The Match Out: Late spurt pushes stocks up on the day, Resmed (RMD) hit on earnings miss

A quieter end to a more volatile week for equities with a US rating downgrade, continued volatility in bond markets, while overlapping quarterly earnings in the US and the start of FY reporting locally kept things interesting. Ultimately, stocks ended lower, bond yields were generally higher while commodities by in large remained resilient.

- The ASX 200 finished up +13pts/ +0.19% at 7325.

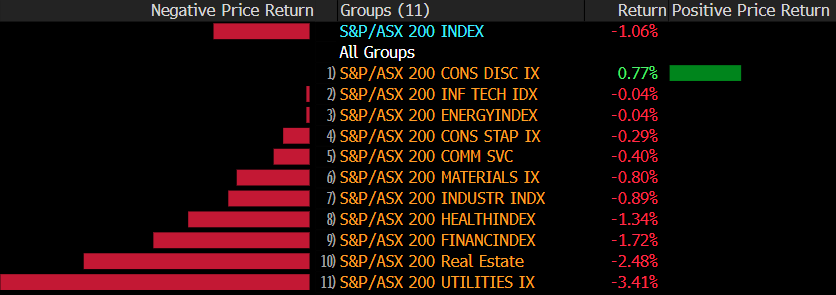

- The IT sector was best on ground (+1.25%) while Energy (+1.09%) & Consumer Discretionary (+0.78%) were also strong.

- Healthcare (-1.20%) and Utilities (-0.71%) the weakest links.

- The ACCC has blocked ANZ’s proposed deal to buy Suncorp’s banking unit – we suspect they will appeal the decision.

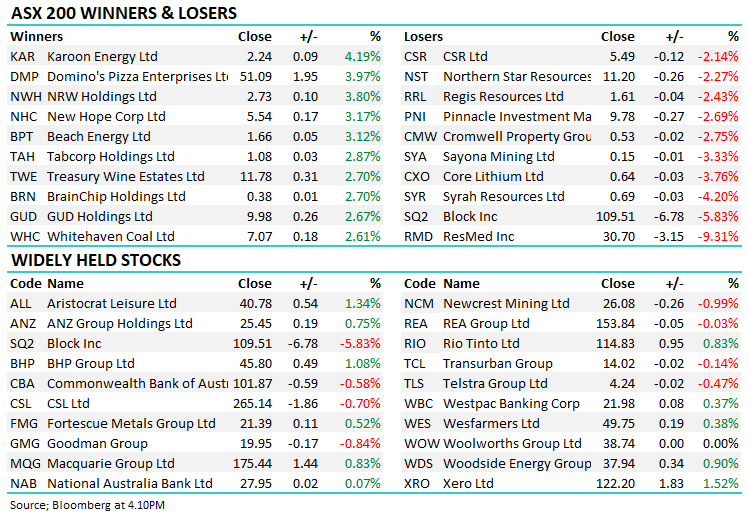

- Resmed (ASX: RMD) -9.31% knocked as weaker margins hit earnings overnight. We own RMD in our Flagship Growth Portfolio.

- City Chic (ASX: CCX) +28.13% ripped higher on news it’s selling its Evans brand and its Europe, Middle East and Africa inventory to AK Retail Holdings for £8m.

- Treasury Wines (ASX: TWE) +2.7% rallied on a broker upgrade and some tentative signs that China is reconsidering some tariffs.

- Ive Group (ASX: IGL) +6.99% higher after UBS initiated with a Buy call and $2.80 PT, saying….Trading on ~8.0x FY24e PE (UBSe) with ~5% organic EPS growth over FY23-25e (+15% including Ovato synergies) vs ASX peers at 9.8x offering 4% growth, delivering ~8% dividend yield in FY24e (UBSe), we think the stock offers compelling value.

- Magellan (ASX: MFG) –0.1% marginally lower following their FUM update for July which showed $400m net outflows, with $300m from retail and $100m from insto. While still negative, the rate of change is slowing and we take this as an incremental positive for the embattled manager. Total FUM sits at $39.2bn.

- Mesoblast (ASX: MSB) -56.88% shows why investing in biotechs can send you to an early grave, the FDA needs more data to support marketing approval of remestemcel-L, the company’s treatment for pediatric steroid-refractory acute graft versus host disease.

- Dicker Data (ASX: DDR) +4.74% bounced on a solid 1H23 result that implies they will likely meet market expectations for the FY on current run rates.

- Iron Ore was flat in Asia today, although is lower for the week as data continues to show an ongoing slowdown.

- Gold was flat overnight and little changed in Asia, ticking around $US1935 at our close.

- Asian stocks were mostly higher, Hong Kong up +1.13%, Japan -0.19% while China put on +0.66%

- Amazon (NASDAQ: AMZN) reported after market and rallied strongly after hours as 2Q results beat in all aspects and they gave a positive outlook.

- Apple (NASDAQ: AAPL) was more mixed with softer than expected iPhone sales offset by strength elsewhere – the stock traded down 2.5% after hours.

- Reporting on Monday: Aurizon (ASX: AZJ): Download the Market Matters Reporting Calendar Here

- US Futures are all up, around +0.40%

ASX 200 Intraday

ASX 200 Daily

ANZ $25.45 & Suncorp (SUN) $14.13

ANZ +0.75% & SUN +0.64%%: the ACCC finally released their determination on ANZ’s attempt to acquire Suncorp’s banking arm, a $4.9b deal that was announced more than 12 months ago now. The Competition regulator has denied the application on fears that the deal would lead to lower competition in the space leaving customers worse off with less innovation and lower quality service.

ANZ argues that a joint effort would improve outcomes for customers of Suncorp and the broader banking space with the small increase in market share (Suncorp has around 2.4% of the Aussie mortgage market vs ANZ ~13%) would allow the company to invest more in its systems while scale improvements would also result in better pricing. From here, ANZ will likely look to appeal the decision to a tribunal that historically has been more favourable on deals like this.

Resmed (RMD) $30.70

RMD -9.31%: Hit hard today after reporting 4Q23 earnings overnight in the US that were softer than expected. A combination of slightly softer revenue, lower gross margin and higher costs created a weaker than anticipated result. Adjusted EPS of $1.60 was higher than last year ($1.49) but below consensus of $1.70.

Revenue was up 23% to $1.12bn but below the $1.13bn expected with that issue compounded by a gross margin of 55% vs. 57.1% last year and estimate of 56.5%. While the result is light on, they are still delivering strong top line growth as demand continues for their products – margins as issue which leads to reasonable reductions in valuation in outer years. We own RMD and do not intend to sell it given the sharp decline.

Sectors This Week

Stocks This Week

Broker Moves

- Core Lithium Cut to Underweight at Wilsons

- OFX Raised to Overweight at Wilsons; PT A$2.35

- Cettire Rated New Overweight at Barrenjoey; PT A$3.80

- Flight Centre Cut to Neutral at Macquarie; PT A$23

- Treasury Wine Raised to Buy at Jefferies; PT A$13

- Harvey Norman Cut to Underperform at Jefferies; PT A$3.20

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

10 stocks mentioned