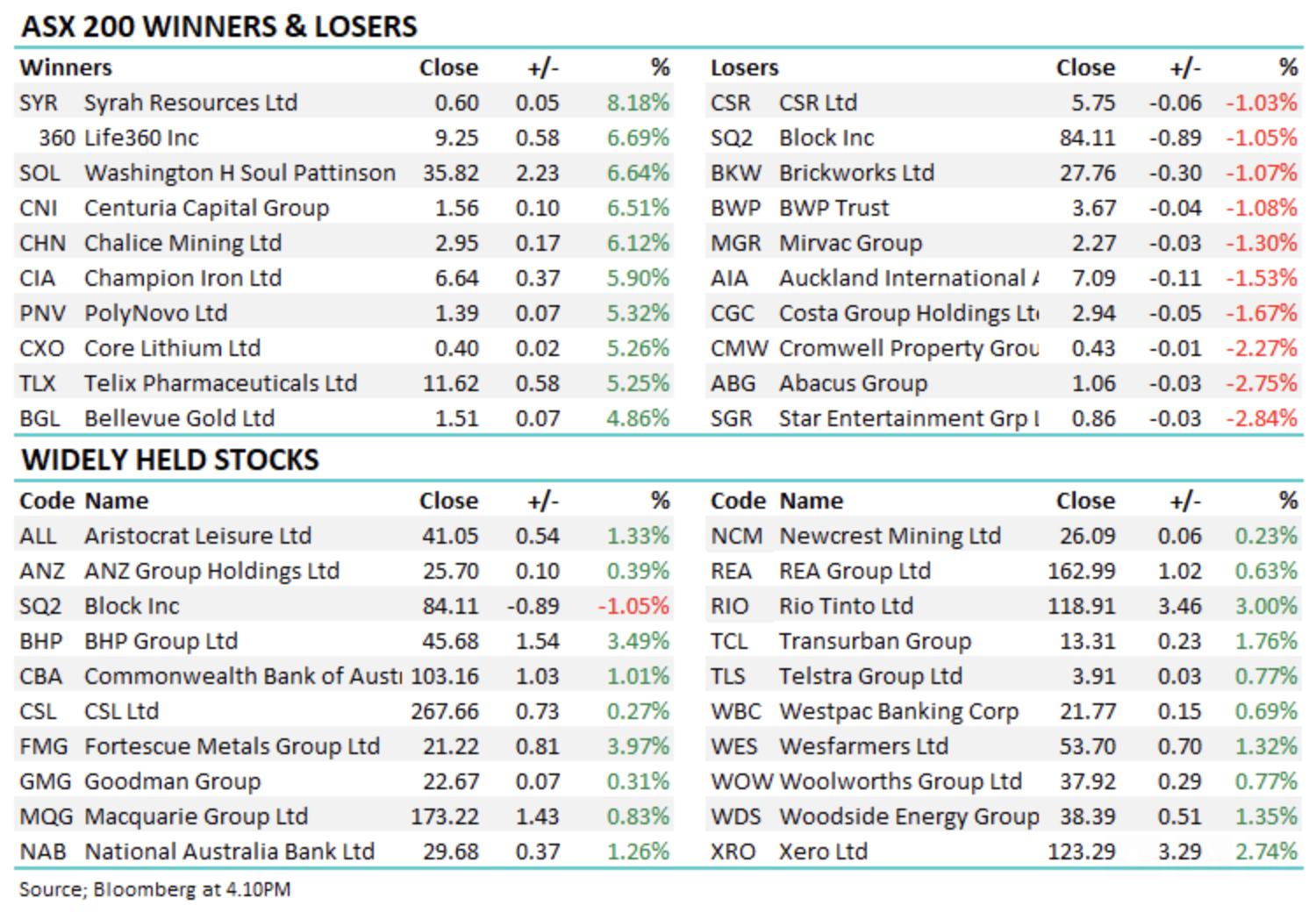

Major Movers Today

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned