The stimulus factor

GFC vs GVC

There are no doubt similarities between the shock of the Global Financial Crisis (GFC) and the current Global Viral Crisis (GVC), however the differences are perhaps more striking - such as the scale and breadth of government stimulus. Currently it has far exceeded the GFC with no real end in sight as second waves of the pandemic decimate global economies.

While this is well documented, for many investors some other differences are more hidden. In particular the underwriting of private sector credit in the USA, where banks have been incentivised to increase lending as loans are underwritten by the government. This is something monetary policy alone singularly failed to do after the GFC.

A case for inflation

While the velocity of money (the frequency one unit of money is used to purchase items) is very depressed given many businesses are physically closed, even a modest rebound to February’s previous all-time low would raise the prospects for a change in the inflation outlook. Persistent higher bank lending on the back of government guarantees combined with a higher turnover of money chasing the same number of goods and services is a recipe for price increases.

Examples of this include financial support for borrowers in the form of state loans and credit guarantees in the United States, Japan, China, Germany, the UK, France, and a host of other countries. In addition, there is now a moratorium on payments by debtors in all the above countries except Germany.

The consequences of this could be severe because the decline in inflation expectations over the last 35 years has broken records in driving bond yields down - and the prices of so-called ‘long duration’ equities up.

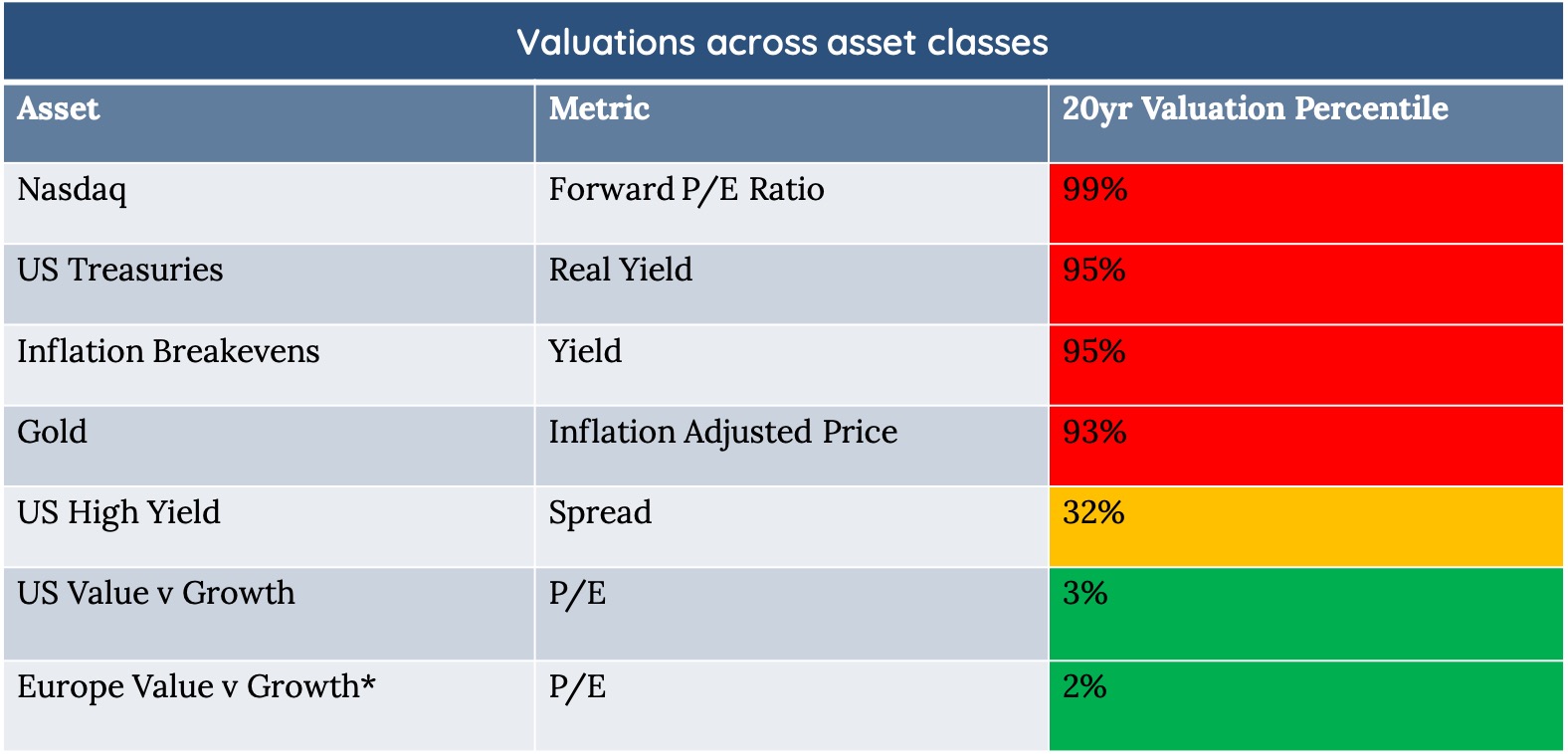

If investors begin to discount inflation, this would cause a significant change in the best investments to hold – moving from growth to value, long to short duration assets, and cash rich and asset light business models to companies with large fixed liabilities (significant operational and financial gearing).

Over 90% of government bonds globally yield less than 1% today and the equity market has never been more concentrated around a few low growth / low inflation winners in areas such as technology and staples - that are basically acting as bond proxies.

*Data from 25.5.12, Source: Bloomberg, Stoxx

Whether or not we see inflation next year, soon after or even in the foreseeable future, one of the biggest risks to savers is financial markets moving away from the current consensus view of ‘deflation forever’ to one of ‘inflation is possible’.

So how to protect yourself from a potential inflation rise?

1/ It’s crucial to have a strategy that reflects an up to date inflation regime and is not subjected to a mismatch between the rate one contracts at today and a potentially very different inflation regime in the more distant future.

2/ Valuing a stock on the cashflows being generated soon not on expectations of its growth. This leaves investors materially less exposed to inflation risk, as the time it takes to be repaid is relatively short (i.e. short duration). This is in stark contrast to today’s winners where the cashflows required to justify valuations are a long way in the future and reliant on inflation remaining at today’s 35 year low.

After so many decades, we recognise there will be skepticism around a change in inflation expectations. While we have no particular view on a change, the fiscal response of governments around the world has opened a path for it to occur.

There is the risk that these government promises and guarantees will only be temporary. After all, the incredible monetary policy of the last decade was meant to normalise when things improved after the GFC. However, given that a politician’s primary motivation is to be re-elected, there ought to be every chance these measures are around for years. This would certainly be the implication of the Rooseveltian rhetoric that seems to be growing in popularity - politics leads economics and in the response to the pandemic it seems as if governments have crossed the Rubicon.

4 topics