The Match Out: Soft session locally ahead of key US data this week

A softer session for the ASX ahead of a big week of data in the US including inflation (14th) & then their much-anticipated interest rate decision (15th) where they should at least slow the pace of rate hikes (50bps expected), however as we suggested this morning, it is not just about the size of the incremental move but also the accompanying rhetoric with hints towards what Jerome Powell et al feel is likely in 2023, another big guess but stocks are nervous and don’t want to see a deviation from recent improved comments e.g. “It makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down,” – Jerome Powell on 30th November.

- The S&P/ASX 200 lost -32 points / -0.45% to close at 7180

- Energy (+1.22%) & Property (+0.33%) were the standouts.

- Utilities (-4.27%) fell after a great November, Staples (-1.10%) underperformed as did Materials (-1.49%)

- Origin Energy (ASX: ORG) -7.82% fell as the Government announced gas and coal price caps, with concerns about what this means for its $9 per share takeover.

- AGL Energy (ASX: AGL) -2.63% also fell, more so in the early trade before a decent recovery played out.

- Tyro (ASX: TYR) -19.46% tanked after the board saw away with both suitors, the most recent bid coming at $1.60 per share from Potentia Capital, today TYR closed at $1.20.

- St Barbara (ASX: SBM) & Genesis (ASX: GMD) were both in a trading halt having announced an interesting deal to team up in WA – we’ll cover more on this tomorrow.

- Other gold stocks fell as a result – there is an attached capital raise to the deal so selling other gold names to fund is understandable.

- Smart Group (ASX: SIQ) +2.55% was upgraded to a buy from Citi & $6.60 price target.

- The Pendal (ASX: PDL) +2.03% / Perpetual (ASX: PPT) -0.17% tie-up is progressing, PDL closed at $5.02 today while the deal is worth $5.09 per share based on PPT’s close of $24.11.

- Data out today showed that the median balanced super fund generated returns of 2.6% in November while the growth option increased 3.2%! If Dec is okay balanced options should be flat on the year. In comparison, the MM Income Portfolio is up ~8%.

- Gold was down $10 in Asia, trading $US1786/oz at our close.

- Asian stocks were down, Hang Seng off -2.12%, the Nikkei in Japan fell -0.3%, while China lost -0.8%

- US Futures are down circa -0.10%

ASX 200 Chart

Origin Energy (ASX: ORG) $7.19

ORG –7.82%: Hit today following recent developments around government intervention in gas and coal markets. The proposal around price caps etc is creating concern around the $9 per share takeover of ORG that is currently undergoing due diligence. The concern is that price caps on domestic gas and coal next year, and then controlled prices for gas into the future would hurt ORG’s energy supply business and its Australia Pacific LNG venture, and in that sort of environment, the $9 bid price seems overly optimistic. Clearly, these changes to pricing will have knock effects and ORG is front and centre.

Broker Moves

- Cochlear Cut to Hold at Jefferies; PT A$220.40

- ASX Rated New Hold at Jefferies; PT A$69.63

- Qube Reinstated Accumulate at CLSA; PT A$3.20

- SmartGroup Rated New Buy at Citi; PT A$6.60

- McMillan Shakespeare Rated New Buy at Citi; PT A$16.40

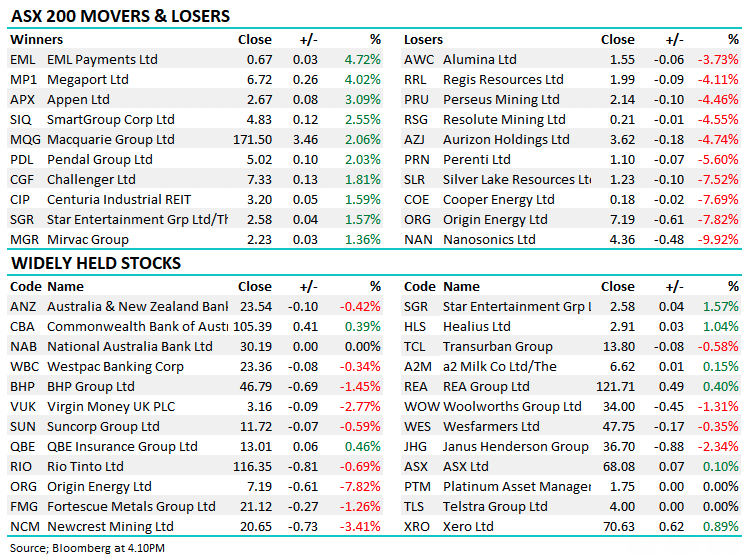

Major Movers Today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

8 stocks mentioned